Pharmacovigilance Market Size, Share, Trends, Industry Analysis Report: By Service (In–house and Contract Outsourcing), Product Life Cycle, Type, Process Flow, Therapeutic Area, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 117

- Format: PDF

- Report ID: PM2355

- Base Year: 2023

- Historical Data: 2019-2022

Pharmacovigilance Market Overview

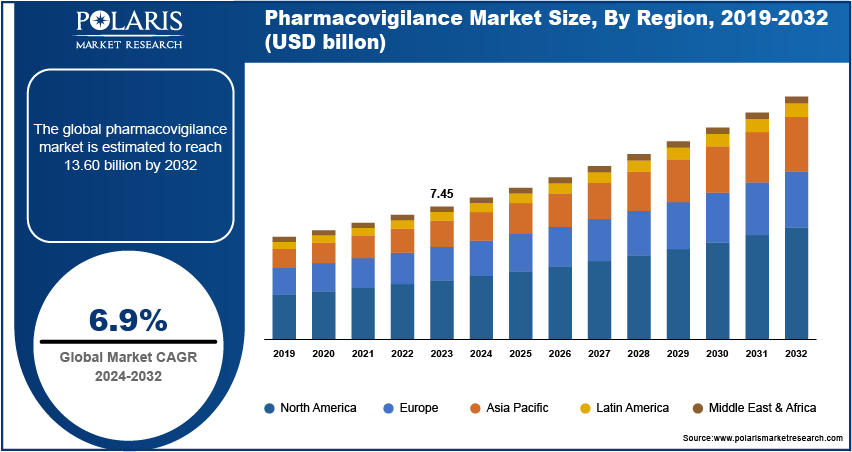

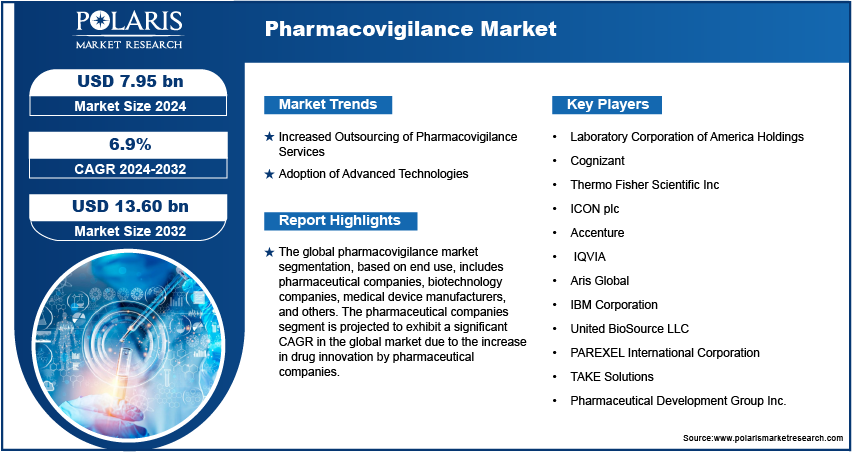

The global pharmacovigilance market size was valued at USD 7.45 billion in 2023. The market is projected to grow from USD 7.95 billion in 2024 to USD 13.60 billion by 2032, exhibiting a CAGR of 6.9% during the forecast period.

Pharmacovigilance is the study of detecting, assessing, and preventing adverse effects of medicine. Although medicines and vaccines are subjected to various testing for safety and efficacy in clinical trials before approval, these trials involve a limited number of patients over a relatively short duration. Increased research and development activities and new drug approvals are major growth drivers for the pharmacovigilance market. For instance, in 2022, according to the UNESCO Institute for Statistics (UIS), global research and development (R&D) expenditure amounted to USD 2.5 trillion, reflecting a 5.43% surge compared to the previous year. Increase of clinical trials and new drug approval, leading to an increased need for pharmacovigilance during drug development. Therefore, with these advancements in new drug approval and research and development, the growth of the pharmacovigilance market is being propelled.

