Piperidine Market Share, Size, Trends, Industry Analysis Report, By Purity (98%, 99%); By End-Use (Agrochemicals, Pharmaceuticals, Rubber, Others); By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa); Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 117

- Format: PDF

- Report ID: PM2645

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

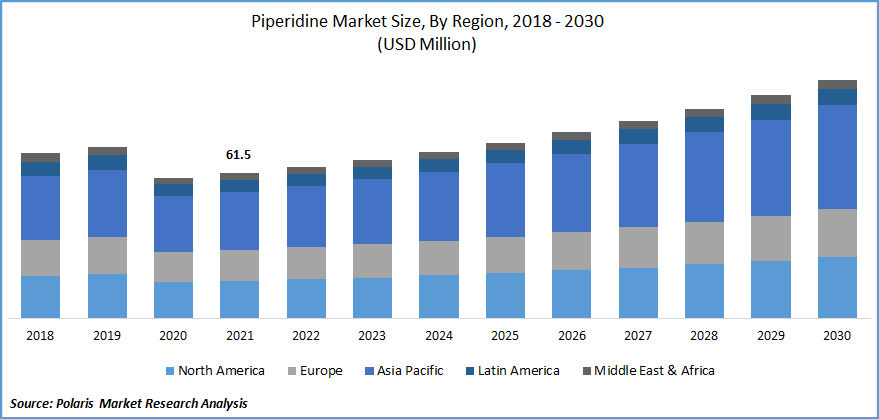

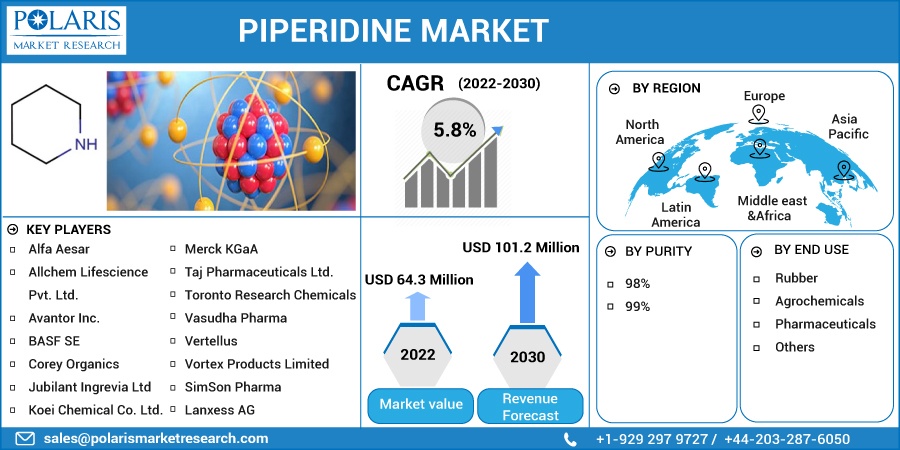

The global piperidine market was valued at USD 61.5 million in 2021 and is expected to grow at a CAGR of 5.8% during the forecast period. The rising demand for piperidine in the pharmaceutical and agrochemical industry drives the market’s growth. Piperidine is a heterocyclic organic compound containing one nitrogen atom. It is acquired naturally from black pepper. Piperidine is used in the manufacturing of drugs and forms the structure of several pharmaceutical drugs, such as thioridazine and raloxifene among others.

Know more about this report: Request for sample pages

The byproducts of piperidine exhibit pharmacophoric properties, increasing their application in various therapeutic applications. Derivatives of piperidine are used in antimicrobial, anticancer, and antiviral treatments. It is also utilized in analgesic, antifungal, and antihypertension drugs.

Piperidine is increasingly being used in the production of agrochemicals. It is an extensively used amine for producing a wide range of organic compounds. It finds application as a solvent and base for the manufacturing of agrochemicals. Piperidine exhibits the high property of anti-oxidation through the suppression of free radicals. Increasing need to improve agricultural production and gain improved yield has increased the application of piperidine in the agricultural sector.

It is also used in the manufacturing of rubber chemicals. Piperidine is used to obtain Dipiperidinyl Dithium Tetra sulfide, which is utilized widely for accelerating rubber vulcanization. It is increasingly being used as an intermediate for the automotive industry. It is used to obtain rubber with varying properties of elasticity, durability, and hardness through sulfur vulcanization of rubber. It is utilized for the manufacturing of tires, conveyor systems, hoses, and belts, among others. Greater demand for passenger vehicles, modernization of vehicles, and higher demand for lightweight and high-performing vehicles boost the demand for piperidine.

