Pellicle Market Share, Size, Trends, Industry Analysis Report, By Lithography Technology (ArF, EUV, KrF); By Transmittance; By Permeability; By Region; Segment Forecast, 2023 – 2032

- Published Date:Oct-2023

- Pages: 117

- Format: PDF

- Report ID: PM3834

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global pellicle market was valued at USD 611.49 million in 2022 and is expected to grow at a CAGR of 9.8% during the forecast period.

The continuous increase in the need and demand for several types of sophisticated lithography technologies, like extreme ultraviolet lithography and greater penetration for higher resolution in semiconductor manufacturing, are among the leading factors propelling the global market growth.

To Understand More About this Research: Request a Free Sample Report

Apart from this, as the product is extensively consumed in semiconductor manufacturing because of its excellent longevity, better uniform transmission, and permeability, the growth in the semiconductor industry worldwide is directly impacting the sales and demand for pellicles worldwide at a significant pace.

- For instance, according to a report published by the Semiconductor Industry Association, the global semiconductor industry sales totaled at around USD 43.2 Bn in July 2023, with a notable increase of approx. 2.3%, as compared to the previous month's sales of USD 42.2 Bn.

With the increasing demand and proliferation for various types of electronic devices or gadgets, including smartphones, tablets, laptops, and wearables, that all require semiconductors to be manufactured, there is an emerging opportunity in the market for pellicle, as it is an integral part of semiconductor manufacturing.

- For instance, according to our findings, the number of people worldwide who own a smartphone is approximately 7.3 billion, which makes up around 90.97% of the world’s total population. Also, the number of smartphones across the world is likely to reach 7.5 billion by 2025.

Furthermore, the rapidly growing advances in materials science technology across the globe that could lead to the development of new pellicle materials with improved and enhanced optical properties, higher durability, and cleanliness, which contribute to better pellicle performance and reliability, are also likely to bode well for the pellicle market growth in the coming years.

For Specific Research Requirements: Request for Customized Report

However, the high cost associated with the manufacturing of high-quality pellicles due to precision required in their manufacturing and a large number of regulatory compliance and standards that need to be adhered to by pellicle manufacturers are anticipated to be the key factors hindering the pellicle market growth.

Growth Drivers

Semiconductor advancements and the introduction to EUV lithography are driving the market growth.

The semiconductor industry is undergoing a profound transformation, driven by advancements in technologies such as artificial intelligence, the Internet of Things, 5G, and electrified vehicles. These innovations have led to a surge in demand for high-quality, high-yield chips across various industry verticals. In response to this growing need, leading semiconductor manufacturers are investing in the development and production of cutting-edge semiconductors.

For instance, as per our findings, the number of 5G subscriptions worldwide is estimated to be around 236 million, and it is expected to reach over 3 billion by 2025. Also, the shipments of 5G smartphones stood at 89.5 million units and will reach 153.3 million units by 2025.

One pivotal advancement in this context is the introduction of Extreme Ultraviolet (EUV) lithography. EUV lithography enables the production of smaller, more efficient, and higher-performance semiconductor chips. This technology enhances the precision and capabilities of semiconductor manufacturing, driving the demand for pellicles.

Pellicles are essential components in the semiconductor manufacturing process, as they protect semiconductor wafers from contamination during photolithography. The integration of EUV lithography has further intensified the need for high-quality pellicles to ensure the flawless production of advanced semiconductor chips. Consequently, the Pellicle Market is experiencing significant growth, bolstered by the semiconductor industry's relentless pursuit of innovation and excellence.

Report Segmentation

The market is primarily segmented based on lithography technology, transmittance, permeability, and region.

|

By Lithography Technology |

By Transmittance |

By Permeability |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Lithography Technology Analysis

EUV segment accounted for the largest market share in 2022

The EUV segment accounted for the largest market share in 2022. The growth of the segment market is highly attributable to the increasing adoption of EUV lithography technology in semiconductor manufacturing, along with its ability to help enhance manufacturing yield by reducing defects and contamination during the semiconductor fabrication process.

Apart from this, growing investments by leading semiconductor manufacturers and equipment suppliers in research & development activities to develop and deploy new and more improved EUV technology, coupled with the growing government support, research collaborations, and industry associations, is likely to accelerate the development and adoption of EUV technology, is further escalating the segment market.

By Transmittance Analysis

≥85 segments held a significant market share in 2022

The ≥85 segment held the majority market share in terms of revenue in 2022, which is significantly driven by its numerous beneficial characteristics, such as its ability to help achieve higher resolution in semiconductor manufacturing, which is particularly important in applications where several critical components are shrinking. Additionally, pellicles with higher transmittance levels are also becoming crucial to ensure that a sufficient amount of light passes through to create or develop accurate patterns on the semiconductor wafer.

