Plant-Based Seafood Alternative Products Market Size, Share, Trends, Industry Analysis Report: By Product Type, Source Ingredients, Consumer Type (Omnivore, Vegetarian, Vegan, and Others), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5412

- Base Year: 2024

- Historical Data: 2020-2023

Plant-Based Seafood Alternative Products Market Overview

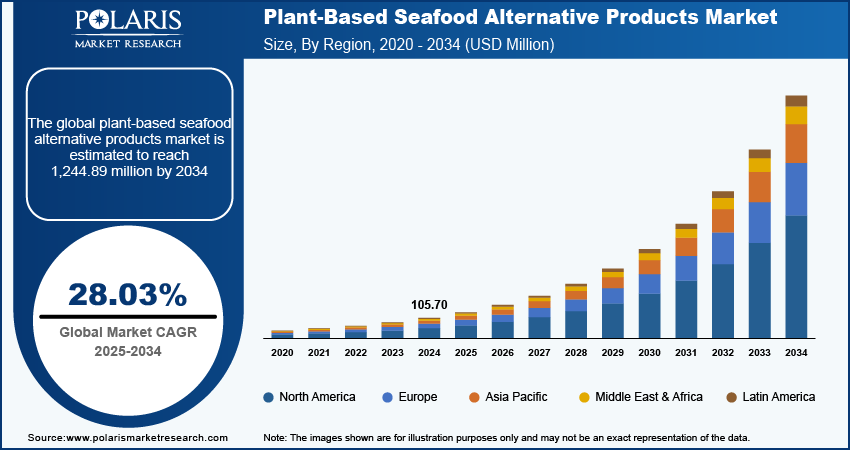

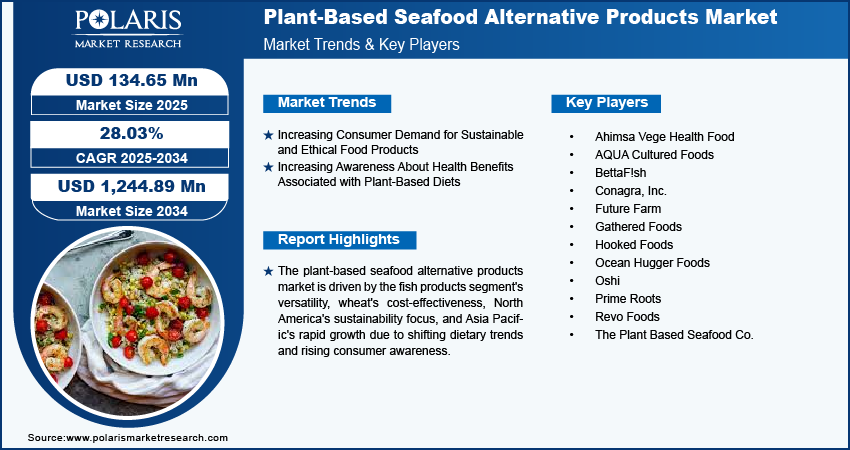

The global plant-based seafood alternative products market was valued at USD 105.70 million in 2024. It is expected to grow from USD 134.65 million in 2025 to USD 1,244.89 million by 2034, at a CAGR of 28.03% during 2025–2034..

Plant-based seafood alternative products are innovative food items designed to replicate the taste, texture, and nutritional benefits of traditional seafood using plant-derived ingredients. The market is expanding rapidly, driven by increased investments and innovations in plant-based seafood products. Companies are leveraging advancements in food technology, such as protein extraction and fermentation, to develop products that closely mimic conventional seafood. For instance, in March 2022, Aqua Cultured Foods advanced its fermentation technology, doubling its biomass output. This improvement enhanced the texture and appearance of whole-muscle seafood alternatives such as tuna, shrimp, and scallops by controlling factors such as temperature and oxygen. Additionally, the growing consumer demand for sustainable and ethical food choices has encouraged funding and research in this sector. As a result, the industry is witnessing a surge in new product launches, strategic partnerships, and technological advancements, strengthening its position in the broader plant-based seafood alternative products market expansion.

To Understand More About this Research: Request a Free Sample Report

Another key driver of the plant-based seafood alternative products market growth is the depletion of natural ocean resources, which has boosted the need for sustainable seafood alternatives. Overfishing, habitat destruction, and climate change have adversely impacted global fish populations, raising concerns about long-term seafood availability. A June 2024 FAO report indicated that global fisheries and aquaculture production rose to 223.2 million tons in 2022, a 4.4% increase from 2020. This included 185.4 million tons of aquatic animals and 37.8 million tons of algae. Despite this growth, over 35% of fish stocks remain overfished, highlighting the urgent need for sustainable alternatives such as plant-based seafood to clear pressure on marine ecosystems. Additionally, consumers, environmental organizations, and regulatory bodies are increasingly supporting responsible seafood consumption, leading to greater acceptance of plant-based alternatives. Thus, as sustainability becomes a central factor in food purchasing decisions, the plant-based seafood alternative products market demand is expected to rise in the coming years, providing a feasible solution to reducing the pressure on marine ecosystems while meeting consumer preferences for seafood flavors and textures.

