Plastic Extrusion Machine Market Size, Share, Trends, Industry Analysis Report: By Machine Type (Single-Screw and Twin-Screw), Process Type, Solution, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5536

- Base Year: 2024

- Historical Data: 2020-2023

Plastic Extrusion Machine Market Overview

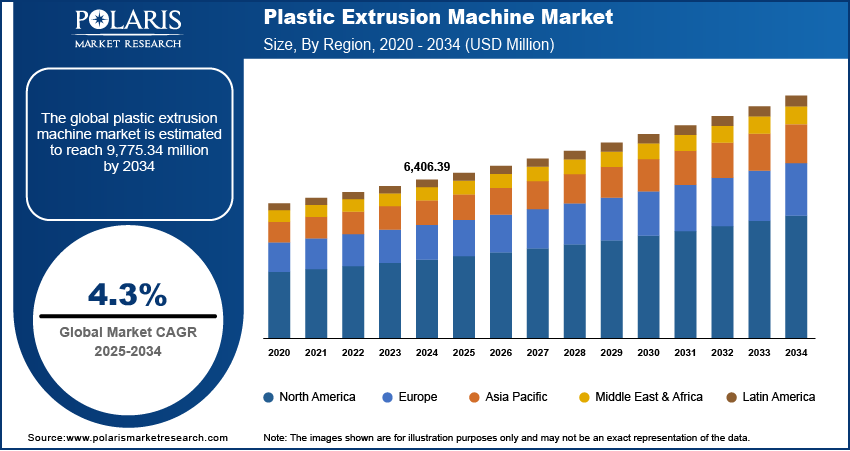

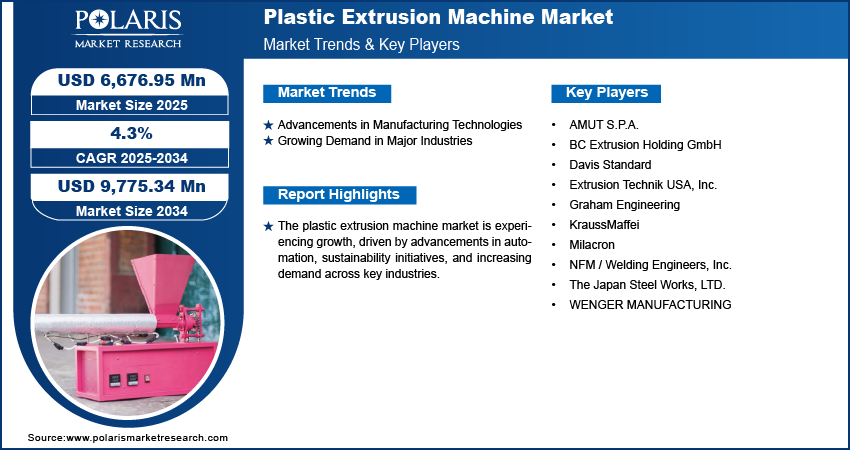

The global plastic extrusion machine market size was valued at USD 6,406.39 million in 2024. It is expected to grow from USD 6,676.95 million in 2025 to USD 9,775.34 million by 2034, at a CAGR of 4.3% during 2025–2034.

A plastic extrusion machine is a manufacturing device used to process and shape plastic materials into continuous profiles, such as pipes, sheets, and films, through a high-pressure extrusion process. The global plastic extrusion machine market growth is driven by the increasing demand for sustainable and eco-friendly products. Manufacturers are focusing on biodegradable and recycled plastic extrusion solutions as industries shift toward environmentally responsible practices. Stricter regulations on plastic waste management and consumer preference for sustainable packaging further contribute to this demand. For instance, in June 2022, Heinz, Tesco, Berry Global, Plastic Energy, and Sabic collaborated on a trial to create Heinz Beanz Snap Pots using 39% recycled soft plastic. This initiative highlights the growing trend of recycling consumer-returned plastic into food-grade material for sustainable packaging production. Additionally, advancements in extrusion technologies are enabling higher efficiency and reduced energy consumption, aligning with sustainability goals across various industries.

