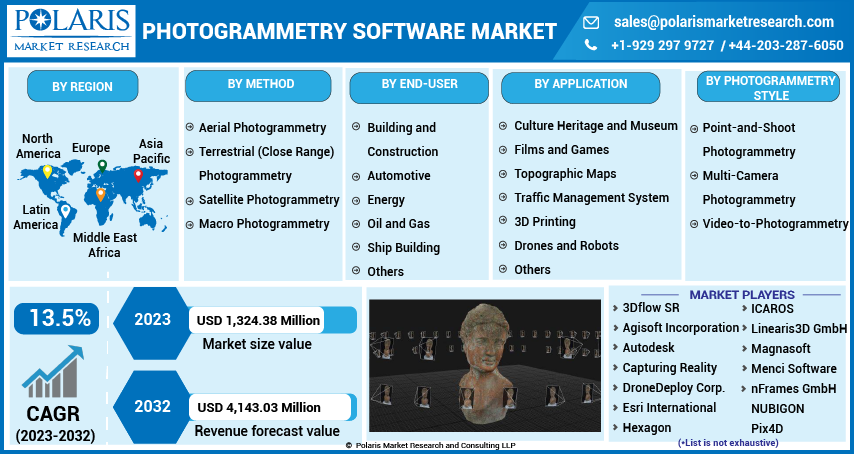

Photogrammetry Software Market Share, Size, Trends, Industry Analysis Report, By Method (Aerial Photogrammetry, Terrestrial Photogrammetry, Satellite Photogrammetry, & Macro Photogrammetry); By Photogrammetry Style; By End-User; By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Aug-2023

- Pages: 118

- Format: PDF

- Report ID: PM3722

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

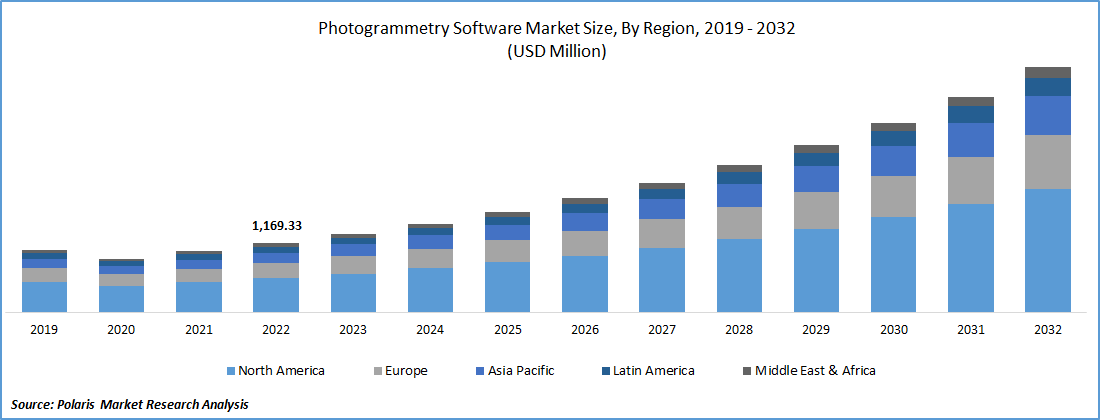

The global photogrammetry software market was valued at USD 1,169.33 million in 2022 and is expected to grow at a CAGR of 13.5% during the forecast period.

Photo-based 3D data is extracted from images using a process called photogrammetry. By comparing and mapping the pixels across a collection of pictures of any object or item, photogrammetry software was used to create this sphere. Surveyors, engineers, architects, and contractors frequently employ photogrammetry to produce topographic maps, drawings, and maps. In addition, photogrammetry software has advantages for several other industries, including entertainment, sports, and filmmaking.

