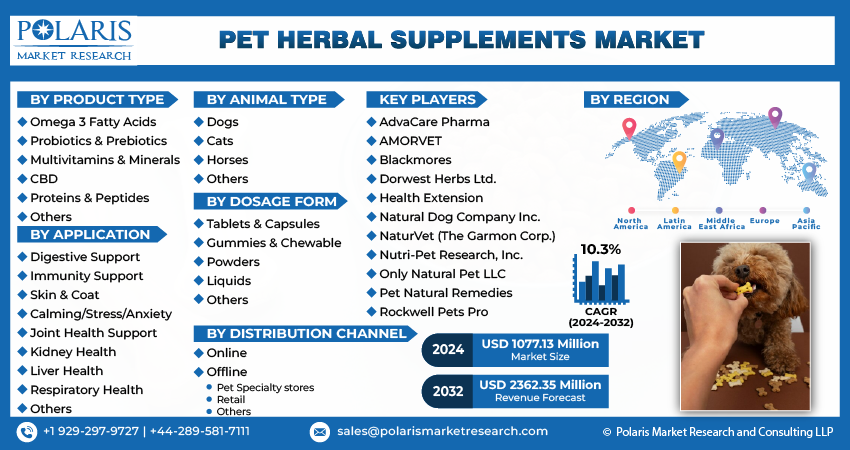

Pet Herbal Supplements Market Share, Size, Trends, Industry Analysis Report, By Product Type (Omega 3 fatty acids, Probiotics & prebiotics), By Application, By Animal Type, By Dosage Form, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM4298

