Peritoneal Dialysis Market Size, Share, Trends, Industry Analysis Report: By Offering, Modality (CAPD and APD), Disease Indication, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5519

- Base Year: 2024

- Historical Data: 2020-2023

Peritoneal Dialysis Market Overview

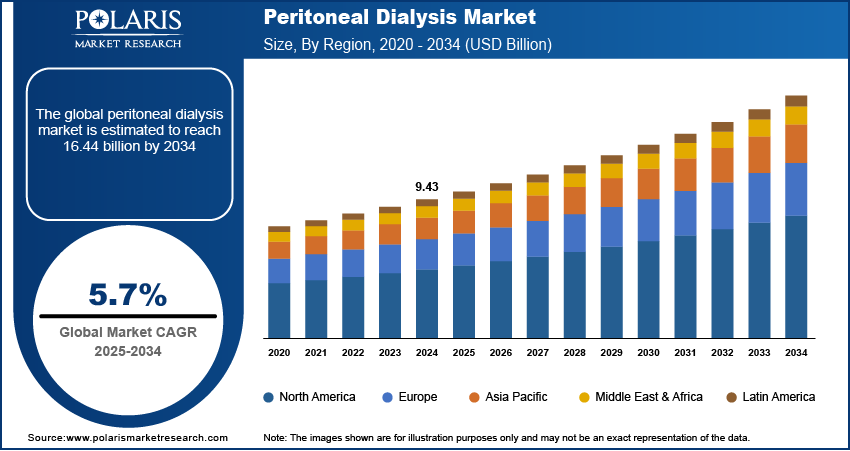

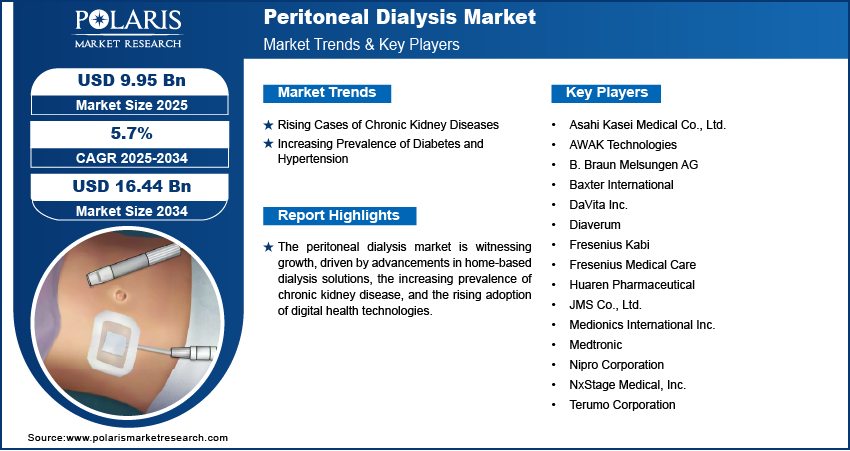

The global peritoneal dialysis market was valued at USD 9.43 billion in 2024. It is expected to grow from USD 9.95 billion in 2025 to USD 16.44 billion by 2034, at a CAGR of 5.7% during the forecast period.

Peritoneal dialysis is a kidney replacement therapy that uses the peritoneal membrane to filter waste, excess fluids, and toxins from the blood, serving as an alternative to hemodialysis. The peritoneal dialysis market growth is primarily driven by technological advancements and increased investment in research and development (R&D). For instance, in April 2022, the FDA cleared Fresenius Medical Care's VersiPD Cycler, a portable automated peritoneal dialysis system. Designed for home use, it features quiet operation, personalized programming, and remote monitoring via the Kinexus platform to enhance patient convenience and treatment outcomes. Innovations such as automated peritoneal dialysis (APD) systems, wearable dialysis devices, and improved dialysate solutions are improving treatment efficiency, patient compliance, and overall outcomes. Additionally, growing R&D investments are accelerating the development of biocompatible materials, infection control solutions, and novel catheter designs, further improving efficacy and safety and thereby boosting market expansion.

