Patient Support Technology Market Size, Share, Trends, Industry Analysis Report: By Type (Standalone and Integrated) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5293

- Base Year: 2024

- Historical Data: 2020-2023

Patient Support Technology Market Overview

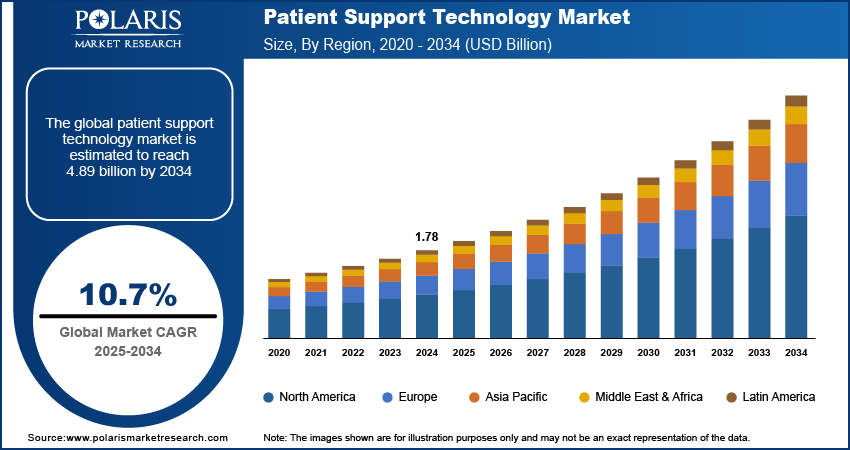

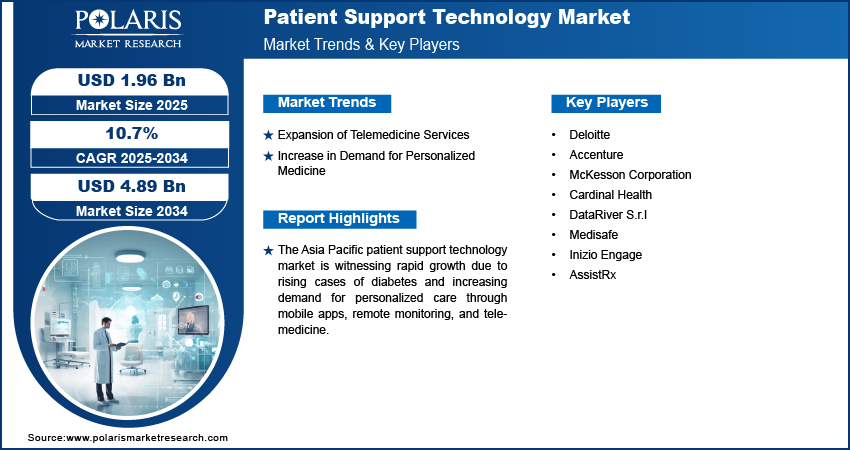

The global patient support technology market size was valued at USD 1.78 billion in 2024. The market is projected to grow from USD 1.96 billion in 2025 to USD 4.89 billion by 2034, exhibiting a CAGR of 10.7% during 2025–2034.

Patient support technology refers to a broad range of tools and systems designed to enhance the healthcare experience for patients, improve health outcomes, and simplify communication between patients and healthcare providers.

Advancements in healthcare IT, such as electronic health records and cloud-based platforms, are driving the growth of the patient support technology market. Electronic health records and cloud-based platforms have made it easier for doctors to access patient information, which has led to better decision-making and personalized care. In October 2023, Fujitsu Limited launched a cloud-based platform in Japan to collect health-related data to promote digital transformation in the medical field. This integration improves efficiency, reduces errors, and improves patient outcomes, boosting demand for patient support tools. Thus, advancement in healthcare IT is driving the patient support technology market growth.

To Understand More About this Research: Request a Free Sample Report

During the forecast period, the integration of artificial intelligence (AI) is expected to drive the patient support technology market expansion by making healthcare services more efficient and personalized. For instance, Deloitte integrated AI post of its launch of the patient support program for more personalized, preventative, predictive, and participatory (4P) medicine. This makes healthcare more accessible, accurate, and tailored to individual needs, which is expected to drive the patient support technology market development during the forecast years.

Patient Support Technology Market Driver Analysis

Expansion of Telemedicine Services

Many patients are consulting doctors remotely, which propels the demand for patient support technology tools such as video consultation platforms, appointment scheduling apps, and remote monitoring devices. According to the Centers for Disease Control and Prevention (CDC), 37% of adults in the US used telemedicine services in 2021. These technologies help doctors track patient health from a distance, ensuring continuous care, improving convenience for patients, and supporting better health management outside of traditional clinics. Therefore, the expansion of telemedicine services is driving the patient support technology market growth.

