Global Pharmaceutical Aseptic Transfer Market Size, Share, Trends, Industry Analysis Report: By System Type, By Usability, By Transfer Type, By End-User, and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 115

- Format: PDF

- Report ID: PM2682

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

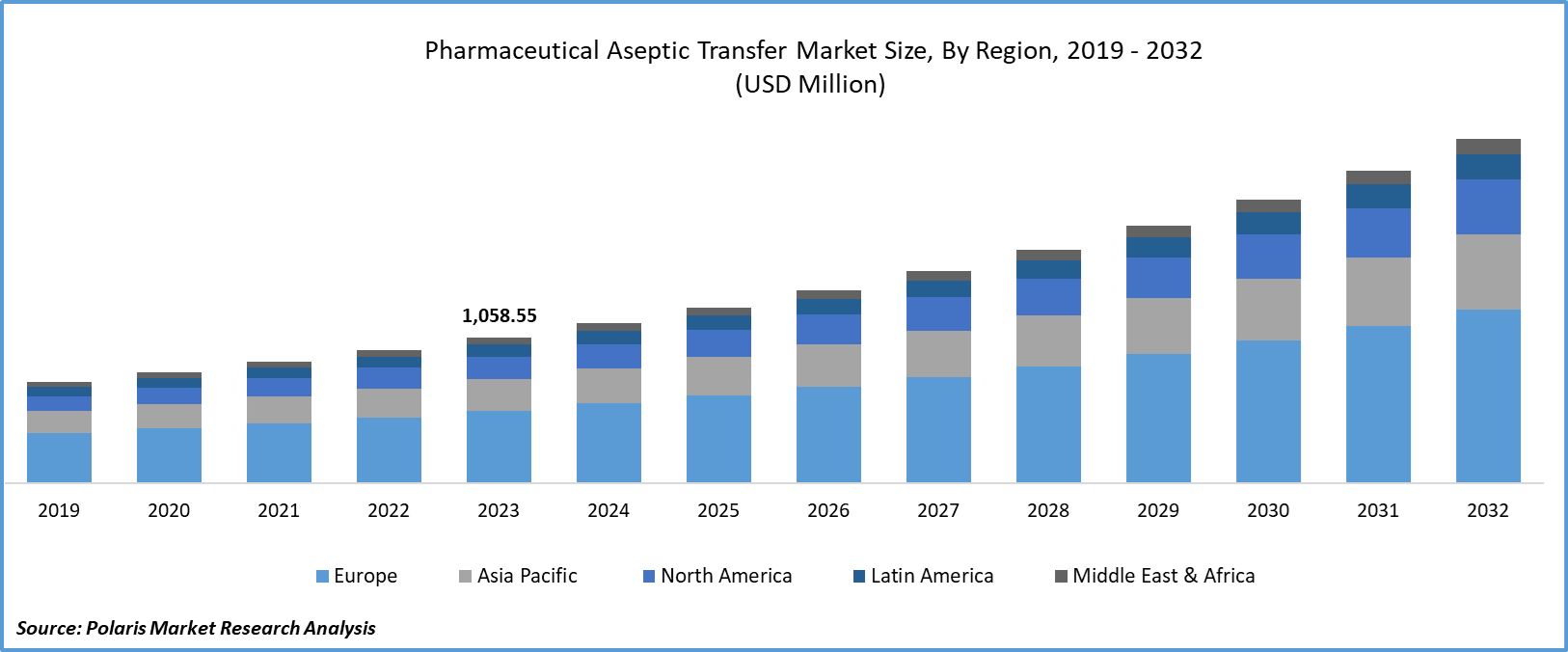

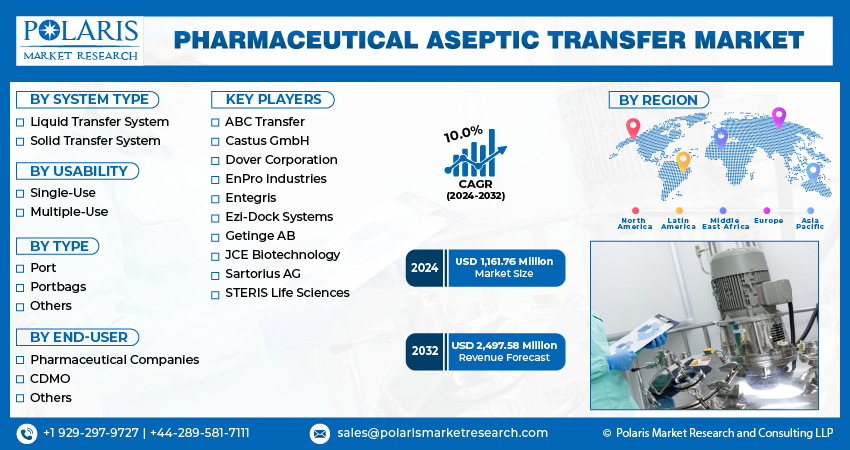

Global pharmaceutical aseptic transfer market size was valued at USD 1,058.55 million in 2023. The pharmaceutical aseptic transfer industry is projected to grow from USD 1,161.76 million in 2024 to USD 2,497.58 million by 2032, exhibiting a compound annual growth rate (CAGR) of 10.0% during the forecast period (2024 - 2032). The pharmaceutical aseptic transfer market involves technologies and equipment used to safely move sterile products, such as drugs and vaccines, between containers without contamination. Pharmaceutical aseptic transfer ensures that the product remains free from microbes during manufacturing, packaging, and transport, maintaining safety and effectiveness for patients.

The pharmaceutical aseptic transfer market is experiencing robust growth driven by the increasing number of pharmaceutical companies globally, coupled with a strong emphasis on research and development to support production scalability and efficiency of aseptic transfer solutions.

Moreover, the stringent regulatory standards, particularly enforced by the FDA, necessitate high-quality aseptic transfer systems to maintain product integrity and safety throughout the manufacturing process, thus boosting the pharmaceutical aseptic transfer market growth.

To Understand More About this Research: Request a Free Sample Report

Additionally, pharmaceutical companies are expanding their manufacturing capabilities to meet growing demand by investing in advanced aseptic transfer technologies that can maintain sterility throughout production, packaging, and distribution processes. The increasing preference for sterile products to minimize the risk of infections among patients is propelling the pharmaceutical aseptic transfer market expansion.