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

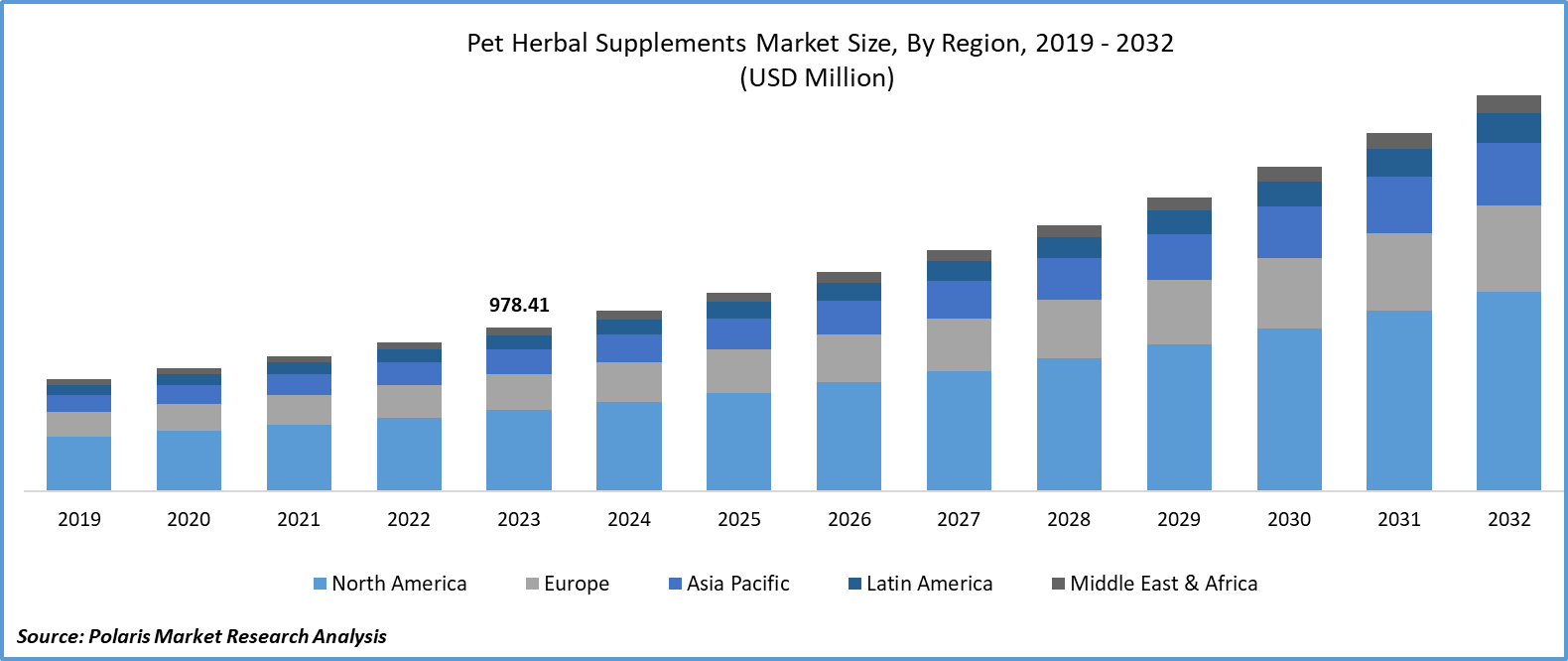

The global pet herbal supplements market was valued at USD 978.41 million in 2023 and is expected to grow at a CAGR of 10.3% during the forecast period.

Key factors responsible for the market growth include the shift of manufacturers towards natural & herbal supplements for pet preventive care, increased spending on pets, the aging pet population, growing demand for pet supplements, & innovations in natural ingredients. Herbal supplements can address nutritional deficiencies in senior pets. A 2020 Survey of Pet Owners by Packaged Facts revealed that 77% of pet supplement purchasers prefer products with natural ingredients, and 68% opt for organic supplements for their pets. Therefore, the expanding number of aging pets is anticipated to boost product demand.

To Understand More About this Research: Request a Free Sample Report

Moreover, an increasing number of aging dogs and cats require immune boosters, heart, and cognitive support products, as well as anti-inflammatory and pain management support due to advancements in veterinary care and pet owners' focus on pet wellness and nutrition through herbal supplements. The Packaged Facts 2020 Survey of Pet Owners revealed that 47% of dog owners have dogs aged seven years or older, up from 43% in the 2019 survey, and 43% of cat owners have cats in that age range, up from 39%. This illustrates the growing senior pet demographic.

The COVID-19 pandemic has had a significant impact on the market. Data from the American Society for the Prevention of Cruelty to Animals (ASPCA) indicates that almost one in five American households welcomed a cat or dog into their homes in the first year of the crisis. Additionally, a Forbes Advisors poll revealed that 78% of pet owners acquired their pets during the pandemic, with 16% in 2020, 39% in 2021, and 23% in 2022. This surge in pet ownership has led to increased expenditure on herbal supplements to support pet health.

Growth Drivers

Increasing Focus on Pet Health and Wellness

Additionally, due to lockdowns and stay-at-home orders, individuals spent more time at home, fostering stronger connections with their pets. This increased closeness may have heightened pet owners' awareness of their pets' health, leading them to seek ways to enhance their overall well-being through herbal supplements. Moreover, the pandemic accelerated a larger trend where people increasingly sought natural and holistic methods for pet health and wellness. This changed mindset extended to the pet care, with owners displaying a greater interest in natural products, including herbal supplements, thereby boosting pet herbal supplements market growth.

Report Segmentation

The market is primarily segmented based on product type, application, animal type, dosage form, distribution channel, and region.

|

By Product Type |

By Application |

By Animal Type |

By Dosage Form |

By Distribution Channel |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

Multivitamins and Minerals Garnered the Largest Share in 2022

The multivitamins & minerals segment dominated the market. Pet owners are turning to multivitamins and mineral supplements as a proactive approach to enhance their pets' overall health. These supplements aid in maintaining optimal well-being, supporting immune function, promoting healthy skin and coat, and more. According to the 2023-2024 APPA National Pet Owners Survey, 53% of cat owners and 55% of dog owners use calming products. These products, ranging from chews and vitamins to herbal CBD products, help keep pets’ content and relaxed, especially in situations causing common anxieties, such as thunderstorms and crowded gatherings.

By Animal Type Analysis

Dog Segment Accounted for the Largest Market Share in 2022

The dog segment accounted for the largest market share. According to the American Pet Products Association's National Pet Owners Survey, 69 Mn American households are home to dogs. The market is witnessing growth driven by the introduction of new dog supplements, a trend expected to continue in the forecast period.

