Penetration Testing as a Service Market Share, Size, Trends, Industry Analysis Report: By Deployment Mode (On-Premises and Cloud), Offering, Testing Type, Organization Size, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Sep-2024

- Pages: 119

- Format: PDF

- Report ID: PM5072

- Base Year: 2023

- Historical Data: 2019-2022

Penetration Testing as a Service Market Overview

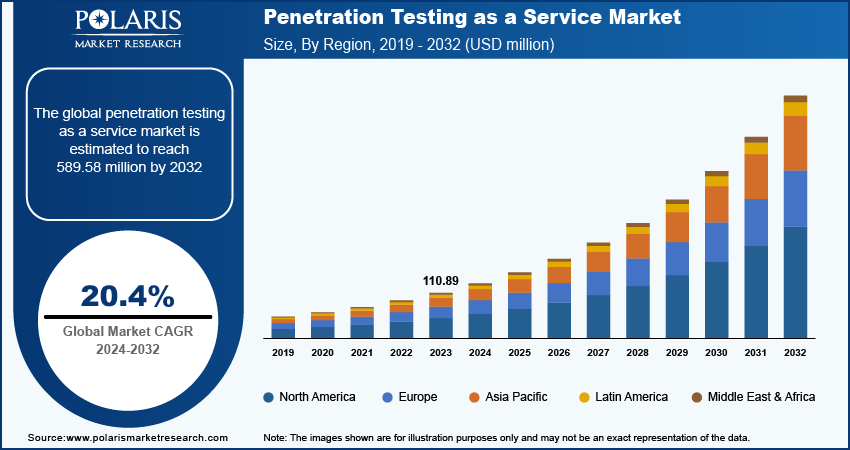

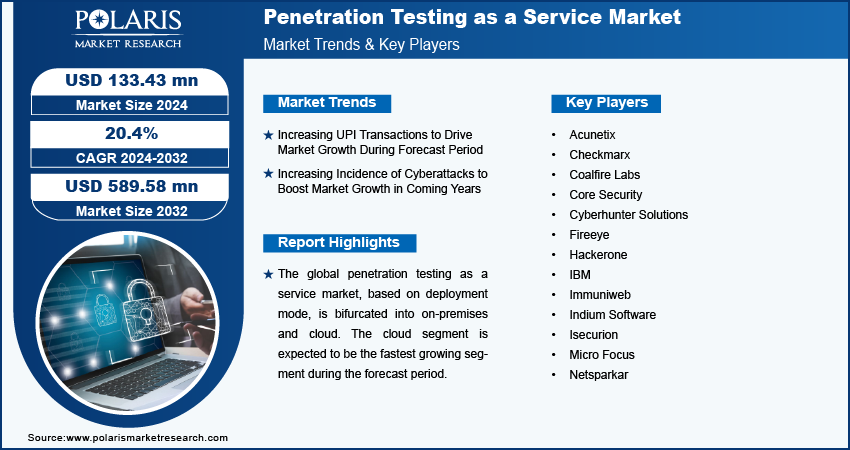

The global penetration testing as a service market size was valued at USD 110.89 million in 2023. The market is projected to grow from USD 133.43 million in 2024 to USD 589.58 million by 2032, exhibiting a CAGR of 20.4% during 2024–2032.

Penetration testing, or pen testing, evaluates IT infrastructure security by simulating attacks to exploit susceptibilities. These could exist in operating systems, services, applications, misconfigurations, or end user behavior. Tests are automated or manual, aiming to identify and address security weaknesses before exploitation. The increasing adoption of IoT, rising smartphone demand, and growing internet usage are among the primary drivers of market growth. Furthermore, the expanding array of cloud-based services, concerns regarding application security for businesses, and the growing frequency of cyberattacks stimulate the growth of the global penetration testing as a services market.

To Understand More About this Research: Request a Free Sample Report

The increasing integration of technologies such as artificial intelligence (AI) and machine learning (ML) in penetration testing, along with the growing trend of remote working security assessments, is expected to present attractive opportunities for the market growth during the forecast period. The increase in remote work has increased the potential vulnerabilities for organizations, leading to a greater demand for thorough security assessments, particularly fulfilled through penetration testing services. Governments globally are boosting cybersecurity budgets to defend against advanced cyber threats targeting sensitive data, critical infrastructure, and national security. The President’s Budget has allocated around USD 10.9 million for citizen cybersecurity, focusing on safeguarding Federal IT and critical national information, including personal data. These efforts often involve investments in penetration testing services, further fueling the penetration testing as a service market growth.

