Personalized Medicine Biomarkers Market Size, Share, Trends, Industry Analysis Report: By Indication, Application (Early Detection/Screening, Diagnosis, Treatment Selection, and Monitoring), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5290

- Base Year: 2024

- Historical Data: 2020-2023

Personalized Medicine Biomarkers Market Overview

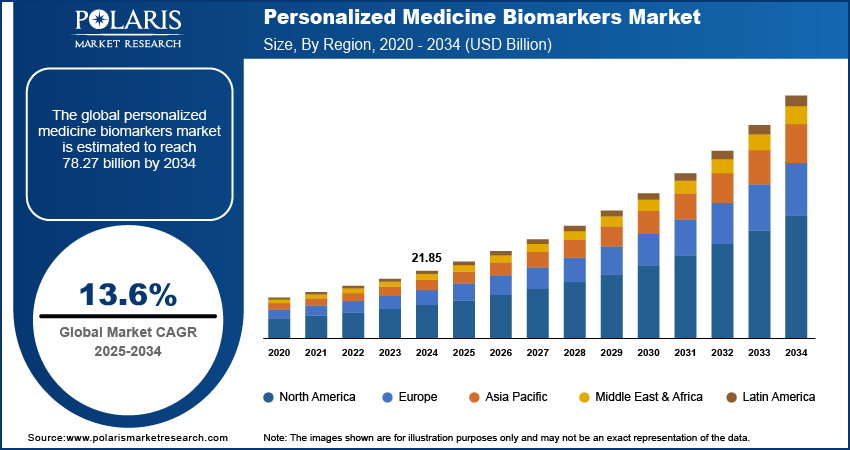

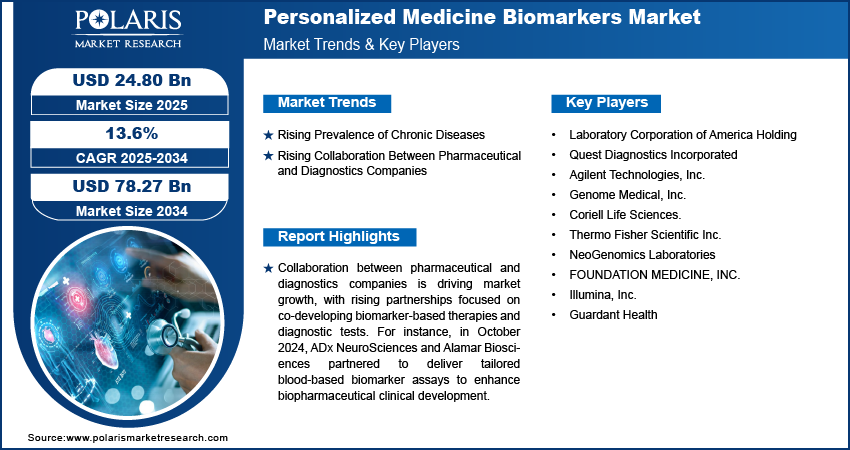

The personalized medicine biomarkers market size was valued at USD 21.85 billion in 2024. The market is projected to grow from USD 24.80 billion in 2025 to USD 78.27 billion by 2034, exhibiting a CAGR of 13.6% during the forecast period.

The personalized medicine biomarkers involve using biological indicators to tailor treatments to individual patients, enhancing diagnostic accuracy and treatment efficacy, especially in areas such as oncology and cardiology. The increasing need for targeted therapies, mainly in oncology and chronic disease management, drives demand for personalized biomarkers, thereby contributing to market growth. Furthermore, innovations in genomics, proteomics, and bioinformatics enhance biomarker identification and accuracy, fueling personalized medicine biomarkers market expansion. Rising focus on early diagnosis and preventive healthcare boosts biomarker adoption for personalized medicine. Moreover, pharmaceutical and biotech companies are investing heavily in biomarker research to develop more effective, patient-specific treatments, thereby driving market growth.

To Understand More About this Research: Request a Free Sample Report

Personalized Medicine Biomarkers Market Dynamics

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases is driving demand for personalized medicine biomarkers. Increasing cases of conditions such as cardiovascular diseases, diabetes, and cancer are creating a growing need for personalized treatments, making biomarkers essential for targeted therapies. For instance, the World Health Organization (WHO) estimated around 20 million new cancer cases globally in 2022. Projections indicate this number could exceed 35 million by 2050, representing a 77% increase. This shift is fueling market expansion, increasing market value, and contributing to a larger market share for biomarker-driven solutions.

