Plastic Films and Sheets Market Share, Size, Trends, Industry Analysis Report, By End-Use (Packaging, Agriculture, Automotive, Construction, Electronics, Healthcare, Others); By Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 112

- Format: PDF

- Report ID: PM2610

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

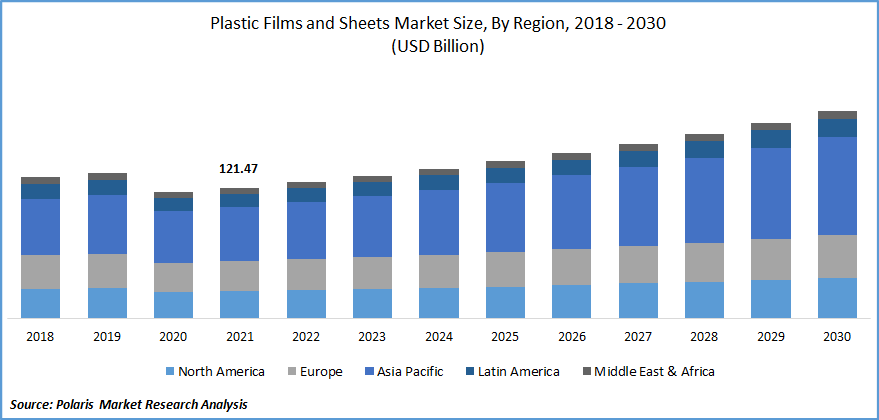

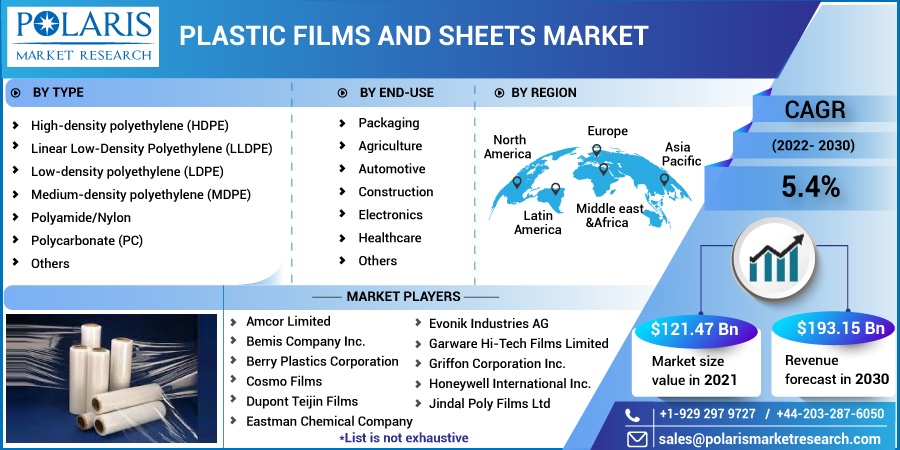

The global plastic films & sheets market was valued at USD 121.47 billion in 2021 and is expected to grow at a CAGR of 5.4% during the forecast period. Plastic films consist of a thin continuous polymeric material, whereas plastic sheets comprise thicker material. Plastic films and sheets are used as printable surfaces, separators for areas, barriers, and to hold items.

Know more about this report: Request for sample pages

These films and sheets find applications in packaging, construction, agriculture, healthcare, and others. They are of varied thicknesses and finishes are developed by industry players for different industries.

They are widely used in the automotive sector. Greater demand for passenger vehicles, increasing adoption of electric and hybrid vehicles, and rise in penetration of luxury vehicles has boosted the demand for the product from the automotive industry. Rise in requirement for vehicles with decreased weight to achieve higher fuel efficiency and lower carbon emissions has further increased the application of the industry.

Technological advancements associated with plastics and rising investments in R&D have been observed. Increasing environmental awareness and concerns regarding packaging waste has resulted in modified buying habits of consumers. Brands are also introducing sustainable packaging solutions and biodegradable & water-soluble films to address environmental concerns.

In July 2021, SABIC introduced LEXAN polycarbonate film & sheet. The new products are derived from renewable feedstock to offer sustainable alternatives in the market. The new product launch aligns with the company’s TRUCIRCLE initiative to address the growing demand for sustainable material solutions in the industry.

The COVID-19 outbreak influenced the global plastic films and sheets market on account of negative impact on associated industries such as transportation, construction, and electronics among others. The demand and supply of and sheets across the world was impacted by disrupted supply chain, operational issues, and reduced workforce. Manufacturing activities, travel restrictions, and limited import export activities also restricted the market growth.

However, the market experienced increased demand from packaging and healthcare sector during the pandemic. Greater need for packaging solutions for food and beverage, and increased requirement for barriers and face shields supported the growth of the market during the pandemic.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Plastic films and sheets are used in packaging, agriculture, automotive, construction, electronics, healthcare, and others. Rise in demand for bi-axially oriented film and recyclable solutions support the growth of the market. There has been increasing application of the product in modernization of vehicles and development of electric and hybrid vehicles.