Penetration Testing as a Service Market Trends

Increasing UPI Transactions to Drive Market Growth During Forecast Period

The rapid rise in online transactions, especially in the e-commerce, banking, and financial sectors, has expanded the potential target pool for cybercriminals. The National Payments Corporation of India (NPCI) reported over 1.49 million transactions through the UPI in June 2021. It surged to 83.75 million transactions by 2023. This proliferation in online transactions has led to a corresponding increase in cyberattacks, fueling the demand for penetration testing as a service.

The growing digital landscape allows cybercriminals to exploit, resulting in a heightened need for businesses to safeguard their online transaction platforms and customer data against potential breaches. This heightened awareness, coupled with the escalating cyberattacks, has significantly propelled the penetration testing as a service market growth.

Increasing Incidence of Cyberattacks to Boost Market Growth in Coming Years

The escalating frequency of cyberattacks has resulted in a heightened need for penetration testing services. For instance, the 2023 Annual Data Breach Report indicated a 78% upsurge in data compromises in 2023 (3,205) compared to 2022 (1,801), setting a new record for the ITRC and representing a 72% increase from the previous peak in 2021 (1,860). Thus, to effectively combat these attacks, it is critical to establish robust defense mechanisms. Therefore, the growing demand for advanced security protocols is expected to drive the growth for the penetration testing as a service market during the forecast period.

Penetration Testing as a Service Market Segment Insights

Penetration Testing as a Service Market – Vertical-Based Insights

The global penetration testing as a service market segmentation, based on vertical, includes banking, financial services, and insurance (BFSI); healthcare; retail & ecommerce; government; energy & utilities; IT & ITES; telecom; and other verticals. In 2023, the banking, financial services, and insurance (BFSI) segment accounted for the largest market share. The BFSI (Banking, Financial Services, and Insurance) sector faces a high volume of sensitive financial data, making it a prime target for cybercriminals. Penetration testing service is essential to protect this valuable data from breaches and theft. According to the IMF, the financial sector has experienced over 20,000 cyberattacks and incurred more than USD 12 billion in losses in the last 20 years. The increasing frequency of cyberattacks has significantly driven the growth of penetration testing as a service market. Penetration testing services are crucial for early detection and mitigation of these attacks before they cause substantial damage. Financial fraud poses a significant risk for the BFSI sector, and penetration testing plays a vital role in identifying and preventing fraudulent activities, thereby safeguarding institutions and their customers. The BFSI sector is making substantial investments in cybersecurity strategies, leading to an increased need for penetration testing, propelling the growth of the penetration testing as a service market.