To Understand More About this Research: Request a Free Sample Report

Government support and increasing reimbursement policies are playing a crucial role in peritoneal dialysis market development by improving access to peritoneal dialysis treatment. Many healthcare authorities and regulatory bodies are implementing favorable policies, subsidies, and funding programs to encourage home-based dialysis solutions, reducing the burden on hospital infrastructure. For instance, in November 2024, CMS reported that Medicare would pay USD 6.6 billion to 7,700 ESRD facilities in 2025, with a base rate of USD 273.82, a USD 2.80 increase from 2024. Total payments are projected to rise by 2.7%, with hospital-based facilities seeing a 4.5% increase. Expanding reimbursement coverage for dialysis procedures and supplies, particularly in developed markets, is making peritoneal dialysis more affordable for patients, promoting wider adoption. These initiatives are enabling a supportive ecosystem for manufacturers and healthcare providers, ensuring sustained expansion opportunities and increased adoption of peritoneal dialysis as a preferred modality.

Peritoneal Dialysis Market Driver Dynamics

Rising Cases of Chronic Kidney Diseases

There is a growing demand for cost-effective and patient-friendly dialysis solutions with an increasing global burden of chronic kidney disease due to aging populations and lifestyle-related factors. For instance, a June 2024 report from the National Kidney Foundation revealed that approximately 35.5 million US adults, or more than 1 in 7 (14%), are estimated to be affected by kidney disease. This rising majority highlights the urgent need for effective and accessible treatment options. Peritoneal dialysis offers advantages such as home-based treatment, greater flexibility, and reduced dependency on hospital visits. It is a preferred option for managing ESRD as CKD progression often leads to end-stage renal disease (ESRD), necessitating long-term dialysis treatment. Thus, as healthcare systems focus on expanding dialysis accessibility and treatment options, the demand for peritoneal dialysis continues to grow, driving peritoneal dialysis market expansion.

Increasing Prevalence of Diabetes and Hypertension

Uncontrolled diabetes and high blood pressure contribute to kidney damage over time, especially increasing the number of patients requiring renal replacement therapy, as both conditions are leading causes of CKD and ESRD. For instance, a November 2024 WHO report highlighted that diabetes and diabetes-related kidney disease contributed to over 2 million deaths in 2021. Additionally, high blood glucose was responsible for approximately 11% of cardiovascular-related deaths. Peritoneal dialysis provides an effective treatment solution for these patients, particularly those with comorbidities who may benefit from a less invasive and more adaptable dialysis approach. Therefore, as the incidence of diabetes and hypertension rises globally, the need for accessible and efficient dialysis options is driving growth opportunities, further strengthening the adoption of peritoneal dialysis.

Peritoneal Dialysis Market Segment Assessment

Peritoneal Dialysis Market Assessment by Modality

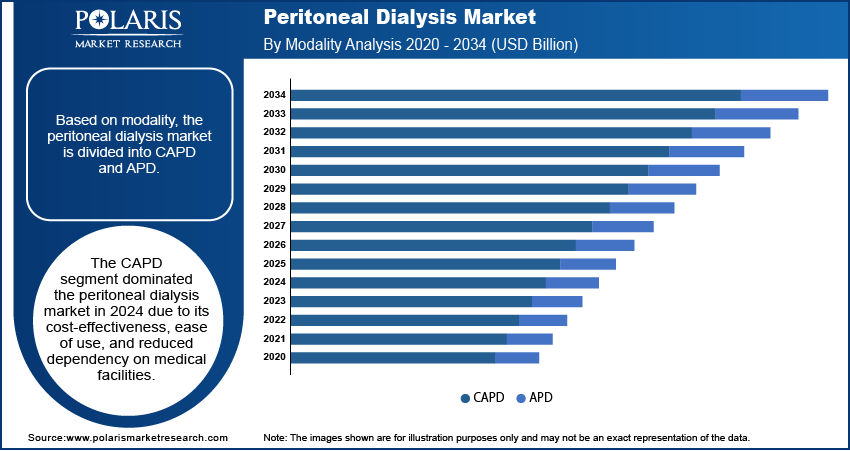

The global peritoneal dialysis market segmentation, based on modality, includes CAPD and APD. The Continuous Ambulatory Peritoneal Dialysis (CAPD) segment dominated the market in 2024 due to its cost-effectiveness, ease of use, and reduced dependency on medical facilities. CAPD does not require automated machinery, allowing patients to perform dialysis manually at home, which improves convenience and accessibility, particularly in regions with limited healthcare infrastructure. Additionally, CAPD is associated with fewer technical complications and lower initial setup costs compared to Automated Peritoneal Dialysis (APD), making it a preferred choice for patients and healthcare providers. The growing adoption of home-based dialysis solutions and increasing awareness of self-care management further contributed to the segment’s market leadership.

