Pectin Market Size, Share, Trends, Industry Analysis Report: By Type (High Methylated Ester Pectin, Low Methylated Ester Pectin, and Amidated Pectin), Raw Material (Citrus Peel, Apple Peel, and Sugar Beet), Function (Thickener, Stabilizer, Gelling Agent, and Fat Replacer), Application (Food & Beverage, Pharmaceuticals, Personal Care and Cosmetics, and Others), and Region – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 118

- Format: PDF

- Report ID: PM1560

- Base Year: 2024

- Historical Data: 2020-2023

Pectin Market Overview

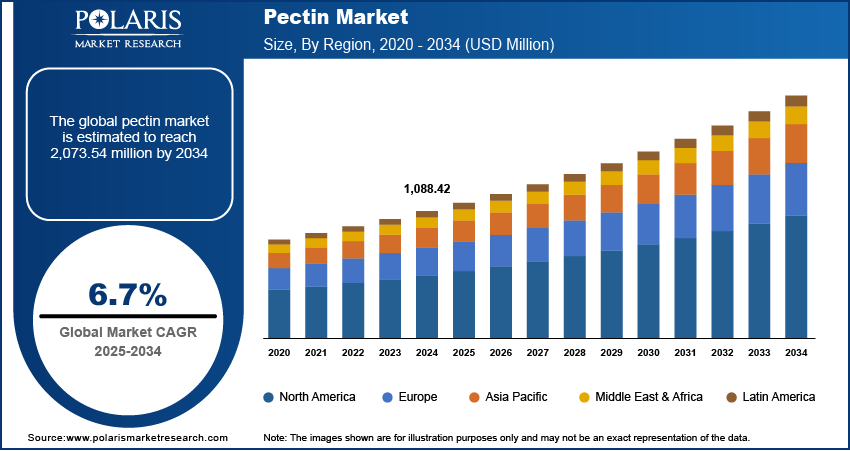

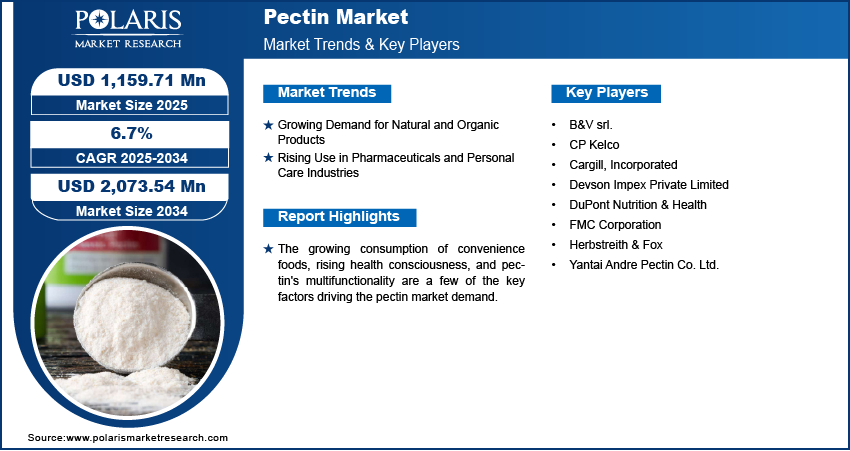

The global pectin market was valued at USD 1,088.42 million in 2024. The market is projected to grow from USD 1,159.71 million in 2025 to USD 2,073.54 million by 2034. It is projected to exhibit a CAGR of 6.7% from 2025 to 2034.

Pectin is a naturally occurring polysaccharide found in the cell walls of fruits, especially citrus fruits and apples. It is frequently utilized in food processing as a gelling agent, thickener, and stabilizer. When mixed with sugar and acid, pectin creates a gel-like texture, which aids in obtaining the intended consistency in food products such as jams, jellies, and gummies. It is additionally utilized in certain pharmaceutical and cosmetic products.

To Understand More About this Research: Request a Free Sample Report

The increasing health concerns and rising demand for healthy, organic raw materials in food production boost the pectin market growth. The rising consumption of convenience foods, greater health consciousness, and pectin's multifunctionality, resulting in its diverse applications, are crucial elements driving the pectin market demand. Moreover, the increasing inclination toward natural products and plant-derived ingredients is enhancing the demand for pectin in multiple industries.