For instance, in March 2024, GeminiBio launched the Aseptic Assurance System, which facilitates closed system manufacturing for cell therapies to reduce the risk of human error and contamination by improving the manufacturing process efficiency.

Pharmaceutical Aseptic Transfer Market Trends:

Increasing Demand for Automated Products

Market CAGR for pharmaceutical aseptic transfer is being driven by the growing demand for automated products in aseptic transfer processes. Automation enhances the efficiency and reliability of aseptic operations by reducing human intervention, thereby minimizing the risk of contamination and human error.

Also, automated processes offer increased output, scalability, and consistency, which are essential for handling large volumes of sensitive pharmaceutical products. Furthermore, the adoption of automated products for aseptic transfer improves operational efficiency and reduces overall cost and downtime associated with manual operations.

For instance, in June 2022, Getinge AB introduced the DPTE-EXO along with the Sleeveless DPTE-BetaBag to offer an automated transfer solution. The feature of the external opening in the product was specifically created to minimize the chances of contamination by maintaining sterility and ensuring product safety. The connectivity in automation provides enhanced traceability and data analysis capabilities, driving a shift towards automated technologies in the pharmaceutical aseptic transfer market.

Rising Investments in the Pharmaceutical Industries

The pharmaceutical aseptic transfer market is experiencing significant growth, driven by the significant rise of investments in the pharmaceutical industries. These growing investments are due to the increasing demand for stringent quality standards and regulatory-compliant pharmaceutical products.