To Understand More About this Research: Request a Free Sample Report

The pharmacovigilance market is driven by increasing drug consumption and adverse drug reactions (ADRs). Global rise in drug consumption, particularly due to the aging population and the prevalence of chronic diseases, is leading to more cases of adverse drug reactions and has driven market growth. For instance, according to the Food and Drug Administration's Adverse Event Reporting System (FAERS), in 2022, more than 1.25 million severe cases of adverse drug reactions were reported in the U.S. ADRs (adverse drug reactions) lead to increased morbidity, mortality, hospitalizations, and healthcare costs. With a rise in global drug consumption and the incidence of ADRs, there is a growing need for pharmacovigilance systems to monitor, detect, and manage these adverse events. Therefore, an increase in adverse drug reactions (ADRs) is driving the market growth.

Pharmacovigilance Market Drivers and Trends

Increased Outsourcing of Pharmacovigilance Services

Pharmaceutical companies are increasingly outsourcing pharmacovigilance services to comply with stringent regulatory requirements. Global health authorities including the Food and Drug Administration (FDA) and European Medicines Agency (EMA), enforce more rigorous safety standards. Also, companies must implement pharmacovigilance systems to ensure their products remain compliant throughout their lifecycle. For instance, in September 2021, IQVIA Holdings announced a collaboration with NRx Pharmaceuticals (NRXP) to provide pharmacovigilance services and medical information. This collaboration aims to support the emergency use authorization of ZYESAMI (a pre-commercial drug being investigated for COVID-19-associated respiratory failure) by facilitating pharmacovigilance and medical information programs.

Adoption of Advanced Technologies

The integration of artificial intelligence (AI), machine learning, and big data analytics in pharmacovigilance has enhanced safety monitoring capabilities for companies. These technologies facilitate the rapid processing of safety data volumes, leading to enhanced accuracy and efficiency in pharmacovigilance operations. For instance, in December 2021, Roche and Genentech collaborated with Recursion Pharmaceuticals to investigate novel domains in cell biology and create new therapies in critical areas of neuroscience and oncology. The alliance will harness Recursion's technology-driven drug discovery platform and Roche single-cell data generation and machine learning (ML) capabilities to comprehensively identify new drug targets and accelerate the development of small molecule medications. Genentech and Roche are using machine learning (ML) techniques across various disease areas and therapeutic modalities to develop more advanced models for drug discovery. Consequently, technological advancement is improving the efficiency and accuracy of pharmacovigilance processes, driving market growth.

Pharmacovigilance Market Segment Insights

Pharmacovigilance Market Breakdown by Therapeutic Area Insights

The global pharmacovigilance market segmentation, based on therapeutic area, includes oncology, neurology, cardiology, respiratory systems, and others. The oncology segment held the largest revenue share of the market due to the side effects of cancer therapy being one of the most important issues faced by cancer patients during their illness. Pharmacovigilance in oncology helps to prevent, detect, and manage drug-induced adverse reactions. For instance, according to the World Health Organization (WHO), in 2022, there were nearly 20 million new cancer cases reported worldwide, leading to 9.7 million cancer-related deaths. Among these cases, lung cancer was the most commonly occurring cancer, with 2.5 million new cases accounting for 12.4% of the total new cancer cases globally. Increase in the number of cancer cases leads to an increased need for pharmacovigilance to study the side effects of drugs on oncology patients.

Pharmacovigilance Market Breakdown by End-Use Insights

The global pharmacovigilance market segmentation, based on end use, includes pharmaceutical companies, biotechnology companies, medical device manufacturers, and others. The pharmaceutical companies segment is projected to exhibit a significant CAGR in the global market due to the increase in drug innovation by pharmaceutical companies. For instance, in 2022, the Center for Drug Evaluation and Research (CDER) approved 37 new drugs, with 28 of them receiving approval after their first review cycle. Pharmacovigilance is crucial in facilitating drug innovation, spanning from the pre-approval phase to the post-marketing stage.

