Pet Accessories Market Size, Share, Trends, Industry Analysis Report: By Product, Pet Type (Cat, Dog, and Others), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5523

- Base Year: 2024

- Historical Data: 2020-2023

Pet Accessories Market Overview

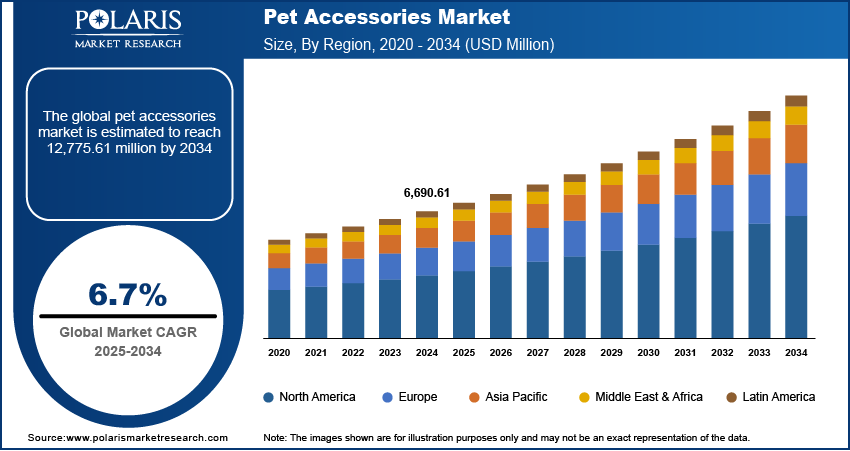

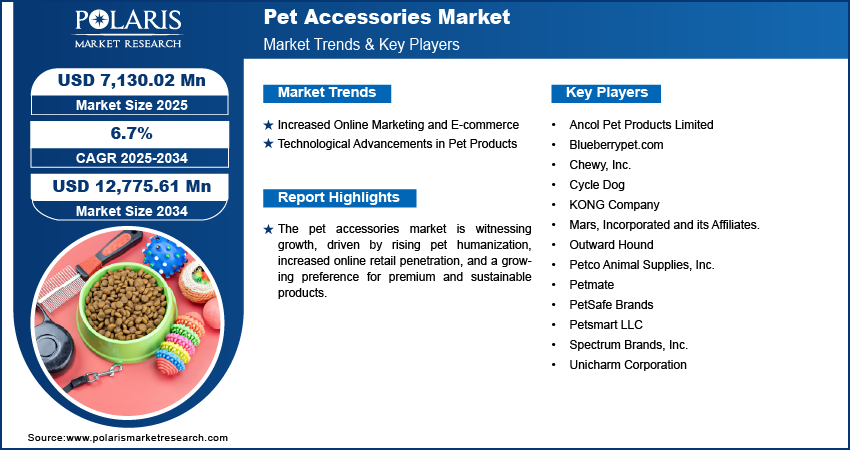

The global pet accessories market size was valued at USD 6,690.61 million in 2024. The market is expected to grow from USD 7,130.02 million in 2025 to USD 12,775.61 million by 2034, at a CAGR of 6.7% from 2025 to 2034.

Pet accessories refer to a wide range of products designed to improve the comfort, well-being, and lifestyle of pets, such as collars, toys, beds, grooming tools, and apparel. The pet accessories market is experiencing growth, primarily driven by the rising pet ownership worldwide. In the UK alone, there are almost 39.8 million pets, according to a September 2023 estimate from the WPS. Increasing disposable income, urbanization, and changing lifestyles have contributed to a higher number of households adopting pets, particularly in developing economies. As pet adoption rates rise, so does the demand for both essential and luxury pet accessories, reflecting an expanding consumer base seeking high-quality products to assure their pets’ well-being. This demand is further supported by the growing influence of e-commerce and specialty pet stores, making pet accessories more accessible to a broader audience.

To Understand More About this Research: Request a Free Sample Report

Another major driver of the pet accessories market expansion is the increasing trend of pet humanization. Pet owners treat their animals as family members, leading to higher spending on premium and customized pet accessories. This shift in consumer behavior has driven demand for high-quality, aesthetically appealing, and functionally advanced products, such as smart pet collars, orthopedic beds, pet wearable, health monitoring devices, and designer pet apparel. The integration of technology into pet care has further accelerated the pet accessories market value, with companies leveraging artificial intelligence (AI) and the Internet of Things (IoT) to improve pet health and wellness. For instance, in December 2024, PetPace collaborated with TelmyVet to integrate advanced AI-powered pet health monitoring with telemedicine solutions. This collaboration provides Canadian pet owners and veterinarians with real-time health insights, improving pet care accessibility and enhancing veterinary support. Additionally, increasing awareness of pet health and wellness has led to an increased preference for eco-friendly, sustainable, and organic pet products. Therefore, as pet owners seek to improve their pet's overall quality of life, manufacturers are continuously innovating to offer a diverse range of accessories that align with these evolving preferences.

