Payment Processing Solutions Market Size, Share, Trends, Industry Analysis Report: By Mode of Payment, Deployment Type (On-Premise and Cloud-Based), End–User Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Mar-2025

- Pages: 120

- Format: PDF

- Report ID: PM2612

- Base Year: 2024

- Historical Data: 2020-2023

Payment Processing Solutions Market Overview

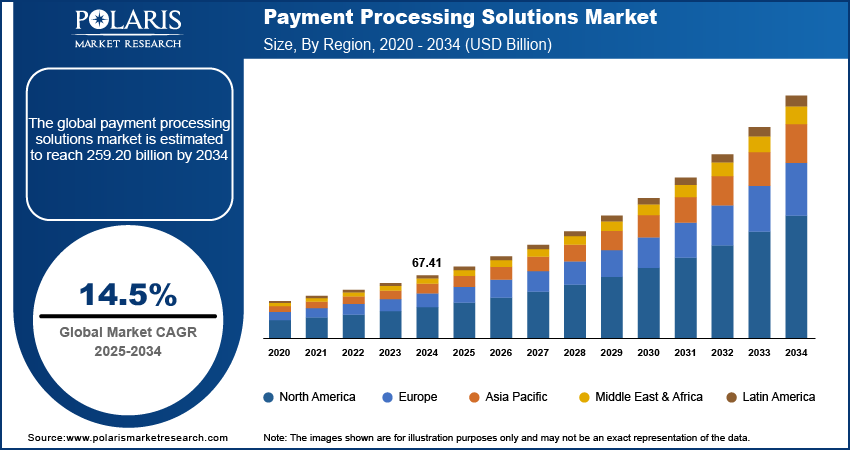

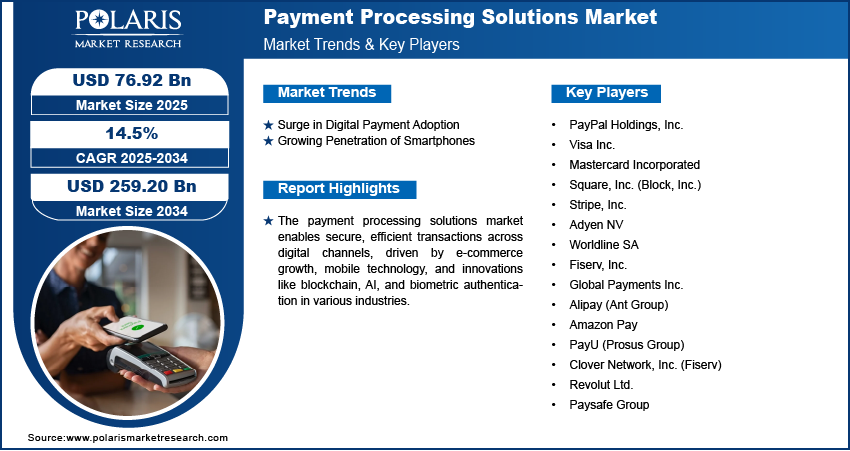

Payment processing solutions market size was valued at USD 67.41 billion in 2024. The market is projected to grow from USD 76.92 billion in 2025 to USD 259.20 billion by 2034, exhibiting a CAGR of 14.5% during the forecast.

The Payment Processing Solutions Market refers to the industry that provides secure, efficient, and seamless transaction processing services for businesses and consumers. These solutions facilitate electronic payments through credit and debit cards, digital wallets, bank transfers, and emerging payment technologies, ensuring smooth financial transactions across various platforms, including online, in-store, and mobile commerce. The market is experiencing significant growth due to increasing digitalization, the rise of e-commerce, and the shift toward cashless economies. Businesses are investing in advanced payment infrastructure to enhance customer experience, improve transaction security, and streamline financial operations. The growing preference for contactless payments and mobile wallets further accelerates market expansion. Additionally, regulatory frameworks promoting secure transactions, such as PCI DSS compliance and PSD2 regulations, are driving innovation and adoption. The integration of AI and blockchain in payment solutions enhances fraud detection, transaction speed, and transparency, making digital payments more reliable. The rise of embedded finance and Buy Now, Pay Later (BNPL) services also contribute to market growth. Financial institutions and technology providers continue to innovate with increasing consumer demand for fast, secure, and flexible payment options, shaping the future of payment processing and driving the industry forward.