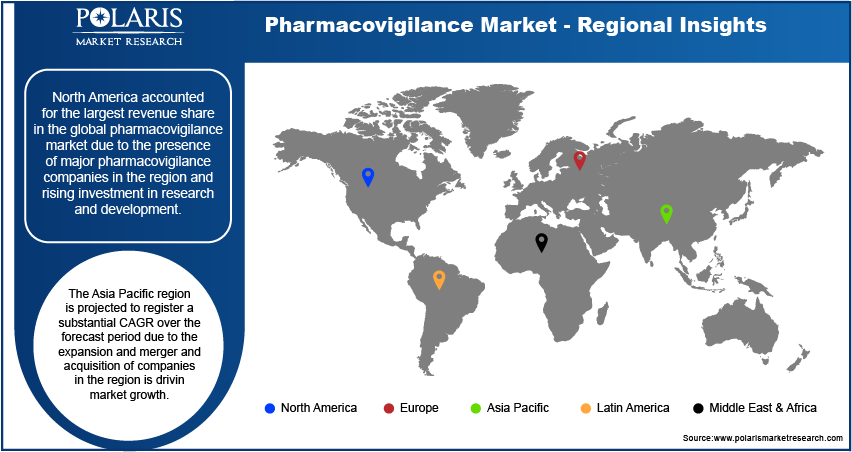

Pharmacovigilance Regional Insights

By region, the study provides the pharmacovigilance market insights into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest revenue share in the global pharmacovigilance market due to the presence of major pharmacovigilance companies in the region and rising investment in research and development. For instance, in 2023, the Center for Drug Evaluation and Research (CDER) approved 55 novel drugs in the region. Thus, the rise in the number of new drug approvals and the presence of major pharmacovigilance companies in the region is driving market growth, thereby contributing to the dominance of North America in the global market.

The Asia Pacific region is projected to register a substantial CAGR over the forecast period due to the expansion and merger and acquisition of companies in the region is driving market growth. For instance, in May 2023, Labcorp Laboratory Corporation of America Holdings announced an expansion project for its CB Trial Laboratory in collaboration with BML Research Institute and General Laboratory in Japan. The expanded laboratory will offer additional dedicated space to facilitate global clinical trials managed by Labcorp. Thus, such expansion and merger and acquisitions are fuelling the pharmacovigilance market in the Asia Pacific region.

The pharmacovigilance market in Japan is expected to have significant growth due to the increased prevalence of chronic diseases, elevated drug usage, and growing occurrence of adverse drug reactions (ADRs). For instance, Nextrove founded a subsidiary in Tokyo in August 2020 to enhance support for current and prospective partners and clients. The company offers consulting services to assist Japanese pharmaceutical firms with pharmacovigilance and other pertinent challenges.

Pharmacovigilance Market Key Players & Competitive Insights

The pharmacovigilance market is a dynamic and rapidly evolving environment with several players striving to innovate and differentiate from each other. Major global companies are dominating the market by leveraging extensive research and development capabilities, advanced manufacturing technologies, and broad distribution networks to maintain a competitive edge. The players are engaged in strategic activities such as mergers and acquisitions, partnerships, and collaborations to enhance their product portfolios and expand their market presence.

Startups are contributing to the market by introducing innovative technologies and attributing them to pharmacovigilance. This competitive scenario is further intensified by ongoing advancements in biotechnology, increased focus on big data analytics, machine learning (ML), and growing demand for the pharmacovigilance market. Major players in the pharmacovigilance market include Laboratory Corporation of America Holdings; Cognizant; Thermo Fisher Scientific Inc; ICON plc.; Accenture; IQVIA; Aris Global; IBM Corporation; United BioSource LLC; PAREXEL International Corporation; TAKE Solutions; and Pharmaceutical Development Group, Inc.

IQVIA is a provider of advanced analytics, technology solutions, and clinical research services to the life sciences industry. It creates connections across all aspects of healthcare through its analytics, transformative technology, big data resources, and extensive domain expertise. IQVIA, with approximately 86,000 employees, conducts operations in more than 100 countries. For instance, in October 2023, IQVIA announced a collaboration with Argenx to enhance the treatment options for patients with rare autoimmune diseases using advanced technology-enabled pharmacovigilance safety services and solutions with a focus on rapidly expanding clinical development and commercialization efforts for new indications.

