Personal Care Products Market Size, Share, Trends, Industry Analysis Report: By Type (Conventional and Organic); Product; Ingredient; Distribution Channel; and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 114

- Format: PDF

- Report ID: PM1284

- Base Year: 2023

- Historical Data: 2019-2022

Personal Care Products Market Overview

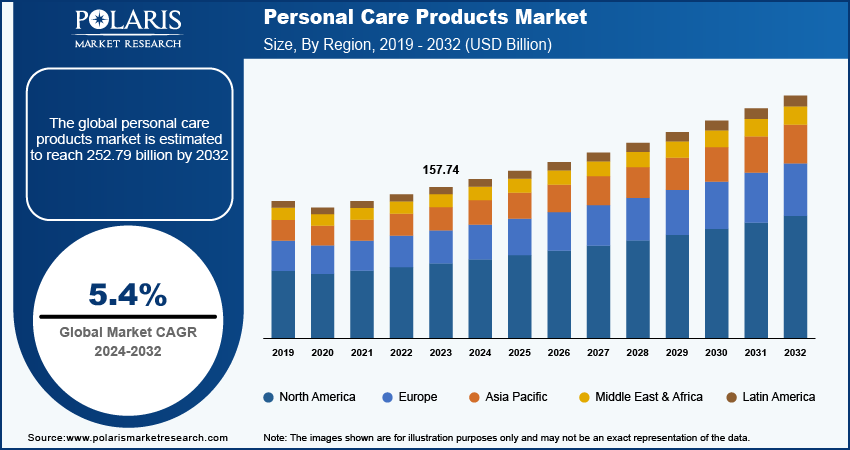

The personal care products market size was valued at USD 157.74 billion in 2023. The market is projected to grow from USD 165.85 billion in 2024 to USD 252.79 billion by 2032, exhibiting a CAGR of 5.4% during 2024–2032.

Personal care products encompass a broad range of items designed for hygiene, grooming, and beautification, catering to the diverse needs of consumers across various demographics. These products include skincare items such as creams, lotions, and sunscreens; hair care products such as shampoos and gels; oral hygiene products including toothpaste; and cosmetics used for makeup.

The growing urbanization across the world is expected to boost the global personal care products market. According to the United Nations, 68% of the world population is projected to live in urban areas by 2050. Personal grooming is often seen as a reflection of one’s social status and professionalism in urban areas, increasing the demand for personal care products. Additionally, urban residents usually have better access to information and a wider variety of products. Exposure to advertising, social media, and beauty trends fosters a greater awareness and desire for personal care products, thereby increasing demand.

To Understand More About this Research: Request a Free Sample Report

The market for personal care products is driven by the growing popularity of e-commerce platforms. E-commerce platforms typically offer a broader range of products compared to offline or physical stores, allowing consumers to find niche, specialty, and international brands that may not be available locally. Moreover, e-commerce platforms utilize data analytics to offer personalized recommendations and promotions, effectively targeting consumers based on their preferences and shopping behavior, which increases sales of personal care products.

Personal Care Products Market Driver Analysis

Rising Popularity of Organic Products

The rising popularity of organic products is expected to boost the demand for personal care products. Many consumers believe that organic products are more effective due to their natural ingredients. This perception drives demand for organic personal care products, especially for skincare and haircare items. Additionally, several organic personal care products are marketed as premium items, appealing to consumers willing to pay more for perceived quality and ethical considerations.

Growing Number of Women Workforce

The growing number of women workforces globally is estimated to propel the global personal care products market. As per data published by the International Labor Workforce, women represent over 40% of the global labor force. Professional environments often emphasize the importance of personal appearance. Working women usually invest more in grooming and personal care products to enhance their professional image. Furthermore, the disposable income of women increases as they enter the workforce, leading to greater purchasing power and a willingness to spend on personal care products.

