Peptide and Oligonucleotide CDMO Market Share, Size, Trends, Industry Analysis Report, By Product (Peptides, Oligonucleotides); By Service; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4342

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

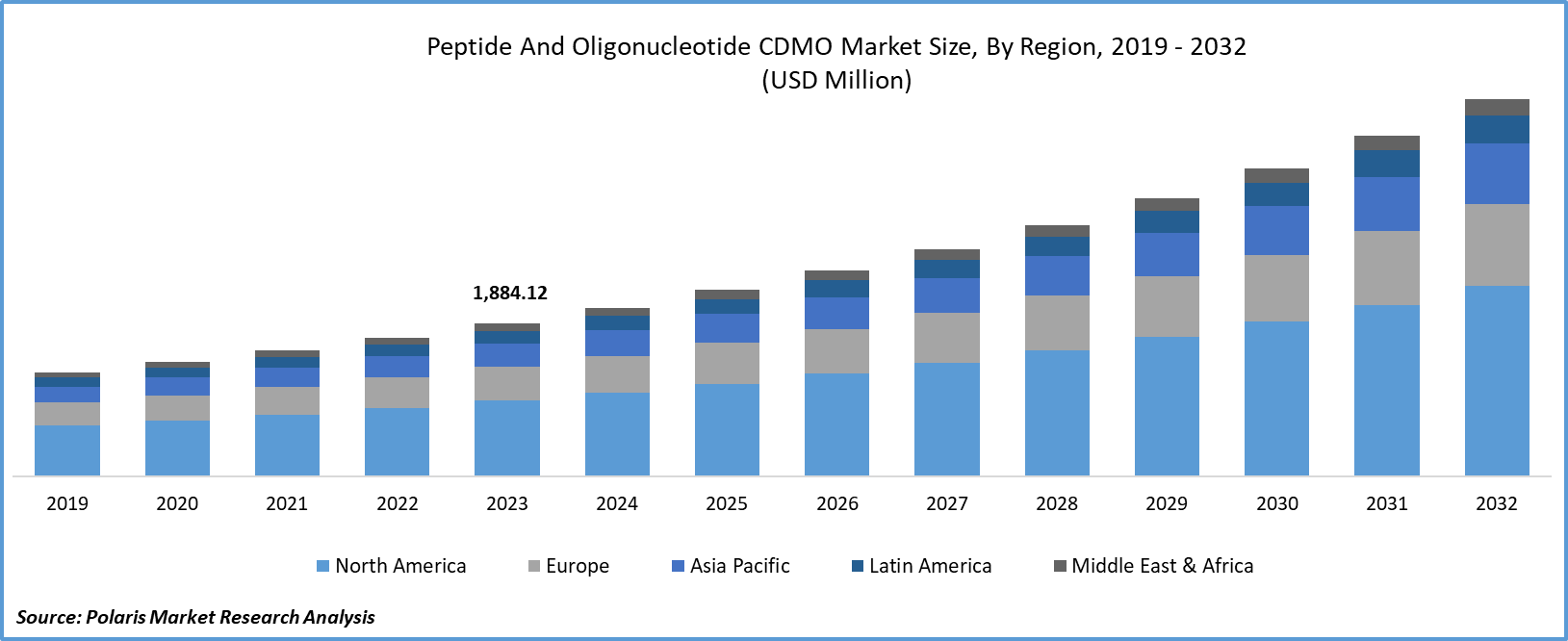

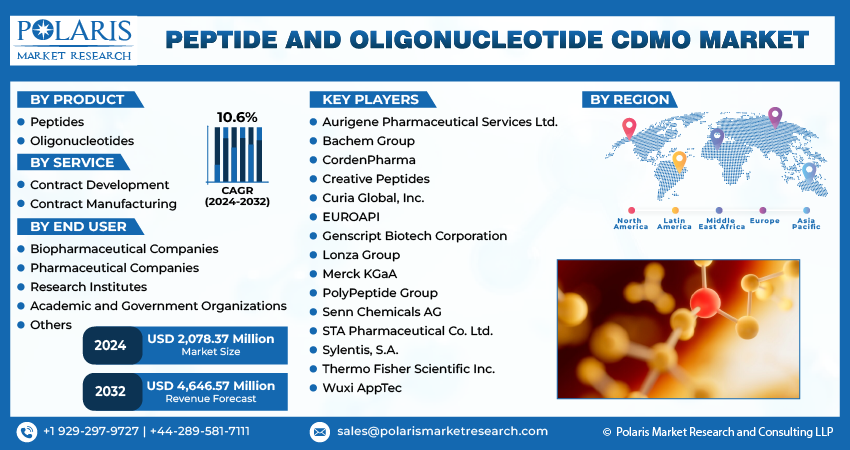

- Peptide and Oligonucleotide CDMO Market size was valued at USD 1,884.12 million in 2023.

- The market is anticipated to grow from USD 2,078.37 million in 2024 to USD 4,646.57 million by 2032, exhibiting a CAGR of 10.6% during the forecast period.

