Patient Handling Equipment Market Size, Share, Trends, Industry Analysis Report: By Application (Bariatric Care, Acute Care, Long-Term Care, Rehabilitation, and Others), Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 117

- Format: PDF

- Report ID: 3251

- Base Year: 2024

- Historical Data: 2020-2023

Patient Handling Equipment Market Overview

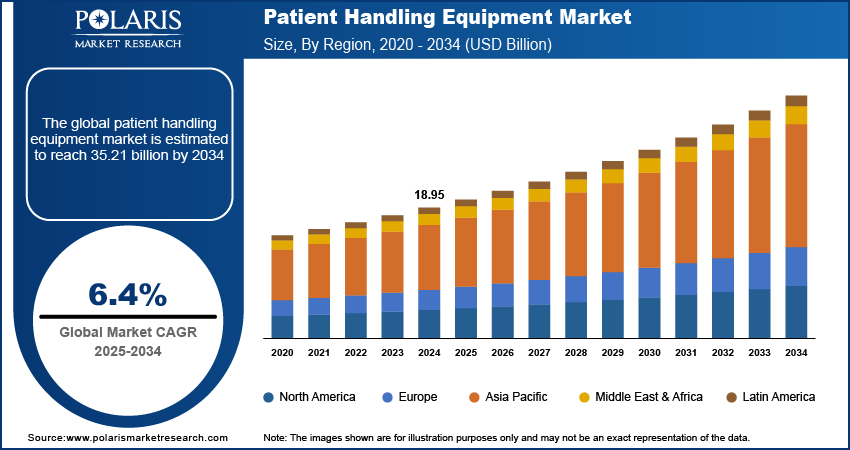

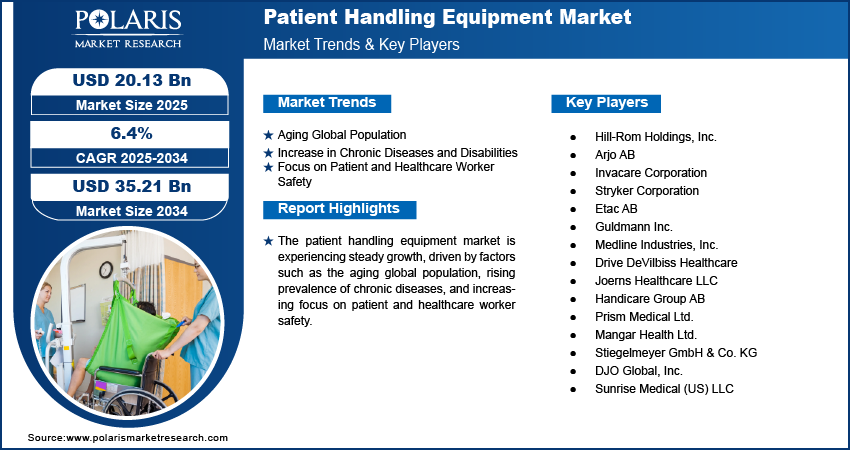

The patient handling equipment market size was valued at USD 18.95 billion in 2024. The market is projected to grow from USD 20.13 billion in 2025 to USD 35.21 billion by 2034, exhibiting a CAGR of 6.4% during 2025–2034.

The patient handling equipment market refers to the production and sale of tools and devices designed to assist healthcare providers in the safe movement, transportation, and repositioning of patients. These equipment’s include manual and powered wheelchairs, patient lifts, transfer aids, and other mobility devices. Key drivers of this market include an aging global population, increased incidence of chronic conditions, and a growing emphasis on patient safety and healthcare worker ergonomics. Additionally, technological advancements in automation and the rising adoption of home healthcare services are significant trends shaping the patient handling equipment market. The demand for patient handling equipment is also being influenced by regulations aimed at reducing healthcare-associated injuries.