Penetration Testing as a Service Market – Deployment Mode-Based Insights

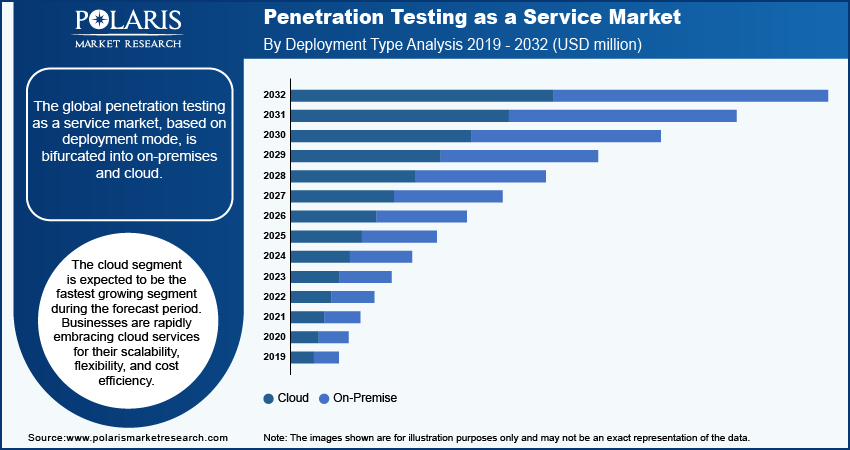

The global penetration testing as a service market, based on deployment mode, is bifurcated into on-premises and cloud. The cloud segment is expected to be the fastest growing segment during the forecast period. Businesses are rapidly embracing cloud services for their scalability, flexibility, and cost efficiency. However, as more operations and data move to the cloud, there is a pressing need for robust security measures. As a result, organizations are increasing their investments and innovations in cloud security to align with the growing adoption of cloud technology. In June 2024, Oracle announced its plan to invest over USD 1 billion to launch a third cloud region in Madrid and promote AI skills development across the country. This new public cloud region will provide Oracle customers and partners from various industries in Spain, including the prominent financial services sector, with enhanced capabilities. This heightened demand is driving the requirement for specialized cloud penetration testing services, thereby propelling market growth.

Regional Insights

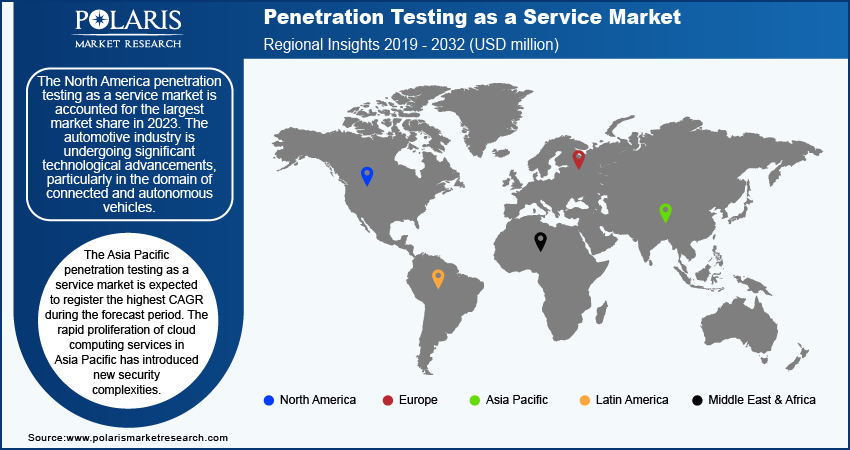

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America penetration testing as a service market is accounted for the largest market share in 2023. The automotive industry is undergoing significant technological advancements, particularly in the domain of connected and autonomous vehicles. These developments are greatly enhancing the driving experience. The complex network of sensors, software, and connectivity utilized by autonomous vehicles present potential targets for cyberattacks. Thus, penetration testing as a service is crucial for testing and securing these systems and identifying vulnerabilities before they are exploited. Consequently, several companies are expanding their presence in the North American automotive cybersecurity market to meet the rising need for robust security solutions and services, including penetration testing as a service. In April 2024, Argus Cyber Security, a major provider of automotive cybersecurity solutions, established a new penetration testing lab in Detroit, Michigan, to cater to the increasing demand from local OEMs and Tier 1 suppliers for cybersecurity testing services. Hence, the escalating demand for automotive cybersecurity solutions in North America highlights the pivotal role of penetration testing as a service, which drives the market growth.

The US penetration testing as a service market accounted for the largest market share in 2023 due to the rise in government spending on cybersecurity. Heightened funding and grants from the government have incentivized public and private organizations to make significant investments in robust penetration testing services, aiming to enhance cybersecurity capabilities across sectors.

The Asia Pacific penetration testing as a service market is expected to register the highest CAGR during the forecast period. The rapid proliferation of cloud computing services in Asia Pacific has introduced new security complexities. Organizations utilizing cloud services require penetration testing services to effectively monitor and secure their cloud environments. The region is undergoing significant digital transformation, characterized by the widespread adoption of digital technologies and online services. This upsurge in digital activity has expanded the attack surface, necessitating advanced penetration testing services to mitigate cyberattacks. Additionally, the economic growth in many Asia Pacific countries is accompanied by large-scale digital initiatives and smart city projects. These initiatives are propelling the dependence on digital infrastructure, thereby increasing the demand for advanced cybersecurity protocols and driving the growth of the penetration testing as a service market in the region.

The India penetration testing as a service market is expected to grow significantly during the forecast period due to rapid digital transformation and the widespread adoption of digital technologies, online services, and e-commerce. This evolution has significantly expanded the attack surface, highlighting the critical need for advanced penetration testing as a service to safeguard digital assets.

