Piperazine Market Size, Share, Trends, Industry Analysis Report: By Source (Synthetic and Natural), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5512

- Base Year: 2024

- Historical Data: 2020-2023

Piperazine Market Overview

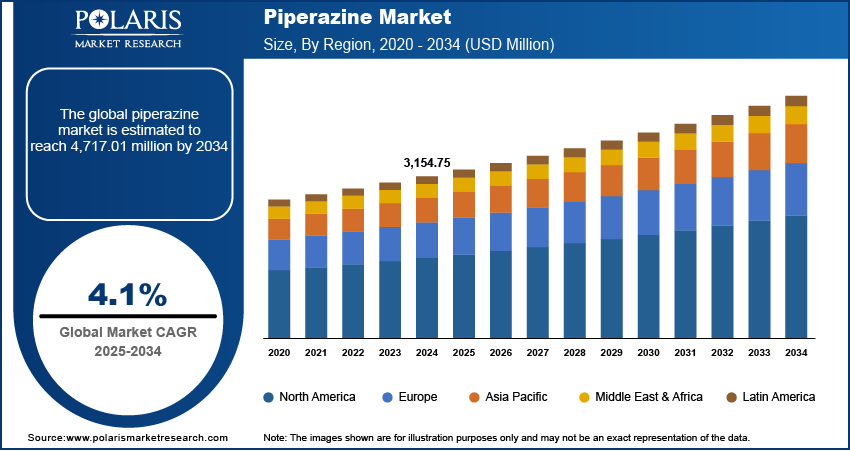

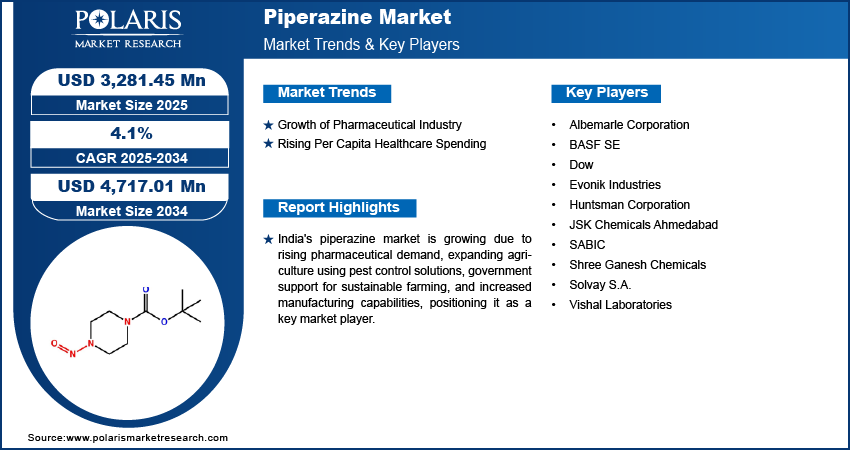

Piperazine market size was valued at USD 3,154.75 million in 2024. The market is projected to grow from USD 3,281.45 million in 2025 to USD 4,717.01 million by 2034, exhibiting a CAGR of 4.1% during the forecast period.

Piperazine is an organic compound commonly used in the chemical industry as a building block for producing various chemicals, including pharmaceuticals and agrochemicals. It is also utilized in the manufacturing of industrial solvents, corrosion inhibitors and as a treatment for certain parasitic infections in humans and animals.

The growth of the water treatment sector is driving the demand for piperazine. The piperazine plays an important role in water treatment control corrosion and scale formation in water pipes and systems. The need for effective water management is increasing as more regions around the world focus on water conservation and sustainability. Piperazine ensures clean and efficient water systems by preventing the buildup of scale that hinders water flow and quality. The global push for better water treatment solutions and rising concerns about water scarcity make piperazine essential, thereby driving the piperazine market expansion.

To Understand More About this Research: Request a Free Sample Report

Advancements in chemical manufacturing technologies have made piperazine production more efficient and cost-effective. Innovations in manufacturing processes allow for better yields, reduced waste, and lower production costs. These improvements make piperazine more accessible to a variety of industries, such as pharmaceuticals, water treatment, and agrochemicals. Lower production costs enable piperazine to become more competitive in the market, leading to greater adoption across different sectors, thereby driving the piperazine market growth.