Pet Accessories Market Dynamics

Increased Online Marketing and E-commerce

The increasing penetration of digital platforms and the expansion of specialized online pet stores have provided pet owners with a convenient shopping experience, offering a vast selection of products at competitive prices. Additionally, targeted marketing strategies, such as personalized recommendations, influencer endorsements, and social media promotions, have strengthened brand visibility and consumer engagement. Subscription-based models and direct-to-consumer approaches have further contributed to the pet accessories market development by assuring recurring demand for pet accessories and allowing wider product accessibility and consumer reach. For instance, in October 2023, Zooplus SE launched a subscription model for pet supplies delivery in Germany and Austria. The flexible service allows customers to schedule regular deliveries of pet food, litter, and treats, offering convenience, discounts, and customizable options for recurring needs. The ease of comparing products, reading reviews, and accessing exclusive discounts has encouraged higher spending, accelerating the growth opportunities of premium and innovative pet accessories.

Technological Advancements in Pet Products

The integration of smart technologies, such as GPS-enabled pet collars, automated feeders, and health-monitoring wearables, has transformed traditional pet accessories into more functional and efficient products. For instance, in January 2025, Tractive launched its dog tracker at CES, featuring bark monitoring and upcoming vital tracking (heart and respiratory rates). The redesigned device offers improved night visibility, extended battery life, and sleek aesthetics, enhancing pet safety and health monitoring. These advancements serve the growing demand for convenience and personalized pet care, allowing owners to monitor their pet's activity levels, diet, and overall health in real-time to improve pet care and well-being. Furthermore, the incorporation of sustainable materials, ergonomic designs, and AI-powered interactive toys reflects the market’s focus on product innovation. Thus, as pet owners increasingly prioritize functionality and quality, manufacturers continue to invest in research and development, further propelling the technologically advanced pet accessories market demand.

Pet Accessories Market Segment Insights

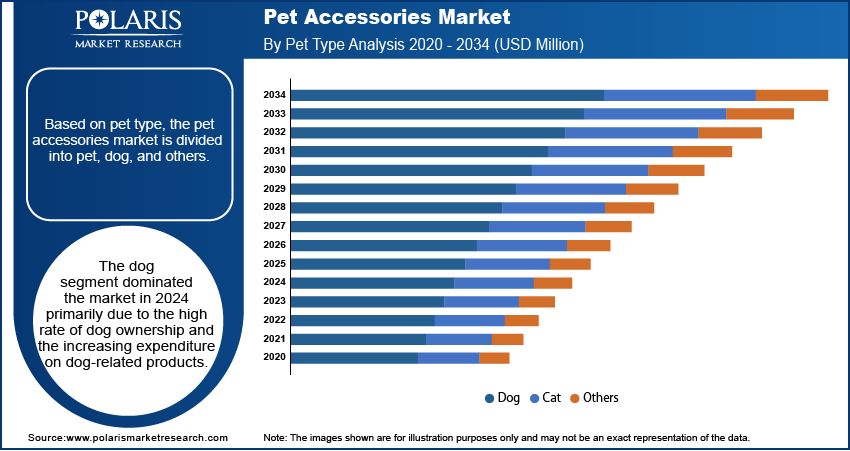

Pet Accessories Market Assessment by Pet Type Outlook

The global pet accessories market assessment, based on pet type, includes pet, dog, and others. The dog segment dominated the pet accessories market in 2024 primarily due to the high rate of dog ownership and the increasing expenditure on dog-related products. Dogs are among the most popular pets globally, and their owners frequently invest in a wide range of accessories, such as collars, leashes, beds, grooming supplies, and training tools. The rising trend of premiumization in pet care has further driven the demand for high-quality and specialized accessories tailored for dogs. Additionally, the growing focus on canine health, comfort, and entertainment has encouraged the adoption of innovative and functional products, such as orthopedic beds, interactive toys, and smart collars. This strong consumer preference, coupled with continuous product innovation, has solidified the dominance of the dog segment within the market.