Strengthening construction industry and development of public infrastructure, especially in the emerging economies, has increased the demand for plastic film and sheets. The sale of consumer goods and home appliances has increased across the globe on account of rise in industrialization and urbanization, increase in disposable income of consumers, and enhanced living standards, thereby boosting the adoption of the industry.

Report Segmentation

The market is primarily segmented based on type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

LLDPE segment accounted for the largest market share

Based on type, the global plastic films and sheets market is segregated into high-density polyethylene (HDPE), linear low-density polyethylene (LLDPE), low-density polyethylene (LDPE), medium-density polyethylene (MDPE), polyamide/nylon, polycarbonate (PC), and others.

The linear low-density polyethylene (LLDPE) film & sheets are widely used in diverse industries such as automotive, packaging, and food and beverage on account of its versatility, greater strength, and quality. Use of LLDPE offers several benefits such as flexibility, durability, and resistance.

Polycarbonate sheets are used in automotive, construction, electronics, and industrial sectors among others. These sheets offer low moisture absorption, high strength, greater impact resistance, and superior chemical resistance. Some applications of these sheets include skylights, face shields, machine guards, eyewear, and medical equipment among others.

Wide application areas of these sheets, growth of the construction industry, and greater investments in the public infrastructure drive the growth of this segment. Increase in use in the automotive industry, modernization of vehicles, and rise in demand for high performing light weight automobiles further support the growth of this segment.

Packaging segment accounted for a significant share in 2021

On the basis of end-use industry, the plastic films and sheets market has been segmented into packaging, agriculture, automotive, construction, electronics, healthcare, and others. The packaging segment accounted for a significant share in 2021. These films are used in packaging of various products to offer protection against damage from external forces. They also provide barrier and safeguard products against moisture, light, and microorganisms to avoid biological and physical degradation of products.

Several companies operating in the market are developing new solutions to cater to the growing consumer demand. In September 2021, Toray Plastics announced commercial production of packaging and label film through its new 8.7-meter in-line coating polypropylene film line.

The advanced equipment assists the company to strengthen its flexible packaging product lines and develop highly engineered laminations and mono-material film. The development is aimed at expanding the company’s presence in medical, packaging, label, and industrial applications.

Asia-Pacific is expected to witness the fastest growth

The demand for the product is expected to increase from Asia Pacific during the forecast period. Growth in urbanization and industrialization, greater use of the product in the automotive sector, and expansion of global players in Asia-Pacific through partnerships and acquisitions drive the market growth in this region.

Launch of new products by market players, investment in R&D, and rise in inclination toward sustainable solutions has increased the adoption of bio-based and recycled plastic solutions in the region. Increase in demand for the product from developing nations such as China, India and Japan, rising application in food and beverages sector, and greater use in the healthcare sector further contribute to the market growth in Asia-Pacific. The adoption of these sheets and films is expected to rise in applications such as agriculture and construction during the forecast period.

Competitive Insight

Some prominent companies operating in the plastic films and sheets market include Amcor Limited, Bemis Company Inc., Berry Plastics Corporation, Cosmo Film, Dupont Teijin Film, Eastman Chemical Company, Evonik Industries AG, Garware Hi-Tech Films Limited, Griffon Corporation Inc., Honeywell International Inc., Jindal Poly Films Ltd., Mitsubishi Chemical Holdings Corporation, Saudi Basic Industries Corporation (SABIC), The Dow Chemical Company, and Toray Industries Inc.

The leading players in the market are investing in development of sustainable and bio-based products to address growing environmental concerns. Companies are also partnering and collaborating with the public and private organizations to strengthen market presence.

Recent Developments

In March 2020, Smart Plastic collaborated with Marubeni, and Plaskolite to produce thermoplastic sheets to address safety concerns during COVID-19 outbreak. The OPTIX acrylic, VIVAK PETG and TUFFAK polycarbonate sheets were developed to design protective partitions and barriers for customer and employee protection.

In June 2022, VTT introduced a transparent cellulose film, which is designed as an alternative solution to traditional plastic in food packaging applications. The launch is aimed at development of food packaging solutions that are biobased and biodegradable.

In March 2019, Jet Technologies introduced a new oxo-degradable plastic film designed and developed to be used for packaging labels and laminates in food and beverage industry. These films comprise enzyme additive, which assists in faster degradation after disposal.

Plastic Films & Sheets Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 121.47 billion |

|

Revenue forecast in 2030 |

USD 193.15 billion |

|

CAGR |

5.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Amcor Limited, Bemis Company Inc., Berry Plastics Corporation, Cosmo Films, Dupont Teijin Films, Eastman Chemical Company, Evonik Industries AG, Garware Hi-Tech Films Limited, Griffon Corporation Inc., Honeywell International Inc., Jindal Poly Films Ltd., Mitsubishi Chemical Holdings Corporation, Saudi Basic Industries Corporation (SABIC), The Dow Chemical Company, and Toray Industries Inc. |