The cat segment will exhibit a robust growth rate. Cats have become increasingly popular as pets, offering comfort and companionship to their owners. The demand for cat food and supplements has risen as a result. CNN's health report in November 2021 highlighted that at least 25 million people in the U.S. suffer from obstructive sleep apnea, and approximately 30% of the population experiences insomnia. Interestingly, sleeping with cats has been found to alleviate insomnia, leading to a higher adoption rate for cats and creating new opportunities for market growth.

By Application Analysis

Digestive Health Segment Accounted for the Largest Market Share in 2022

The digestive health segment accounted for the largest market share. The segment's growth is propelled by increasing awareness regarding the benefits of herbal supplements in addressing various pet digestive issues. Additionally, there is a rising trend of using herbal digestive supplements preventively to uphold pets' digestive health. Consistent use of these supplements can assist in preserving a healthy digestive tract and averting potential issues. Probiotics, beneficial microorganisms promoting a healthy gut microbiota, are utilized as herbal supplements for digestive health.

Other (energy and electrolytes) segments will exhibit a robust growth rate. Unlike synthetic medications or stimulants that might pose risks and side effects, herbal supplements are often viewed as safer and milder, with fewer adverse effects when it comes to enhancing pets' energy levels. The rising adoption of herbal pet supplements to boost pet energy levels is a key factor driving the growth of this segment. Additionally, owners of working dogs, including police dogs, search and rescue dogs, and sporting dogs, are turning to energy-enhancing herbal supplements to help their animals perform optimally during physically demanding tasks.

Regional Insights

North America Accounted for the Largest Share of Global Market in 2022

North America garnered the largest share. The presence of major players drives the significant market share in the region, the trend of pet humanization, and the improved quality of pet products. Key companies are expanding their market reach through the establishment of subsidiaries, leading to the region's market growth. For instance, Pet Honesty launched its pet health supplements at PetSmart in August 2023. Being a pioneer in herbal pet nutritional supplements, Pet Honesty products are now available in the top three pet stores in the U.S., including Petco & Pet Supplies Plus.

Asia Pacific will grow at a substantial pace. The increasing pet population and rising concerns for pet well-being are driving market growth in this region. Market participants are actively involved in launching products specific to the region or expanding their presence in the veterinary sector.

Key Market Players & Competitive Insights

The market is highly competitive due to the presence of a wide range of players, ranging from major animal health corporations to smaller private entities. These companies utilize various strategies to increase their market share and strengthen their positions. Key players have undertaken various initiatives, such as mergers and acquisitions, introducing new products, forming alliances, and expanding their presence at the local and regional levels.

Some of the major players operating in the global market include:

- AdvaCare Pharma

- AMORVET

- Blackmores

- Dorwest Herbs Ltd.

- Health Extension

- Natural Dog Company Inc.

- NaturVet (The Garmon Corp.)

- Nutri-Pet Research, Inc.

- Only Natural Pet LLC

- Pet Natural Remedies

- Rockwell Pets Pro

Recent Developments

- In February 2023, Pet Well-being has launched its inaugural line of products called Chewies, consisting of four vet-strength soft chewables designed to offer pet parents a convenient and straightforward solution while ensuring strong, all-natural daily healthcare for dogs.

Pet Herbal Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1077.13 million |

|

Revenue forecast in 2032 |

USD 2362.35 million |

|

CAGR |

10.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product Type, By Application, By Animal Type, By Dosage Form, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the 2024 market share, size, and revenue growth rate statistics in the field of pet herbal supplements market, meticulously compiled by Polaris Market Research Industry Reports. This comprehensive analysis encompasses a market forecast outlook extending to 2032, along with an insightful historical overview. Experience the depth of this industry analysis by obtaining a complimentary PDF download of the sample report.

Browse for Our Top Selling Reports

Disposable Medical Sensors Market Size & Share

Portable Dishwasher Market Size & Share

Dental Service Organization Market Size & Share

FAQ's

key companies in pet herbal supplements market are Blackmores, NaturVet, Natural Dog Co., Pet Natural Remedies, Dorwest Herbs

The global pet herbal supplements market is expected to grow at a CAGR of 10.3% during the forecast period.

The pet herbal supplements market report covering key segments are product type, application, animal type, dosage form, distribution channel, and region.

key driving factors in pet herbal supplements market are o Rising consumer preference for natural and organic products

The global pet herbal supplements market size is expected to reach USD 2.36 billion by 2032