Parexel, a clinical research organization (CRO), with headquarters based in Durham, North Carolina, offers comprehensive Phase I to IV clinical development services, regulatory and product development consulting, eClinical solutions, patient and site recruitment, medical device consulting, pharmacovigilance, biotechnology, and biotech with a team of over 21,000 global professionals. Parexel collaborates with biopharmaceutical industry leaders, emerging innovators, and research sites to strategize and execute patient-centric clinical trials. For instance, in February 2023, Parexel International Corporation introduced the Expert Series–New Medicines, Novel Insights. The series focuses on the increasing personalization and precision of advanced medicines within the therapeutic landscape, as well as the growing complexity of the drug development process. Through the New Medicines, Novel Insights research series, Parexel aims to provide expert-led guidance to facilitate patient-focused drug development and expedite the delivery of impactful treatments to patients.

List of Key Companies in Pharmacovigilance Market

- Laboratory Corporation of America Holdings

- Cognizant

- Thermo Fisher Scientific Inc

- ICON plc

- Accenture

- IQVIA

- Aris Global

- IBM Corporation

- United BioSource LLC

- PAREXEL International Corporation

- TAKE Solutions

- Pharmaceutical Development Group Inc.

Pharmacovigilance Industry Developments

February 2024: PrimeVigilance, a subsidiary of the Ergomed Group, has announced the acquisition of Panacea, which will significantly enhance PrimeVigilance's Generics, Hybrids, and Biosimilars Portfolio. This strategic acquisition enables PrimeVigilance to strengthen its presence in the rapidly growing Asian market.

March 2023: LEO Pharma has formed a partnership with ICON plc to enhance the scale of patient-centric and cost-effective clinical trial execution. The collaboration aims to bolster the efficient and effective execution of LEO Pharma's clinical portfolio.

February 2022: Ergomed Group announced the acquisition of ADAMAS Consulting Group Limited. This strategic move is expected to significantly enhance Ergomed's international presence, particularly in the US, Europe, and the Asia-Pacific region.

Pharmacovigilance Market Segmentation

By Service Outlook

- In-house

- Contract Sourcing

By Product Life Cycle Outlook

- Pre-clinical

- Phase I

- Phase II

- Phase III

- Phase IV

By Type Outlook

- Spontaneous Reporting

- Intensified ADR Reporting

- Targeted Spontaneous Reporting

- Cohort Event Monitoring

- EHR Mining

By Process Flow Outlook

- Case Data Management

- Case Logging

- Case Data Analysis

- Medical Reviewing and Reporting

- Signal Detection

- Adverse Event Logging

- Adverse Event Analysis

- Adverse Event Review & Reporting

- Risk Management System

- Risk Evaluation System

- Risk Mitigation System

BY Therapeutic Area Outlook

- Oncology

- Neurology

- Cardiology

- Respiratory Systems

- Others

By End-Use Outlook

- Pharmaceuticals

- Biotechnology Companies

- Medical Device Manufacturers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pharmacovigilance Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 7.45 billion |

|

Market Size Value in 2024 |

USD 7.95 billion |

|

Revenue Forecast in 2032 |

USD 13.60 billion |

|

CAGR |

6.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global pharmacovigilance market size was valued at USD 7.45 billion in 2023 and is projected to grow to USD 13.60 billion by 2032.

The global market is projected to register a CAGR of 6.9% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are Laboratory Corporation of America Holdings; Cognizant; Thermo Fisher Scientific Inc; ICON plc.; Accenture; IQVIA; Aris Global; IBM Corporation; United BioSource LLC; PAREXEL International Corporation; TAKE Solutions; and Pharmaceutical Development Group, Inc

The oncology segment is anticipated to experience substantial growth with a significant CAGR in the global market due to increasing prevalence of cancer cases.

The pharmaceutical companies segment accounted for a significant revenue share of the market in 2023 due to the increase in drug innovation by pharmaceutical companies.