Phytosterols Market Size, Share, Trends, Industry Analysis Report: By Product (Beta-Sitosterol, Campesterol, Stigmasterol, Others), Form, Source, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM1937

- Base Year: 2024

- Historical Data: 2020-2023

Phytosterols Market Overview

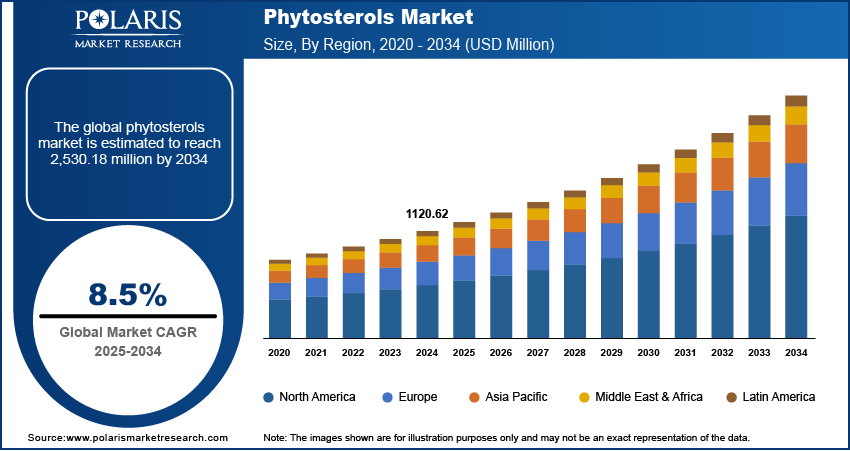

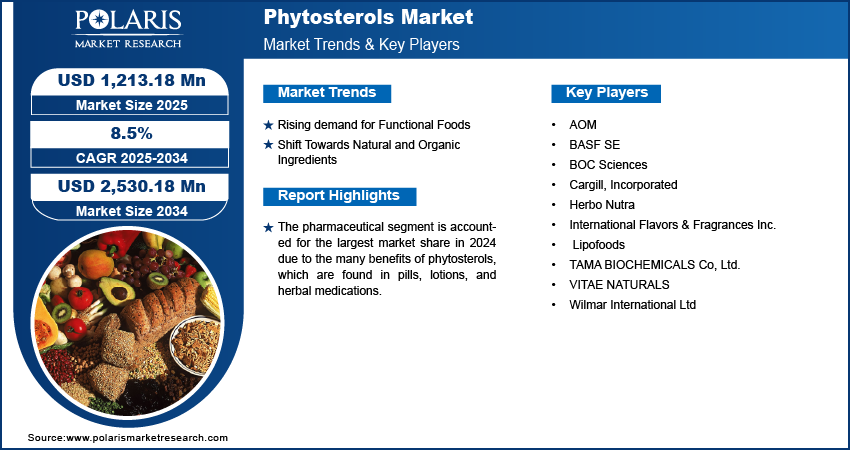

Phytosterols market size was valued at USD 1,120.62 million in 2024 and is expected to reach USD 1,213.18 million by 2025 and 2,530.18 million by 2034, exhibiting a CAGR of 8.5% during the forecast period (2025-2034).

The phytosterols market focuses on plant-based sterols widely used for their cholesterol-lowering properties in functional foods, dietary supplements, and pharmaceuticals. These compounds are increasingly in demand due to their cardiovascular health benefits, driving their integration into food formulations, nutraceuticals, and personal care products.

The phytosterols market is expanding as more consumers seek healthier lifestyles and prefer plant-based compounds over synthetic alternatives. Phytosterols are beneficial in managing blood cholesterol levels, which helps reduce the risk of cardiovascular diseases. Additionally, the fortification of foods with phytosterols is becoming more widespread, as meals enriched with these compounds helps to lower LDL cholesterol levels. This trend is further driving the growth of the phytosterols market.

To Understand More About this Research: Request a Free Sample Report

Phytosterols are added to three product categories: condiment sauces, fresh dairy and related products, and margarines. When foods are enriched with phytosterols, plasma phytosterol levels increase, which helps to lower the risk of cardiovascular issues. For instance, in April 2023, a recent study published in the journal Nutrition, Metabolism and Cardiovascular Diseases shows that the impact of PS-fortified meals successfully lowered the blood LDL-C concentrations by conducting a meta-analysis.

