Plant-Based Meat Market Size, Share, Trends, Industry Analysis Report

By Source (Soy, Wheat), By Product, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 116

- Format: PDF

- Report ID: PM1689

- Base Year: 2024

- Historical Data: 2020-2023

Overview

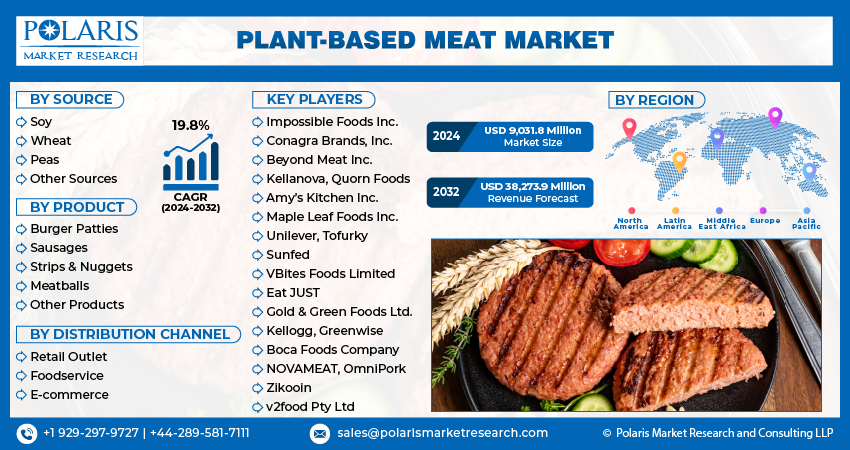

The global plant-based meat market size was valued at USD 9.03 billion in 2024, growing at a CAGR of 19.7% from 2025 to 2034. Key factors driving demand is growth in the number flexitarian, ethical, and health-conscious consumer across the globe, and strategy revision by industry participants and the advent of Direct-to-Consumer Model (D2C).

Key Insights

- The soy segment is projected to register a CAGR of 20.3% over the forecast period due to the growing awareness of the environmental impact of traditional meat production.

- The e-commerce segment held a significant revenue share in 2024, holding 11.86% as companies are focusing on e-commerce platforms, which are particularly preferred by millennials.

- North America accounted for 40.65% of global revenue share in 2024 due to growing health awareness and shifting consumer preferences

- The U.S. held 84.55% of the revenue share in North America in 2024, driven by high consumer awareness and demand for healthier food alternatives

- The Asia Pacific is expected to register a CAGR of 20.3% during the forecast period, fueled by rising population, urbanization, and growing awareness of health and sustainability.

Industry Dynamics

- Growth in the number of flexitarian, ethical, and health-conscious consumers across the globe is driving the demand for plant-based meat.

- Strategy revision by industry participants and the advent of direct-to-consumer model (D2C) is fueling the market expansion.

- Industry participants are trying to expand their footprint by entering into partnerships with retail chains, as well as restaurants.

- High product prices compared to conventional meat limit the growth.

Market Statistics

- 2024 Market Size: USD 9.03 Billion

- 2034 Projected Market Size: USD 54.49 Billion

- CAGR (2025-2034): 19.7%

- North America: Largest Market Share

AI Impact on Plant-Based Meat Market

- AI accelerates product development by analyzing vast datasets on taste, texture, and nutritional profiles to create meat alternatives that closely mimic animal-based products.

- Integration of AI enables predictive modeling to improve ingredient combinations and formulations, enhancing flavor, texture, and shelf life.

- AI-powered consumer insights tools help companies understand market trends, preferences, and purchasing behavior, enabling targeted product innovation and marketing.

- AI automates supply chain and production optimization, reducing food waste, lowering costs, and improving efficiency in plant-based meat manufacturing.

Plant-based meat can be defined as products manufactured by using plant ingredients that mimic animal-derived meat both in terms of taste and appearance. These products are made by using a variety of sources such as peas, wheat, and soy. As they directly substitute animal meat, they are often referred to as meat products.

The concept of plant-based meat was originally formed to replace animal meat consumption and to curb the adverse effects of the same, both on human health and environmental impact. The concept has garnered a lot of attention both from public as well as government alike.

Inclination toward healthy lifestyles, competitive strategies adopted by key market participants, and favorable initiatives across the globe are benefiting the growth. Moreover, considerable investments and ventures by leading personalities across the globe such as Bill Gates. The founder of Microsoft Corporation has invested in Beyond Meat, which is one of the major players in the industry. There have been many such instances of investments, funding, as well as deals in the recent past, and this trend is expected to continue over the forecast period, thus favoring plant-based meat industry growth.

