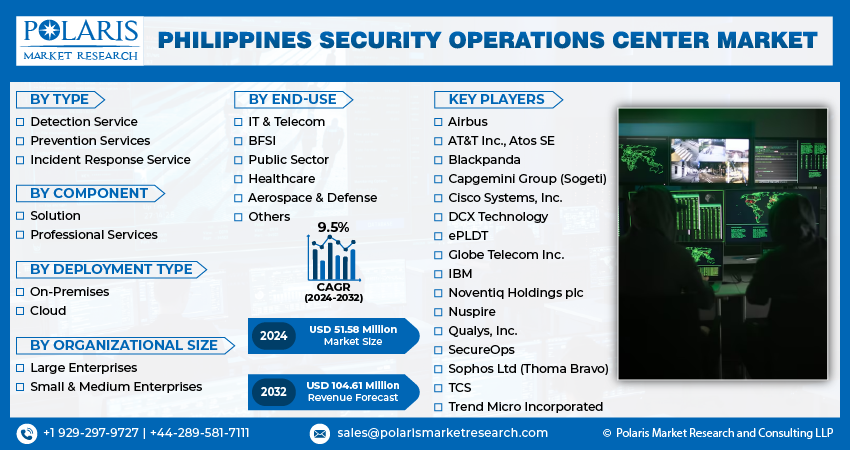

Philippines Security Operations Center Market Share, Size, Trends, Industry Analysis Report, By Type (Detection Service, Prevention Services, Incident Response Service); By Component; By Deployment Type; By Organizational Size; By End-Use; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 119

- Format: PDF

- Report ID: PM4940

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Philippines security operations center market size was valued at USD 46.05 million in 2023. The market is anticipated to grow from USD 51.58 million in 2024 to USD 104.61 million by 2032, exhibiting a CAGR of 9.5% during the forecast period

Industry Trends

A Security Operations Center (SOC) is a centralized facility where IT professionals and information security specialists analyze, monitor, and defend an organization against cyber-attacks. The number of data breaches is rising throughout the period, which is increasingly focusing on the cybersecurity process, pushing the security operation center market during the forecasted period. Furthermore, the rise in BYOD/CYOD trends and WFH will likely positively impact the market's growth. Moreover, the high growth of cyber security incidents during the COVID-19 pandemic and the dynamic changing business environment are also expected to create a huge demand for security operations centers (SOC) and lift the growth of the security operations center (SOC) market.

To Understand More About this Research:Request a Free Sample Report

With the rise of digital transformation, organizations face a surge of security threats and risks as more employees, clients, and partners adopt new trends and innovations. According to IBM, in 2020, the average cost of data breaches reached USD 67.7 million across all industry verticals.

Organizations secure themselves through agreements with a security policy and external security standards, such as the NIST Cybersecurity Framework (CSF), the General Data Protection Regulation (GDPR), and ISO 27001x. Organizations need a SOC to help comply with important security standards and best practices. For instance, Total Information Management (TIM) launched its most recent managed services offering, the Security Operations Center, in partnership with RSA and Nexusguard on December 9, 2020. Many vendors also offer specific SOC solutions to the various end-use applications. For instance, SecureOps launched a new Security Operations Center in the Philippines to expand its cyber-defense services. Additionally, In February 2021, UK-based Bluedog Security Monitoring signed an agreement with IT Security Distribution (ITSDI) to manage detection and response offerings via the channel in the Philippines, supported by a second security operations center (SOC) launch in Manila.

Key Takeaways

- By type category, the prevention services segment accounted for the largest Philippines security operations center market share in 2023

- By end-use category, the healthcare segment is expected to grow with a significant CAGR over the Philippines security operations center market forecast period

What are the market drivers driving the demand for the market?

Rising Cyberattacks in Philippines

The Philippines has been experiencing an alarming increase in cyberattacks in recent years. As the country's digital infrastructure continues to expand and its economy becomes more interconnected with the global digital landscape, the threat landscape for cybercrimes has grown exponentially. This surge in cyberattacks has propelled the growth of the security operation center (SOC) market in the Philippines, as businesses and organizations recognize the urgent need for robust cybersecurity measures.

The evolving threat landscape is a significant driver behind the expanding SOC market in the Philippines. Cybercriminals have become increasingly sophisticated, employing a wide array of tactics, from ransomware attacks to phishing campaigns, targeting both government institutions and private enterprises. These attacks not only jeopardize sensitive data but also disrupt critical operations, resulting in financial losses and reputational damage.

As a response to these escalating cyber threats, organizations across various sectors in the Philippines are investing in building or outsourcing SOC services. These centers serve as the first line of defense, continuously monitoring networks, analyzing data, and swiftly identifying and mitigating security breaches. With the rise of remote work and the digitalization of business operations, SOC services have become indispensable for safeguarding sensitive information and maintaining business continuity.

Which factor is restraining the demand for the market?

Lack of Skilled Professional

The Security Operations Center (SOC) market in the Philippines is on an upward trajectory, mirroring the global trend of increasing cyber threats and the growing awareness of the importance of cybersecurity. However, this burgeoning market faces a significant challenge - a shortage of skilled cybersecurity professionals.