Plant-Based Seafood Alternative Products Market Dynamics

Increasing Consumer Demand for Sustainable and Ethical Food Products

Consumers are becoming more conscious of the environmental impact of traditional seafood production, such as overfishing, bycatch, and habitat destruction, as consumers demand sustainable and ethical food products. A January 2023, World Economic Forum report stated that over 65% of consumers aim to make healthier and more sustainable spending choices. Ethical considerations, such as concerns over animal welfare and the shortage of marine biodiversity, are influencing purchasing decisions. As a result, there is a growing preference for seafood alternatives that offer a lower ecological footprint while maintaining the taste and texture of conventional seafood. The alignment of plant-based seafood with sustainability goals has encouraged businesses to expand their product offerings. For example, in October 2023, BlueNalu introduced cell-cultured bluefin tuna toro seafood in collaboration with Mitsubishi, Pulmuone, and Thai Union. This initiative aims to target premium markets and is expected to further drive the plant-based seafood alternatives products market growth during the forecast period.

Increasing Awareness About Health Benefits Associated with Plant-Based Diets

Plant-based seafood products are often free from mercury, micro plastics, and harmful pollutants commonly found in conventional seafood. The products are formulated to provide essential nutrients such as omega-3 fatty acids, vitamins, and high-quality plant proteins. Leading manufacturers are responding to the demand for healthy plant-based food by developing innovative products that match the nutritional profile and sensory experience of conventional seafood. For instance, in January 2022, Gathered Foods launched the first US-made plant-based salmon burgers under its Good Catch brand. The burgers mimic the texture and flavor of real salmon fish, serving high consumer demand for salmon alternatives with 16g of protein per serving. The shift toward healthier dietary patterns, driven by growing concerns over chronic diseases, has led consumers to seek nutritious and functional food options. A December 2024 WHO report found that noncommunicable diseases (NCDs) caused 43 million deaths in 2021, representing 75% of global non-pandemic deaths. Health-conscious individuals prioritize clean-label and minimally processed alternatives. Hence, the increasing awareness about the health benefits associated with plant-based diets is expected to boost the plant-based seafood alternative products market demand during the forecast period.

Plant-Based Seafood Alternative Products Market Segment Insights

Plant-Based Seafood Alternative Products Market Assessment by Product Type Outlook

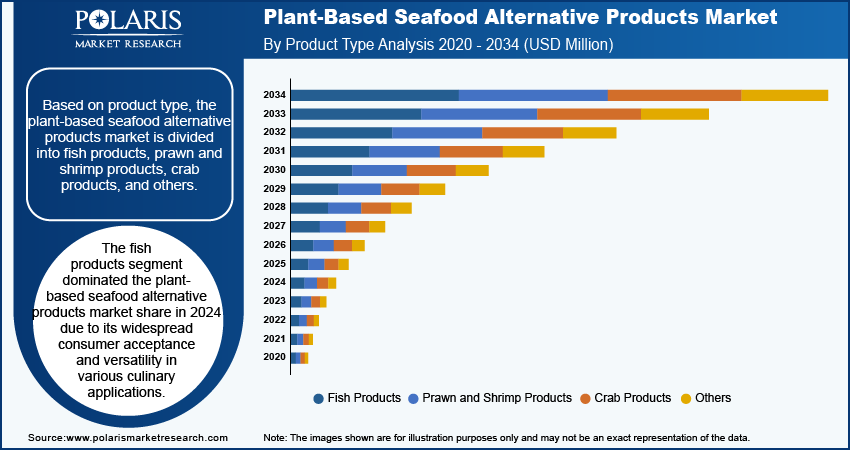

The global plant-based seafood alternative products market segmentation, based on product type, includes fish products, prawn and shrimp products, crab products, and others. The fish products segment dominated the plant-based seafood alternative products market share in 2024 due to its widespread consumer acceptance and versatility in various culinary applications. Consumers transitioning from conventional seafood to plant-based alternatives often seek familiar textures and flavors, making plant-based fish products a preferred choice. The availability of diverse fish alternatives, such as plant-based fillets, fish sticks, and tuna, has contributed to higher adoption rates. Additionally, advancements in food technology have allowed manufacturers to closely replicate the taste and mouthfeel of traditional fish, further driving plant-based seafood alternative products market expansion for the fish products segment. The rising popularity of plant-based fish in the retail and food service sectors has also played a crucial role in its market dominance.

