Pet Meal Kit Delivery Services Market Share, Size, Trends, Industry Analysis Report

By Pet Type (Dogs, Cats); By Food Type (Dry, Wet); By Subscription Type (Topper, Full); By Region; Segment Forecast, 2022 - 2030

- Published Date:Apr-2022

- Pages: 116

- Format: PDF

- Report ID: PM2365

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

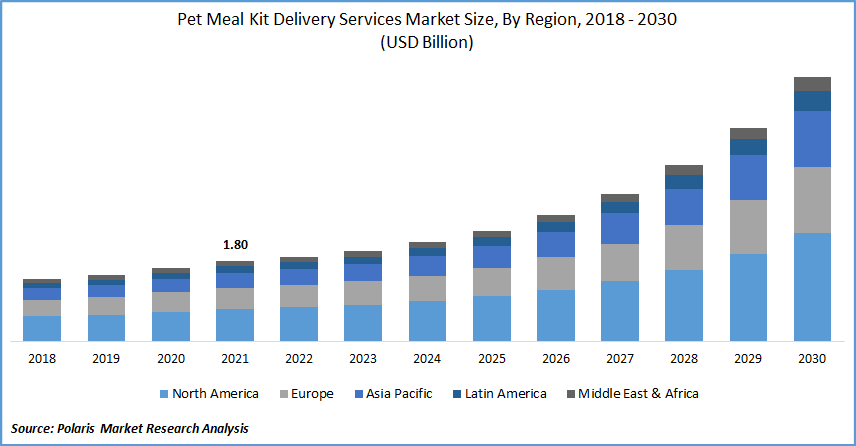

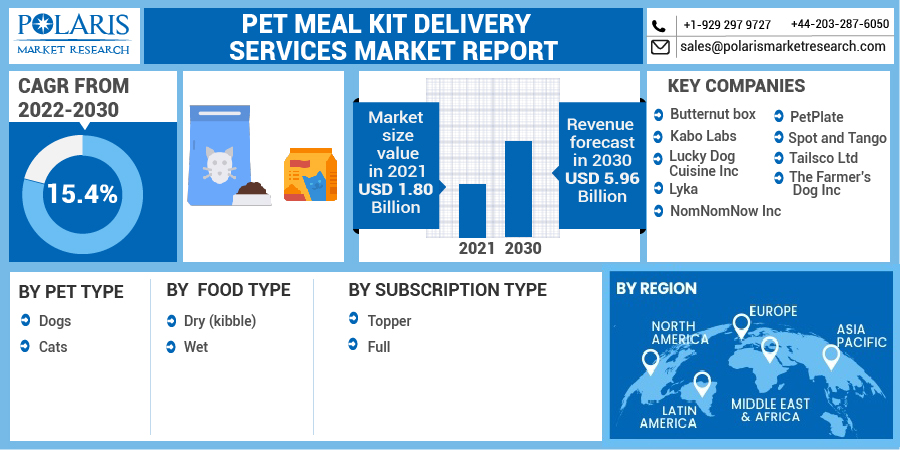

The global pet meal kit delivery services market was valued at USD 1.80 billion in 2021 and is expected to grow at a CAGR of 15.4% during the forecast period. The factors such as the benefits of animal meal kit delivery services, consumer awareness for such meal kit delivery services, and an increase in the purchase of pet supplies during the pandemic, are boosting the market growth during the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

These kit-based delivery services provide doorstep delivery services for a set time. Typically, kit delivery services provide their customers with both ready-to-eat and ready-to-cook meal kits. The meal kit delivery services are essentially a monthly or weekly subscription model that assists its members in preparing their fresh meals at home by shipping food components and customized recipes. These delivery services are also recognized for delivering pre-cooked meal kits.

Following the outbreak, there has been a significant increase in internet purchases of pet supplies. Roughly 90% of the supplies sold in China in 2020 were purchased online, including animal meal kit delivery services. Furthermore, the growing emphasis of significant suppliers on shipping meals globally via their online platforms is expected to drive global use of these services.

Growing consumer awareness of tailored meal kits delivery services on their pet's characteristics and taste preferences, combined with an increased propensity to spend on animal meal kits, will boost the pet meal kit delivery services market throughout the forecast period. The global COVID-19 epidemic has raised the market demand for such kits, especially for food delivery services. Primarily, nations such as the U.S., India, Brazil, and the United Kingdom have seen a large increase in domestic animal populations, which has resulted in higher sales of such meal kits delivery services.