Pet Accessories Market Evaluation by Distribution Channel Outlook

The global pet accessories market evaluation, based on distribution channel, includes supermarkets/hypermarkets, specialty pet stores, online, and others. The online segment is expected to witness the fastest pet accessories market growth during the forecast period, driven by the increasing convenience of e-commerce and the expanding presence of digital platforms. Consumers prefer online shopping due to the ease of browsing a diverse product range, accessing competitive pricing, and reading customer reviews before making a purchase. Additionally, the availability of subscription-based services and personalized product recommendations has improved customer engagement and repeat purchases. The growing influence of social media marketing and pet influencers has further fueled online sales, with brands leveraging targeted digital advertising to reach a wider audience. Therefore, as e-commerce platforms continue to improve user experience through seamless payment options, fast delivery, and hassle-free returns, the online segment is set to expand at a rapid pace.

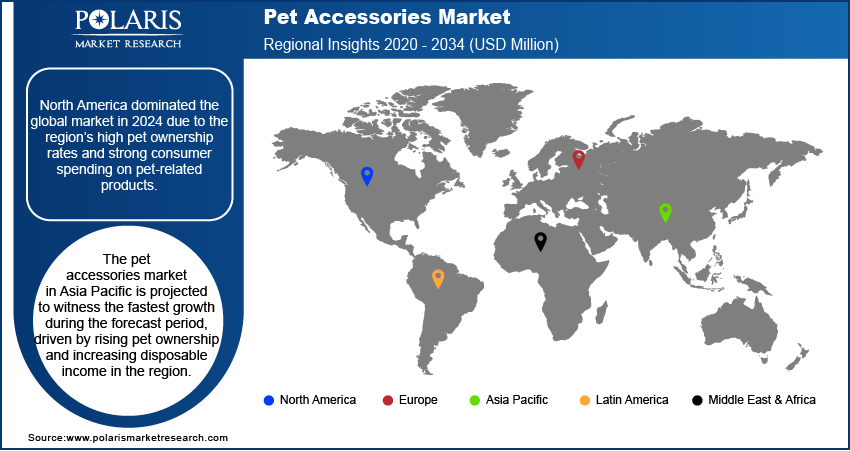

Pet Accessories Market Regional Analysis

By region, the report provides the pet accessories market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the pet accessories market in 2024 due to the region’s high pet ownership rates and strong consumer spending on pet-related products. In the US alone, there are almost 70 million domestic dogs and 74 million domestic cats, according to a September 2023 estimate from the WPS. The growing trend of pet humanization has led to a rise in demand for premium and customized accessories. Additionally, the presence of established pet brands, extensive retail networks, and advanced e-commerce platforms has supported the market growth. The region also benefits from a strong culture of pet wellness, with pet owners prioritizing high-quality products designed for comfort, safety, and health enhancement. Favorable economic conditions and the widespread adoption of technologically advanced pet accessories have further contributed to North America’s leadership in the global market.

The Asia Pacific pet accessories market is projected to witness the fastest growth during the forecast period, driven by rising pet ownership and increasing disposable income in the region. According to a September 2023 estimate from the WPS, there are almost 27.4 million domestic dogs and 53.1 million domestic cats in China alone. The growing middle-class population, particularly in countries such as China, India, and Japan, has led to higher spending on pet care and accessories. Additionally, the influence of Western pet care trends, such as pet humanization and the demand for premium products, has gained traction among pet owners in the region. The rapid expansion of e-commerce and online retail platforms has further facilitated access to a wide variety of pet accessories, boosting the pet accessories market growth. Moreover, the increasing awareness of pet health and wellness, along with a surge in pet-friendly policies and services, has created a favorable environment for the expansion of the pet accessories market in Asia Pacific.

Pet Accessories Market – Key Players and Competitive Insights

The competitive landscape combines global leaders and regional players competing to capture pet accessories market share through innovation, strategic alliances, and regional expansion. Global players such as Mars, Incorporated; Petco Animal Supplies, Inc.; and Petsmart LLC leverage strong R&D capabilities and extensive distribution networks to deliver advanced, high-quality pet accessories, such as smart collars, interactive toys, and ergonomic products. Pet accessories market trends indicate rising demand for tech-enabled accessories, eco-friendly products, and personalized solutions, reflecting advancements in pet care and increasing humanization of pets. According to pet accessories market analysis, the market is projected to grow, driven by rising pet ownership, growing awareness of pet health, and increasing disposable incomes.