The increasing preference for packaged goods to shorten cooking times and the use of pectin in packaged food and beverages to extend shelf life and enhance texture and color are favorably impacting the pectin market development. Moreover, increasing investments in research and development are expected to generate profitable opportunities for market participants during the forecast period.

Pectin Market Dynamics

Growing Demand for Natural and Organic Products

Consumers are progressively emphasizing natural and organic food options, influenced by an enhanced focus on health and wellness. This change is evident in their choice of clean-label ingredients, which are viewed as healthier options compared to artificial additives. Pectin, a naturally occurring compound present in fruits such as citrus and apples, seamlessly aligns with this trend. Pectin serves as a natural gelling agent, thickener, and stabilizer, making it perfect for use in various food products such as jams, jellies, and fruit preserves. With the growing demand for products containing fewer artificial ingredients, the requirement for pectin is projected to rise during the forecast period.

Rising Use in Pharmaceuticals and Personal Care Industries

The functional characteristics of pectin, including its functions as a stabilizer and texturizer, are driving its increasing use in the pharmaceutical and personal care industries. In pharmaceutical products, pectin is utilized for wound healing drug delivery systems and functions as an excipient in numerous formulations. In personal care, it improves the feel and uniformity of items such as lotions and creams. Its natural, hypoallergenic characteristics make it an attractive option for consumers looking for safer, more natural skincare components. Other than the food industry, the expansion of pectin uses in industries such as pharmaceuticals and personal care industries is enhancing the pectin market development.

Pectin Market Segment Insights

Pectin Market Outlook Based on Type

The pectin market, by type, is segmented into high methylated ester pectin, low methylated ester pectin, and amidated pectin. The high methylated ester pectin segment is anticipated to lead the global market during the forecast period. HM ester pectin, the most common type, is labeled as rapid-set or slow-set. Its gel strength remains high due to a significant level of methylation; however, the degree of methylation influences the setting properties, with higher methylation levels (~70–75%) resulting in a rapid-set gel, while lower levels (~50–65%) produce a slow-set gel. HM pectin is mainly utilized in the production of jams and jellies, as it acts as a thickening agent to improve the texture and consistency of these items.

Pectin Market Assessment Based on Raw Material

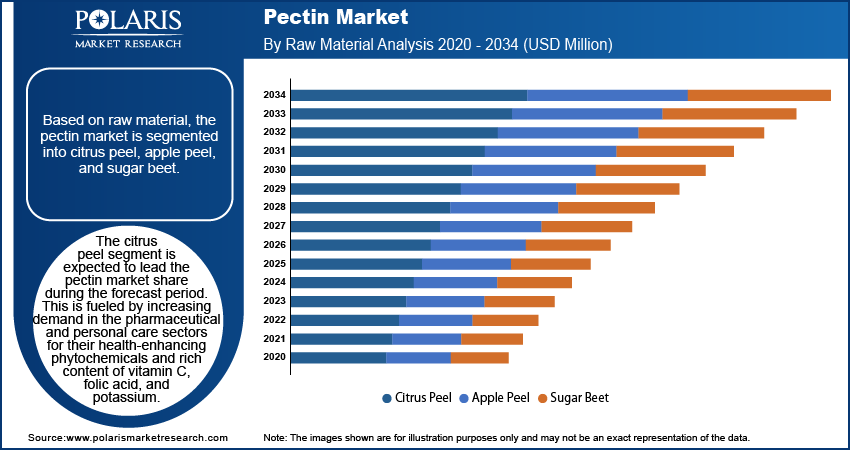

The pectin market, by raw material, is segmented into citrus peel, apple peel, and sugar beet. The citrus peel segment is expected to lead the pectin market share during the forecast period. The pharmaceutical and personal care industries have seen a significant rise in demand for citrus fruits, which are valued for their health-boosting phytochemicals and rich content of vitamin C, folic acid, and potassium.

Pectin Market Evaluation Based on Application

The pectin market, based on application, is segmented into food & beverage, pharmaceuticals, persona care and cosmetics, and others. The food & beverages segment dominated the market in 2024. The increasing demand for natural and organic ingredients in jams, jellies, spreads, baked goods, and sweets, along with rising uses in sauces, dressings, and meat products, is driving the pectin market expansion for the segment.