During the epidemic, many network operators began offering both topper and full subscription plans and reduced trials, which has fortunately increased the supply of health-conscious pet parents. As a result of owners' rising concern for their pets' health, there has been a significant shift in customer preference for tailored meat kit delivery subscriptions. Furthermore, most service providers give topping subscription delivery services options for their owners who want to use such kit-based delivery services in addition to conventional dry food.

This makes the services more affordable for users, increasing acceptance worldwide. However, due to the obvious rising cancelation rate of kit-based delivery services subscriptions, the market may face hurdles to its future growth. Additionally, it has been discovered that the meal kits are relatively pricey, and the buyers believe that the value for the money paid is comparable. As a result, customers are canceling their kit-based delivery services subscriptions, which may impede the pet meal kit delivery services market growth.

Industry Dynamics

Growth Drivers

Innovation in the pet meal kit delivery services market such as launches of personalized meals kits, the launch of online grocery stores for purchasing or customized meal kits, and the expansion of food delivery services, among others. For instance, in October 2021, Marley Spoon launched a bezzie, which is marketed as a "simple delivery service for feeding someone furry pets nutritious meals each day without having to worry about ever running out of food."

Customers can customize their orders for their animal companions by using a subscription mechanism similar to the company's meal kit brands. Each program is tailored to their age, weight, and activity level. Customers can choose from a variety of fresh selections cooked with living person meat and vegetables for "vitamin-rich" meals, as well as dry nibbles "stuffed" with nutrients. Also, Marley Spoon is expanding into such meal delivery services as it wants to use its technology to handle the large number of homes that purchased pets during the pandemic. Further, in July 2021, HelloFresh is launching an online grocery store where customers may purchase additional products.

The business announced the introduction of the HelloFresh Sector, which will compete with Amazon, Walmart, FreshDirect, and Instacart in the grocery delivery market over the coming weeks. Customers will purchase food items for fast meals using HelloFresh's online grocery shopping services. Customers can purchase things from the online marketplace and include them in their weekly orders. Thus, the major player's activities in the market are assisting the market growth.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on pet type, food type, subscription type, and region.

|

By Pet Type |

By Food Type |

By Subscription Type |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Food Type

The dry market segment is expected to be the most significant revenue contributor in the global market. The dry (kibble) food type sector is the most common among consumers of daily food. Consumers are becoming more interested in this area as main providers emphasize supplying fresh dry meal kits. Furthermore, dry food is preferred over wet food due to variables such as the convenience of combining with current prepared food and lower pricing, which has resulted in increased consumer spending in this area.

Geographic Overview

North America had the largest revenue share in the global market. Market demand is expected to be driven by an increase in the adoption of dogs and cats in the U.S. and an increase in food spending. According to the U.S. Bureau of Labor Statistics (BLS) Consumption Expenditure Surveys, food consumption among U.S. consumers increased 18% in 2020, reaching USD 36.8 billion. Spending on pet food differed by demographic group. In terms of food spending, the average U.S. family spent USD 230.38 on pet food in 2020, representing an 18% rise. Except for those earning USD 70,000 to USD 99,999, all income categories saw an increase in spending, except those earning USD 70,000 to USD 99,999, who spent USD 3.75 billion (33.7 percent) less.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. Over the last few years, there's been a significant increase in the pet community in countries like China, Japan, India, and Australia, promoting market growth. Furthermore, consumers' increased discretionary income allows them to invest more in food, including online food delivery services. For instance, a government authority warned that India, with an estimated pet wildlife population of 29 million, faces a scarcity of meals and urges the market to enhance local manufacturing by using current central programs.

According to the Animal Welfare Board of India (AWBI), a webinar hosted by industry group PHDCCI, market leaders can use the loan facility provided under the Animal Husbandry Infrastructure Development Scheme (AHIDS) to set up animal feed production plants. India's requirement for this food is, on average, 30,000 tonnes. Some foods are imported, yet they are expensive to get to customers at reasonable pricing. Thus, these schemes are boosting market growth.

Competitive Insight

Some of the major players operating in the global market include Butternut box, Kabo Labs, Lucky Dog Cuisine Inc., Lyka, NomNomNow Inc., Ollie Pets Inc., PetPlate, Spot and Tango, Tailsco Ltd, and The Farmer’s Dog, Inc.

Pet Meal Kit Delivery Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.80 Billion |

|

Revenue forecast in 2030 |

USD 5.96 Billion |

|

CAGR |

15.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Pet Type, By Food Type, By Subscription Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Butternut box, Kabo Labs, Lucky Dog Cuisine Inc., Lyka, NomNomNow Inc., Ollie Pets Inc., PetPlate, Spot and Tango, Tailsco Ltd, and The Farmer’s Dog, Inc. |