Pharmaceutical companies are expanding their production capacities and introducing new drug formulations, focusing on maintaining sterility and preventing contamination throughout the manufacturing process. Moreover, rising investments in advanced aseptic technologies, such as isolators, barrier systems, and automated filling systems, to ensure the safety and efficacy of pharmaceutical products are driving the pharmaceutical aseptic transfer market revenue.

For instance, in March 2024, Argonaut Manufacturing Services, a contract development and manufacturing organization (CDMO), received an investment of $45 million for the expansion of new drug product fill/finish operations in California. The expansion encompasses the establishment of a specialized facility featuring an isolator-based filling line that will increase the existing drug product fill/finish capacity by more than four times intended for clinical and commercial distribution.

Pharmaceutical Aseptic Transfer Market Segment Insights:

Pharmaceutical Aseptic Transfer System Type Insights:

The global pharmaceutical aseptic transfer market segmentation, based on system type, includes liquid transfer system and solid transfer system. The liquid transfer system segment is expected to grow at the fastest CAGR in the market during the forecast period, mainly attributed to the growing emphasis on liquid-based pharmaceutical products such as injectable drugs and biologics.

Further, the key players are contributing to the advancement and adoption of liquid transfer systems, owing to the rising use of aseptic transfer systems in the pharmaceutical sector.

For instance, in June 2024, AdvantaPure entered into a distributor agreement with High Purity New England (HPNE) to collaborate on the sales of the company's liquid transfer system solutions in the U.S. market, focused on distributing single-use assemblies, sensors, pumps, and other biopharma solutions with exceptional customer services and high-quality products.

Pharmaceutical Aseptic Transfer Usability Insights:

The global pharmaceutical aseptic transfer market segmentation, based on usability, includes single-use and multiple-use. In 2023, the single-use segment dominated the market as it maintains the sterility of parts and minimizes the chances of contamination, therefore eliminating the need for extensive cleaning and sterilization procedures associated with multi-use systems.

The rise in the single-use segment is attributed to enhancing the company’s versatility and capacity to respond to evolving customer needs. Therefore, companies are investing in the single-use segment, driving the pharmaceutical aseptic transfer market growth.

For instance, in April 2024, ChargePoint Technology invested in a manufacturing plant in the United Kingdom in response to a growing market demand for single-use aseptic transfer solutions and equipment from drug developers, contract development and manufacturing organizations (CDMO), and pharmaceutical and biotech companies.

Global Pharmaceutical Aseptic Transfer Market, Segmental Coverage, 2019 - 2032 (USD Million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Pharmaceutical Aseptic Transfer Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America region is expected to grow significantly in the pharmaceutical aseptic transfer market. The region’s robust growth is attributed to the technological advancements and innovation that have enabled the development of more efficient and reliable transfer systems, thereby meeting the needs of pharmaceutical manufacturers.

Additionally, the key market players are merging, acquiring, and expanding to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

For instance, in June 2022, ChargePoint Technology expanded its aseptic transfer services in the U.S. market by introducing a newly formed team to provide exceptional customer services to the pharmaceutical and biopharmaceutical industries.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Global Pharmaceutical Aseptic Transfer Market, Regional Coverage, 2019 - 2032 (USD Million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Europe pharmaceutical aseptic transfer market accounted for the largest market share over the forecast period. This is due to the presence of a robust infrastructure, including advanced manufacturing facilities and a skilled workforce, that supports pharmaceutical research and development in European countries.

Key players are making strategic investments in innovation and technology to enhance Europe's capabilities in the pharmaceuticals aseptic transfer market. For instance, in November 2021, Sartorius AG aimed to increase its presence in France by 2025 by investing 100 million euros to enhance its production, innovation, and storage capabilities. The investment will be used for the construction of new cleanrooms and R&D labs for pharmaceutical aseptic transfer processes, catering to the growing needs of the biopharmaceutical industries.