Penetration Testing as a Service Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the penetration testing as a service market grow. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaborations with other organizations. To expand and survive in a more competitive and rising market climate, the penetration testing as a service industry must offer cost-effective items.

In recent years, the penetration testing as a service industry has offered some technological advancements. Major players in the penetration testing as a service market are Acunetix, Checkmarx, Coalfire Labs, Core Security, Cyberhunter Solutions, Fireeye, Hackerone, IBM, Immuniweb, Indium Software, Isecurion, Micro Focus, and Netsparkar.

Bugcrowd was established in 2012 and headquartered in California, US. It is a crowdsourced security company that uses an AI-powered platform to connect customers with trusted hackers to protect organizations' assets from advanced threat actors proactively. Bugcrowd's product portfolio consists of penetration testing, AI bias assessment, bug bounty, vulnerability disclosure, and attack surface management. In May 2024, Bugcrowd acquired Informer, a move that significantly enhanced Bugcrowd's platform capabilities in vulnerability scanning. This acquisition integrated continuous asset discovery and expert penetration testing, and Informer's integration is expected to bring enhanced security insights and continuous monitoring to Bugcrowd's clients. This gives Bugcrowd a competitive advantage in the crowdsourced security industry.

International Business Machines Corporation (IBM) is an American multinational technology company operating in over 75 countries. The company mainly sells software that generates 29% of its revenue. It provides healthcare and healthcare payer solutions through the IBM Watson Health business. In March 2024, IBM launched a new IBM X-Force Cyber Range, featuring custom training exercises tailored to assist US federal agencies, their suppliers, and critical infrastructure organizations in enhancing their ability to counter ongoing and disruptive cyberattacks and AI-related threats.

Key Companies in Penetration Testing as a Service Market

- Acunetix

- Checkmarx

- Coalfire Labs

- Core Security

- Cyberhunter Solutions

- Fireeye

- Hackerone

- IBM

- Immuniweb

- Indium Software

- Isecurion

- Micro Focus

- Netsparkar

Penetration Testing as a Service Industry Developments

- In January 2024, Aquion, a value-added software distribution specialist, partnered with Trustwave, a global leader in managed cybersecurity. The partnership aims to bolster cybersecurity in New Zealand and Australia by leveraging Trustwave's advanced technologies.

- In June 2023, Edgescan launched its new External Attack Surface Management (EASM) solution, offering exceptional visibility and continuous monitoring to secure organizations of all sizes. EASM provides inventorying, monitoring, and protection of corporate assets across digital footprints using a hybrid approach. Combined with Edgescan's Penetration Testing as a Service and Risk-based Vulnerability Management (RBVM) capabilities, EASM ensures complete visibility and assessment across multicloud and on-premises infrastructures, thereby facilitating faster remediation and optimized incident response.

- In January 2023, Trustwave launched an enhanced version of Advanced Persistent Penetration testing as a service, leveraging a novel patent-pending methodology for identifying previously unknown threats.

Penetration Testing as a Service Market Segmentation

By Deployment Mode Outlook

- On-Premises

- Cloud-Based

By Offering Outlook

- Solution

- Managed Services

By Testing Type Outlook

- Cloud

- Mobile Applications

- Network Infrastructure

- Social Engineering

- Web Applications

- Others

By Organization Size Outlook

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Vertical Outlook

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail & Ecommerce

- Government

- Energy & Utilities

- IT & ITES

- Telecom

- Other Verticals

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Penetration Testing as a Service Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 110.89 million |

|

Market Size Value in 2024 |

USD 133.43 million |

|

Revenue Forecast in 2032 |

USD 589.58 million |

|

CAGR |

20.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global penetration testing as a service market size was valued at USD 110.89 million in 2023.

The market is projected to register a CAGR of 20.4% during 2024–2032

North America held the largest share of the global market.

Acunetix, Checkmarx, Coalfire Labs, Core Security, Cyberhunter Solutions, Fireeye, Hackerone, IBM, Immuniweb, Indium Software, Isecurion, Micro Focus, and Netsparkar are among the key players in the market.

The banking, financial services, and insurance (BFSI) segment dominated the market in 2023.

The cloud-based segment held a larger share in the global market.