Pectin Market Regional Analysis

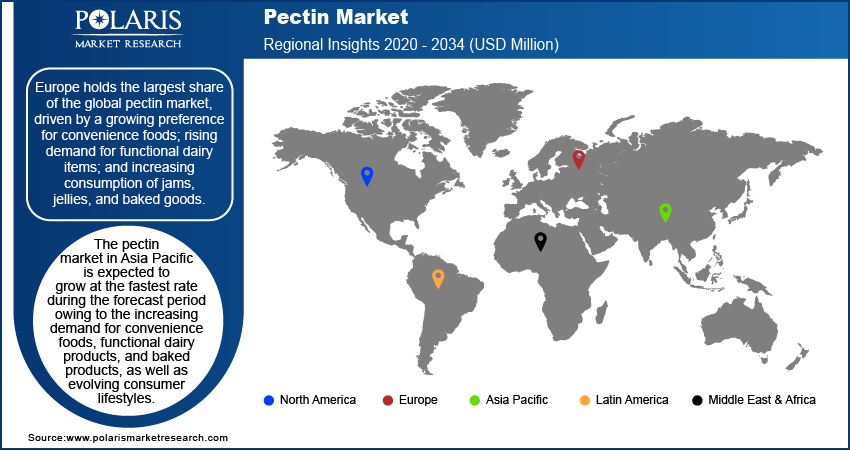

The market report offers pectin market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe held the largest share of the global market in 2024 due to the rising demand for convenience foods and functional dairy products, as well as the growing consumption of jams, jellies, and baked goods.

The Asia Pacific pectin market is likely to witness the fastest growth during the forecast period. This growth is driven by the increasing demand for convenience foods, functional dairy products, and baked products, as well as the evolving consumer lifestyle in the region.

Pectin Market – Key Players and Competitive Insights

Major participants in the global pectin market are increasingly investing in R&D to drive innovation. To take advantage of emerging opportunities in regions such as Asia Pacific, they are establishing manufacturing plants to enhance their regional presence. The market value chain includes raw material producers, manufacturers, packaging and product suppliers, and end-use industries.

FMC Corporation; DuPont Nutrition & Health; Devson Impex Private Limited; CP Kelco; Cargill, Incorporated; Herbstreith & Fox; Yantai Andre Pectin Co. Ltd.; and B&V srl. are among the key players in the pectin market.

List of Key Companies in Pectin Market

- B&V srl.

- CP Kelco

- Cargill, Incorporated

- Devson Impex Private Limited

- DuPont Nutrition & Health

- FMC Corporation

- Herbstreith & Fox

- Yantai Andre Pectin Co. Ltd.

Pectin Industry Developments

July 2024: The US Department of Agriculture's Agricultural Research Service (ARS) announced a cost-efficient, high-quality pectin that gels well in low-sugar products and can be scaled up for commercial use, presenting a valuable solution for the food industry.

September 2023: Cargill launched a new line of LM conventional (LMC) pectin, developed with proprietary technology to provide unique texture and support organic certifications. UniPECTINE LMC improves gel consistency and spreadability in low-sugar jams and bakery fillings, offering a cost-effective solution for sugar reduction and clean-label preferences in organic and conventional markets.

Pectin Market Segmentation

By Type Outlook

- High Methylated Ester Pectin

- Low Methylated Ester Pectin

- Amidated Pectin

By Raw Material Outlook

- Citrus Peel

- Apple Peel

- Sugar Beet

By Function Outlook

- Thickener

- Stabilizer

- Gelling Agent

- Fat Replacer

By Application Outlook

- Food & Beverage

- Pharmaceuticals

- Personal Care & Cosmetics

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Pectin Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,088.42 million |

|

Market Size Value in 2025 |

USD 1,159.71 million |

|

Revenue Forecast by 2034 |

USD 2,073.54 million |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

North America Europe Asia Pacific Latin America Middle East & Africa |

|

Competitive Landscape |

Pectin Industry Trends Analysis (2024) Company profiles/industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The pectin market size was valued at USD 1,088.42 million in 2024 and is projected to grow to USD 2,073.54 million by 2034.

The market is projected to register a CAGR of 6.7% from 2025 to 2034.

Europe accounted for the largest region-wise market size in 2024.

FMC Corporation; DuPont Nutrition & Health; Devson Impex Private Limited; CP Kelco; Cargill, Incorporated; Herbstreith & Fox; Yantai Andre Pectin Co. Ltd.; and B&V srl. are among the key players in the pectin market.

The high methylated ester pectin segment accounted for the largest market share in 2024.

The food & beverages segment dominated the market for pectin in 2024.