Plant-Based Seafood Alternative Products Market Evaluation by Source Ingredients Outlook

The global plant-based seafood alternative products market, based on source ingredients, is segmented into soy, pea protein, wheat, canola, and others. The wheat segment is expected to register the fastest growth during the forecast period due to its functional properties and cost-effectiveness. Wheat-based ingredients offer a fibrous texture that closely resembles seafood, making them suitable for various plant-based formulations. The high protein content and gluten properties of wheat allow manufacturers to develop products with improved texture and binding capabilities. Additionally, wheat is widely available and relatively affordable, making it a feasible ingredient for large-scale production. Thus, as consumer demand for plant-based seafood grows, the increasing use of wheat in innovative product formulations is expected to drive the plant-based seafood alternative products market expansion during the forecast period.

Plant-Based Seafood Alternative Products Market Regional Analysis

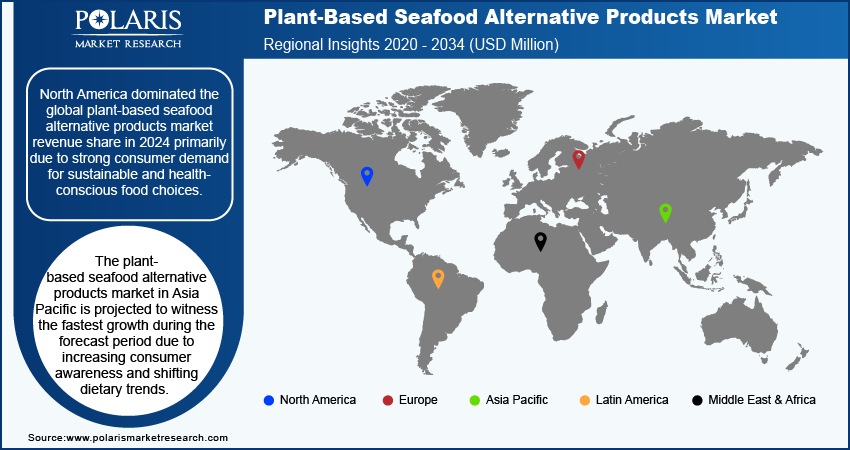

By region, the report provides the plant-based seafood alternative products market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the plant-based seafood alternative products market revenue share in 2024 primarily due to strong consumer demand for sustainable and health-conscious food choices. The region has a well-established plant-based food industry, supported by high awareness of environmental concerns and ethical food consumption. Major retailers across North America have significantly expanded their plant-based seafood offerings in response to growing consumer demand and market opportunities. For instance, in October 2023, Nestlé introduced nutritious vegan alternatives to white fish, such as breaded fillets, nuggets, and fish fingers, known for their strong nutrition, taste, and fish-like texture. Additionally, the presence of major plant-based seafood manufacturers and a robust distribution network, such as supermarkets, specialty stores, and food service channels, has improved product accessibility. The rising number of flexitarian consumers and shifting dietary preferences toward plant-based proteins have further solidified North America's market leadership. In April 2023, Sodexo announced plans to make 50% of its campus menus plant-based by 2025 to reduce its carbon footprint and meet consumer demand. Partnering with the Humane Society, Sodexo focuses on convenient, enjoyable plant-based options, especially for eco-conscious Gen Z students.

The plant-based seafood alternative products market demand in Asia Pacific is projected to witness the fastest growth during the forecast period due to increasing consumer awareness and shifting dietary trends. The region's growing population and rising disposable income levels have led to greater demand for sustainable and nutritious food options. Traditional seafood consumption is deeply rooted in many Asian cultures, making plant-based seafood an appealing alternative as concerns over marine resource depletion increase. Additionally, the expansion of plant-based food brands and increasing government support for sustainable food initiatives are accelerating plant-based seafood alternative products market penetration. As plant-based diets gain traction in key markets such as China, Japan, and India, the demand for seafood alternatives is expected to surge greatly during the forecast period.

List of Key Companies in Plant-Based Seafood Alternative Products Market

- Ahimsa Vege Health Food

- AQUA Cultured Foods

- BettaF!sh

- Conagra, Inc.

- Future Farm

- Gathered Foods

- Hooked Foods

- Ocean Hugger Foods

- Oshi

- Prime Roots

- Revo Foods

- The Plant Based Seafood Co.