Increase in Demand for Personalized Medicine

In personalized medicine, manufacturers can be connected with patients more directly. Companies are developing technologies, such as apps and digital platforms, that allow patients to track their health data and share it with manufacturers to narrow down treatments. This closer connection between patients and manufacturers improves treatment outcomes, fueling the demand for technologies that support this personalized approach. Therefore, the rise in demand for personalized medicine boosts the patient support technology market expansion.

Patient Support Technology Market Segment Analysis

Patient Support Technology Market Outlook by Type Insights

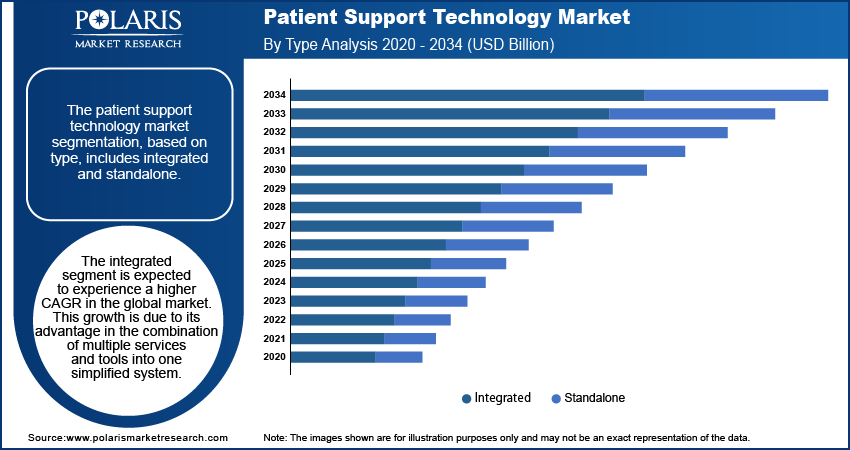

The patient support technology market segmentation, based on type, includes standalone and integrated. The integrated segment is expected to experience a higher CAGR in the global market during the forecast period. This growth is attributed to the integrated type advantage in combination of multiple services and tools into one simplified system. This integration enables better management of patient care and improves communication between healthcare providers and patients. This technology leads to better patient outcomes by improving efficiency, reducing errors, and offering convenience, making it the preferred choice for healthcare organizations.

Patient Support Technology Market Regional Outlook

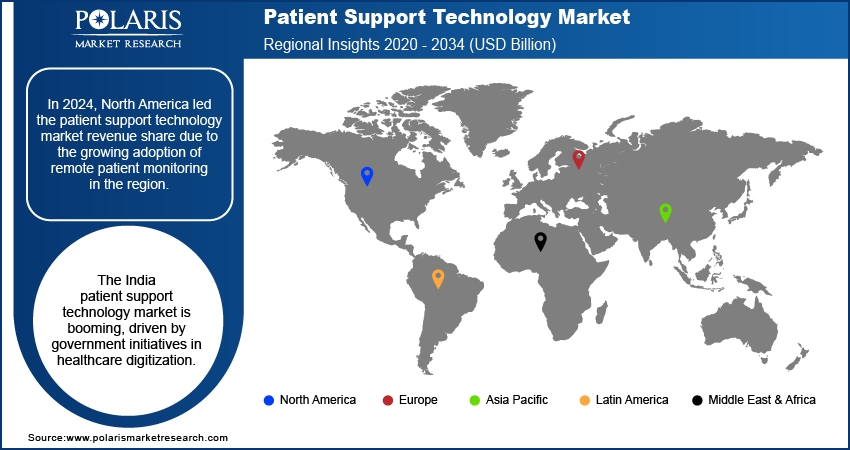

By region, the study provides the patient support technology market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the market due to the growing adoption of remote patient monitoring in the region. Remote patient monitoring utilizes a wide range of patient support technology tools such as video conferencing platforms, telemedicine kits, and remote monitoring devices, due to which the demand for patient support technology in North America is rising. According to the Center for Connected Health Policy, 34 states in the US have adopted medical coverage for remote health monitoring, highlighting the growing adoption of remote health monitoring by the government as well as the population. Therefore, the growing adoption of remote health monitoring is driving the patient support technology market in North America.

The Asia Pacific patient support technology market is growing rapidly because of the increasing focus on managing chronic diseases like diabetes. Many people with diabetes are looking for more personalized and efficient ways to manage their health. As a result, technologies such as mobile apps, remote monitoring devices, and telemedicine are becoming more popular.