Many companies, both startups and established companies are entering the market. Industry participants are trying to expand their footprint by entering into partnerships with retail chains, as well as restaurants. Such moves are aimed at improving the overall product availability by utilizing the pre-established distribution channels of retail chains as well as restaurants. One of the other driving factors prompting rapid growth mainly in the U.S. as well as Europe is the adoption of flexitarian lifestyle and incorporation of plant-based food in their diets by a sizeable number of citizens.

Drivers & Opportunities

Growth in Number Flexitarian, Ethical, and Health Conscious Consumer Globally: The growth of the plant-based meat demand is largely driven by rising ethical awareness among consumers, especially millennials, and the global shift toward flexitarian diets. Flexitarians aim to reduce meat and dairy intake for health, environmental, and ethical reasons, contributing to increased demand for plant-based alternatives. While earlier the focus was on vegetarians and vegans, the consumer base has expanded significantly. Europe, particularly the UK, has seen notable growth in veganism, supporting expansion. According to the European Vegetarian Union, in 2021, in Germany, the plant based product sales reached USD 952.3 million. Social media and mainstream media have played a key role in raising awareness about the environmental and ethical concerns associated with animal meat production. Additionally, animal rights organizations have effectively highlighted inhumane practices in the meat industry, influencing consumer preferences, thereby driving the growth.

Strategy Revision by Industry Participants and Advent of Direct to Consumer Model (D2C): Traditional meat producers and plant-based brands are revising strategies to capitalize on the growing plant-based meat market. Large companies are entering the space through acquisitions, such as Unilever’s purchase of The Vegetarian Butcher, and further merger and acquisition activity is expected. The market includes agile, innovative small brands that challenge established players, pushing them to protect market share while expanding. Many companies are adopting the direct-to-consumer (D2C) model to gain insights into consumer behavior, enabling personalized marketing and product development. The rise of e-commerce and social media improves the effectiveness of this approach. D2C increases profitability and meets consumer demands for personalized experiences by bypassing traditional retail channels, thereby driving growth.

Segmental Insights

Source Analysis

Based on source, the segmentation includes soy, wheat, peas, and other sources. The soy segment is projected to register a CAGR of 20.3% over the forecast period due to the growing awareness of the environmental impact of traditional meat production. Consumers are increasingly seeking sustainable and eco-friendly alternatives to animal-based products with concerns about climate change and resource depletion on the rise. Soy-based plant-based meats offer a promising solution, as soy cultivation generally requires less land, water, and energy compared to traditional livestock farming, leading to reduced greenhouse gas emissions and environmental footprint. Furthermore, health considerations play a pivotal role in propelling the soy-based plant-based meat forward. There is a growing demand for nutritious and wholesome plant-based alternatives as consumers become more health-conscious and informed about the potential risks associated with excessive meat consumption. Soy-based plant-based meats, enriched with protein and devoid of cholesterol, appeal to health-conscious consumers seeking to adopt a balanced diet without compromising on taste or texture, thereby fueling the growth.

The wheat segment is expected to witness a significant share during the forecast period due to a shift toward plant-based diets as consumer awareness regarding health, sustainability, and animal welfare continues to rise, with wheat-based alternatives gaining significant traction. Wheat proteins, particularly gluten, serve as foundational ingredients in many plant-based meat products, offering texture, structure, and protein content akin to conventional meat. This abundant and versatile protein source enables manufacturers to create a diverse range of meat substitutes, including burgers, sausages, and nuggets, that closely mimic the taste and texture of animal-derived meats. The Vegetarian Butcher (Netherlands) Morningstar Farms (US), Maple Leaf Foods (US), VBites (UK), Quorn Foods (UK), and Garden Protein International (US) are a few of the leading participants that utilize wheat to produce meat-based products.

Product Analysis

In terms of product, the segmentation includes burger patties, sausages, strips & nuggets, meatballs, and other products. The burger patties segment held 39.28% of revenue share in 2024. A considerable number of companies are trying to gain share in the segment. Novel product development and partnerships with retail and smart retail chains are among the strategies adopted by leading plant-based burger patties manufacturers. Competitors have developed superior products that are in line with the traditional meat-based burgers in terms of similarities. Furthermore, the surge in demand for plant-based options is fueled by shifting demographics and evolving consumer preferences. Millennials and Generation Z, in particular, are driving the demand for sustainable and ethical food products, favoring plant-based burger patties for their perceived health benefits and alignment with their values. Moreover, the culinary versatility and innovation surrounding plant-based ingredients have significantly contributed to the appeal of burger patties within this segment. Companies are leveraging advanced food science and technology to replicate the taste, texture, and juiciness of traditional beef burgers, thereby improving the sensory experience for consumers.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes retail outlet, foodservice, and e-commerce. The e-commerce segment held significant revenue share of 11.86% in 2024. Companies are focusing on E-commerce platforms, which is particularly preferred by millennials. Additionally, convenience factor of e-commerce websites and rapid penetration of mobile phones has further resulted in growing usage of this distribution channels thus benefitting the segment growth. providing a seamless shopping experience tailored to the evolving preferences of modern consumers. Online retail platforms offer a wide range of plant-based meat alternatives from various brands, allowing consumers to explore and discover products that align with their dietary needs and preferences. Moreover, the convenience of online shopping enables consumers to bypass traditional retail barriers such as geographic limitations and store availability, empowering them to access plant-based meat products regardless of their location, thereby driving the segment growth.