Phytosterol has been extensively researched for its various health benefits, including anti-diabetic, antioxidant, anticancer, anti-inflammatory, antiviral, and antiparasitic properties. Unlike cholesterol, phytosterols in the human body come from the diet, as humans dont produce phytosterols themselves. Clinical trials have shown that daily consumption of foods containing at least 2 grams of free or esterified plant sterols or stanols which lower serum total and LDL cholesterol by 9–14%.

Phytosterols Market Dynamics

Rising demand for Functional Foods

The growing demand for functional foods is a key driver of the phytosterols market, as consumers increasingly prioritize health-focused diets. Phytosterols, known for their cholesterol-lowering properties, are extensively used in fortified products such as margarine, dairy alternatives, and cereals. Their inclusion in functional food formulations aligns with rising consumer awareness of cardiovascular health and preventive care. Additionally, frequent product launches of phytosterol-enriched foods by manufacturers are expanding product portfolios, meeting consumer demand, and significantly contributing to phytosterols market growth. For instance, in May 2023, Kirin Holdings and Kellogg Japan have launched All-Bran Immune Care, a new product designed to boost immune system health. This is the first "meal"-style product to feature the Lacticaseibacillus rhamnosus L. lactis strain Plasma, classifying it as a functional food and highlighting the integration of nutrition and immunology in food innovation.

Shift Towards Natural and Organic Ingredients

The shift toward natural and organic ingredients is a significant growth driver for the phytosterols market, as these plant-derived compounds align with consumer preferences for healthier, eco-friendly options. Phytosterols are widely used in natural and organic functional foods due to their cholesterol-lowering benefits and compatibility with clean-label trends. Furthermore, companies are actively investing in expanding their natural ingredient portfolios and enhancing production capabilities to meet this demand, reflecting the increasing integration of phytosterols into organic food formulations. For instance, in April 2024, REDUCED, an AgriFood portfolio company, invested USD 6.6 million to expand its business selling natural food ingredients. They intend to use the funds to develop their technology platform further, expand their portfolio with additional savory ingredients, increase production capacity, obtain certifications, and strengthen their marketing and sales efforts.

Phytosterols Market Segment Insights

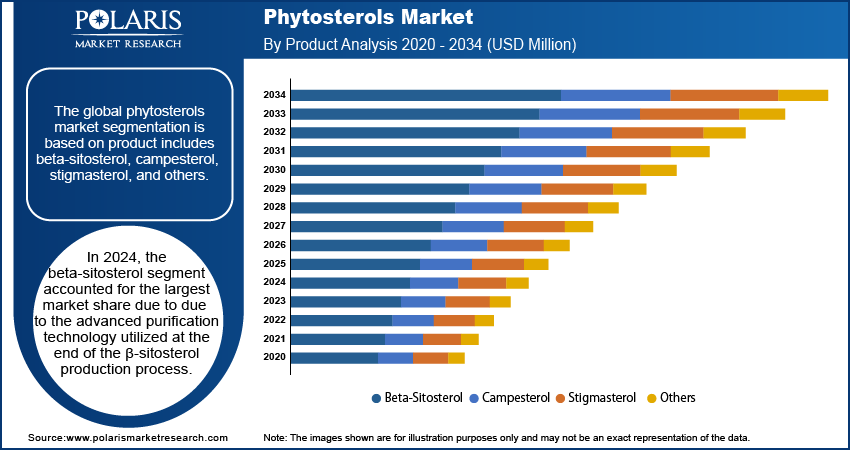

Phytosterols Market Assessment by Product Outlook

The global phytosterols market segmentation is based on product includes beta-sitosterol, campesterol, stigmasterol, and others. In 2024, the beta-sitosterol segment accounted for the largest market share due to due to the advanced purification technology utilized at the end of the β-sitosterol production process. This technology allows over 98% of the main eluent to be recycled back into the same process, thereby enhancing resource efficiency and sustainability. For example, in February 2024, CordenPharma introduced β-sitosterol to enhance endosome escape capability while preserving the size and encapsulation of Lipid NanoParticles (LNPs), representing a groundbreaking advancement in the field of cholesterol replacement.

The campesterol segment is projected to grow at a fastest CAGR during the projected period, mainly driven by its anti-inflammatory properties and antimicrobial effects. It has been shown to inhibit cholesterol formation, decrease cholesterol levels, and possess antioxidant, anti-inflammatory, and immune-boosting properties.