Rising Collaboration Between Pharmaceutical and Diagnostics Companies

Collaborations between pharmaceutical and diagnostics companies are driving market growth, with rising partnerships focused on co-developing biomarker-based therapies and diagnostic tests. For instance, in October 2024, ADx NeuroSciences and Alamar Biosciences partnered to deliver tailored blood-based biomarker assays to enhance biopharmaceutical clinical development. Their collaboration aims to provide advanced diagnostic tools for identifying and validating relevant biomarkers, accelerating therapeutic development. Collaborations are accelerating the development and adoption of biomarkers, enhancing market expansion, increasing market value, and boosting the overall market share of personalized medicine solutions.

Personalized Medicine Biomarkers Market Segment Insights

Personalized Medicine Biomarkers Market Assessment by Application Outlook

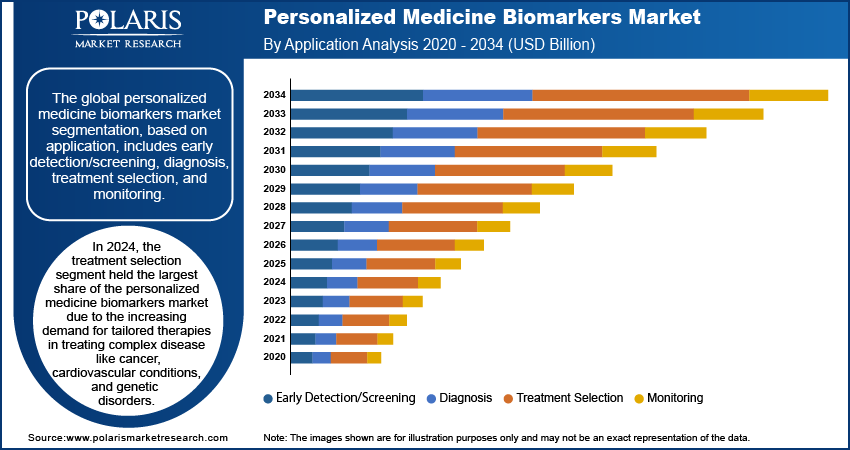

The global personalized medicine biomarkers market segmentation, based on application, includes early detection/screening, diagnosis, treatment selection, and monitoring. In 2024, the treatment selection sector led the personalized medicine biomarkers market share. This is attributed to the increasing demand for tailored therapies in treating complex diseases such as cancer, cardiovascular conditions, and genetic disorders. Biomarkers are crucial in identifying the most effective treatment options based on an individual’s genetic profile, disease characteristics, and response to previous treatments. This personalized approach enhances treatment efficacy and minimizes adverse effects, leading to better patient outcomes. Healthcare providers and pharmaceutical companies are increasingly prioritizing precision medicine to improve patient care, and the demand for biomarkers to guide treatment selection continues to drive the market’s growth, solidifying its dominant position.

Personalized Medicine Biomarkers Market Evaluation by Indication Outlook

The global personalized medicine biomarkers market segmentation, based on indication, includes oncology, neurology, diabetes, autoimmune diseases, cardiology, and others. The diabetes segment is expected to witness the highest CAGR over the forecast period due to the increasing prevalence of diabetes worldwide and the growing need for individualized treatment strategies. Advancements in biomarker technologies improve early diagnosis, treatment monitoring, and personalized care plans. Thus, the demand for diabetes-related biomarkers is expected to rise significantly. This trend is further fueled by the increasing focus on preventing complications associated with diabetes, such as cardiovascular issues and neuropathy, thereby driving market growth.