Regional Analysis

The North America plant-based meat market accounted for a 40.65% of global revenue share in 2024 due to growing health awareness and shifting consumer preferences. Increasing concerns about animal welfare, climate change, and rising cases of lifestyle-related diseases are driving demand. Major food companies and startups are investing in innovation and product development. The region further has a strong presence of flexitarian and vegan consumers, especially among younger generations. Additionally, retail stores and foodservice chains are expanding their plant-based offerings, making these products more accessible. Moreover, marketing through social media and influencer campaigns has further helped boost awareness and adoption across the region, thereby driving the growth.

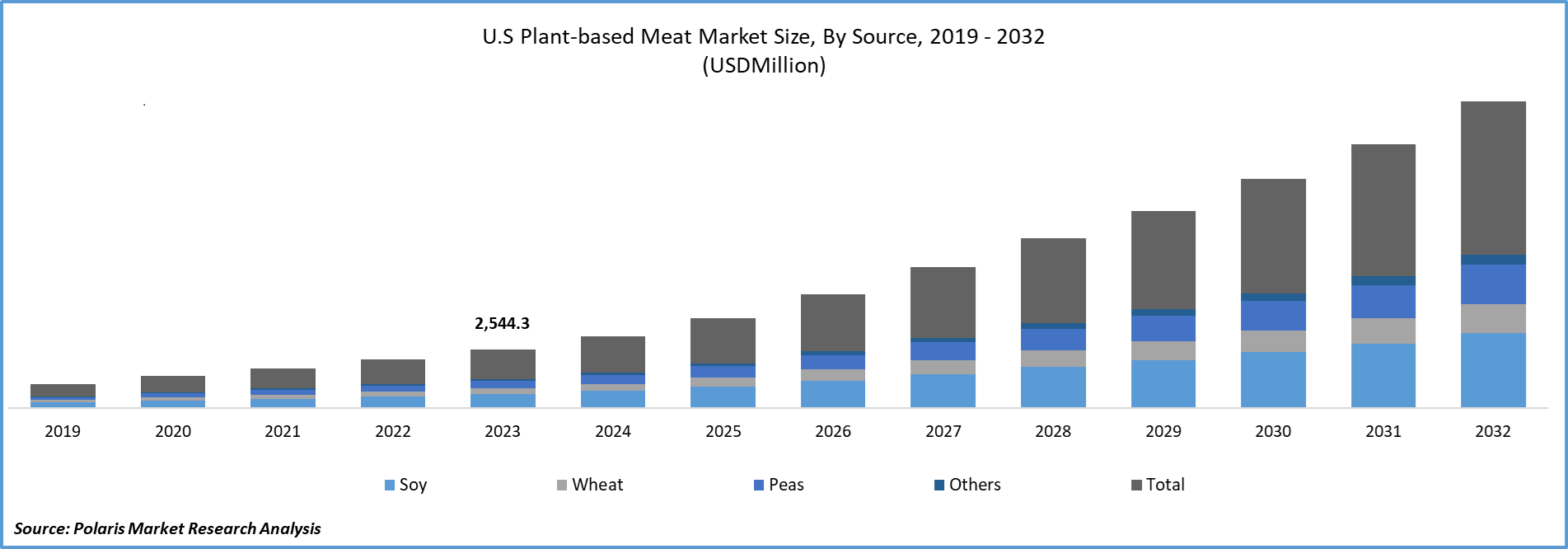

U.S. Plant-Based Meat Market Insights

The U.S. held 84.55% of the revenue share within North America in 2024, driven by high consumer awareness and demand for healthier food alternatives. Growing concerns about the environmental impact of animal agriculture and the increasing popularity of flexitarian diets are fueling the market. Many American companies such as Beyond Meat and Impossible Foods have set global benchmarks in innovation. Additionally, supermarkets and restaurants across the U.S. have widely adopted plant-based options, making them mainstream. Online sales and direct-to-consumer models are further rising, giving consumers easier access. Moreover, continued investment in research and product development is expected to support long-term growth in the U.S. market.