To Understand More About this Research: Request a Free Sample Report

Payment Processing Solutions Market Dynamics

Surge in Digital Payment Adoption

The growing penetration of smartphones has led to an increase in digital payment adoption. For instance, In Aug 2023, according to the India Brand Equity Foundation, digital payment adoption in India has reached a significant milestone, with 40% of all transactions now conducted electronically. This statistic highlights the increasing penetration and acceptance of digital payment systems. The integration of advance technologies such as AI and machine learning into payment systems has improved security and operational efficiency, bolstering consumer trust in digital payments.

Increasing Government Initiatives

Governments worldwide are actively promoting the adoption of payment processing solutions to drive financial inclusion, enhance security, and support digital economies. Initiatives such as real-time payment systems, digital identity frameworks, and open banking regulations encourage businesses and consumers to embrace cashless transactions. Policies like India’s Digital India, Europe’s PSD2, and the U.S. FedNow Service boost market growth by enabling faster, more secure payments. Additionally, government-backed incentives for small businesses to adopt digital payments and stricter compliance requirements further accelerate the expansion of secure, efficient, and transparent payment processing solutions globally.

Payment Processing Solutions Market Segment Analysis

Payment Processing Solutions Market Assessment by Mode of Payment

The payment processing solutions market segmentation, based on mode of payment, includes credit cards, debit cards, e-wallets, bank transfers, and cryptocurrencies. The e-wallets segment held the largest market share, driven by the adoption of smartphones and the convenience they offer to users. Digital wallets such as PayPal, Google Pay, and Alipay have experienced significant growth, especially in the realms of e-commerce and peer-to-peer (P2P) money transfers. The ease of use, security features, and the ability to instantly complete transactions make them a preferred choice for both consumers and merchants.

E-wallets streamline the payment process by eliminating the need to manually enter card details, making them particularly attractive in fast-paced environments such as online shopping or on-the-go payments. Additionally, these digital wallets integrate advanced security measures such as encryption and biometric authentication, which further boost consumer confidence. Furthermore, the implementation of loyalty programs and cashback incentives are driving the growth of the segment. Many e-wallet providers offer users rewards for using their services, which include cashback, discounts, or exclusive offers.

Payment Processing Solutions Market Evaluation by End–User Industry

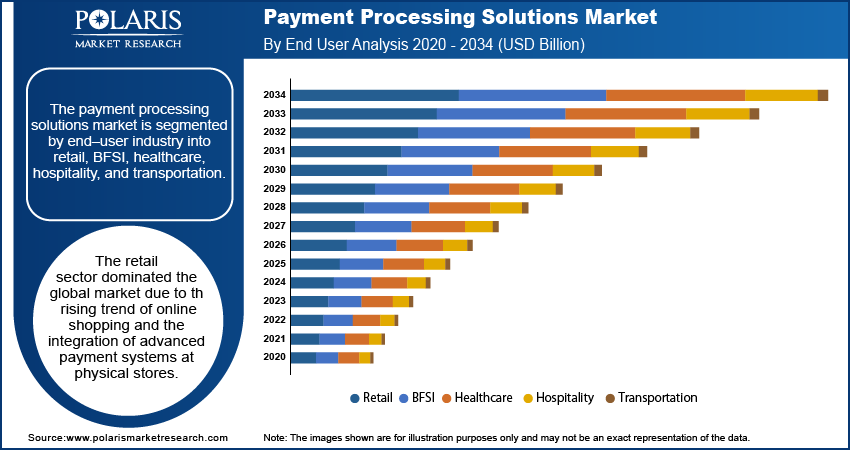

The payment processing solutions market is segmented by end–user industry into retail, BFSI, healthcare, hospitality, and transportation. The retail sector dominated the market in 2024 due to the rising trend of online shopping and the integration of advanced payment systems at physical stores. Contactless payments and omnichannel strategies have improved customer experiences, propelling this segment’s growth. The pandemic-induced shift to online platforms has amplified the need for robust payment processing systems, making retail a key driver of market expansion.