Market Introduction

Peptide and oligonucleotide contract development and manufacturing organizations (CDMOs) are seeing substantial expansion in the worldwide biopharmaceutical market. Specialized services provided by CDMOs are in greater demand as biopharmaceutical operations spread internationally. These firms streamline the development and manufacture of peptides and oligonucleotides while fulfilling the varying needs of pharmaceutical companies across several areas. Through their skillful management of diverse regulatory environments, these CDMOs are positioned as essential collaborators in the booming biopharmaceutical industry, promoting mutual success and progress.

In addition, companies operating in the market are concentrating on expanding their manufacturing capabilities to cater to the growing market demand.

- For instance, in May 2023, GenScript Biotech Corporation extended its main manufacturing facility in Zhenjiang, Jiangsu, China, focusing on oligonucleotide and peptide production. The enhanced capability in oligonucleotide synthesis now provides a diverse range of products, including qPCR oligos, NGS oligos, RNA oligos, and DNA oligos. This expansion is designed to support various applications, spanning from molecular diagnostics and RNA interference to genome editing.

Elevated investment in research and development is propelling the peptide and oligonucleotide contract development and manufacturing organization market. Pharmaceutical enterprises are dedicating considerable funds to investigate pioneering therapeutic peptides and oligonucleotides, fostering creativity and broadening the range of products in the pipeline. The increasing collaboration between research and development initiatives and CDMOs lays the groundwork for the market to grow consistently and assume a crucial role in advancing novel treatments.

To Understand More About this Research: Request a Free Sample Report

Industry Growth Drivers

- Growth in personalized medicine is projected to spur the product demand

The growth of personalized medicine drives the nucleic acid therapeutics CDMO market growth. The surge in precision medicine strategies, tailoring treatments to individual patient characteristics, has sparked a heightened demand for customized therapeutic solutions, especially peptides and oligonucleotides. These molecular entities are pivotal in targeted therapies, specifically addressing distinct genetic markers and diverse patient profiles. As pharmaceutical companies intensify endeavors to craft personalized treatments for conditions such as cancer and genetic disorders, the dependence on specialized CDMOs for manufacturing and development escalates.

- Technological advancement is expected to drive peptide and oligonucleotide CDMO market industry outlook report growth

Technological advancements in peptide and oligonucleotide CDMOs encompass automated synthesis, solid-phase peptide synthesis (SPPS), and continuous flow methods for enhanced efficiency. Next-Generation Sequencing (NGS) ensures comprehensive oligonucleotide characterization. Cell-free synthesis is employed for flexible peptide production. RNA synthesis advances support the development of RNA-based therapeutics. Innovative delivery systems, like nanoparticle-based approaches, aim to improve bioavailability. Integrated analytical platforms, combining various techniques, ensure thorough product characterization and quality control in the dynamic landscape of CDMOs.

Industry Challenges

- Regulatory Compliance Challenges likely to impede the market growth

Regulatory compliance challenges serve as a barrier to the expansion of the Peptide CDMO (Pharmaceutical) market. Stringent regulatory requirements demand substantial investments in quality assurance and regulatory affairs. The evolving regulatory landscape, characterized by dynamic updates, creates uncertainty and necessitates continuous adaptation. Complex approval processes, coupled with the risk of delays, impede product development timelines and market entry. Global variability in compliance standards and the need for meticulous documentation and reporting further intensify the challenges. Overcoming these hurdles is imperative for unlocking the full growth potential of the market cap.

Report Segmentation

The market is primarily segmented based on product, service, end user, and region.

|

By Product |

By Service |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Peptides segment accounted for substantial market share in 2023

The peptides segment accounted for a substantial market share in 2023. Demand for peptides is rising in several industries for a variety of reasons. Peptides are essential for targeted therapy in biopharmaceuticals, including conditions such as cancer and metabolic diseases. Their increasing importance in sophisticated diagnostics is improving the precision of biomarker identification. Peptides are essential to skincare and are used in anti-aging and collagen-synthesizing formulas. The nutraceutical industry uses peptides for their antibacterial and antioxidant properties. Peptides are crucial research instruments for biological investigations. Advances in peptide synthesis technology enable affordable, mass manufacture, expanding the uses of these molecules. The demand for peptides is further driven by ongoing medicinal discoveries and increased consumer awareness.

By Service Analysis

- Contract manufacturing segment accounted for consequential market share in 2023

The contract manufacturing segment accounted for a consequential market share in 2023. Contract manufacturing for peptide and oligonucleotide involves outsourcing to specialized CDMOs, ensuring precision in biopharmaceutical development. CDMOs offer tailored solutions, aligning production with individual project intricacies and therapeutic goals. This cost-efficient approach allows access to cutting-edge facilities without extensive in-house investments. The flexibility of scalable production meets varying project volumes, while strict adherence to regulatory standards ensures compliance. Accelerated timelines and risk mitigation are inherent benefits, as CDMOs streamline processes with specialized expertise. Global market access is expanded, and innovation integration guarantees adherence to industry advancements.