Personal Care Products Market Segment Insights

Personal Care Products Market Breakdown – Type Insights

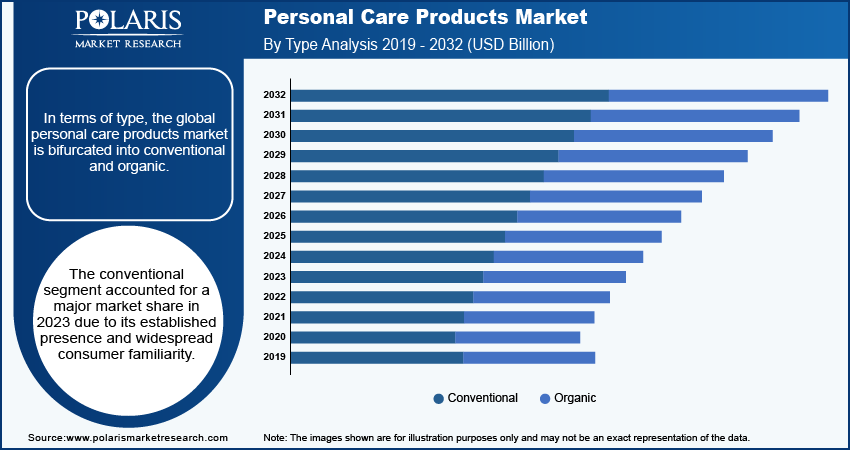

In terms of type, the global personal care products market is bifurcated into conventional and organic. The conventional segment accounted for a major market share in 2023 due to its established presence and widespread consumer familiarity. Conventional products, often backed by extensive marketing and brand loyalty, appeal to a broad demographic. Consumers prioritize accessibility and price, making conventional items more appealing compared to their organic counterparts. Additionally, the availability of a vast range of options, from budget-friendly to premium brands, ensures that conventional products meet diverse consumer needs, contributing to segment dominance.

The organic segment is also projected to grow at a robust pace in the coming years, owing to the increasing health consciousness and a shift toward sustainable living. Consumers actively seek out natural alternatives as they become aware of the potential adverse effects of synthetic chemicals. The rising interest in eco-friendly and cruelty-free products further propels this trend. Brands that prioritize transparency in sourcing and formulation foster trust among consumers, which enhances loyalty and demand. Additionally, the influence of social media and beauty influencers amplifies awareness and encourages younger demographics to embrace organic options, positioning the segment for substantial growth in the coming years.

Personal Care Products Market Breakdown – Product Insights

Based on product, the global personal care products market is divided into skin care, hair care, color cosmetics, fragrances, and others. The skin care segment dominated the market in 2023 due to the increasing focus on health and wellness among consumers. The rising awareness of the importance of skin health has led individuals to prioritize effective skincare routines, resulting in increased demand for moisturizers, serums, and treatments. Innovations in product formulations, including the incorporation of natural ingredients and advanced technology, have further captivated consumers. Moreover, the growing prevalence of skin concerns, such as acne and aging, has prompted consumers to invest in skin care products, solidifying segment position.

The hair care segment is also estimated to grow at a significant CAGR in the coming years owing to the evolving consumer preferences for specialized and high-quality products. Consumers actively seek out products tailored to their specific needs, such as hair restoration, damage repair, and moisture retention, as they increasingly recognize the importance of healthy hair. The rise of e-commerce has made a wide variety of hair care products more accessible, allowing consumers to explore niche brands and formulations that cater to diverse hair types and concerns. Additionally, trends toward natural and organic ingredients are influencing the market as consumers become more aware of the benefits of using gentle, chemical-free products. This shift, combined with continuous innovation from brands, positions hair care to capture a dominant share of the market in the coming years.

Personal Care Products –

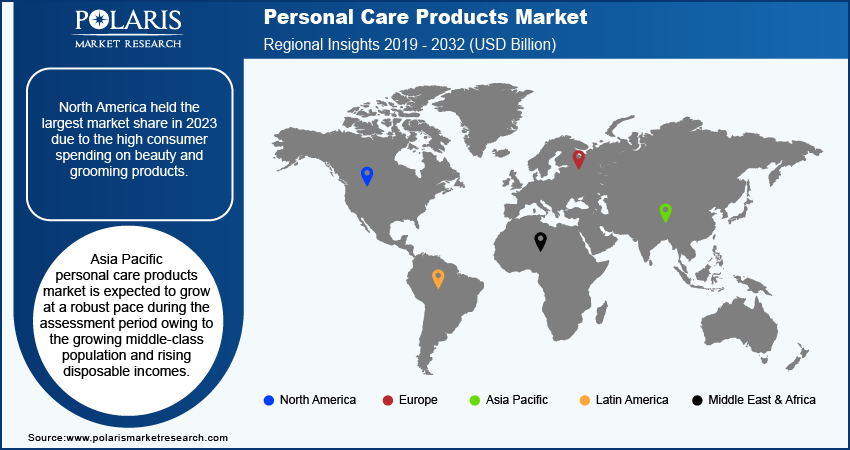

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2023 due to the high consumer spending on beauty and grooming products. The US, as the dominant country in this region, has a well-established retail landscape and a robust presence of both global and local brands. The cultural emphasis on personal appearance and wellness continues to propel demand across various product categories. Additionally, consumers in North America increasingly seek innovative and high-quality formulations, particularly in skin care and hair care. The influence of social media and beauty influencers also plays a crucial role in shaping trends and driving purchases, as consumers actively engage with brands and products that align with their lifestyles.