In recent years, the Philippines has emerged as a hotspot for cybersecurity services and solutions. This growth is driven by a multitude of factors, including the expansion of digitalization across various industries, the rise in remote work due to the COVID-19 pandemic, and the increasing sophistication of cyberattacks. Organizations in the Philippines, spanning from government entities and financial institutions to small and medium-sized enterprises (SMEs), are recognizing the need to bolster their cybersecurity defenses, and as a result, are investing in SOC services.

The demand for SOC services in the Philippines is palpable, with businesses seeking 24/7 security monitoring, threat detection, and incident response capabilities. This demand is not confined to any particular sector; it spans across industries, emphasizing the pervasive nature of cybersecurity concerns in today's interconnected world.

Report Segmentation

The market is primarily segmented based on type, component, deployment type, organizational size, and end-use.

|

By Type |

By Component |

By Deployment Type |

By Organizational Size |

By End-Use |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Type Insights

Based on type category analysis, the market has been segmented on the basis of detection service, prevention services, and incident response service. The prevention services segment dominated the market since it encompasses a wide range of security measures to stop security incidents before they can cause harm proactively. These services typically include firewalls, intrusion prevention systems (IPS), secure access controls, and threat intelligence integration. As organizations in the Philippines recognize the importance of fortifying their cybersecurity defenses, there is a growing emphasis on prevention services to build robust security postures that can thwart potential threats. With the evolving threat landscape and the nation's determination to protect critical infrastructure and sensitive data, Prevention Services is poised to play a pivotal role in the country's overall cybersecurity strategy.

Organizations in the Philippines often turn to third-party SOC providers or establish in-house SOCs to access these proactive cybersecurity measures, which help defend against emerging threats and vulnerabilities. For instance, in July 2023, Deloitte strengthened its MXDR cybersecurity solution, collaborated with CrowdStrike and Claroty to bolster prevention, detection, and response capabilities for identity and operational technology security.

By End-Use Insights

Based on end-use category analysis, the market has been segmented on the basis of IT & telecom, BFSI, public sector, healthcare, aerospace & defense, and others. The healthcare segment is anticipated to grow over the forecast period because of the demand for Security Operations Centers (SOCs) in the healthcare market in the Philippines is influenced by several factors highlighting the critical need for robust cybersecurity measures in the healthcare sector. The Philippines has data privacy regulations, including the Data Privacy Act of 2012, which mandates the protection of sensitive patient data. Compliance with these regulations is essential for healthcare organizations, making SOC services necessary to ensure data security.

Healthcare organizations handle significant patient data, including medical records, billing information, and personal health details. Protecting this sensitive information from data breaches and unauthorized access is a top priority, requiring continuous monitoring and threat detection. Globally, the healthcare sector has experienced a surge in ransomware attacks, and the Philippines is no exception. Ransomware attacks can disrupt healthcare services and compromise patient data. SOCs are essential in detecting and mitigating these threats to prevent data encryption and extortion.

Competitive Landscape

In the market, companies employ various strategies to expand their presence and make the most of their experience and resources. Emerging players tend to diversify their services, embrace cloud and SaaS, offer competitive pricing, form partnerships, reach new markets, continuously innovate, and market their products aggressively. On the other hand, matured players collaborate with leading technology vendors, threat intelligence providers, and other industry leaders to enhance their service capabilities and stay ahead of the curve.

Some of the major players operating in the Philippines market include:

- Airbus

- AT&T Inc.

- Atos SE

- Blackpanda

- Capgemini Group (Sogeti)

- Cisco Systems, Inc.

- DCX Technology

- ePLDT

- Globe Telecom Inc.

- International Business Machines Corporation (IBM)

- Noventiq Holdings plc

- Nuspire

- Qualys, Inc.

- SecureOps

- Sophos Ltd (Thoma Bravo)

- Tata Consultancy Services Limited (TCS)

- Trend Micro Incorporated

Recent Developments

- In July 2023, Sophos launched Managed Detection and Response (MDR) for Microsoft Defender, enhancing cybersecurity by offering robust threat response capabilities across Microsoft Security solutions to combat data breaches and cyberattacks.

- In June 2023, Cisco launched generative AI technology in collaboration and security portfolios, including Webex summarization and AI-driven policy management for enhanced productivity and security.

- In February 2023, Trend Micro acquired Anlyz, a security operations center technology provider, to enhance its orchestration, automation, and integration capabilities for improved security outcomes and operational efficiency.

- In July 2023, Sophos and Cysurance have partnered to provide fixed-price cyber insurance to Sophos MDR customers, combining financial protection and technical response for cyberthreat risks.

- In February 2023, ePLDT and Microsoft collaborated to promote cloud migration and cybersecurity awareness, addressing growing threats and technical debt in the Philippines.

Report Coverage

The Philippines security operations center market research report provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, component, deployment type, organizational size, end-use, and futuristic growth opportunities.

Philippines Security Operations Center Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 51.58 million |

|

Revenue Forecast in 2032 |

USD 104.61 million |

|

CAGR |

9.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Component, By Deployment Type, By Organizational Size, By End-Use |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

Philippines Security Operations Center Market report covering key segments are type, component, deployment type, organizational size, and end-use.

Philippines Security Operations Center Market Size Worth USD 104.61 Million by 2032

Philippines security operations center market exhibiting a CAGR of 9.5% during the forecast period.

the key driving factors in Philippines Security Operations Center Market Rising cyberattacks in Philippines.