Asia Pacific Plant-Based Meat Market Trends

The market in Asia Pacific is expected to register a CAGR of 20.3% during the forecast period fueled by rising population, urbanization, and growing awareness of health and sustainability. Cultural openness to plant-based diets in countries such as India and Buddhist-influenced regions has further supported expansion. Increasing demand for protein-rich diets, along with concerns about food security and environmental issues, is encouraging consumers to try meat alternatives. Moreover, governments and food companies are investing in innovation and infrastructure to promote plant-based products, thereby fueling the growth.

China Plant-Based Meat Market Overview

The demand for plant-based meat in China is rising due to changing dietary habits, food safety concerns, and increasing awareness about health and sustainability. Younger consumers and urban populations are driving the demand for meat alternatives. Traditional plant-based eating practices in China, such as tofu and mock meat, further provide a cultural foundation for acceptance of new products. Chinese companies, as well as international brands, are expanding their presence through local partnerships and online platforms. Moreover, the government’s support for sustainable food innovation is further boosting the demand, thereby driving the growth.

Europe Plant-Based Meat Market Overview

The industry in Europe is projected to register a CAGR of 19.3% from 2025 to 2034, driven by strong environmental and animal welfare awareness. Countries such as the UK, Germany, and the Netherlands have experienced a rise in veganism and flexitarianism. Consumers in Europe are highly conscious of food sustainability, and many prefer plant-based options to reduce their carbon footprint. The European Union has further supported plant-based innovation through funding and regulatory support. Retail chains and restaurants have rapidly expanded their plant-based offerings, making them widely available. This growing consumer interest, combined with supportive policies, fueling the growth in Europe.

Key Players & Competitive Analysis

The industry is characterized by strong competition among established food companies and emerging startups. Major players such as Beyond Meat and Impossible Foods have built significant market presence through product innovation and brand recognition. Traditional food manufacturers, including Kellogg (MorningStar Farms), Conagra Brands (Gardein), Unilever (The Vegetarian Butcher), Maple Leaf Foods, and Amy’s Kitchen, continue to expand their plant-based offerings by utilizing their existing production and distribution capabilities. Companies such as Quorn Foods, Tofurky, Gold & Green Foods, and Sunfed also contribute to a diverse range of products across categories. Newer entrants such as NOVAMEAT, v2food, OmniPork, VBites, and Eat JUST bring technological innovation and region-specific products to the market. The competitive landscape remains dynamic, with companies focusing on product quality, nutrition, and sustainability to differentiate themselves.

Key Players

- Amy’s Kitchen Inc.

- Beyond Meat Inc.

- Boca Foods Company (Kraft Foods, Inc.)

- Conagra Brands, Inc.

- Eat JUST

- Gold & Green Foods Ltd.

- Greenwise

- Impossible Foods Inc.

- Kellanova

- Kellogg

- Maple Leaf Foods Inc.

- NOVAMEAT

- OmniPork

- Quorn Foods

- Sunfed

- Tofurky

- Unilever

- v2food Pty Ltd

- VBites Foods Limited

- Zikooin

Plant-Based Meat Industry Developments

In August 2025, Eat Just launched its new plant-based chicken line under the JUST Meat brand. It features original, buffalo, and sesame ginger flavors. Spotted at Sprouts and listed on H-E-B, the products offer 18g of protein and quick frozen preparation.

In August 2025, Juicy Marbles partnered with Revo Foods to launch Kinda Salmon, a raw, plant-based salmon filet featuring 13g of protein and omega-3s. Released in the U.S. on August 4, the product followed the sellout success of Kinda Cod.

Market Segmentation

By Source Outlook (Revenue, USD Billion, 2021–2034)

- Soy

- Wheat

- Peas

- Other Sources

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Burger Patties

- Sausages

- Strips & Nuggets

- Meatballs

- Other Products

By Distribution Channel Outlook (Revenue, USD Billion, 2021–2034)

- Retail Outlet

- Foodservice

- E-commerce

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.03 Billion |

|

Market Size in 2025 |

USD 10.77 Billion |

|

Revenue Forecast by 2034 |

USD 54.49 Billion |

|

CAGR |

19.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The e-commerce segment is projected to witness the fastest growth during the forecast period.

The global market size was valued at USD 9.03 billion in 2024 and is projected to grow to USD 54.49 billion by 2034.

The global market is projected to register a CAGR of 19.7% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Amy’s Kitchen Inc.; Beyond Meat Inc.; Boca Foods Company (Kraft Foods, Inc.); Conagra Brands, Inc.; Eat JUST; Gold & Green Foods Ltd.; Greenwise; Impossible Foods Inc.; Kellanova; Kellogg; Maple Leaf Foods Inc.; NOVAMEAT; OmniPork; Quorn Foods; Sunfed; Tofurky; Unilever; v2food Pty Ltd; VBites Foods Limited; and Zikooin.

The soy segment dominated the market revenue share in 2024.