Phytosterols Market Evaluation by Form Outlook

The global phytosterols market segmentation is based on form includes liquid, and dry. The liquid segment is accounted for the largest market share in 2024. Incorporating phytosterols into food and beverages is a challenge due to their insolubility in lipids and water. However, using a unique delivery system in liquid form enhances the dispersibility of phytosterols in food and beverages. This makes it easier to include phytosterols in a person's diet, leading to decreased blood cholesterol levels and reduced risk of cardiovascular diseases

The dry segment is expected to grow at the fastest growth rate over the next coming years, attributed to its extended shelf life, minimal processing, and ease of packaging. Phytosterols are commonly produced in granular and powder forms due to their natural state, requiring minimal processing, and being highly commercialized. Additionally, using dry phytosterols ensures precise dosage integration in foods.

Phytosterols Market Evaluation by Application Outlook

The global phytosterols market segmentation is based on application includes food & beverage, dairy products, bakery & confectionery, nutritional products, snacks & cereals, beverages, pharmaceuticals, cosmetics & personal care products, others. The pharmaceutical segment is accounted for the largest market share in 2024 due to the many benefits of phytosterols, which are found in pills, lotions, and herbal medications. The market for phytosterols in medicinal formulations has been growing due to the increasing cases of high cholesterol among the elderly, as well as the prevalence of lifestyle disorders and other health issues. It is expected that this trend will continue to drive the expansion of this market segment in the foreseeable future.

The food and beverage segment is expecting rapid growth with healthy CAGR. Phytosterols are known for their ability to reduce cholesterol and are frequently included as an ingredient in functional foods. They are found in a variety of food items, including dairy products, baked goods, and spreads. As people become more health-conscious and seek ways to improve their diets, there is likely to be an increase in demand for these products.

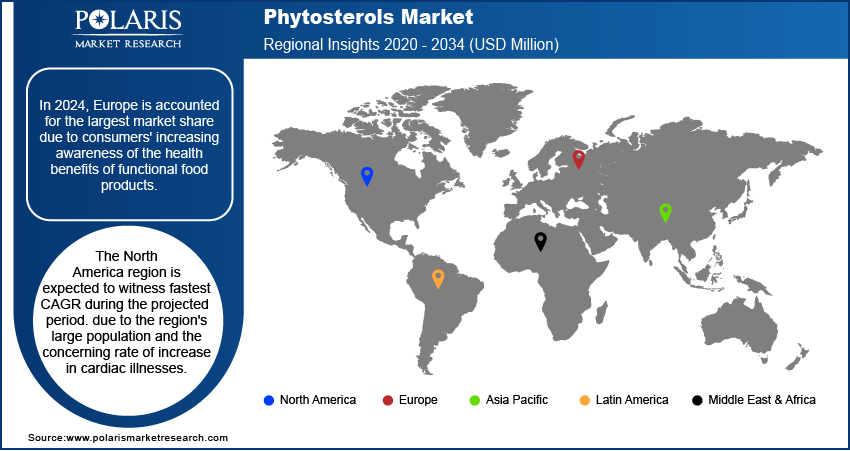

Phytosterols Market Share by Regional Analysis

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe is accounted for the largest market share. The growth is largely attributed to consumers' increasing awareness of the health benefits of functional food products and their ability to afford upscale personal care goods due to their high disposable incomes. Further, the rising demand for natural and sustainable extract-based cosmetics is driving the addition of phytosterols to these products. For example, in October 2023, a French agritech startup, Elicit Plant, plans to introduce a new phytosterol-based product called EliSun-a to increase sunflower yields in the European market. This product is designed to be sprayed on sunflower plants, allowing phytosterols to enter and promote the growth of their roots.

The North America region is expected to witness fastest CAGR during the projected period. due to the region's large population and the concerning rate of increase in cardiac illnesses. The US Food and Drug Administration has granted Generally Recognized as Safe (GRAS) certification for adding plant sterols to food items. For instance, Cargill produces and distributes the CoroWise brand of plant sterols. Plant sterols have been clinically shown to lower cholesterol levels and are supported by an FDA health claim. They are recommended by the National Heart, Lung, and Blood Institute of the National Institutes of Health's National Cholesterol Education Program (NCEP). Plant-based meals contain modest levels of plant sterols, which have a potent ability to reduce cholesterol. In response to consumer demands, food producers have started including plant sterols in their products.