Payment Processing Solutions Market Regional Insights

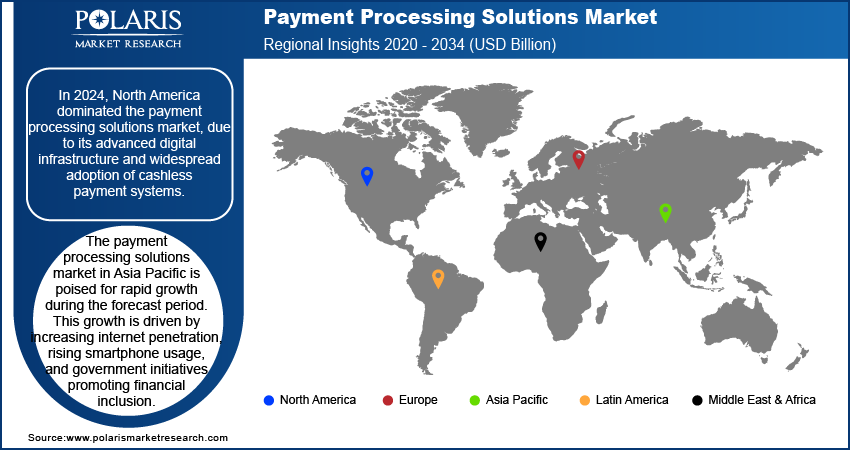

The payment processing solutions market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America dominated the market in 2024 due to its advanced digital infrastructure, high e-commerce activity, and widespread adoption of cashless payment systems. For instance, according to data from Visa Inc., 71% of the US population engages in digital money transfers, while 59% of Canadians participate in similar practices. This illustrates a significant penetration of cashless payment systems across North America, highlighting trends in consumer behavior and the increasing reliance on digital financial transactions within these markets. The US, in particular, leads due to the presence of major players such as PayPal and Visa, along with a tech-savvy population that readily embraces innovative solutions, thereby driving the payment processing solutions market expansion in North America.

The payment processing solutions market in Asia Pacific is poised for rapid growth during the forecast period. This growth is driven by increasing internet penetration, rising smartphone usage, and government initiatives promoting financial inclusion. For instance, according to the World Economic Forum, India alone boasts a wide network of smartphones with 700 million users, showcasing a large volume of smartphone usage. China leads the region with platforms such as Alipay and WeChat Pay revolutionizing digital payments through seamless integration into daily life. The government’s push for a cashless society and the large unbanked population transitioning to digital platforms contribute significantly to this growth.

Payment Processing Solutions Market Key Players & Competitive Analysis Report

The payment processing solutions market exhibits a highly competitive landscape where companies compete through technological innovation, service differentiation, and strategic partnerships. The major players dominate the market through continuous innovation, strategic partnerships, and acquisitions. Companies such as PayPal, Stripe, and Adyen lead in providing seamless cross-border payment solutions, while Visa and Mastercard excel in integrating secure, real-time payment networks. Additionally, regional players including Alipay leverage localized strategies to capture market share. Overall, the competitive landscape is characterized by rapid technological advancements and a strong focus on enhancing customer experience, ensuring sustained dominance by these market leaders

Mastercard Incorporated is a multinational payment technology company based in Purchase, New York. Founded in 1966 as the Interbank Card Association, it has developed into a major player in the financial services sector, facilitating electronic payment transactions across over 210 countries and territories. Mastercard's product offerings include a variety of payment solutions designed for both consumers and businesses. Its primary products are credit and debit cards, which come in different tiers such as standard, gold, platinum, and World Elite. These cards serve various consumer needs and preferences. In addition to card products, Mastercard provides payment systems that support both domestic and international transactions. The company also offers value-added services, including fraud prevention tools, loyalty programs, and data analytics to assist businesses in managing their operations. Mastercard operates on a global scale with a significant presence in the Americas, Europe, Asia Pacific, the Middle East, and Africa. The company has invested in emerging markets such as India to enhance digital payment adoption.