The outbreak of the COVID-19 influenced the growth of the piperidine market. The market experienced supply chain disruptions, transportation delays, and workforce impairment. Reduced demand for piperidine was experienced by automotive and agriculture industries due to restrictions in import and export activities, the imposition of lockdown, and travel restrictions. Reduced availability of raw materials and the closure of global markets further hampered the growth in industrial sectors. However, piperidine was widely used in healthcare and pharmaceutical to produce several drugs to address health concerns during the pandemic.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Growth in population and rapid urbanization have increased the demand for piperidine in recent years. The application of piperidine in the production of drugs and pharmaceuticals has significantly contributed to market growth. Research and development for the production of advanced drugs for treating diseases, rising healthcare expenditure, and greater demand from emerging economies further boost the demand for piperidine.

There has been a rise in demand for piperidine from the automotive sector to manufacture rubber products. The growing disposable income of consumers and urbanization has increased the demand for passenger vehicles. There has been an increasing inclination toward high-performing and efficient vehicles, driving the demand for piperidine. The rise in the electrification of vehicles, implementation of stringent safety regulations, and greater demand for luxury vehicles boost the market growth.

Piperidine is increasingly being used for the production of agrochemicals. The rise in the need to improve agricultural output, greater demand for high-quality and organic food products, and government support for the improvement of agricultural yield further increases the application of piperidine in the agriculture sector.

Report Segmentation

The market is primarily segmented based on purity, end-use, and region.

|

By Purity |

By End Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

99% purity segment accounted for a significant share

Based on purity, the global piperidine market has been segmented into 98% and 99%. The 99% purity segment accounted for a major share 2021. The 99% purity is used in the pharmaceutical sector for production of several drugs. Several anti-inflammatories, antipsychotic anti-Alzheimer, and anticoagulant agents are based on piperidine. A significant rise in investments in pharmaceutical research, technological advancements associated with drug discovery, and greater initiatives toward drug development and testing boost the growth of this segment.

The demand for 98% purity will increase during the forecast period. It is used in applications such as the production of agrochemicals and rubber products. Economic growth in developing countries, rise in industrialization, and greater demand for high-performing vehicles supports the growth of this segment. Strengthening the manufacturing sector across the world, rise in application in the agriculture sector to obtain higher quality agricultural produce, and technological advancements further contribute to the growth of this segment.

The pharmaceutical segment accounted for a major share in 2021

Based on end-use industry, the global piperidine market is segmented into rubber, agrochemicals, pharmaceutical, and others. The pharmaceutical segment generated significant revenue in 2021. Piperidine is widely used to produce many anti-microbial, anti-cancer, and anti-inflammatory drugs, among others. Piperidine and its associated derivatives are also increasingly used as antiproliferation and antimetastatic drugs.

A rise in cases of chronic diseases, growth in healthcare expenditure, and an increase in investments in drug development and testing boost the growth of this segment. The rise in the geriatric population, growing instances of lifestyle diseases, and the development of advanced drugs support the increasing demand for piperidine.

Asia-Pacific generated significant revenue in 2021

The Asia Pacific piperidine market accounted for a major market share in 2021. Rise in population, growing industrialization, and greater investments in research and development in the healthcare and pharmaceutical sector drive the market growth in the region.

With greater application in the automotive sector for the production of tires and other rubber products, the rising need for high-performing and lightweight vehicles further accelerate the demand for piperidine.

The demand for agrochemicals derived from piperidine is expected to increase in the region during the forecast period. The rise in need to improve agricultural output, rising demand from India, Australia, and China, and the adoption of improved farming practices would contribute to higher demand for piperidine in Asia Pacific over the coming years.

Competitive Insight

Some prominent companies operating in the global piperidine market include Alfa Aesar, Allchem Lifescience Pvt. Ltd., Avantor Inc., BASF SE, Corey Organics, Jubilant Ingrevia Limited, Koei Chemical Co. Ltd., Lanxess AG, Merck KGaA, Taj Pharmaceuticals Ltd., Toronto Research Chemicals, Vasudha Pharma, Vertellus, Vortex Products Limited, and SimSon Pharma. These leading market players are investing in developing advanced products for applications such as pharmaceutical, agriculture, and automotive. They also enter mergers and collaborations to strengthen their market presence and expand their customer base.

Recent Developments

In May 2022, Avantor, Inc. announced the establishment of a new manufacturing and distribution facility. The new unit is to be based in Singapore. The new facility would enable the company to improve its manufacturing capabilities and leverage its established distribution facility. The new unit is expected to begin operations in 2023 to serve a wider customer base in Asia-Pacific.

Piperidine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 64.3 million |

|

Revenue forecast in 2030 |

USD 101.2 million |

|

CAGR |

5.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Purity, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Alfa Aesar, Allchem Lifescience Pvt. Ltd., Avantor Inc., BASF SE, Corey Organics, Jubilant Ingrevia Limited, Koei Chemical Co. Ltd., Lanxess AG, Merck KGaA, Taj Pharmaceuticals Ltd., Toronto Research Chemicals, Vasudha Pharma, Vertellus, Vortex Products Limited, and SimSon Pharma |