Regional companies focus on localized needs by offering affordable and culturally relevant products, particularly in emerging markets. The pet accessories market competitive strategy includes mergers and acquisitions, partnerships with pet care brands, and the introduction of innovative products to serve the growing demand for premium and functional pet accessories. These developments highlight the role of technological innovation, sustainability trends, and regional investments in driving the market growth. A few key major players are Ancol Pet Products Limited; Blueberrypet.com; Chewy, Inc.; Cycle Dog; KONG Company; Mars, Incorporated and its Affiliates; Outward Hound; Petco Animal Supplies, Inc.; Petmate; PetSafe Brands; Petsmart LLC; Spectrum Brands, Inc.; and Unicharm Corporation.

Mars, Incorporated is an American multinational company founded in 1911. Headquartered in McLean, Virginia, it is entirely owned by the Mars family. It is a privately held company in the United States. Mars operates across several sectors, such as confectionery, pet food, and animal care services. The company is structured into four main subsidiaries: Mars Wrigley Confectionery, Petcare, Food, and MARS Edge. In the pet care sector, Mars Petcare specializes in offering a wide range of pet food brands such as Pedigree, Whiskas, and Royal Canin. The company also provides veterinary services through its acquisitions, such as Banfield Pet Hospital and BluePearl Veterinary Partners. Additionally, Mars Petcare offers pet accessories and supplies, such as birdseed, under the 'Trill' brand. Mars's global presence spans over 80 countries, with a diverse portfolio of brands that serve both human and pet needs. Mars continues to innovate and expand its offerings, ensuring a lasting impact on the global market while maintaining its family-owned legacy.

Chewy, Inc. is an American online retailer specializing in pet food and accessories, based in Plantation, Florida. Founded in 2011. Chewy offers a wide range of products, such as pet food, treats, supplies, medications, and health products for various animals, such as dogs, cats, fish, birds, small pets, horses, and reptiles. The company's mission is to be the most trusted and convenient destination for pet parents, providing personalized service and competitive pricing, along with fast shipping options. Chewy's success is largely attributed to its Autoship subscription program, which allows customers to schedule recurring orders, assuring they never run out of essential pet supplies. The company also focuses on customer service, offering 24/7 assistance and advice to pet owners. In recent years, Chewy has expanded its services to include tele-triage services, customized prescription medications, and pet insurance and wellness plans. Additionally, Chewy has launched Chewy Vet Care, offering veterinary services such as routine check-ups and surgical procedures. Chewy continues to innovate and grow in the pet care industry, with a strong online presence.

List of Key Companies in Pet Accessories Market

- Ancol Pet Products Limited

- Blueberrypet.com

- Chewy, Inc.

- Cycle Dog

- KONG Company

- Mars, Incorporated and its Affiliates.

- Outward Hound

- Petco Animal Supplies, Inc.

- Petmate

- PetSafe Brands

- Petsmart LLC

- Spectrum Brands, Inc.

- Unicharm Corporation

Pet Accessories Industry Developments

January 2025: SATELLAI launched its AI-integrated SATELLAI pet Tracker and Collar at CES 2025. Featuring satellite tracking, virtual boundaries, and activity monitoring, the tracker uses Qualcomm’s 9205S Modem and Skylo’s global network for precise, worldwide connectivity, ideal for outdoor enthusiasts.

January 2025: Authentic Brands Group collaborated with K9 Wear to launch the Izod Pet Collection, featuring stylish and functional pet apparel and accessories. The product line includes harnesses, raincoats, collars, and leashes, set to debut in Spring 2025.

Pet Accessories Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Collars, Leashes, and Harnesses

- Waste Disposal Tools

- Feeding Accessories

- Travel Accessories

- Others

By Pet Type Outlook (Revenue, USD Million, 2020–2034)

- Cat

- Dog

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Supermarkets/Hypermarkets

- Specialty Pet Stores

- Online

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pet Accessories Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6,690.61 million |

|

Market Size Value in 2025 |

USD 7,130.02 million |

|

Revenue Forecast by 2034 |

USD 12,775.61 million |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global pet accessories market size was valued at USD 6,690.61 million in 2024 and is projected to grow to USD 12,775.61 million by 2034.

The global market is projected to register a CAGR of 6.7% during the forecast period.

North America dominated the pet accessories market in 2024.

Some of the key players in the market are Ancol Pet Products Limited; Blueberrypet.com; Chewy, Inc.; Cycle Dog; KONG Company; Mars, Incorporated and its Affiliates; Outward Hound; Petco Animal Supplies, Inc.; Petmate; PetSafe Brands; Petsmart LLC; Spectrum Brands, Inc.; and Unicharm Corporation.

The dog segment dominated the pet accessories market expansion in 2024.