Piperazine Market Dynamics

Growth of Pharmaceutical Industry

The pharmaceutical industry is growing worldwide due to which the demand for piperazine is rising. According to the US Bureau of Labor Statistics, the US alone employs 341,770 people in the pharmaceutical industry, showcasing the growth of the pharmaceutical industry. Piperazine is crucial in producing drugs for treating parasitic infections, anxiety, and neurological disorders. The rising global prevalence of conditions such as intestinal worms and other parasitic diseases contributes to the increased need for piperazine-based medications. As a result, the piperazine market demand is expanding.

Rising Per Capita Healthcare Spending

Healthcare spending per capita is increasing worldwide, particularly in emerging markets, leading to a higher demand for medical treatments, including those involving piperazine. According to the US Centers for Medicare & Medicaid Services, in 2023, the US national healthcare spending per capita was recorded at USD 14,570, showcasing growth in healthcare spending per capita. Governments and private sectors are making significant investments in healthcare infrastructure, resulting in greater accessibility and affordability of medicines on an individual basis. This surge in healthcare expenditure per capita supports the growing demand for drugs containing piperazine, especially in treating parasitic infections and other related conditions, thereby driving the piperazine market growth.

Piperazine Market Segment Analysis

Piperazine Market Assessment by End Use

The piperazine market segmentation, based on end use, includes pharmaceutical, agrochemicals, personal care & cosmetics, and others. The agrochemicals segment is expected to witness significant growth during the forecast period. Piperazine is widely used in the production of pesticides, herbicides, and insecticides, which help control pests and diseases that affect crops. The growing global demand for food has led farmers to rely more on effective pest control solutions to ensure higher crop yields. The shift towards sustainable farming practices and the increasing need for low-toxicity chemicals in agriculture further drive the use of piperazine-based products in agrochemicals, thereby driving the segmental growth.

Piperazine Market Evaluation by Source

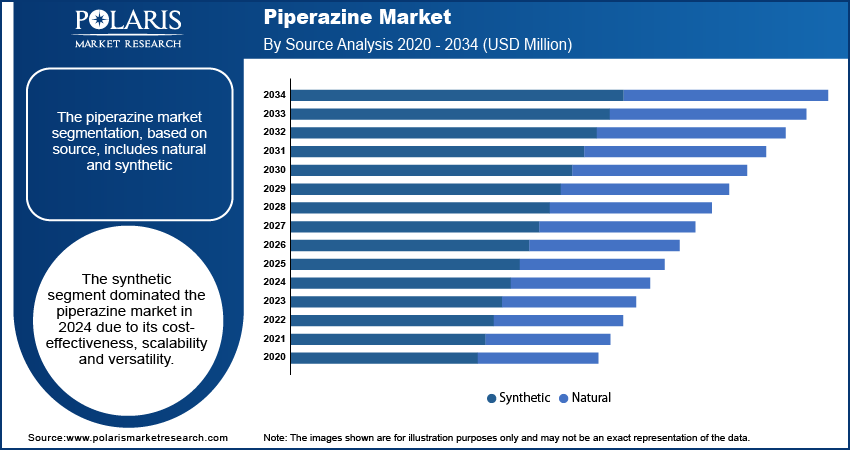

The piperazine market segmentation, based on source, includes natural and synthetic. The synthetic segment dominated the piperazine market in 2024. Synthetic piperazine is produced through chemical processes, offering high purity and consistency, which makes it ideal for use in pharmaceuticals, agrochemicals, and other industries. The demand for synthetic piperazine is driven by its cost-effectiveness, scalability, and versatile applications. Synthetic piperazine remains the preferred choice due to its reliability and efficiency in production as industries such as healthcare and agriculture continue to grow, thereby driving the segmental growth in the market.

Piperazine Market Regional Insights

By region, the study provides the piperazine market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to its widespread use in the pharmaceutical and agrochemical industries. The region has a well-established healthcare infrastructure, driving the demand for piperazine-based medications, especially for treating parasitic infections. Additionally, the growing demand for efficient insect pest control in agriculture contributes to the use of piperazine in pesticides and insecticides. The increasing awareness of animal health and veterinary further drives the demand for piperazine in the region, thereby driving the growth of the piperazine market in North America.

Asia Pacific is expected to record a significant piperazine market share during the forecast period. The region’s expanding population and improving healthcare systems are driving the demand for medicines containing piperazine, particularly for treating parasitic infections in both humans and animals. Additionally, the agricultural sector in Asia Pacific is experiencing significant growth, with an increasing need for effective pest control solutions, driving the demand for piperazine-based agrochemicals. The rise of sustainable farming practices and government initiatives to improve healthcare further fuel the demand for the piperazine.