According to the International Diabetes Federation, there are 206 million people with diabetes in the Asia Pacific region. The large and growing number of diabetes patients is driving the demand for these patient support technologies. These technologies help patients monitor their condition, receive medical advice remotely, and manage their diabetes more effectively. This has led to an increase in the market for tools and services that support patients in managing their health, especially for chronic conditions like diabetes.

The patient support technology market in India is experiencing substantial growth due to government initiatives in healthcare digitization. Programs such as the National Digital Health Mission (NDHM) are encouraging the use of digital tools for health management, such as electronic health records and telemedicine services. These efforts are improving access to healthcare, especially in remote areas. By supporting digital infrastructure and encouraging innovation, the government is making it easier for patients to manage their health using technology, thereby driving the patient support technology market growth in India.

Patient Support Technology Market – Key Players and Competitive Insights

The patient support technology market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative formulations to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the patient support technology market are Deloitte, Accenture, McKesson Corporation, Cardinal Health, DataRiver S.r.l, Medisafe, Inizio Engage, and AssistRx.

Accenture plc is a global professional services company headquartered in Dublin, Ireland, specializing in information technology (IT) services and management consulting. The company emerged from the consulting division of Arthur Andersen and rebranded as Accenture in 2001 following its separation from the accounting firm. Its operations are organized into five key segments—strategy and consulting, which helps organizations develop strategies and drive enterprise transformation; Interactive (Accenture Song), which focuses on enhancing customer experience through design and marketing solutions; Technology, which provides comprehensive services such as cloud solutions and application management; Operations, which manages business processes across various functions using data-driven approaches; and Industry X, which is dedicated to digital transformation within manufacturing and product development. Accenture’s regional operations are extensive, with a strong presence in North America, which is its largest market, contributing significantly to overall revenue. The EMEA region (Europe, Middle East, and Africa) is also vital, encompassing diverse industries and client needs.

Deloitte is a global professional services firm established in 1845. The firm operates through several key service areas such as audit & assurance, consulting, financial advisory, risk advisory, and tax services. In the audit & assurance segment, Deloitte provides independent assessments of financial statements and internal controls, ensuring transparency and compliance for clients. The Consulting division addresses a wide range of business needs, encompassing core business operations, customer & marketing strategies, enterprise technology & performance improvements, human capital management, and strategy & analytics. Deloitte's financial advisory services assist organizations with mergers and acquisitions (M&A), restructuring efforts, and risk management strategies. The risk advisory practice helps clients navigate various operational, regulatory, and cyber risks. At the same time, the tax services division offers comprehensive tax compliance and consulting solutions tailored to both individuals and corporations. With a strong global footprint, Deloitte serves a diverse client that includes four out of five fortune global 500 companies. Its network of member firms operates as legally separate entities but collaborates under the Deloitte brand to provide localized services while adhering to local laws and regulations.

Key Companies in Patient Support Technology Market

- Deloitte

- Accenture

- McKesson Corporation

- Cardinal Health

- DataRiver S.r.l

- Medisafe

- Inizio Engage

- AssistRx

Patient Support Technology Industry Developments

September 2023: EVERSANA launched a new platform, ACTICS eAccess, to enhance patient support services. The platform, offering 90% accuracy in electronic benefits verification and prior authorization, was designed to expedite coverage verification and improve the reimbursement process for patients and providers.

November 2022: Roche Pharma India launched the Blue Tree 2.0 mobile app for patients in the Blue Tree support program. The app, available on Android and iOS, was designed to streamline enrollment, enhance support services, and improve patient access to treatment resources.

Patient Support Technology Market Segmentation

By Type Outlook (USD Billion, 2020–2034)

- Standalone

- Integrated

By Regional Outlook (USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Patient Support Technology Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.78 billion |

|

Market Size Value in 2025 |

USD 1.96 billion |

|

Revenue Forecast by 2034 |

USD 4.89 billion |

|

CAGR |

10.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.78 billion in 2024 and is projected to grow to USD 4.89 billion by 2034.

The global market is projected to register a CAGR of 10.7% during 2025–2034.

North America held the largest share of the global market in 2024

A few key players in the market are Deloitte, Accenture, McKesson Corporation, Cardinal Health, DataRiver S.r.l, Medisafe, Inizio Engage, and AssistRx

The integrated segment is expected to experience a higher CAGR in the global market during the forecast period due to its advantage in combination of multiple services and tools into one simplified system.