To Understand More About this Research: Request a Free Sample Report

Another key factor boosting the plastic extrusion market demand is the rapid infrastructure development and industrialization across emerging economies. Expanding urbanization, growing construction activities, and increasing investments in industrial manufacturing drive the demand for plastic extrusion machines for producing pipes, profiles, and insulation materials. The need for cost-effective and durable plastic components in sectors such as construction, automotive, and electronics further accelerates expansion opportunities. In January 2025, Guill launched its next-generation Series 800 extrusion tooling, designed for 2-to-6 layer tubing production. This innovation ensures high-quality, material-efficient tubing for automotive, medical, and industrial applications, featuring precision adjustments and advanced polymer processing capabilities. Such advancements highlight how technological innovations in extrusion machinery are enhancing production capabilities, supporting large-scale industrial applications, and reinforcing the role of plastic extrusion in modern infrastructure development.

Plastic Extrusion Machine Market Dynamics

Advancements in Manufacturing Technologies

Modern extrusion machines integrate automation, real-time monitoring, and energy-efficient mechanisms to optimize output while reducing material waste, enhancing efficiency, precision, and sustainability in production processes. Innovations such as multi-layer extrusion and high-speed processing improve product quality and expand application possibilities across industries. Additionally, the adoption of Industry 4.0 technologies, such as IoT and AI-driven systems, allows predictive maintenance and process optimization, ensuring higher productivity and lower operational costs. In March 2025, UltiMaker launched the UltiMaker S8 3D printer, a next-generation solution offering speeds up to 500mm/s and 4x productivity gains. This advancement exemplifies how innovative technologies are enabling fast, precise, and reliable production, supporting diverse industrial needs. These technological advancements strengthen the market by meeting evolving industry requirements for precision, consistency, and environmental compliance.

Growing Demand in Major Industries

The growing demand in major industries such as construction, packaging, automotive, and healthcare drives the plastic extrusion machine market development. These industries increasingly rely on extruded plastic components. In construction, extruded profiles, pipes, and insulation materials are essential for infrastructure projects, while the packaging industry depends on high-quality films and sheets for flexible and rigid packaging solutions. The automotive sector benefits from lightweight, durable plastic parts that enhance fuel efficiency and performance. Additionally, the medical industry’s need for precision-extruded tubing and components continues to rise. For instance, in March 2024, MAS launched the MAS 110, a next-generation extruder designed for modern recycling challenges. Compact yet powerful, it processes up to 6 tonnes of PET per hour, offering high-quality melt and flexibility for various plastics and applications, including chemical recycling. This innovation exemplifies how extrusion technologies are advancing to address the complex needs of diverse industries. Such developments ensure sustained market growth and the continuous evolution of extrusion technologies to meet industrial demands.

Plastic Extrusion Machine Market Segment Insights

Plastic Extrusion Machine Market Assessment by Type Outlook

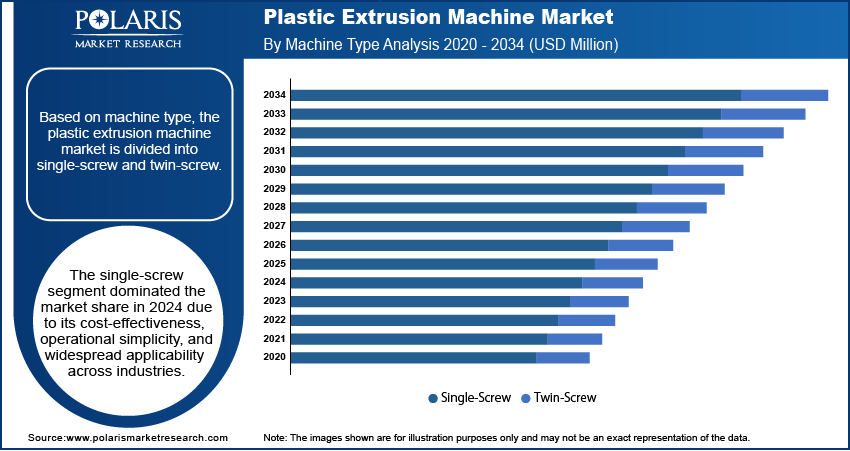

The global plastic extrusion machine market segmentation, based on type, includes single-screw and twin-screw. The single-screw segment dominated the plastic extrusion machine market revenue share in 2024 due to its cost-effectiveness, operational simplicity, and widespread applicability across industries. Single-screw extruders are preferred for their efficiency in processing a wide range of thermoplastic materials, making them ideal for manufacturing pipes, films, and sheets. Their lower maintenance requirements and ease of operation make them a viable choice for both small-scale and large-scale production facilities. Additionally, technological advancements in single-screw extruders have improved their throughput and energy efficiency, further solidifying their market dominance. These factors collectively contribute to their strong adoption across various end-use sectors.