Phytosterols Key Market Players & Competitive Analysis Report

The Phytosterols market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to enhance the properties of phytosterols by various extraction methods to ensure sustainability during the manufacturing processes to stay ahead of the competition and to ensure enhanced properties of phytosterols to meet the consumers demand. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Cargill is a global provider of food, ingredients, agricultural solutions, and industrial products, serving multiple sectors with a focus on safety, responsibility, and sustainability. The company's diverse product and service offerings span agriculture, animal nutrition, beauty, bio-industrial solutions, data asset solutions, food and beverage, food service, industrial applications, meat and poultry, pharmaceuticals, risk management, supplements, and transportation. In the agricultural sector, Cargill supplies grains, oilseeds, cotton, and palm oil, contributing to global food systems and commodity markets. The company's animal nutrition division offers specialized products, including NutreBeef Cattle Feeds, Right Now Minerals, Fescue EMT Mineral Defense, Cattle Grazers Mineral, Ranger Limiter, and Safe-Guard 32SG Mineral to support livestock health and performance.

BASF SE is a chemical corporation that operates all over the world. The company operates through seven segments including chemicals, industrial solutions, materials, surface technologies, nutrition & care, and agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the Materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. Polymer dispersions, resins, electronic materials, pigments, antioxidants, light stabilizers, oilfield chemicals, mineral processing, and hydrometallurgical chemicals are among the ingredients and additives developed and sold by the industrial solutions sector. Surface Technologies provide chemical solutions and automotive OEM services to the automotive and chemical sectors, including refinishing coatings, surface treatment, catalysts, battery materials, and base metal services.

Key Companies in the Phytosterols Market

- AOM

- BASF SE

- BOC Sciences

- Cargill, Incorporated

- Herbo Nutra

- International Flavors & Fragrances Inc.

- Lipofoods

- TAMA BIOCHEMICALS Co, Ltd.

- VITAE NATURALS

- Wilmar International Ltd

Phytosterols Market Developments

In May 2024, Kensing acquired Vitae Naturals and Advanced Organic Materials (AOM), to produce plant-based phytosterols and vitamin E made from non-GMO, deforestation-free sources such sustainable soy, sunflower, and rapeseed.

In September 2023, Nutrartis launched Cardiosmile, a liquid sachet supplement that uses water-dispersible phytosterols to control cholesterol and heart health.

Phytosterols Market Segmentation

By Product Outlook (Revenue USD Billion 2020 - 2034)

- Beta-Sitosterol

- Campesterol

- Stigmasterol

- Others

By Form Outlook (Revenue USD Billion 2020 - 2034)

- Liquid

- Dry

By Source Outlook (Revenue USD Billion 2020 - 2034)

- Vegetable Oils

- Nuts and Seeds

- Whole Grains

- Others

By Application Outlook (Revenue USD Billion 2020 - 2034)

- Food & Beverage

- Dairy Products

- Bakery & Confectionery

- Nutritional Products

- Snacks & Cereals

- Beverages

- Pharmaceuticals

- Cosmetics & Personal Care Products

- Others

By Regional Outlook (Revenue USD Billion 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Phytosterols Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,120.62 million |

|

Market Size Value in 2025 |

USD 1,213.18 million |

|

Revenue Forecast in 2034 |

USD 2,530.18 million |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global phytosterols market size was valued at USD 1,120.62 million in 2024 and is projected to grow to USD 2,530.18 million by 2034.

• The global market is projected to grow at a CAGR of 8.5% during the forecast period.

• In 2024, Europe is accounted for the largest market share due to consumers' increasing awareness of the health benefits of functional food products.

• Some of the key players in the market are AOM; BASF SE; BOC Sciences; Cargill, Incorporated; Herbo Nutra; International Flavors & Fragrances Inc.; Lipofoods; TAMA BIOCHEMICALS Co, Ltd.; VITAE NATURALS; Wilmar International Ltd.

• In 2024, the beta-sitosterol segment accounted for the largest market share due to due to the advanced purification technology utilized at the end of the ?-sitosterol production process.

• The pharmaceutical segment is accounted for the largest market share in 2024 due to the many benefits of phytosterols, which are found in pills, lotions, and herbal medications.