The piperazine market in India is experiencing substantial growth driven by its large population and expanding healthcare sectors. The demand for piperazine in pharmaceuticals is rising due to the growing prevalence of parasitic infections and the increasing availability of healthcare services. Additionally, India’s agricultural industry relies heavily on pest control solutions, and piperazine-based chemicals are widely used in insecticides and fungicides. India’s growing manufacturing capabilities further drive the demand for piperazine in industrial settings.

Piperazine Market Key Players & Competitive Analysis Report

The piperazine market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. According to the piperazine market analysis, this competitive trend is amplified by continuous progress in product offerings. Major players in the piperazine market include Albemarle Corporation, BASF SE, Dow, Evonik Industries, Huntsman Corporation, JSK Chemicals Ahmedabad, SABIC, Shree Ganesh Chemicals, Solvay S.A., and Vishal Laboratories.

BASF is a chemical corporation that operates all over the world. The company operates through seven segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, and agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the Materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. Polymer dispersions, resins, electronic materials, pigments, antioxidants, light stabilizers, oilfield chemicals, mineral processing, and hydrometallurgical chemicals are among the ingredients and additives developed and sold by the industrial solutions sector. Surface Technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors, including refinishing coatings, surface treatment, catalysts, battery materials, and base metal services. The Nutrition & Care sector provides nutrition and care ingredients for pharmaceutical as well as food and feed producers, detergent, cleaner industries, and cosmetics. The Agricultural Solutions segment offers seeds and crop protection products, such as insecticides, herbicides, fungicides, biological crop production products, and seed treatment products. BASF's piperazines are cyclic amines available in various forms, including a 68% aqueous solution. These intermediates have diverse applications across industries.

Dow is a chemical manufacturing conglomerate with a wide range of products. Dow Inc. offers consumer care, construction, and industrial materials science solutions throughout the United States, Canada, Latin America, Europe, Africa, India, the Middle East, and Asia Pacific. The company maintains 113 production facilities in 31 countries. Coatings, durable goods, home and personal care, adhesives and sealants, and food and specialized packaging are among the applications served by the company. Dow's portfolio includes six global business divisions, structured into three functioning segments including industrial intermediates & infrastructure, packaging & specialty plastics, and performance material & coatings. The industrial intermediates & infrastructure segment offers propylene oxide, ethylene oxides, aromatic isocyanates, and polyurethane systems, propylene glycol, polyether polyols, coatings, sealants, adhesives, composites, elastomers caustic soda, vinyl chloride monomers; ethylene dichloride, cellulose ethers, silicones, acrylic emulsions, and redispersible latex powders. The packaging & specialty plastics segment offers ethylene, polyolefin elastomers, propylene and aromatics products, ethylene propylene diene monomer rubbers, polyethylene, and ethylene-vinyl acetate. The performance materials and coatings segment offers industrial coatings and architectural paints that are used in maintenance and protective industries, thermal paper, metal packaging, wood, traffic markings, leather, standalone silicones, performance monomers and silicones, and home and personal care solutions. DOW provides piperazine, a 68% AQ cyclic ethyleneamine in a 68% aqueous solution. It is used in various applications and offers several benefits due to its unique properties.

Key Companies in Piperazine Market

- Albemarle Corporation

- BASF SE

- Dow

- Evonik Industries

- Huntsman Corporation

- JSK Chemicals Ahmedabad

- SABIC

- Shree Ganesh Chemicals

- Solvay S.A.

- Vishal Laboratories

Piperazine Market Segmentation

By Source Outlook (Volume, Kilotons; Revenue USD Million, 2020–2034)

- Natural

- Synthetic

By End Use Outlook (Volume, Kilotons; Revenue USD Million, 2020–2034)

- Pharmaceutical

- Agrochemicals

- Personal Care & Cosmetics

- Other

By Regional Outlook (Volume, Kilotons; Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Piperazine Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,154.75 million |

|

Market Size Value in 2025 |

USD 3,281.45 million |

|

Revenue Forecast in 2034 |

USD 4,717.01 million |

|

CAGR |

4.1% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The piperazine market size was valued at USD 3,154.75 million in 2024 and is projected to grow to USD 4,717.01 million by 2034.

The global market is projected to register a CAGR of 4.1% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Albemarle Corporation, BASF SE, Dow, Evonik Industries, Huntsman Corporation, JSK Chemicals Ahmedabad, SABIC, Shree Ganesh Chemicals, Solvay S.A., and Vishal Laboratories.

The synthetic segment dominated the piperazine market in 2024 due to its cost-effectiveness, scalability, and versatility.

The agrochemicals segment is expected to witness significant growth in the forecast period.