The ≥95 segment is likely to register the highest growth over the next coming years, which is mainly attributed to the growing need for pellicles with extremely high transmittance, as they allow for effective and efficient exposure of small features on photomasks. It further helps reduce the number of defects caused by particles and contaminants that improve manufacturing quality and higher yields, which, in turn, is likely to boost demand for the segment market.

By Permeability Analysis

≥95 segment is expected to witness the highest growth over the projected period.

The ≥95 segment is projected to grow at the highest growth rate during the anticipated period on account of its widespread use to selectively allow the passage of certain gases or substances while blocking contaminants, which is highly valuable in various industries such as semiconductor manufacturing, where controlling contamination is crucial for product quality. Along with this, pellicles with high permeability are also known to help maintain stable environmental conditions, which is extremely important in processes like lithography, where small variations in environmental factors could also lead to defects, thereby propelling the market at an exponential pace.

Regional Insights

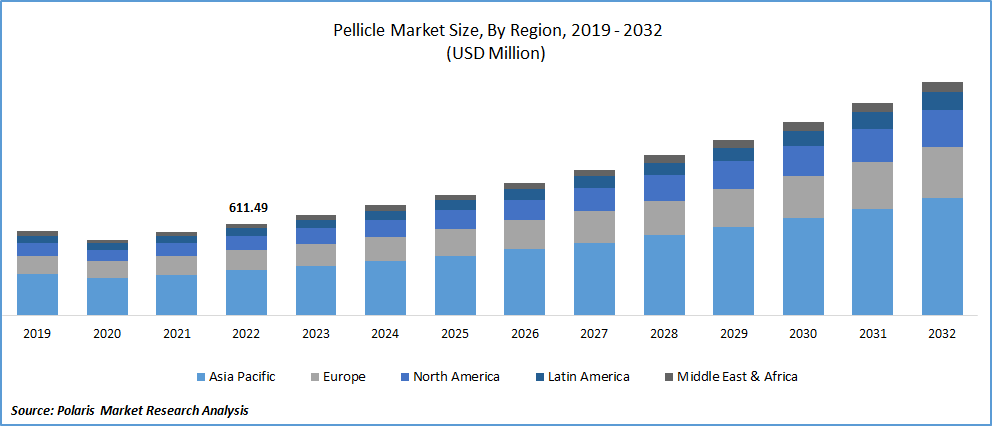

Asia Pacific region dominated the global market in 2022

Asia Pacific held the largest share in 2022. The regional market growth can be mainly attributed to the region’s well-established and developed semiconductor industries and the continuous surge in demand for advanced electronics such as smartphones, laptops, and IoT devices. As the region is experiencing significant growth in cloud computing and data center infrastructure that heavily relies on high-performance semiconductors, it is further projected to boost the demand for pellicles to maintain chip quality and reliability.

For instance, as per a report published by the National Bureau of Statistics, the total production of integrated chips in China in June 2023 was around 322 million units, which is almost 5.7 percent higher than the production from last year. Also, the production of chips between the period of January 2023 to June 2023 totaled 1,617 million units, a slight decrease from the last year.

North America will grow at the fastest rate, owing to the rapid adoption of advancements in semiconductor manufacturing techniques and rising investments by both government and private organizations in the development of new manufacturing facilities and infrastructure across the region.

Key Market Players & Competitive Insights

The pellicle market is moderately consolidated in nature, with the presence of various local and global market players all over the world. The leading product manufacturers are extensively focusing on increasing their investments in research & development activities to develop and introduce new products to the market in order to cater to a diverse range of applications in semiconductor manufacturing.

Some of the major players operating in the global market include:

- ASML Holding Inc.

- Canatu

- Dai Nippon Printing Co. Ltd.

- Fujifilm Corporation

- Fine Semtech Corporation

- Hoya Corporation

- IMEC

- Kolon Industries

- Micro Lithography

- Mitsu Chemicals America

- Mitsubishi Materials

- Photronics

- S&S Tech

- SHIN-ETSU

- SKC Inc.

- Teledyne DALSA Inc.

Recent Developments

- In February 2023, ESOL introduced its prototype of 2nd generation EUV equipment. This EUV pellicle line-up will include a total of three products. It can easily scan the whole surface of the mask at certain points.

- In December 2021, FST started production of extreme ultraviolet pellicles in 2023, which will be mainly used in high-NA EUV equipment. These pellicles will offer over 90% of the transmittance rate as the EUV equipment, which bends light that reduces their strength before reaching out the wafer.

Pellicle Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 670.68 million |

|

Revenue Forecast in 2032 |

USD 1,559.56 million |

|

CAGR |

9.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Lithography Technology, By Transmittance, By Permeability, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The pellicle market report covering key segments are lithography technology, transmittance, permeability, and region.

Pellicle Market Size Worth $1,559.56 Million By 2032.

The global pellicle market is expected to grow at a CAGR of 9.8% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in pellicle market are Growing Demand for High-Performance Chips.