Personalized Medicine Biomarkers Market Regional Insights

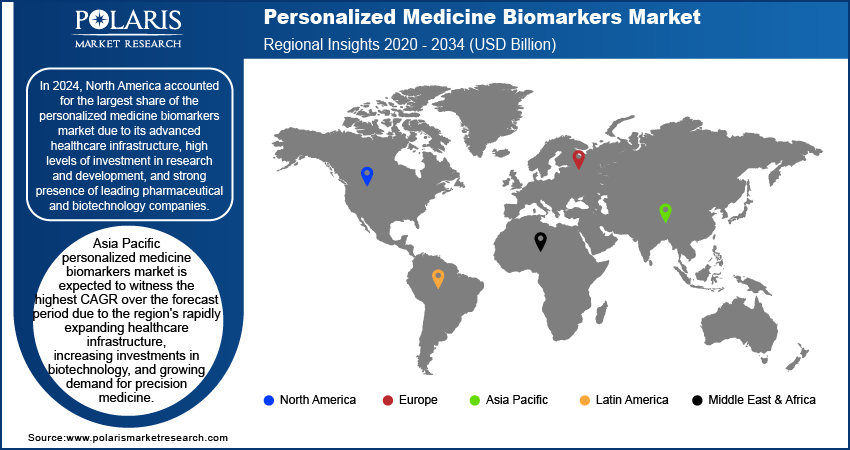

By region, the study provides personalized medicine biomarkers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to its advanced healthcare infrastructure, high levels of investment in research and development, and strong presence of leading pharmaceutical and biotechnology companies. The region benefits from a favorable regulatory environment that supports the development and approval of biomarker-based therapies. For instance, in July 2024, Governor Shapiro signed House Bill 1754, mandating that all state-regulated health plans, including Medicaid, cover comprehensive biomarker testing. This legislation enhances access to biomarker diagnostics, which is crucial for precision medicine. Facilitating targeted treatments aims to reduce side effects, improve survival rates, enhance quality of life, and potentially lower costs for patients with cancer and serious illnesses. Additionally, the region's early adoption of advanced technologies and strong collaboration between academia, healthcare providers, and industry players also contribute to its dominant market share.

The US personalized medicine biomarkers market accounted for the largest market share. This is due to the increasing prevalence of chronic diseases, such as cancer and diabetes, coupled with a growing demand for personalized medicine, further propels market growth in the US.

Asia Pacific personalized medicine biomarkers market is expected to witness the highest CAGR over the forecast period due to the region's rapidly expanding healthcare infrastructure, increasing investments in biotechnology, and growing demand for precision medicine. Governments in countries such as China, India, and Japan are increasingly supporting initiatives aimed at improving healthcare systems and advancing research in biomarkers. Additionally, the rising prevalence of chronic diseases, such as cancer and diabetes, along with a growing awareness of personalized treatments, further drives market growth. For instance, according to the WHO South-East Asia Region, there were an estimated 2.37 million new cancer cases and 1.53 million deaths in 2022, with projections suggesting an 85.7% increase in new cases by 2050.

Personalized Medicine Biomarkers Market – Key Players and Competitive Analysis Report

The competitive landscape of the personalized medicine biomarkers industry is characterized by the presence of key players across the biotechnology, pharmaceutical, and diagnostic sectors. Leading companies such as Roche, Abbott Laboratories, Thermo Fisher Scientific, Illumina, and Qiagen are at the forefront, driving innovation and market growth. Major companies focus on developing advanced biomarker technologies, including genomic, proteomic, and metabolomic biomarkers, to enhance personalized treatment options across various therapeutic areas including oncology, neurology, and diabetes.

Large corporations, numerous smaller biotech firms, and research institutions are contributing to the market by introducing innovative biomarkers and diagnostic tools. Partnerships and collaborations between pharma companies and diagnostic firms are common, facilitating the co-development of biomarker-based therapies and diagnostics. These collaborations are vital in accelerating the adoption of personalized medicine and expanding the personalized medicine biomarkers market value.

The market is witnessing increased competition in terms of research and development, with companies striving to improve the accuracy and efficiency of biomarker testing. A few key major players are Laboratory Corporation of America Holding; Quest Diagnostics Incorporated; Agilent Technologies, Inc.; Genome Medical, Inc.; Coriell Life Sciences; Thermo Fisher Scientific Inc.; NeoGenomics Laboratories; FOUNDATION MEDICINE, INC.; Illumina, Inc.; Guardant Health.