Plastic Extrusion Machine Market Evaluation by Application Outlook

The global plastic extrusion machine market segmentation, based on application, includes building & construction, medical, transportation, consumer goods, and others. The building & construction segment dominated the plastic extrusion machine market share in 2024, driven by the increasing demand for extruded plastic components in infrastructure projects. Plastic extrusions, such as pipes, profiles, window frames, and insulation materials, play a crucial role in modern construction due to their durability, cost-effectiveness, and resistance to corrosion. Rapid urbanization and large-scale residential and commercial developments are fueling the need for advanced construction materials. Additionally, the shift toward sustainable and energy-efficient building solutions is driving the adoption of plastic extrusion technologies, ensuring continued expansion in this segment.

Plastic Extrusion Machine Market Regional Analysis

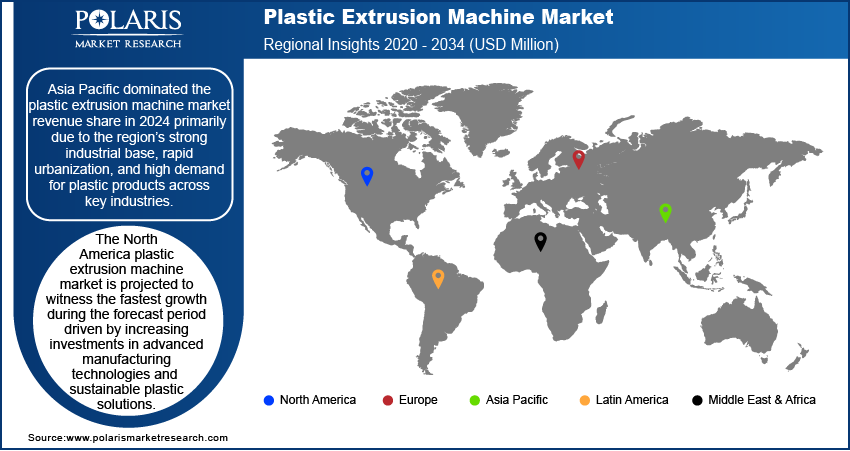

By region, the report provides the plastic extrusion machine market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the plastic extrusion machine market share in 2024 primarily due to the region’s strong industrial base, rapid urbanization, and high demand for plastic products across key industries. Countries such as China, India, and Japan are major manufacturing hubs, contributing to substantial investments in extrusion technologies for applications in the packaging, construction, and automotive sectors. The availability of low-cost raw materials and labor further improves production capabilities, attracting global manufacturers to set up facilities in the region. Additionally, government initiatives promoting industrial expansion and infrastructure development continue to drive demand for advanced extrusion machinery, reinforcing Asia Pacific’s market leadership. In March 2025, Orbetron Extrusion and Technovel Corporation formed a strategic partnership to expand their market reach. Orbetron will distribute Technovel’s products in North America, while Technovel will distribute Orbetron’s solutions in Japan and Asia, improving global access to advanced extrusion technologies. This collaboration highlights the growing importance of Asia Pacific as a hub for innovation and expansion opportunities in the extrusion industry.

The North America plastic extrusion machine market is projected to witness the fastest growth during the forecast period, driven by increasing investments in advanced manufacturing technologies and sustainable plastic solutions. The region's strong focus on innovation, automation, and energy-efficient extrusion systems is accelerating market expansion. Additionally, the growing demand for high-performance plastic components in industries such as healthcare, automotive, and packaging is fueling the adoption of advanced extrusion machines. Strict environmental regulations are also prompting manufacturers to invest in eco-friendly and recyclable plastic processing solutions, further driving the North America plastic extrusion machine market expansion.

Plastic Extrusion Machine Market – Key Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for plastic extrusion machine market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Plastic extrusion machine market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes. Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with plastic extrusion machine market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the plastic extrusion machine industry's growth is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, assuring sustained growth in a hypercompetitive global market. A few key major players are AMUT S.P.A.; BC Extrusion Holding GmbH; Davis Standard; Extrusion Technik USA, Inc.; Graham Engineering; KraussMaffei; Milacron; NFM / Welding Engineers, Inc.; The Japan Steel Works, LTD.; and Wenger Manufacturing.