To Understand More About this Research: Request a Free Sample Report

Patient Handling Equipment Market Dynamics

Aging Global Population

One of the major drivers of the patient handling equipment market is the aging global population. As people age, they often experience physical decline, making it difficult for them to move or reposition themselves independently. According to the United Nations, the number of people aged 60 or older is expected to reach 2.1 billion by 2050, nearly double the number in 2017. This demographic shift creates a significant need for patient handling devices that can provide safe and efficient mobility solutions. Elderly patients are particularly vulnerable to falls and injuries, which increases the demand for equipment such as patient lifts, wheelchairs, and transfer aids to reduce the risk of accidents and enhance overall care.

Increase in Chronic Diseases and Disabilities

The rise in chronic diseases and disabilities is another important patient handling equipment market driver. The World Health Organization (WHO) reports that approximately 60% of adults in the US live with at least one chronic condition, such as arthritis, diabetes, or cardiovascular disease. These conditions often lead to decreased mobility and independence, creating a growing need for patient handling equipment. Patients with physical disabilities, whether due to chronic illnesses, injury, or congenital conditions, require specialized equipment to move safely. With the increasing prevalence of chronic conditions globally, there is a growing demand for a variety of handling devices that can assist both healthcare workers and patients in improving mobility and preventing injuries.

Focus on Patient and Healthcare Worker Safety

Another key driver is the increasing focus on safety for both patients and healthcare workers. Healthcare settings, particularly hospitals, have a high incidence of workplace injuries related to manual patient handling. The Bureau of Labor Statistics of 2020 reported that healthcare workers, especially nurses, are more likely to experience musculoskeletal injuries due to lifting and moving patients. In response, many healthcare facilities are implementing stricter regulations and guidelines for patient handling to minimize injuries. The Occupational Safety and Health Administration (OSHA) has recommended the use of mechanical lifting equipment to assist in moving patients safely. This focus on safety not only drives the adoption of patient handling equipment but also leads to innovations in ergonomically designed devices to reduce physical strain on healthcare workers.

Patient Handling Equipment Market Segment Insights

Patient Handling Equipment Market Assessment by Application

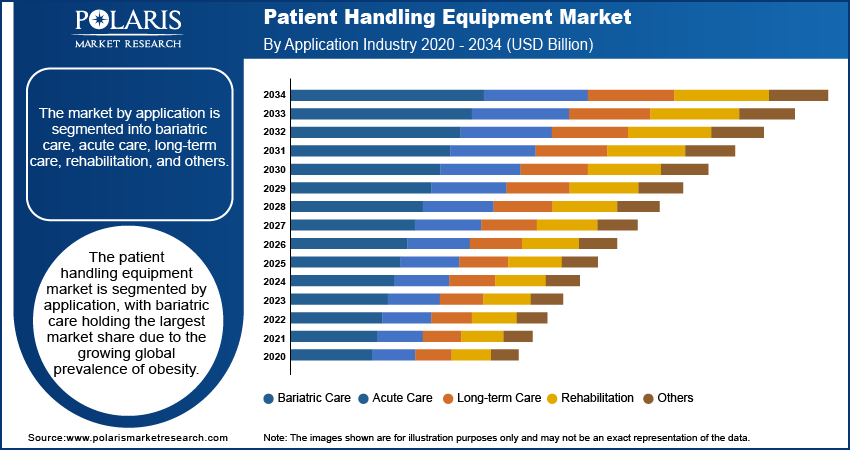

The patient handling equipment market segmentation, by application, includes bariatric care, acute care, long-term care, rehabilitation, and others. Bariatric care holds the largest market share due to the growing global prevalence of obesity. As obesity rates increase, the need for specialized equipment to support bariatric patients, including bariatric patient lifts and stretchers, is on the rise. This segment is driven by the demand for devices that can safely accommodate higher weights and ensure both patient and caregiver safety during handling. Acute care is also witnessing significant growth, driven by the increasing number of patients requiring hospitalization for serious conditions. In acute care settings, patient handling equipment is essential to ensure quick, safe, and efficient transfer and positioning of patients, particularly in critical situations. The segment benefits from advancements in technology, such as powered and automated devices, to enhance the efficiency of patient handling in emergency settings.