Peritoneal Dialysis Market Evaluation by Disease Indication

The global peritoneal dialysis market is segmented by disease indication into end-stage renal disease, acute kidney injury, and others. The end-stage renal disease segment has witnessed the largest peritoneal dialysis market share, driven by the increasing global prevalence of ESRD and the rising demand for long-term renal replacement therapies. Peritoneal dialysis is emerging as a preferred treatment option due to its flexibility, lower cost burden, and better quality-of-life outcomes compared to in-center hemodialysis, as ESRD patients require ongoing dialysis or kidney transplantation. Furthermore, advancements in peritoneal dialysis technologies and improved patient education are improving treatment adherence and clinical outcomes, accelerating the adoption of peritoneal dialysis for ESRD management.

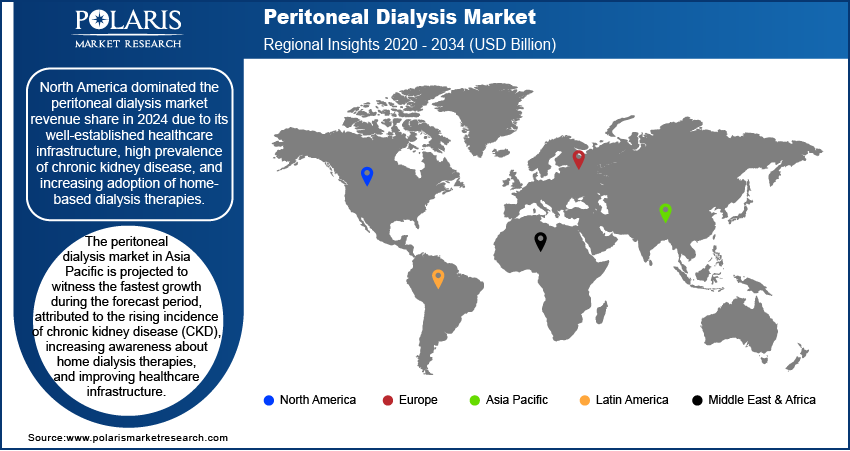

Peritoneal Dialysis Market Regional Insights

By region, the report provides the peritoneal dialysis market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market revenue share in 2024 due to its well-established healthcare infrastructure, high prevalence of chronic kidney disease, and increasing adoption of home-based dialysis therapies. For instance, an August 2022 AHA report noted that 13.1% of US dialysis patients use home therapies, with 11.2% on peritoneal dialysis and 1.9% on home hemodialysis. This trend reflects a growing shift toward patient-centered care and home-based treatment options. The presence of major industry players, continuous technological advancements, and favorable reimbursement policies have contributed to the widespread availability and accessibility of peritoneal dialysis in the region. Additionally, growing healthcare expenditure, patient preference for home-based care, and strong government support for dialysis programs have further strengthened North America's market position.

The peritoneal dialysis market in Asia Pacific is projected to witness the fastest growth during the forecast period, attributed to the rising incidence of chronic kidney disease (CKD), increasing awareness about home dialysis therapies, and improving healthcare infrastructure. For instance, a January 2022 NCBI report estimated that 434.3 million people in Asia have CKD, with China and India accounting for up to 299.9 million cases. Among these, approximately 65.6 million individuals are in the advanced stages of the disease. Rapid urbanization, changing lifestyles, and the growing burden of diabetes and hypertension are leading to a surge in kidney-related disorders, driving market demand. Additionally, government initiatives to improve dialysis accessibility, coupled with increasing investments in healthcare facilities and reimbursement policies, are facilitating market growth. The expanding presence of key market players and the adoption of cost-effective dialysis solutions are further accelerating the expansion opportunities in the region.

Peritoneal Dialysis Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for peritoneal dialysis market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Peritoneal dialysis market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes.

Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with peritoneal dialysis market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the peritoneal dialysis industry's growth is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, assuring sustained growth in a hypercompetitive global market. A few key major players are Fresenius Medical Care; Baxter International; DaVita Inc.; Diaverum; Medtronic; B. Braun Melsungen AG; Nipro Corporation; NxStage Medical, Inc.; Fresenius Kabi; Asahi Kasei Medical Co., Ltd.; Terumo Corporation; JMS Co., Ltd.; Huaren Pharmaceutical; Medionics International Inc.; and AWAK Technologies.

