Global Pharmaceutical Robot Market Size, Share, Trends, Industry Analysis Report: By Product (Traditional Robots and Collaborative Robots), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM1517

- Base Year: 2024

- Historical Data: 2020-2023

Pharmaceutical Robot Market Overview

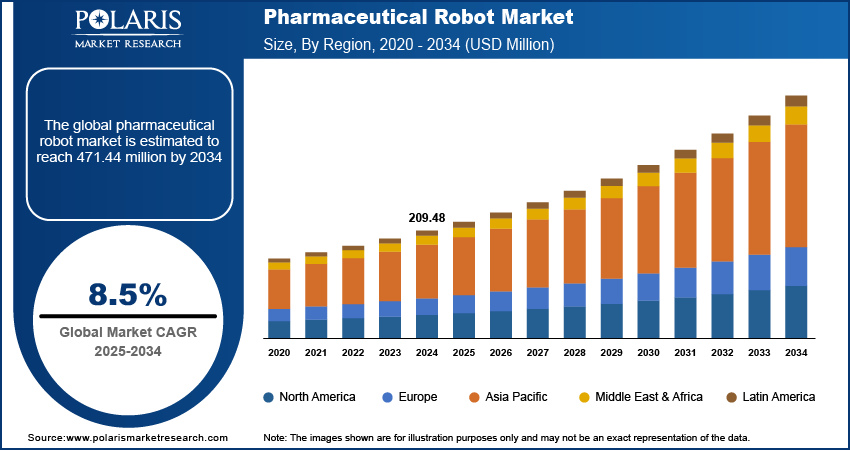

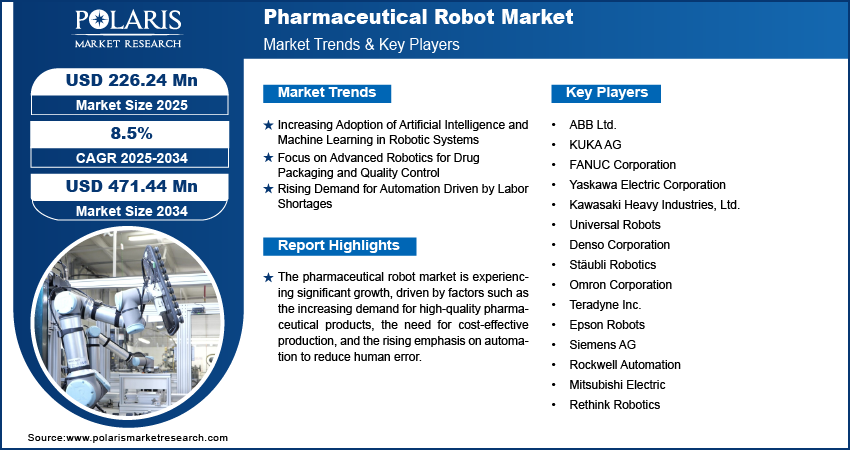

The pharmaceutical robot market size was valued at USD 209.48 million in 2024. The market is projected to grow from USD 226.24 million in 2025 to USD 471.44 million by 2034, exhibiting a CAGR of 8.5% during the forecast period.

The pharmaceutical robot market refers to the use of automated robotic systems in pharmaceutical manufacturing, research, and distribution processes. These robots are employed for tasks such as drug formulation, packaging, quality control, and distribution, enhancing efficiency, precision, and safety. Key drivers of the market include the increasing demand for high-quality pharmaceuticals, the need for cost-effective production, and the rising emphasis on minimizing human errors in complex tasks. Additionally, trends such as the integration of artificial intelligence (AI) and machine learning with robotic systems, advancements in robotic technology, and the growing adoption of automation in response to labor shortages are contributing to the pharmaceutical robot market expansion. As pharmaceutical companies strive for improved productivity and compliance with regulatory standards, the market for pharmaceutical robots is expected to experience significant growth.

To Understand More About this Research: Request a Free Sample Report

Pharmaceutical Robot Market Dynamics

Increasing Adoption of Artificial Intelligence and Machine Learning in Robotic Systems

The integration of artificial intelligence (AI) and machine learning (ML) in pharmaceutical robotics is rapidly becoming a prominent trend. AI and ML algorithms enable robots to adapt to changing environments, enhance decision-making processes, and improve efficiency in pharmaceutical manufacturing. These technologies facilitate predictive maintenance, optimize production processes, and ensure compliance with quality standards by reducing human intervention. The ability of AI and ML to identify anomalies and fine-tune robotic operations in real-time is expected to reduce errors and operational costs significantly.

