Photoacoustic Imaging Market Size, Share, Trends, Industry Analysis Report: By Product [Photoacoustic Tomography (PAT) and Photoacoustic Microscopy (PAM)], Imaging Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM4987

- Base Year: 2024

- Historical Data: 2020-2023

Photoacoustic Imaging Market Overview

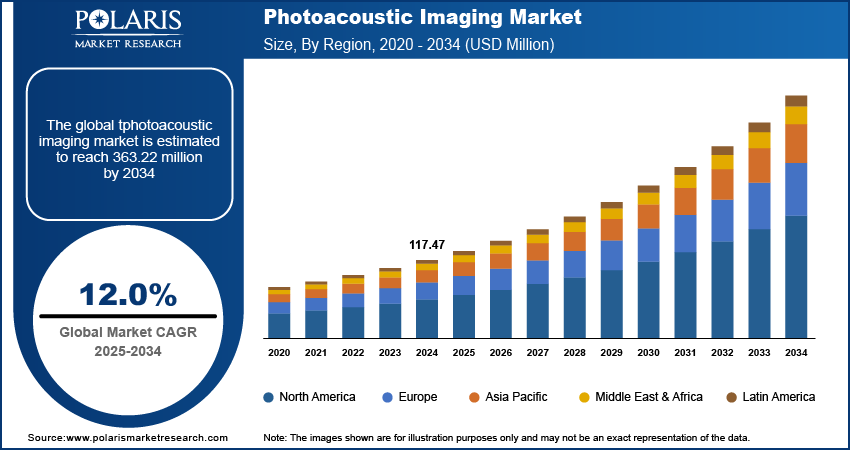

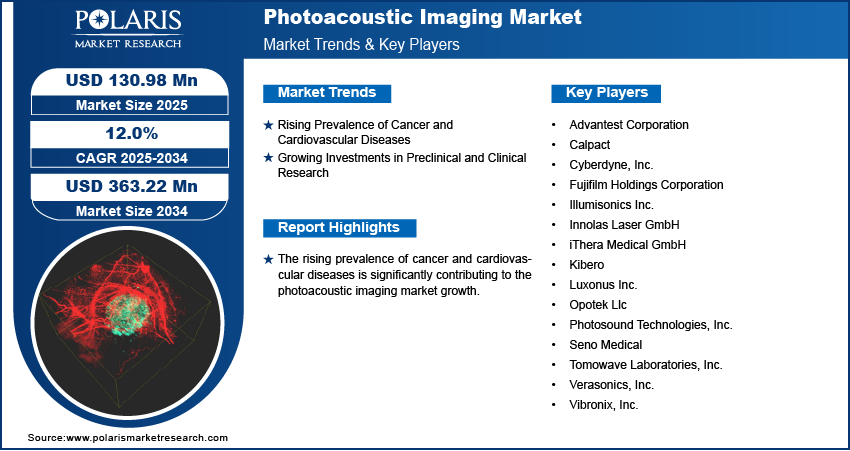

The global photoacoustic imaging market size was valued at USD 117.47 million in 2024 and is expected to reach USD 130.98 million by 2025 and USD 363.22 million by 2034, exhibiting a CAGR of 12.0% during 2025–2034.

Photoacoustic imaging (PAI) is an advanced biomedical imaging method that operates non-invasively. PAI functions by generating ultrasonic waves through pulsed laser irradiation of tissue, followed by reconstructing an image derived from the absorption pattern of light energy within the tissue. The ability of photoacoustic imaging to provide detailed vascular and molecular insights is boosting its adoption in brain imaging and skin cancer detection, thereby fueling photoacoustic imaging market expansion. Advancements in laser technology, increasing biomedical research, and rising demand for noninvasive imaging solutions are key factors shaping the market dynamics.

To Understand More About this Research: Request a Free Sample Report

The rising shift toward safer, radiation-free imaging techniques for real-time visualization is accelerating photoacoustic imaging market demand. Furthermore, increasing Food and Drug Administration and Conformite Europeenne (CE) approvals for clinical photoacoustic imaging devices are driving market demand.