Fresenius Medical Care is a provider of peritoneal dialysis (PD) solutions, offering a broad approach to this form of kidney replacement therapy. Fresenius Medical Care has introduced innovative programs such as the "P3" concept, which integrates all aspects of PD therapy, including cyclers, equipment, and monitoring software, to enhance treatment safety and quality. Their products include automated peritoneal dialysis (APD) systems such as the sleep-safe harmony cycler, designed for home use, particularly at night, allowing patients to manage their treatment with ease. Additionally, Fresenius offers Continuous Ambulatory Peritoneal Dialysis (CAPD) solutions, which are tailored to individual patient needs, ensuring flexibility and comfort during treatment. The company's focus on patient-centric care empowers patients to manage their dialysis effectively, improving their quality of life. Fresenius also provides biocompatible PD solutions in double-chamber bags, reducing the risk of infection and preserving the peritoneal membrane. Overall, Fresenius Medical Care's peritoneal dialysis offerings are designed to support patients in managing their condition effectively at home.

Baxter International specializes in the peritoneal dialysis (PD) market. They introduced the world's first PD solution in 1960. The company has been committed to providing end-stage renal disease (ESRD) patients with this life-saving therapy, which allows patients to maintain their lifestyle and independence while offering potentially better clinical outcomes and lower costs compared to hemodialysis. Baxter's wide PD portfolio includes automated peritoneal dialysis systems like the Amia APD System, which is enhanced by remote patient management (RPM) technology. This RPM system, known as Sharesource, enables healthcare professionals to remotely monitor and manage therapy, improving clinical outcomes and adherence. Baxter is also innovating with an on-demand PD solution generation system, currently in clinical trials, which aims to simplify therapy management by producing dialysis solutions at home, reducing storage needs, and improving flexibility in treatment. This technology combines Baxter's expertise in dialysis, drug delivery, and water filtration systems to transform the home dialysis experience. Overall, Baxter's commitment to PD is centered on patient-centric solutions that improve care quality and accessibility.

Key Companies in Peritoneal Dialysis Market

- Asahi Kasei Medical Co., Ltd.

- AWAK Technologies

- B. Braun Melsungen AG

- Baxter International

- DaVita Inc.

- Diaverum

- Fresenius Kabi

- Fresenius Medical Care

- Huaren Pharmaceutical

- JMS Co., Ltd.

- Medionics International Inc.

- Medtronic

- Nipro Corporation

- NxStage Medical, Inc.

- Terumo Corporation

Peritoneal Dialysis Market Developments

October 2024: The DaVita Giving Foundation invested in NKF's PEERS program, offering mentorship and emotional support for kidney patients, caregivers, and donors. The initiative emphasizes mental health in chronic disease care, fostering connections to improve well-being and reduce isolation.

August 2024: Baxter International sold its Kidney Care segment, Vantive, to Carlyle for USD 3.8 billion. Baxter received USD 3.5 billion in cash, using proceeds to reduce debt and focus on strategic growth opportunities for both companies.

March 2024: Mitra Industries launched a triple-chambered peritoneal dialysis bag with near-neutral pH and low GDPs, aiming to improve patient outcomes. Rising CKD cases in India, driven by diabetes and hypertension, have increased reliance on dialysis due to limited kidney transplants.

Peritoneal Dialysis Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020 - 2034)

- Products

- Dialysis Solutions Bag

- Dialysis Machines

- Dialysis Catheters

- Dialysis Transfer Sets

- Others

- Services

By Modality Outlook (Revenue, USD Billion, 2020 - 2034)

- CAPD

- APD

By Disease Indication Outlook (Revenue, USD Billion, 2020 - 2034)

- End-Stage Renal Disease

- Acute Kidney Injury

- Others

By End User Outlook (Revenue, USD Billion, 2020 - 2034)

- Home Care

- Hospitals & Independent Dialysis Centers

- Others

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Peritoneal Dialysis Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.43 billion |

|

Market Size Value in 2025 |

USD 9.95 billion |

|

Revenue Forecast in 2034 |

USD 16.44 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global peritoneal dialysis market size was valued at USD 9.43 billion in 2024 and is projected to grow to USD 16.44 billion by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

North America dominated the peritoneal dialysis market revenue share in 2024.

Some of the key players in the market are Fresenius Medical Care; Baxter International; DaVita Inc.; Diaverum; Medtronic; B. Braun Melsungen AG; Nipro Corporation; NxStage Medical, Inc.; Fresenius Kabi; Asahi Kasei Medical Co., Ltd.; Terumo Corporation; JMS Co., Ltd.; Huaren Pharmaceutical; Medionics International Inc.; and AWAK Technologies.

The CAPD segment dominated the peritoneal dialysis market in 2024.

The end-stage renal disease segment witnessed the largest peritoneal dialysis market share.