Focus on Advanced Robotics for Drug Packaging and Quality Control

Robotic systems are increasingly being used in pharmaceutical packaging and quality control processes, which drives the growth of pharmaceutical robot market. As regulations around drug manufacturing become stricter, the demand for robots that can perform these tasks with higher precision and at greater speeds is growing. Robotic systems are particularly valuable in high-volume production environments where maintaining consistent quality is essential. These systems can inspect, package, and label products with accuracy that exceeds human capabilities, significantly reducing the risk of contamination and errors. According to a report by Deloitte, more than 60% of pharmaceutical companies are now integrating robotics into their packaging lines to improve production efficiency and regulatory compliance. The demand for such automation is expected to rise as pharmaceutical manufacturers focus on ensuring product safety and meeting stringent regulatory requirements.

Rising Demand for Automation Driven by Labor Shortages

Another pharmaceutical robot market driver is the ongoing labor shortages in the manufacturing sector, which are prompting pharmaceutical companies to increasingly adopt robotic automation. With a limited pool of skilled workers, particularly in regions facing demographic shifts, pharmaceutical companies are investing in robotics to maintain production capacity and reduce dependency on human labor. This trend is further accelerated by the need to reduce operational costs and improve the scalability of manufacturing processes. The pharmaceutical industry has been particularly focused on automating repetitive, manual tasks such as packaging, labeling, and material handling. Research by McKinsey highlights that automation adoption is expected to grow by 30% in the next five years, largely due to labor shortages and the desire for higher operational efficiency. Robotics are seen as a long-term solution to overcome the challenges posed by the shrinking workforce and to sustain production levels.

Pharmaceutical Robot Market Segment Insights

Pharmaceutical Robot Market Assessment by Product

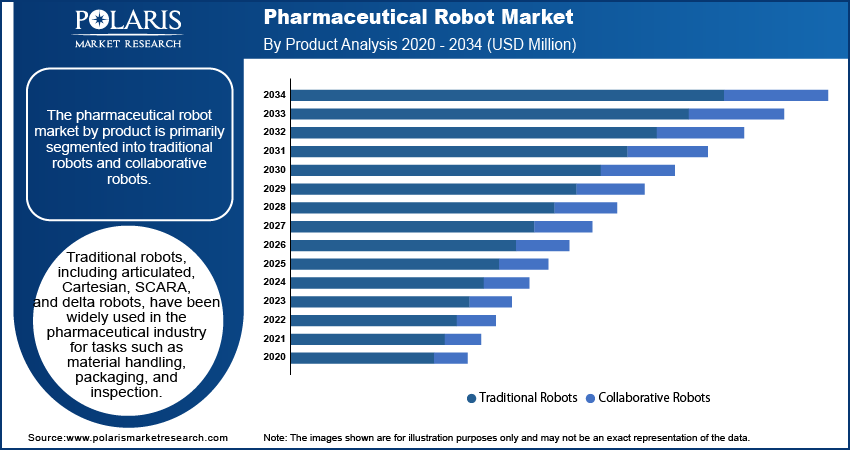

The pharmaceutical robot market by product is primarily segmented into traditional robots and collaborative robots. Traditional robots segment currently holds the largest market share due to their long-established use in pharmaceutical manufacturing and their proven reliability in high-volume production environments. Traditional robots, including articulated, Cartesian, SCARA, and delta robots, have been widely used in the pharmaceutical industry for tasks such as material handling, packaging, and inspection. These robots are known for their high precision, speed, and ability to handle repetitive tasks with minimal human intervention. Traditional robots also offer high payload capacities, making them suitable for heavy-duty applications. However, the segment is witnessing moderate growth as the market increasingly shifts toward more flexible and cost-efficient automation solutions.

Collaborative robots (cobots) are registering the fastest growth in the pharmaceutical robot market, driven by their ability to work alongside human operators in shared environments. Cobots offer increased flexibility, ease of programming, and lower initial investment costs compared to traditional robots. Their growing adoption is due to their versatility in handling tasks such as packaging, sorting, and quality control while enhancing safety in the workplace by reducing the risk of human error. The trend toward collaborative robots is supported by the pharmaceutical industry’s increasing focus on improving operational efficiency and maintaining worker safety. As a result, cobots are expected to experience rapid growth, especially in smaller pharmaceutical firms and companies seeking to optimize production without extensive capital expenditures.