KraussMaffei is a German manufacturing company specializing in machinery and systems for producing and processing plastics and rubber. Founded in 1838 as Maffei and later merged with Krauss & Co. in 1931, the company has evolved, focusing on cutting-edge technologies in injection molding, extrusion, reaction process machinery, and additive manufacturing. In the plastic extrusion machine sector, KraussMaffei offers a wide range of solutions, including high-performance profile extrusion systems for processing PVC, PE, and other materials. They also provide advanced pipe extrusion systems capable of producing pipes from 5 mm to 2,000 mm in diameter, catering to PVC and PO processing. Their twin-screw extruders are particularly noted for their efficiency in producing U-PVC, M-PVC, and foam core PVC pipes, with features such as modular designs and cost-effective production processes. KraussMaffei supports industries such as automotive, packaging, medical, and construction with a global presence through over 30 subsidiaries and 570 commercial partners.

Graham Engineering Company, LLC, established in 1960, is into plastic extrusion machine technology. Known for introducing the Graham Wheel in 1964, the company has maintained its position as a standard-setter in the industry. Graham Engineering specializes in providing innovative, modular machinery solutions tailored to specific manufacturing needs, offering reliable and replicable parisons, single screw extrusion, and complete downstream systems. Their product range includes blow molding, extrusion, sheet extrusion, industrial, and healthcare tubing solutions, all equipped with advanced Navigator control systems. The company has integrated brands such as American Kuhne, Welex, and Navigator Controls to improve its offerings. Graham Engineering's expertise extends to various applications, such as the automotive, medical, and packaging industries. They offer customized extrusion systems, such as the Co-Extrusion Profile System for automotive trim profiles, and have recently introduced new medical extruders designed for clean-room environments.

List of Key Companies in Plastic Extrusion Machine Market

- AMUT S.P.A.

- BC Extrusion Holding GmbH

- Davis Standard

- Extrusion Technik USA, Inc.

- Graham Engineering

- KraussMaffei

- Milacron

- NFM / Welding Engineers, Inc.

- The Japan Steel Works, LTD.

- WENGER MANUFACTURING

Plastic Extrusion Machine Industry Developments

September 2024: Rollepaal Pipe Extrusion Technology collaborated with Reifenhäuser Middle East and Africa (MEA) to expand their reach in African and Middle Eastern markets. The collaboration combines Rollepaal’s advanced extrusion solutions with Reifenhäuser’s regional expertise to enhance production efficiency and sustainability.

June 2024: Jiantai launched Recycled Plastic Extruder, featuring advanced technology for efficient plastic recycling. It reduces energy consumption by 30%, uses durable military-grade forging, and supports closed-loop recycling, promoting sustainability and cost-effective waste management.

Plastic Extrusion Machine Market Segmentation

By Machine Type Outlook (Revenue, USD Million, 2020–2034)

- Single-Screw

- Twin-Screw

By Process Type Outlook (Revenue, USD Million, 2020–2034)

- Blown Film Extrusion

- Sheet/Film Extrusion

- Tubing Extrusion

- Others

By Solution Outlook (Revenue, USD Million, 2020–2034)

- New Sales

- Aftermarket

By Application Outlook (Revenue, USD Million, 2020–2034)

- Building & Construction

- Medical

- Transportation

- Consumer Goods

- Others Source

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Plastic Extrusion Machine Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6,406.39 million |

|

Market Size Value in 2025 |

USD 6,676.95 million |

|

Revenue Forecast in 2034 |

USD 9,775.34 million |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global plastic extrusion machine market size was valued at USD 6,406.39 million in 2024 and is projected to grow to USD 9,775.34 million by 2034.

The global market is projected to register a CAGR of 4.3% during the forecast period.

North America dominated the market revenue in 2024.

A few of the key players in the market are AMUT S.P.A.; BC Extrusion Holding GmbH; Davis Standard; Extrusion Technik USA, Inc.; Graham Engineering; KraussMaffei; Milacron; NFM / Welding Engineers, Inc.; The Japan Steel Works, LTD.; and Wenger Manufacturing.

The single-screw segment dominated the market share in 2024 due to its cost-effectiveness, operational simplicity, and widespread applicability across industries.

The building & construction segment dominated the market in 2024 due to the increasing demand for extruded plastic components in infrastructure projects.