Plant-Based Seafood Alternative Products Market – Key Players & Competitive Analysis Report

The competitive landscape combines global leaders and regional players competing to capture plant-based seafood alternative products market share through innovation, strategic alliances, and regional expansion. Global players such as Gathered Foods (Good Catch), Atlantic Natural Foods, and Conagra Brands leverage robust R&D capabilities and extensive distribution networks to deliver advanced plant-based seafood products, such as tuna, salmon, and shrimp alternatives. Plant-based seafood alternative products market trends indicate rising demand for solutions such as innovative protein texturization technologies and clean-label ingredients, reflecting advancements in food science and consumer preferences. According to plant-based seafood alternative products market statistics, the market is projected to grow immensely, driven by increasing environmental consciousness, health awareness, and concerns about overfishing. Regional companies capitalize on localized needs by offering cost-effective and culturally tailored products, especially in emerging markets. Market competitive strategies include mergers and acquisitions, partnerships with food technology companies, and the introduction of innovative plant-based products to address the growing awareness and willingness of consumers to adopt sustainable alternatives. These developments underline the role of technological innovation, market adaptability, and regional investments in driving the plant-based seafood alternatives products industry expansion. A few key major players are Ahimsa Vege Health Food; AQUA Cultured Foods; BettaF!sh; Conagra, Inc.; Future Farm; Gathered Foods; Hooked Foods; Ocean Hugger Foods; Oshi; Prime Roots; Revo Foods; and The Plant Based Seafood Co.

AQUA Cultured Foods, founded in 2021 and based in Chicago, Illinois, specializes in the development of plant-based seafood alternatives through fermentation technology. Their products, such as animal-free tuna, whitefish, and mycoprotein-based calamari, are designed to replicate the taste, texture, and appearance of traditional seafood while being entirely fish-free. This approach serves the growing demand for sustainable food options and also addresses concerns related to ocean health and overfishing. AQUA's seafood alternatives are marketed as fresher than conventional seafood, boasting a shelf life of up to six weeks without the need for fishing or farming practices that harm marine ecosystems. The company emphasizes a commitment to sustainability and food security, aiming to provide delicious seafood options that are allergen-free and nutrient-dense. AQUA ensures that its products meet high standards of quality and safety by utilizing controlled fermentation processes. Their offerings are suitable for various culinary applications, from sushi to gourmet dishes, making them appealing to both consumers and chefs alike. It positions itself as a leader in the alternative seafood market as AQUA continues to ramp up production, contributing to a more sustainable food future while delighting seafood enthusiasts with its innovative solutions.

Gathered Foods is a plant-based food company committed to providing sustainable and nutritious alternatives to traditional animal-based products, targeting consumers who want to reduce their animal protein consumption. Gathered Foods was known for its Good Catch plant-based seafood brand; it has sold its North American business of Good Catch to Wicked Kitchen. Now, Gathered Foods is shifting its focus to a B2B model where it will still sell products under the Swell Catch brand in various countries. The company excels at producing adaptable plant-based proteins that provide taste, texture, and satisfaction. Gathered Foods is also dedicated to plant-based product development and commercialization. It has sold its plant-based production facility Trellis to Ahimsa Companies, but remains a strategic operating and IP partner. Gathered Foods will continue to develop ingredients and finished goods for the industry, catering to B2B, private label, and food service sectors. It also has a pilot plant and innovation center in Vancouver, B.C., called Cultivated Food Labs.

Plant-Based Seafood Alternative Products Industry Developments

November 2024: Revo Foods and Paleo received USD 2.38 million in EU funding to develop fermentation-based myoglobin for vegan salmon.

July 2024: Big Idea Ventures launched Bayou Best Foods, a new company in the plant-based seafood sector utilizing intellectual property from the alt-shrimp startup New Wave Foods.

Plant-Based Seafood Alternative Products Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Fish Products

- Prawn and Shrimp Products

- Crab Products

- Others

By Source Ingredients Outlook (Revenue, USD Million, 2020–2034)

- Soy

- Pea Protein

- Wheat

- Canola

- Others

By Consumer Type Outlook (Revenue, USD Million, 2020–2034)

- Omnivore

- Vegetarian

- Vegan

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Supermarkets and Hypermarkets

- Specialty Stores

- HoReCa

- Online Sales

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Plant-Based Seafood Alternative Products Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 105.70 Million |

|

Market Size Value in 2025 |

USD 134.65 Million |

|

Revenue Forecast by 2034 |

USD 1,244.89 Million |

|

CAGR |

28.03% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global plant-based seafood alternative products market size was valued at USD 105.70 million in 2024 and is projected to grow to USD 1,244.89 million by 2034.

• The global market is projected to register a CAGR of 28.03% during the forecast period.

• North America dominated the market share in 2024.

• A few of the key players in the market are Ahimsa Vege Health Food; AQUA Cultured Foods; BettaF!sh; Conagra, Inc.; Future Farm; Gathered Foods; Hooked Foods; Ocean Hugger Foods; Oshi; Prime Roots; Revo Foods; and The Plant Based Seafood Co.

• The fish products segment dominated the market share in 2024.