Photoacoustic Imaging Market Dynamics

Rising Prevalence of Cancer and Cardiovascular Diseases

The rising prevalence of cancer and cardiovascular diseases is significantly contributing to the photoacoustic imaging market growth. In 2022, according to the New York State Behavioral Risk Factor Surveillance System, in New York State, 1.3 million adults (i.e., about 8.2% of people) have cardiovascular disease. As the demand for noninvasive, high-resolution imaging solutions increases for disease detection, the adoption of photoacoustic imaging technology is accelerating. This modality enables precise tumor detection, vascular imaging, and functional tissue characterization, enhancing diagnostic accuracy and early disease intervention. The growing need for real-time, high-contrast imaging is driving investments in research and development. Moreover, with increasing advancements in laser-based imaging and multimodal integration, the market forecast indicates sustained growth. Increasing clinical applications and supportive regulatory approvals are further strengthening the photoacoustic imaging market demand in modern medical diagnostics.

Growing Investments in Preclinical and Clinical Research

Increased funding for biomedical research and drug development is driving demand for advanced imaging techniques in disease modeling and therapy monitoring. For instance, the National Institutes of Health invested nearly USD 48 billion annually in medical research to improve life and reduce illness and disability. Moreover, the ability of photoacoustic imaging to provide high-resolution, real-time visualization of biological tissues is accelerating market expansion across pharmaceutical and research institutions. The photoacoustic imaging market statistics indicate a rising adoption of this technology for studying tumor microenvironments, vascular abnormalities, and treatment responses. The demand for photoacoustic imaging is expected to increase as researchers integrate photoacoustic imaging into precision medicine applications. Rising focus on technological advancements and increasing regulatory approvals for clinical adoption are generating investments in preclinical and clinical research. Thus, growing investments in preclinical and clinical research are expected to create the photoacoustic imaging market opportunities in the coming years.

Photoacoustic Imaging Market Segment Insights

Photoacoustic Imaging Market Assessment by Product Outlook

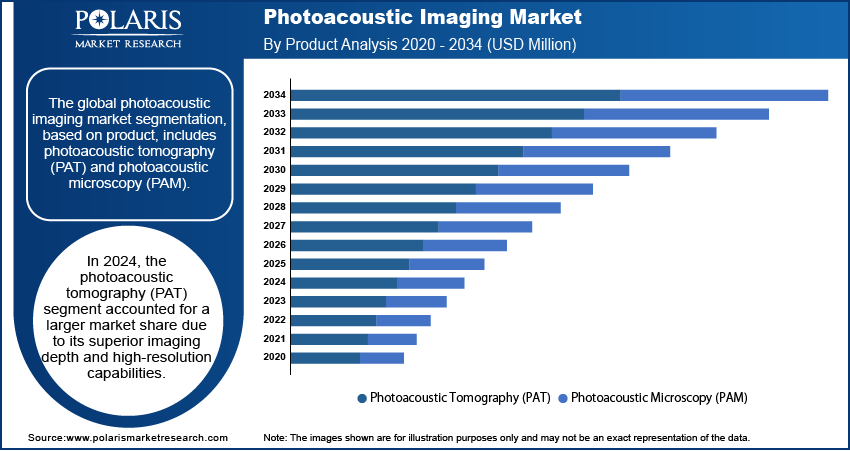

The global photoacoustic imaging market segmentation, based on product, includes photoacoustic tomography (PAT) and photoacoustic microscopy (PAM). In 2024, the photoacoustic tomography (PAT) segment accounted for a larger market share due to its superior imaging depth and high-resolution capabilities, making it indispensable in clinical and preclinical applications. The increasing adoption of PAT in oncology, neurology, and vascular imaging is driving market expansion, as it enables noninvasive visualization of deep tissue structures with functional and molecular contrast. PAT’s integration with ultrasound further enhances its diagnostic potential. The growing emphasis on precision medicine and the rising need for real-time, high-contrast imaging solutions are key factors contributing to photoacoustic tomography dominant market value.

The photoacoustic microscopy (PAM) segment is expected to witness a higher CAGR during the forecast period due to its ability to deliver ultra-high resolution at the cellular and subcellular levels. The rising demand for detailed vascular and microcirculatory imaging, particularly in dermatology, ophthalmology, and neurovascular research, is fueling market growth. The increasing utilization of PAM in drug discovery and histopathological studies is further expanding the demand for PAM. Moreover, continuous advancements in laser technology and miniaturization of imaging systems are enhancing PAM’s accessibility and usability, strengthening its market forecast as a critical tool in biomedical research and diagnostics.

Photoacoustic Imaging Market Evaluation by Application Outlook

The global photoacoustic imaging market segmentation, based on application, includes oncology, cardiology, angiology, histology, and interventional radiology. In 2024, the oncology segment accounted for the largest market share due to the rising prevalence of cancer and the urgent need for early, noninvasive tumor detection. Photoacoustic imaging provides superior soft tissue contrast and functional imaging capabilities, enabling real-time monitoring of tumor angiogenesis, hypoxia, and therapy response. The growing investments in cancer research, coupled with the increasing adoption of precision oncology solutions, are driving market expansion. The growing adoption of personalized treatment strategies is creating demand for advanced imaging modalities and enhancing its market value in oncology applications.