The long-term care sector is also registering the fastest growth, influenced by the expanding elderly population and the rising number of patients requiring ongoing support due to chronic conditions. Long-term care facilities are increasingly adopting patient handling equipment to address the continuous need for patient mobility assistance. Rehabilitation applications also contribute to market growth, especially with the increasing focus on recovery and mobility support for patients’ post-surgery or injury. The others segment, including applications in home care and outpatient services, is also growing, though at a relatively slower pace compared to the primary care-focused segments. The growing trend of home healthcare, however, is likely to drive further expansion in this category as patients opt for in-home recovery options that still require patient handling equipment.

Patient Handling Equipment Market Assessment by Type

The patient handling equipment market, by type, is segmented into patient lifts, medical lifting slings, wheelchairs, transport chairs, stretchers, medical beds, and bathroom & toilet assist devices. Patient lifts segment holds the largest patient handling equipment market share due to their critical role in assisting with the safe transfer and repositioning of patients, particularly in hospital and long-term care settings. These devices, including both manual and powered lifts, are essential for preventing injuries to both patients and healthcare workers during transfers. Additionally, the segment is supported by advancements in technology, such as wireless or battery-powered lifts, which improve efficiency and safety. Wheelchairs and transport chairs are also key components of the market, with the demand driven by the increasing need for mobility assistance, especially among the elderly and disabled populations. As the global aging population grows, the adoption of both manual and powered wheelchairs continues to rise, contributing to the market’s overall growth.

The medical lifting slings segment is also registering the fastest growth, driven by their increasing use in conjunction with patient lifts to provide additional support and comfort during patient transfers. The expanding focus on patient safety and healthcare worker ergonomics also supports growth in this area.

Patient Handling Equipment Market Evaluation by End Use

The patient handling equipment market, by end use, is segmented into hospitals, homecare, elderly care, and other healthcare. The hospitals sector holds the largest market share due to their high demand for patient handling devices in various care settings. Hospitals require a wide range of equipment, such as patient lifts, wheelchairs, and stretchers. This is to facilitate safe and efficient patient movement, particularly in critical care units, emergency rooms, and surgical departments. The increasing number of hospital admissions and advancements in medical technologies are contributing to the steady demand for such equipment. The hospital segment is also benefiting from the growing awareness of patient and healthcare worker safety, driving the adoption of automated and ergonomic solutions designed to reduce injuries related to manual patient handling.

The homecare segment is also registering the fastest growth, driven by the rising trend of in-home care, particularly among the elderly and those with chronic conditions. As more patients seek recovery or long-term care at home, the demand for homecare-related patient handling devices, including patient lifts and mobility aids, has surged. This trend is supported by the preference for personalized care and the cost-effectiveness of home healthcare compared to institutional care. Elderly care facilities are also witnessing steady growth, fueled by the increasing elderly population who require mobility assistance and support for daily activities. Additionally, the other healthcare segment, which includes rehabilitation centers and outpatient clinics, is experiencing growth, though at a slower rate, as these facilities require specialized equipment to support patient rehabilitation and recovery processes.