Pharmaceutical Robot Market Evaluation by Application

The pharmaceutical robot market segmentation, based on application, includes picking & packaging, inspection of pharmaceutical drugs, and laboratory applications. The picking & packaging segment holds the largest market share, driven by the growing demand for automation in packaging lines to improve efficiency and reduce human error. Robots in this segment are used for tasks such as sorting, labeling, and packaging pharmaceutical products at high speeds, ensuring accuracy and consistency. This segment benefits from the high volume of production in the pharmaceutical industry, where robots are essential to maintaining the pace of production while adhering to regulatory standards. The picking & packaging segment’s dominance is further supported by the industry's increasing focus on automation to meet strict regulatory requirements and reduce labor costs.

The inspection of pharmaceutical drugs segment is registering the fastest growth, as regulatory bodies demand greater accuracy in drug quality control. Robots equipped with advanced vision systems and sensors are increasingly being used for inspecting drug integrity, packaging quality, and labeling accuracy. This application ensures compliance with quality standards and reduces the risk of errors, contamination, and defects in pharmaceutical products. The rise in product recalls, and regulatory scrutiny has intensified the need for automated inspection systems to ensure product safety and quality. The adoption of robotic systems for drug inspection is expected to continue growing as pharmaceutical companies invest in advanced technologies to streamline quality control processes and ensure product consistency.

Pharmaceutical Robot Market Assessment by End Use

The pharmaceutical robot market, based on end use, is segmented into pharmaceutical companies and research laboratories. The pharmaceutical companies segment holds the largest pharmaceutical robot market share due to the high demand for automation in large-scale manufacturing processes. Pharmaceutical companies are increasingly adopting robotic systems for applications such as drug production, packaging, quality control, and labeling. The push for cost reduction, increased production efficiency, and compliance with regulatory standards is driving the adoption of robotics in this segment. Large pharmaceutical manufacturers are focused on integrating robotics into their operations to enhance productivity, reduce human error, and ensure the consistency of pharmaceutical products.

The research laboratories segment is also registering the fastest growth, driven by the increasing need for automation in drug development, testing, and research processes. Robotics in research laboratories helps improve precision and speed in experiments, sample analysis, and data collection, particularly in high-throughput environments. Research institutions are adopting robotic systems to optimize workflows, reduce manual labor, and increase the reproducibility of results. This growth is fueled by the rise in biopharmaceutical research, clinical trials, and personalized medicine, which require precise and efficient laboratory processes. As more research laboratories look to automate repetitive and time-consuming tasks, this segment is expected to continue expanding at a rapid pace.

Pharmaceutical Robot Market Regional Insights

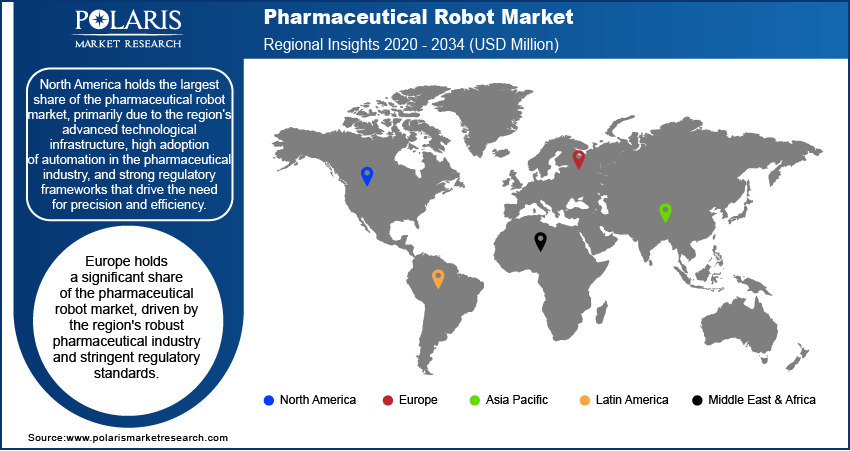

By region, the study provides pharmaceutical robot market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to the region's advanced technological infrastructure, high adoption of automation in the pharmaceutical industry, and strong regulatory frameworks that drive the need for precision and efficiency. The presence of major pharmaceutical companies and a high level of research and development investment further contribute to the market growth in the region. Additionally, the US is at the forefront of integrating advanced robotics and AI in pharmaceutical manufacturing and quality control processes. The demand for improved productivity, reduced operational costs, and compliance with stringent regulations are key factors that have positioned North America as the dominant region in the pharmaceutical robot market. Europe follows closely, with significant investments in automation, while Asia Pacific is expected to experience rapid growth due to increasing manufacturing activities and a rising focus on drug quality and production efficiency.