The cardiology segment is expected to witness the highest CAGR over the forecast period due to the increasing incidence of cardiovascular diseases (CVDs) and the need for advanced imaging technologies to assess vascular health. Photoacoustic imaging enables high-resolution visualization of atherosclerotic plaques, microvascular changes, and myocardial tissue oxygenation, driving market demand for early diagnosis. Advancements in multimodal imaging integration, such as PAT-ultrasound hybrids, are enhancing diagnostic accuracy and expanding market opportunities. The rising focus on preventive cardiology and the growing adoption of non-ionizing imaging modalities are key factors accelerating the photoacoustic imaging market expansion for the cardiology segment.

Photoacoustic Imaging Market Share by Regional Analysis

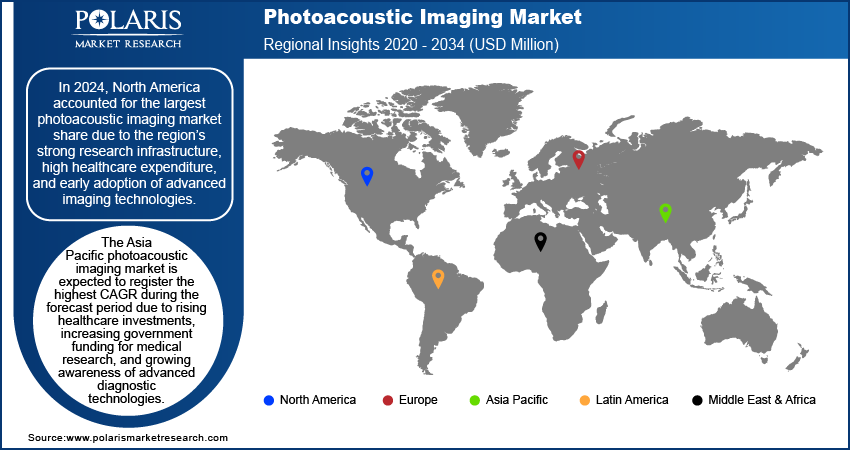

By region, the study provides photoacoustic imaging market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest photoacoustic imaging market share due to the region’s strong research infrastructure, high healthcare expenditure, and early adoption of advanced imaging technologies. For instance, in 2023, healthcare spending in the US reached $4.9 trillion, growing by 7.5% compared to the previous year. This was higher than the 4.6% growth rate recorded in 2022.. The increasing prevalence of cancer and cardiovascular diseases, coupled with growing investments in biomedical research, is driving market expansion. Leading academic institutions and research centers in the US and Canada are actively integrating photoacoustic imaging for clinical and preclinical applications, further contributing to market growth. Additionally, the presence of key industry players and favorable regulatory frameworks supporting medical imaging innovation strengthen North America’s dominant position in the global market.

The Asia Pacific photoacoustic imaging market is expected to witness the highest CAGR over the forecast period due to rising healthcare investments, increasing government funding for medical research, and growing awareness of advanced diagnostic technologies. For instance, according to the World Health Organization, over 2.3 million people are diagnosed with cancer in Southeast Asia annually, with approximately 1.4 million deaths by cancer in the region. The region’s expanding biotechnology and pharmaceutical sectors, particularly in China, Japan, and India, are accelerating demand for noninvasive, high-resolution imaging solutions. Additionally, the rising burden of cancer and cardiovascular diseases, coupled with an increasing focus on early disease detection and personalized medicine, is driving market growth. Collaborations between research institutes and industry players, along with technological advancements, are further boosting the Asia Pacific market expansion.

Photoacoustic Imaging Market Players & Competitive Analysis Report

The photoacoustic imaging market is characterized by intense competition, with key players focusing on strategic partnerships, collaborations, and mergers and acquisitions to strengthen their market position. Leading companies are investing in technological advancements to enhance imaging resolution, expand clinical applications, and integrate artificial intelligence for improved diagnostics. Academic and industry collaborations are driving innovation, particularly in preclinical and clinical research. Market participants are also expanding their geographic presence through joint ventures and distribution agreements to capitalize on growing demand in emerging economies. Furthermore, increased funding for biomedical research and precision medicine is prompting companies to develop next-generation imaging platforms, supporting the market’s growth trajectory and competitive intensity.