To Understand More About this Research: Request a Free Sample Report

Moreover, drones take overhead shots and pictures; they can fly close enough to record minute features like fractures in the pavement or survey markings. The ortho mosaic, a big image created by the photogrammetry program, combines several photos of a location. A point cloud or 3D model can be made using the data. The software takes all the images and compares the pixels to produce an accurate orthomosaic. Then, it connects the colors in a manner akin to that of a jigsaw by matching their hues. The software allows users to closely examine photographs of infrastructure or other items, such as streets, buildings, and pavements. Additionally, the information from the drone's GPS navigation system aids the software in pinpointing the precise location of any object.

The market is expanding due to drone-based photogrammetry for aerial surveying and mapping operations. In July 2020, Pix4D, the market leader in photogrammetry and drone imaging software, introduced Pix4Dscan and Pix4Dinspect. To provide an all-inclusive solution for commercial inspections and asset management, the flight app and a cloud-based software solution are outfitted with capabilities tailored to the business and artificial intelligence.

The market's expansion is aided by the expanding acceptance of photogrammetry software across various industries and the high customer satisfaction with the product. Additionally, the market benefits from expanding urbanization, rising investment, and government efforts. The two main drivers of market growth are changes in lifestyle and the rise of the agricultural industry. The market's expansion is accelerated by the availability of sensors, including those for temperature, vibration, and location.

For Specific Research Requirements, Request for a Sample Report

Industry Dynamics

Growth Drivers

Rising use of GPS in construction industry

The Global Positioning System (GPS) has become more widely used in various industries. Construction is one of the sectors that primarily relies on GPS data. Conversely, GPS provides timely and accurate data, improving their performance even under these challenging circumstances. The construction industry has undergone significant change due to its ability to provide accuracy at centimeter and sub-meter levels at a low cost. The use of GPS technology in the construction sector has many benefits, including the ability to access signals from everywhere on Earth, whether in the air, on land, or at sea, as well as the fact that it is a weather-resistant system that can be used on any platform and runs continuously.

Further, the market expansion is primarily driven by the increase in GPS receiver utilization in the construction sector and the creation of photogrammetry software to aid laborers on the job site. Many large-scale construction projects, including megaprojects for confirming construction equipment, utilize GPS technology. For instance, in June 2023, OpenSpace declared that it extended the building information modeling (BIM)-specific insights from its reality capture technology deeper into the construction industry. BIM Compare, a mobile app feature that lets field employees evaluate their model side by side with actual site circumstances, was released by Openspace. These factors are assisting the market to grow rapidly.

Report Segmentation

The market is primarily segmented based on method, end-user, application, photogrammetry style, and region.

|

By Method |

By End-User |

By Application |

By Photogrammetry Style |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Method

The aerial Photogrammetry segment is expected to witness the fastest growth

The aerial photogrammetry segment is driving the fastest CAGR over the forecast period. Large tracts of land can be covered using aerial photogrammetry in a single flight while capturing high-resolution photos. Both timely information and a recent snapshot of the ground can be provided. The procedure is quick and inexpensive, and the imaging applies to various sectors. Construction can benefit from the usage of aerial photos. Filmmaking, archaeology, and environmental research all use aerial photography. Map making is aerial's main application.

Additionally, In June 2023, The C5 and C30 aerial survey cameras from CHC Navigation provided aerial photogrammetry with unmatched accuracy and efficiency. Professionals can utilize the full potential of aerial surveying owing to the cutting-edge cameras that seamlessly integrate with unmanned aerial vehicles (UAVs) and produce outstanding image quality. Launching cameras for the aerial segment drives the market's growth over the forecast period.

By Application

3D Printing accounted for the significant market share in 2022

Using photogrammetry to print 3D models is gaining popularity as 3D scanning technology becomes more accessible. Turning photos and movies into virtual things has used photogrammetry software. It creates a realistic image or model using two major approaches, three-dimensional modeling, and photorealistic rendering, also known as photorealistic engraving. In recent years, 3D printing has advanced tremendously. It plays significant functions in various applications, including manufacturing, custom art and design, and medicine. One of the most popular methods for quick prototyping is this one. 3D replicas of scaled-down real-world things.