Visa Inc. is an American multinational payment technology company based in San Francisco, California. Established in 1958 as BankAmericard and rebranded to Visa in 1976, the company focuses on facilitating electronic funds transfers through its Visa-branded credit, debit, and prepaid cards. Visa does not issue cards or extend credit directly; instead, it provides financial institutions with the necessary infrastructure and products to offer these services to consumers. Visa's operations are structured into several key segments: service revenue, data processing, international transaction processing, and other services. The service segment supports client usage of Visa’s payment services, while data processing encompasses clearing, settlement, and authorization of transactions. The international transaction processing segment deals with cross-border transactions and currency conversion. Other services include licensing fees and account holder benefits. Visa operates in over 200 countries and territories, connecting more than 14,500 financial institutions with approximately 130 million merchant locations worldwide. Its extensive reach allows Visa to maintain a significant presence in the global payments landscape, holding around 50% market share outside of China. The company's operations span various regions, including the Americas, Europe, Asia Pacific, the Middle East, and Africa.

Key Companies in Payment Processing Solutions Market

- PayPal Holdings, Inc.

- Visa Inc.

- Mastercard Incorporated

- Square, Inc. (Block, Inc.)

- Stripe, Inc.

- Adyen NV

- Worldline SA

- Fiserv, Inc.

- Global Payments Inc.

- Alipay (Ant Group)

- Amazon Pay

- PayU (Prosus Group)

- Clover Network, Inc. (Fiserv)

- Revolut Ltd.

- Paysafe Group

Payment Processing Solutions Market Developments

August 2024: Adyen, the global payments platform, announced its expansion in India following the grant of authorization from the Reserve Bank of India to operate as an Online Payment Aggregator in India for domestic and cross-border payments.

October 2024: Worldline, a global player in payment services, and OPP (Online Payment Platform), a specialized payment provider for platforms and marketplaces, announced the launch of their innovative Embedded Payments solution in Europe.

June 2023: Adyen, the global financial technology platform of choice for major businesses, announced the launch of payout services to enable faster processing of payments.

Payment Processing Solutions Market Segmentation

By Mode of Payment Outlook (Revenue, USD Billion, 2020 - 2034)

- Credit Cards

- Debit Cards

- E-Wallets

- Bank Transfers

- Cryptocurrencies

By Deployment Type Outlook (Revenue, USD Billion, 2020 - 2034)

- On-Premise

- Cloud-Based

By End–User Industry Outlook (Revenue, USD Billion, 2020 - 2034)

- Retail

- BFSI

- Healthcare

- Hospitality

- Transportation

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Payment Processing Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 67.41 billion |

|

Market Size Value in 2025 |

USD 76.92 billion |

|

Revenue Forecast in 2034 |

USD 259.20 billion |

|

CAGR |

14.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global payment processing solutions market size was valued at USD 67.41 billion in 2024 and is projected to grow to USD 259.20 billion by 2034.

The global market is projected to register a CAGR of 14.5% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are PayPal Holdings, Inc.; Visa Inc.; Mastercard Incorporated; Square, Inc. (Block, Inc.); Stripe, Inc.; Adyen NV; Worldline SA; Fiserv, Inc.; Global Payments Inc.; Alipay (Ant Group); Amazon Pay; PayU (Prosus Group); Clover Network, Inc. (Fiserv); Revolut Ltd.; and Paysafe Group.

The retail sector dominated the global market due to the rising trend of online shopping and the integration of advanced payment systems at physical stores.