By End User Analysis

- Biopharmaceutical companies segment held significant market revenue share in 2023

The biopharmaceutical companies segment held a significant market revenue share in 2023. Peptide and Oligonucleotide, contract development and manufacturing organizations offer highly specialized services to biopharmaceutical firms. These include personalized solutions made to meet the specific therapeutic objectives of each client and offer complete support from early-stage research to large-scale commercial production. CDMOs use cutting-edge technologies, guarantee stringent regulatory compliance, provide scalability and flexibility, and offer affordable options for efficient development. Working together with CDMOs speeds up timeframes, increases global market access, and mitigates risk. This collaboration highlights how important CDMOs are to the timely, accurate, and regulatory-driven advancement of biopharmaceutical ventures.

Regional Insights

- North America region dominated the global market in 2023

In 2023, the North American region dominated the global market. North America's Peptide and Oligonucleotide CDMO market growth landscape is flourishing due to a burgeoning biopharmaceutical sector and technological strides in synthesis. Continuous R&D activities, particularly in genomics and personalized medicine, propel demand for specialized CDMO services. The market is marked by strategic collaborations among providers to enhance competitiveness. Fierce competition drives innovations, optimizing processes and service offerings. Adherence to stringent regulatory standards is imperative, ensuring quality and safety. Greater focus on personalized medicine fosters the need for tailored manufacturing processes. Substantial investments in advanced infrastructure underscore the region's commitment to meeting evolving market demands.

Asia-Pacific's market size is expected to experience rapid growth owing to robust investments in the biopharmaceutical and life sciences industries. Emerging markets such as China and India play pivotal roles in the global landscape. Supportive government initiatives and favorable regulations foster industry growth. With increasing outsourcing from global biopharmaceutical companies, Asia's CDMO market focuses on innovation and meeting the growing demand for peptides and oligonucleotides in therapeutic applications.

Key Market Players & Competitive Insights

The peptide and oligonucleotide CDMO market demonstrates a segmented landscape, and the competition is anticipated to escalate due to the involvement of multiple players. Prominent service providers in the market continually upgrade their technologies to sustain a competitive edge, giving priority to efficiency, integrity, and safety. These entities underscore the significance of partnerships, improvements in products, and collaborative endeavors as strategic moves to surpass their peers, with the objective of substantial peptide and oligonucleotide CDMO market share.

Some of the major players operating in the global peptide and oligonucleotide CDMO market include:

- Aurigene Pharmaceutical Services Ltd.

- Bachem Group

- CordenPharma

- Creative Peptides

- Curia Global, Inc.

- EUROAPI

- Genscript Biotech Corporation

- Lonza Group

- Merck KGaA

- PolyPeptide Group

- Senn Chemicals AG

- STA Pharmaceutical Co. Ltd.

- Sylentis, S.A.

- Thermo Fisher Scientific Inc.

- Wuxi AppTec

Recent Developments

- In August 2023, EUROAPI revealed its acquisition of BianoGMP, a strategic move aimed at enhancing its capabilities in the Contract Development and Manufacturing Organization (CDMO) within the rapidly growing oligonucleotide market. The forthcoming expansion of EUROAPI's Frankfurt facility's oligonucleotide capacity in 2025 will synergize with Biano's proficiency in early-phase operations, facilitating the undertaking of more extensive projects.

- In May 2023, PolyPeptide and Numaferm entered into a preferred partner collaboration agreement focusing on the development and production of peptides. This collaboration capitalizes on PolyPeptide's cGMP manufacturing capabilities, regulatory expertise, and market reach, combined with Numaferm's biochemical production platform and proficiency in sustainable peptide manufacturing.

- In October 2022, EUROAPI disclosed an initial investment of $19.7 million earmarked for the installation of cutting-edge manufacturing equipment at its Frankfurt facility. This initiative is anticipated to enable EUROAPI to fulfil the escalating demand in the Contract Development and Manufacturing Organization (CDMO) sector for peptides and oligonucleotides.

Report Coverage

The peptide and oligonucleotide CDMO market segment analysis emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, services, end users, and their futuristic growth opportunities.

Peptide and Oligonucleotide CDMO Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,078.37 million |

|

Revenue forecast in 2032 |

USD 4,646.57 million |

|

CAGR |

10.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the 2024 market share, size, and revenue growth rate statistics in the field of Peptide and Oligonucleotide CDMO Market, meticulously compiled by Polaris Market Research Industry Reports. This comprehensive analysis encompasses a market forecast outlook extending to 2032, along with an insightful historical overview. Experience the depth of this industry analysis by obtaining a complimentary PDF download of the sample report.

Browse Our Top Selling Reports:

Rye Market Size, Share 2024 Report

Packaged Salad Market Size, Share 2024 Report

Coworking Spaces Market Size, Share 2024 Report

FAQ's

key companies in Peptide and Oligonucleotide CDMO Market are Bachem Group, CordenPharma, Creative Peptides, EUROAPI, Merck KGaA

Peptide and Oligonucleotide CDMO Market exhibiting the CAGR of 10.6% during the forecast period.

The Peptide and Oligonucleotide CDMO Market report covering key segments are product, service, end user, and region.

key driving factors in Peptide and Oligonucleotide CDMO Market are Growth in personalized medicine is projected to spur the product demand

The global Peptide and Oligonucleotide CDMO market size is expected to reach USD 4,646.57 million by 2032