Adopting 3D printing across various applications drives market growth over the forecast period. For instance, In December 2022, Synopsys introduced Simpleware U-2022.12 3D image software. The most recent Simpleware software edition presents numerous new features and enhancements. It includes the craniomaxillofacial (CMF) CT tool in the Simpleware Ortho/CMF module, the smart painting tool, the automatic connector possibility for 3D printing, and further materials evaluation. These factors are accelerating segmental growth.

Regional Analysis

The demand in North America is expected to witness significant growth during forecast period

North America is anticipated to witness significant growth during the projected period due to its high rate of digitization and considerable usage of photogrammetry software. The U.S. dominates the industry, particularly in topographic mapping, architecture, and engineering. As a result of the vendors in this area making considerable R&D investments, technologies for land surveying and other geospatial tasks like geo-capturing, geo-modeling, geo-imaging, and geo-referencing have advanced.

Moreover, in April 2022, Epic Games launched a 3D scanning app to create high-quality 3D models from smartphone images. The RealityScan app aims to increase accessibility to "sophisticated photogrammetry." It was developed in partnership with Capturing Reality and Quixel. 'Ultra-detailed' digital models of real-world things are added to virtual projects by RealityScan using photogrammetry. The software guides users through the scanning process through interactive feedback, augmented reality (A.R.) assistance, and data quality checks. This is mostly due to the increased demand from the building sector in nations like the United States, Canada, and Mexico. Other businesses are also making significant investments in photogrammetry technologies in this region.

Moreover, due to rising investments and development efforts in nations like Germany, Italy, the U.K., and France, Europe is anticipated to dominate the global market during the projected period. During the projection period, the Asia-Pacific area is expected to be one of the most promising markets for photogrammetry software due to growing interest among businesses in rising economies like India, Japan, China, and South Korea. The need for photogrammetry software has significantly expanded due to evolving processes and a heightened emphasis on boosting production quality across industries.

Competitive Insight

The Photogrammetry Software market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- 3Dflow SR

- Agisoft Incorporation

- Autodesk

- Capturing Reality

- DroneDeploy Corp.

- Esri International

- Hexagon

- ICAROS

- Linearis3D GmbH

- Magnasoft

- Menci Software

- nFrames GmbH

- NUBIGON

- Photometrix Photogrammetry Software

- Pix4D

- REDcatch

- SimActive

- Skyline Software

- Trimble Inc.

- Vexcel Imaging

Recent Developments

- In May 2023, OPF, a brand-new standard for the interchange of photogrammetry projects, is being introduced by Pix4D. Open Photogrammetry Format, or OPF, is for photogrammetry file formats that are being introduced. It is now feasible to save, trade, and collaborate on photogrammetric data between many parties and software products because of OPF, which is an open and free specification.

- In January 2022, Avica Cloud announced the introduction of its official website and client, both of which are intended to assist users in increasing productivity in the mapping industry more practically and affordably.

- In June 2022, Building interiors can be measured with SMARTTECH3D Photogrammetry for things like project design. Many industries, including shipbuilding, aviation, automotive, and energy, can use the most recent SMARTTECH3D photogrammetry technology to verify dimensions.

Photogrammetry Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,324.38 million |

|

Revenue Forecast in 2032 |

USD 4,143.03 million |

|

CAGR |

13.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Method, By Photogrammetry Style, By End-User, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The photogrammetry software market report covering key segments are method, end-user, application, photogrammetry style, and region.

Photogrammetry Software Market Size Worth $4,143.03 Million By 2032.

The global photogrammetry software market is expected to grow at a CAGR of 13.5% during the forecast period.

North America is leading the global market.

key driving factors in photogrammetry software market are rising use of GPS in construction industry.