Quest Diagnostics company is a specialty genetics and bioinformatics company focused on providing genetic testing for inherited diseases. The company is based in Helsinki and Seattle, with a customer base spanning over 70 countries. Quest Diagnostics offers advanced technology and comprehensive support across 14 medical specialties. The company provides an array of testing options, including whole exome sequencing, flex panels, and familial variant testing, catering to various clinical needs. In July 2024, BD and Quest Diagnostics collaborated to manufacture, develop, and commercialize flow cytometry-based companion diagnostics (CDx) for optimizing treatment options for cancer and other diseases.

Thermo Fisher Scientific Inc. provides services to the scientific community. The company is improving patient health via diagnostics, promoting the study of life sciences, resolving complex analytical problems, increasing lab productivity, and creating and producing therapies that will change people's lives. Through their industry-leading brands, which include Thermo Scientific, Invitrogen, Applied Biosystems, Unity Lab Services, Fisher Scientific, Patheon, and PPD, their worldwide team offers an unmatched mix of advanced technology, buying ease, and pharmaceutical services. In May 2023, Thermo Fisher Scientific and Pfizer partnered to enhance global access to next-generation sequencing (NGS) diagnostics for cancer patients, aiming to improve personalized treatment options and patient outcomes.

Key Companies in Personalized Medicine Biomarkers Market

- Laboratory Corporation of America Holding

- Quest Diagnostics Incorporated

- Agilent Technologies, Inc.

- Genome Medical, Inc.

- Coriell Life Sciences.

- Thermo Fisher Scientific Inc.

- NeoGenomics Laboratories

- FOUNDATION MEDICINE, INC.

- Illumina, Inc.

- Guardant Health

Personalized Medicine Biomarkers Market Developments

August 2024: Illumina, Inc. received FDA approval for its TruSight Oncology (TSO) Comprehensive test and its first companion diagnostic indications. This test analyzes over 500 genes in solid tumors, improving the detection of immuno-oncology biomarkers and actionable mutations, thus aiding in targeted therapy selection and clinical trial eligibility.

February 2023: Roche partnered with Janssen Biotech Inc. to advance companion diagnostics for targeted therapies, enhancing their collaboration in precision medicine. The expanded agreement includes various technologies such as immunohistochemistry (IHC), digital pathology, next-generation sequencing (NGS), polymerase chain reaction (PCR), and immunoassays aimed at optimizing biomarker-driven treatment pathways.

Personalized Medicine Biomarkers Market Segmentation

By Indication Outlook (Revenue, USD Billion; 2020–2034)

- Oncology

- By Type

- Breast Cancer

- Lung Cancer

- Colon Cancer

- Others

- By Circulating Biomarkers

- Circulating Tumor Cells(CTCs)

- Circulating Cell-free DNA(cfDNA)

- Extracellular Vesicles (EVs)

- Other Circulating Biomarkers

- By Type

- Neurology

- Diabetes

- Autoimmune Diseases

- Cardiology

- Others

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Early Detection/Screening

- Diagnosis

- Treatment Selection

- Monitoring

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Personalized Medicine Biomarkers Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 21.85 billion |

|

Market Size Value in 2025 |

USD 24.80 billion |

|

Revenue Forecast by 2034 |

USD 78.27 billion |

|

CAGR |

13.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global personalized medicine biomarkers market size was valued at USD 21.85 billion in 2024 and is projected to grow to USD 78.27 billion by 2034.

The global market is projected to register a CAGR of 13.6% during the forecast period.

In 2024, North America dominated the market due to its advanced healthcare infrastructure, high levels of investment in research and development, and strong presence of leading pharmaceutical and biotechnology companies.

A few key players in the market are Laboratory Corporation of America Holding; Quest Diagnostics Incorporated; Agilent Technologies, Inc.; Genome Medical, Inc.; Coriell Life Sciences; Thermo Fisher Scientific Inc.; NeoGenomics Laboratories; FOUNDATION MEDICINE, INC.; Illumina, Inc.; Guardant Health.

In 2024, the treatment selection segment held the largest share of the personalized medicine biomarkers market due to the increasing demand for tailored therapies in treating complex diseases like cancer, cardiovascular conditions, and genetic disorders.

The diabetes segment is expected to witness the highest CAGR over the forecast period due to the increasing prevalence of diabetes worldwide and the growing need for individualized treatment strategies.