Europe holds a significant pharmaceutical robot market share, driven by the region's robust pharmaceutical industry and stringent regulatory standards. Countries such as Germany, Switzerland, and the UK are leaders in pharmaceutical manufacturing and are increasingly adopting automation to streamline production processes. The European market benefits from strong governmental support for technological advancements, as well as an emphasis on reducing labor costs and increasing production efficiency. Moreover, the growing focus on improving the quality and safety of pharmaceutical products, combined with the push toward reducing human errors in drug manufacturing, has led to higher demand for robotic systems. The region is expected to continue growing steadily, with a particular emphasis on enhancing automation in drug packaging and inspection.

Asia Pacific is witnessing the fastest growth in the pharmaceutical robot market, fueled by the increasing demand for automation in pharmaceutical manufacturing and research, especially in emerging markets such as China and India. These countries are rapidly expanding their pharmaceutical production capabilities to meet both domestic and global demands. The cost-efficiency of robotic systems is a major driver, as companies in these regions seek to reduce labor costs and improve manufacturing precision. Furthermore, the rise in pharmaceutical R&D and the growing emphasis on improving drug quality and safety are prompting investments in automation technologies. The rapid industrialization, coupled with an increase in regulatory standards, is expected to support the continued growth of the pharmaceutical robot market in Asia Pacific.

Pharmaceutical Robot Market – Key Market Players and Competitive Insights

Key players in the pharmaceutical robot market include ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, and Kawasaki Heavy Industries, Ltd. These companies provide a wide range of robotic systems, including articulated, SCARA, and collaborative robots, for use in pharmaceutical manufacturing, packaging, and quality control. Other significant players include Universal Robots, Denso Corporation, Stäubli Robotics, and Omron Corporation, which are also actively involved in the development of automation solutions for the pharmaceutical sector. Additionally, companies such as Teradyne Inc. (parent company of Universal Robots), and Epson Robots contribute to the market with their automation technologies tailored to improve efficiency and safety in pharmaceutical processes. Some other active players include Siemens AG, Rockwell Automation, and Mitsubishi Electric, along with newer entrants such as Rethink Robotics, which focuses on providing cost-effective and flexible automation solutions for pharmaceutical applications.

The competitive landscape of the pharmaceutical robot industry is marked by both established industrial robotics companies and newer entrants focusing on more flexible and collaborative systems. Large, well-established companies such as ABB and KUKA offer a comprehensive range of automation solutions with a focus on precision, speed, and scalability in pharmaceutical production. In contrast, newer players such as Universal Robots and Rethink Robotics provide collaborative robots that can work alongside human operators in a more versatile and cost-effective manner. This growing interest in collaborative robots, which can be easily integrated into existing production lines, is altering the competitive dynamics of the market, particularly in smaller pharmaceutical companies that require affordable and adaptable automation solutions.

As the market continues to evolve, companies are focusing on innovation and technological advancements to maintain a competitive edge. Integration of artificial intelligence (AI), machine learning, and advanced vision systems in robotic platforms is increasingly becoming a key strategy to enhance performance and efficiency in pharmaceutical manufacturing and quality control. Additionally, companies are targeting markets in emerging economies, such as Asia Pacific, where demand for pharmaceutical robotics is expected to rise. The trend toward automation in response to labor shortages and increased regulatory pressure on drug quality further intensifies competition. This shift is driving players to diversify their product offerings and provide tailored solutions that address the unique needs of the pharmaceutical sector.

ABB Ltd. is a global technology company that offers a variety of automation solutions, including robotics, for the pharmaceutical industry. The company provides robotic systems used in tasks such as packaging, material handling, and quality control. ABB is known for its high-precision robots and has a strong presence in the pharmaceutical sector, particularly in Europe and North America.

KUKA AG is a German company specializing in industrial automation, including robotic systems used in pharmaceutical production. The company’s robots are employed in various stages of manufacturing, from assembly to packaging, and are known for their precision and flexibility. KUKA has made significant inroads into the pharmaceutical sector with robotic systems that help improve the safety and consistency of drug manufacturing.