Fujifilm Corporation is involved in creating, selling, and distributing image, information, and document solutions. The company has established 280 regional management companies at major locations in the US, Europe, China, and Southeast Asia. It was founded in 1934 and is headquartered in Minato-ku, Tokyo. The three divisions through which the company functions are imaging solutions, information solutions, and document solutions. The Imaging solutions business unit deals with electronic imaging, photofinishing equipment, lab services, film processing, color films, color paper, and chemicals. The information solutions cover visual arts, recording media, and medical and life sciences systems. The document solutions division offers printers, office supplies, document creation, and outsourcing services. Fujifilm Corporation is actively engaged in the photoacoustic imaging market, leveraging its expertise in advanced imaging technologies to develop high-resolution, noninvasive diagnostic services for oncology and cardiovascular applications. The company focuses on technological innovation and strategic collaborations to enhance the adoption of photoacoustic imaging in clinical and research settings.

Advantest Corporation, is a major manufacturer of automatic test equipment (ATE) for the semiconductor industry. The company initially began as Takeda Riken Industry Co., Ltd., focusing on electronic measuring instruments before entering the semiconductor testing business in 1972. The company operates through three primary business segments: Semiconductor and Component Test Systems, Mechatronics Systems, and Services, Support, and Others. The semiconductor and component test systems segment includes various test solutions such as SoC test systems, memory test systems, and burn-in test systems. Advantest's global footprint is extensive, with operations in 18 countries and subsidiaries strategically located across North America, Europe, and Asia. Advantest Corporation is a key player in the photoacoustic imaging market, specializing in high-precision diagnostic and analytical imaging solutions.

List of Key Companies in Photoacoustic Imaging Market

- Advantest Corporation

- Calpact

- Cyberdyne, Inc.

- Fujifilm Holdings Corporation

- Illumisonics Inc.

- Innolas Laser GmbH

- iThera Medical GmbH

- Kibero

- Luxonus Inc.

- Opotek Llc

- Photosound Technologies, Inc.

- Seno Medical

- Tomowave Laboratories, Inc.

- Verasonics, Inc.

- Vibronix, Inc.

Photoacoustic Imaging Industry Developments

In November 2024, Seno Medical received an innovative technology contract from Vizient for its Imagio Breast Imaging System, which combines opto-acoustic and ultrasound imaging to enhance breast cancer diagnostics.

In August 2023, TomoWave launched systems for 3D quantitative optoacoustic tomography, advancing small animal imaging capabilities. These systems combined light and sound to provide high-resolution, functional images of tissue composition and microcirculation, enhancing preclinical research in cancer and vascular diseases.

In April 2022, Advantest Corporation launched the Euclid 3D image viewer for its Hadatomo series of photoacoustic microscopes. The Euclid enabled the display of 3D images by superimposing data on melanin, vascular networks, and skin structures, facilitating the creation of tomographic images.

Photoacoustic Imaging Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Photoacoustic Tomography (PAT)

- Photoacoustic Microscopy (PAM)

By Imaging Type Outlook (Revenue – USD Million, 2020–2034)

- Pre-Clinical

- Clinical

By Application Outlook (Revenue – USD Million, 2020–2034)

- Oncology

- Cardiology

- Angiology

- Histology

- Interventional Radiology

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Photoacoustic Imaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 117.47 Million |

|

Market Size Value in 2025 |

USD 130.98 Million |

|

Revenue Forecast in 2034 |

USD 363.22 Million |

|

CAGR |

12.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 117.47 million in 2024 and is projected to grow to USD 363.22 million by 2034.

The global market is projected to register a CAGR of 12.0% during the forecast period.

In 2024, North America accounted for the largest photoacoustic imaging market share due to the region’s strong research infrastructure, high healthcare expenditure, and early adoption of advanced imaging technologies.

A few of the key players in the market are Advantest Corporation; Calpact; Cyberdyne, Inc.; Fujifilm Holdings Corporation; Illumisonics Inc.; Innolas Laser GmbH; iThera Medical GmbH; Kibero; Luxonus Inc.; Opotek LLC; Photosound Technologies, Inc.; Seno Medical; Tomowave Laboratories, Inc.; Verasonics, Inc.; and Vibronix, Inc.

In 2024, the photoacoustic tomography (PAT) segment accounted for a larger market share due to its superior imaging depth and high-resolution capabilities.

In 2024, the oncology segment accounted for the largest market share due to the rising prevalence of cancer and the urgent need for early, noninvasive tumor detection.