Asia Pacific personal care products market is expected to grow at a robust pace during the assessment period owing to the growing middle-class population and rising disposable incomes. Countries including China and India lead this growth, as their wide populations prioritize personal grooming and self-care. The increasing awareness of global beauty trends and the influence of western brands further drive demand for various products, especially skincare and color cosmetics. E-commerce platforms have made it easier for consumers to access a wide range of products, including niche and organic options, which appeal to younger demographics. Asia Pacific is poised for significant expansion in the coming years as brands continue to innovate and tailor products to local preferences.

Personal Care Products Market – Key Players and Competitive Insights

Major market players are investing hugely in research and development to innovate new products in the market. This strategy helps them expand their product portfolio, which will assist them in acquiring a competitive share in personal care products by enhancing accessibility to their products. Key participants in the personal care products industry are adopting intensive strategies to enhance their global footprint.

L'Oreal SA; Procter and Gamble Co.; Unilever; Colgate-Palmolive; The Estee Lauder Inc.; Natura and Co.; Johnson and Johnson; Beiersdorf; Shiseido Company; and Oriflame Cosmetics are among the major players in the personal care products market.

Colgate-Palmolive is a global consumer products company that produces, distributes, and sells a wide range of products, including household and commercial cleaning supplies, dental and personal care items, and pet foods. The company’s products are available in the US and over 200 countries and territories worldwide. Colgate-Palmolive is headquartered in New York City.

L'Oréal S.A. is a French multinational personal care company specializing in the production and sale of beauty and hair products. Established in 1909 in Clichy, Hauts-de-Seine, France, the company has grown into the world’s largest beauty manufacturer. L'Oréal offers a wide range of products, including makeup, fragrances, hair care, sun care, skincare, and coloring products. The company operates through four segments, namely professional products, consumer products, l'oréal luxe, and active cosmetics. In September 2023, L’Oréal Groupe agreed to make a minority investment in Shinehigh Innovation, a biotech company based in China, to establish a long-term partnership aimed at jointly developing innovative and environmentally sustainable beauty solutions.

Companies in the Personal Care Products Market

- Beiersdorf AG

- Colgate-Palmolive Company

- Johnson and Johnson Inc.

- LOreal SA

- Natura and Co.

- Oriflame Cosmetics Global SA.

- Procter and Gamble

- Shiseido Company Limited

- The Estee Lauder Inc.

- Unilever PLC

Personal Care Products Industry Developments

June 2024: Ananta Capital acquired a 55% stake in the personal care brand Anveya Living. The investment will be used for the new product development of hair & skincare products and support global expansion efforts.

May 2024: The skincare brand Olay introduced cleansing melts, water-activated, dissolving cleansing squares available in three formulations: vitamin C, hyaluronic acid, and retinol. This launch aims to elevate the cleansing category by addressing the most common consumer concerns.

April 2023: Pacifica introduced a new body care line named Wake Up Beautiful, which includes retinoid and mushroom-based products designed to rejuvenate the skin. The collection features a body serum and lotion crafted with sustainable and eco-friendly ingredients. The inclusion of mushrooms in the formulation helps enhance skin hydration.

January 2023: Shroom Skincare introduced its debut product, the Mycelium Glow Brightening Serum, which blends mushroom extracts with vitamin C to revitalize and hydrate the skin. This serum provides multiple benefits, including protection against environmental damage, reduction of inflammation, and enhancement of the appearance of aging and uneven skin tone.

Personal Care Products Market Segmentation

By Type Outlook (Revenue, USD billion, 2024 - 2032)

- Conventional

- Organic

By Product Outlook (Revenue, USD billion, 2024 - 2032)

- Skin Care

- Hair Care

- Color Cosmetics

- Fragrances

- Others

By Ingredient Outlook (Revenue, USD billion, 2024 - 2032)

- Emollients

- Surfactants

- Emulsifiers

- Rheology Modifiers

- Conditioning Polymers

- Others

By Distribution Channel Outlook (Revenue, USD billion, 2024 - 2032)

- Hypermarkets & Supermarkets

- Specialty Stores

- E-commerce

- Others

By Regional Outlook (Revenue, USD billion, 2024 - 2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Personal Care Products Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 157.74 billion |

|

Market Size Value in 2024 |

USD 165.85 billion |

|

Revenue Forecast in 2032 |

USD 252.79 billion |

|

CAGR |

5.4 % from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global personal care products market size was valued at USD 157.74 billion in 2023 and is projected to grow to USD 252.79 billion by 2032.

The global market is projected to grow at a CAGR of 5.4% during 2023–2032.

North America held the largest share of the global market in 2023.

L’Oreal SA; Procter and Gamble Co.; Unilever; Colgate-Palmolive; The Estee Lauder Inc.; Natura and Co.; Johnson and Johnson; Beiersdorf; Shiseido Company; and Oriflame Cosmetics are a few key players in the market.

The conventional segment dominated the market in 2023.

The skin care product segment held the largest share of the global market in 2023.