Pharmaceutical Aseptic Transfer Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the pharmaceutical aseptic transfer market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the pharmaceutical aseptic transfer industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global pharmaceutical aseptic transfer industry to benefit clients and increase the market sector. In recent years, the pharmaceutical aseptic transfer industry has witnessed some technological advancements. Major players in the pharmaceutical aseptic transfer market include ABC Transfer, Castus GmbH, Dover Corporation, EnPro Industries, Entegris, Ezi-Dock Systems, Getinge AB, JCE Biotechnology, Sartorius AG, and STERIS Life Sciences.

Getinge AB is a medical technology company. The company offers a wide range of solutions and products for intensive care, operating rooms, sterile reprocessing, cardiovascular procedures, and life sciences. Getinge operates in 40 countries, including France, China, Germany, Poland, Sweden, Turkey, the Netherlands, the UK, and the US. The company was founded in 1904 and is headquartered in Sweden, Europe. In November 2021, Getinge AB extended its operations to Vietnam in order to cater to a larger customer base and provide enhanced clinical and technical services in the long run.

EnPro Industries is an industrial technology company that designs and manufactures engineered products and materials for technology-intensive sectors. The company serves industries such as semiconductors, aerospace, power generation, heavy-duty trucking, chemical processing, and life sciences. EnPro operates in 12 countries worldwide. In July 2019, EnPro Industries acquired The Aseptic Group, a company specializing in distributing, designing and manufacturing aseptic fluid transfer products for the pharmaceutical and biopharmaceutical sectors.

Key Companies in the pharmaceutical aseptic transfer market include:

- ABC Transfer

- Castus GmbH

- Dover Corporation

- EnPro Industries

- Entegris

- Ezi-Dock Systems

- Getinge AB

- JCE Biotechnology

- Sartorius AG

- STERIS Life Sciences

Pharmaceutical Aseptic Transfer Industry Developments

July 2024: ChargePoint Technology expanded its footprint in India with the establishment of its latest branch, ChargePoint UK Private Ltd. With the new establishment, the company aims to enhance business opportunities and deliver customized support services for the Asia-Pacific region.

May 2024: Novo Holdings acquired a 60% share in the Austrian-based company Single Use Support. The acquisition will enhance the company's expansion in the Life Science Tools & Diagnostics portfolio and help promote cutting-edge healthcare treatments and technologies.

July 2020: STERIS and ChargePoint Technology collaborated to develop a fully validated sterile transfer solution to ensure users have a reliable solution for transferring drug substances and products in a sterile manner during biopharmaceutical manufacturing.

Pharmaceutical Aseptic Transfer Market Segmentation:

Pharmaceutical Aseptic Transfer System Type Outlook

- Liquid Transfer System

- Solid Transfer System

Pharmaceutical Aseptic Transfer Usability Outlook

- Single-Use

- Multiple-Use

Pharmaceutical Aseptic Transfer Transfer Type Outlook

- Port

- Portbags

- Others

Pharmaceutical Aseptic Transfer End-User Outlook

- Pharmaceutical Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Others

Pharmaceutical Aseptic Transfer Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pharmaceutical Aseptic Transfer Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 1,058.55 million |

|

Market Size Value in 2024 |

USD 1,161.76 million |

|

Revenue Forecast in 2032 |

USD 2,497.58 million |

|

CAGR |

10.0% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global pharmaceutical aseptic transfer market size was valued at USD 1,058.55 million in 2023 and is projected to be valued at USD 2,497.58 million in 2032.

The global market is projected to grow at a CAGR of 10.0% during the forecast period, 2024-2032.

Europe held the largest share of the global market.

The key players in the market are ABC Transfer, Castus GmbH, Dover Corporation, EnPro Industries, Entegris, Ezi-Dock Systems, Getinge AB, JCE Biotechnology, Sartorius AG and STERIS Life Sciences.

The liquid transfer system category is expected to grow at the fastest CAGR in the market in 2023.

The single-use category held the largest share of the global market.