Key Companies in Pharmaceutical Robot Market

- ABB Ltd.

- KUKA AG

- FANUC Corporation

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Universal Robots

- Denso Corporation

- Stäubli Robotics

- Omron Corporation

- Teradyne Inc. (Parent company of Universal Robots)

- Epson Robots

- Siemens AG

- Rockwell Automation

- Mitsubishi Electric

- Rethink Robotics

Pharmaceutical Robot Market Developments

- October 2024: ABB expanded its automation offerings with the launch of a new robotic arm designed to improve efficiency in pharmaceutical production lines. This new development aims to reduce the time required for certain manufacturing processes and improve overall operational efficiency.

- August 2024: KUKA announced a partnership with a major pharmaceutical manufacturer to provide automation solutions for their packaging lines. The collaboration aims to enhance production capacity while meeting stringent regulatory standards. This collaboration is expected to boost KUKA’s presence in the pharmaceutical market.

Pharmaceutical Robot Market Segmentation

By Product Outlook

- Traditional Robots

- Collaborative Robots

By Application Outlook

- Picking & Packaging

- Inspection of Pharmaceutical Drugs

- Laboratory Applications

By End Use Outlook

- Pharmaceutical Companies

- Research Laboratories

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pharmaceutical Robot Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 209.48 million |

|

Market Size Value in 2025 |

USD 226.24 million |

|

Revenue Forecast in 2034 |

USD 471.44 million |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The pharmaceutical robot market has been segmented into detailed segments of product, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth strategy for the pharmaceutical robot market focuses on expanding product offerings, improving automation technologies, and targeting emerging markets. Companies are investing in advanced robotics that integrate artificial intelligence and machine learning to enhance efficiency, reduce errors, and ensure compliance with regulatory standards. Partnerships and collaborations with pharmaceutical companies are also key strategies, allowing for the development of tailored automation solutions for specific production needs. Additionally, companies are focusing on entering Asia Pacific market, where the growing demand for pharmaceutical production and quality control presents significant opportunities. Marketing efforts are increasingly focused on demonstrating the cost-effectiveness and productivity improvements offered by robotic automation.

FAQ's

? The pharmaceutical robot market size was valued at USD 209.48 million in 2024 and is projected to grow to USD 471.44 million by 2034.

? The market is projected to register a CAGR of 8.5% during the forecast period, 2025-2034.

? North America had the largest share of the market.

? Key players in the pharmaceutical robot market include ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, and Kawasaki Heavy Industries, Ltd.

? The traditional robots segment accounted for the largest share of the market.

? The picking & packaging segment accounted for the largest share of the market.

? A pharmaceutical robot is an automated robotic system designed to perform various tasks in the pharmaceutical industry, such as manufacturing, packaging, inspection, and quality control. These robots are used to increase the efficiency, precision, and safety of pharmaceutical production processes by automating repetitive or complex tasks that would traditionally require human intervention. Pharmaceutical robots can handle tasks such as sorting, labeling, dispensing, and ensuring compliance with regulatory standards by reducing human errors. They are employed in both large-scale production environments and smaller laboratories, helping pharmaceutical companies improve operational efficiency and meet strict industry regulations.

? A few key trends in the pharmaceutical robot market are described below: Integration of AI and Machine Learning: Increasing use of AI and machine learning in robots to enhance decision-making, optimize processes, and enable predictive maintenance. Adoption of Collaborative Robots (Cobots): Growing use of collaborative robots that work alongside human operators, offering flexibility, ease of use, and cost-effectiveness. Focus on Automation in Quality Control: Rising demand for robots in drug inspection and quality control to ensure compliance with stringent regulatory standards and improve accuracy. Advanced Robotics for Packaging: Increased adoption of robots in packaging lines for tasks like labeling, sorting, and packaging to improve speed and precision.

? A new company entering the pharmaceutical robot market should focus on developing flexible and cost-effective robotic solutions that can be easily integrated into existing production lines. Emphasizing the integration of AI and machine learning to enhance efficiency, predictive maintenance, and process optimization would provide a competitive edge. Additionally, focusing on collaborative robots (cobots) that work alongside human operators can appeal to smaller pharmaceutical companies seeking scalable automation solutions.

? Companies manufacturing, distributing, or purchasing pharmaceutical robot and related products, and other consulting firms must buy the report.