Patient Handling Equipment Market Regional Insights

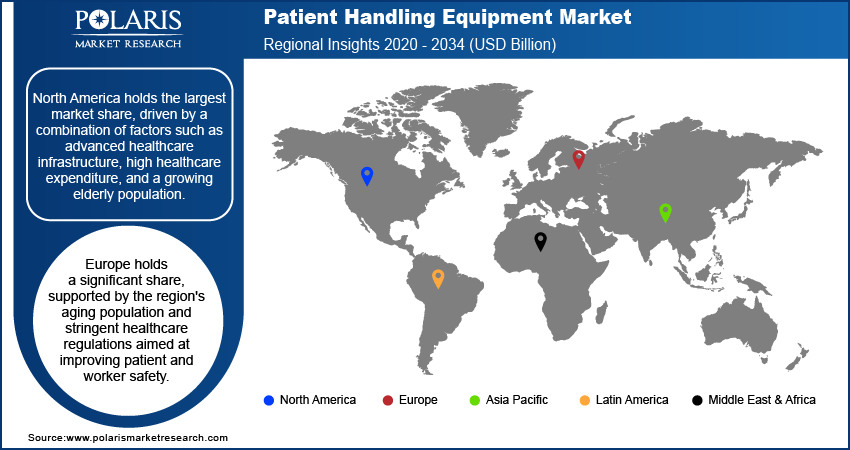

By region, the study provides patient handling equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by a combination of factors such as advanced healthcare infrastructure, high healthcare expenditure, and a growing elderly population. The US, in particular, contributes significantly to this dominance due to the rising prevalence of chronic diseases, increasing awareness of patient safety, and the implementation of strict healthcare regulations promoting the use of patient handling devices. Europe also represents a substantial share, supported by similar trends in aging demographics and healthcare safety standards. Asia Pacific is also emerging as a high-growth market, fueled by expanding healthcare infrastructure, rising medical tourism, and increased investments in healthcare facilities, particularly in countries such as China and India.

Europe holds a significant share, supported by the region's aging population and stringent healthcare regulations aimed at improving patient and worker safety. Countries such as Germany, the UK, and France are key contributors to the market, driven by well-established healthcare systems and increased adoption of advanced patient handling solutions. The European Union’s emphasis on reducing workplace injuries in healthcare settings further boosts the demand for these devices. Additionally, the region's focus on enhancing the quality of care in long-term care facilities and homecare settings contributes to the patient handling equipment market expansion.

Asia Pacific is experiencing rapid patient handling equipment market growth, driven by increasing healthcare investments and expanding healthcare infrastructure in countries such as China, India, and Japan. The rising incidence of chronic diseases, coupled with a growing elderly population, is creating a heightened demand for patient handling devices. Government initiatives to improve healthcare services and the rising trend of medical tourism in the region further support market expansion. Additionally, the increasing adoption of advanced technologies in healthcare facilities and the growing awareness of patient and caregiver safety are key factors driving the market growth in Asia Pacific.

Patient Handling Equipment Market – Key Players and Competitive Insights:

Key players in the patient handling equipment market include Hill-Rom Holdings, Inc.; Arjo AB; Invacare Corporation; Stryker Corporation; Etac AB; Guldmann Inc.; Medline Industries, Inc.; Drive DeVilbiss Healthcare; Joerns Healthcare LLC; Handicare Group AB; Prism Medical Ltd.; Mangar Health Ltd.; Stiegelmeyer GmbH & Co. KG; DJO Global, Inc.; and Sunrise Medical (US) LLC. These companies are actively engaged in the development and supply of various patient handling devices, such as lifts, wheelchairs, and transfer aids, catering to the needs of healthcare facilities globally.

In terms of competitive analysis, Hill-Rom Holdings, Inc. and Stryker Corporation are recognized for their extensive product portfolios and significant presence in hospital settings, where they offer advanced solutions for patient mobility and safety. Arjo AB focuses on ergonomic designs and has a strong foothold in both acute and long-term care markets. Invacare Corporation is well-known for its diverse range of mobility products and homecare solutions. These companies compete by continuously innovating and expanding their offerings to meet the growing demands for patient safety and comfort.

Insights into the market reveal that the competition is driven by technological advancements, strategic partnerships, and a focus on expanding distribution networks. Companies are increasingly investing in research and development to introduce products that enhance user experience, safety, and efficiency. Additionally, there is a growing trend of collaborations with healthcare providers to tailor solutions that address specific patient needs, further intensifying the competitive landscape in the patient handling equipment industry.

Hill-Rom Holdings, Inc. is a prominent player in the patient handling equipment market. It offers a range of products, including patient lifts, hospital beds, and mobility devices. Through its innovative healthcare solutions company focuses on enhancing patient care and safety.

Stryker Corporation is a key manufacturer of medical technologies, including patient handling equipment such as stretchers, medical beds, and transport chairs. The company is well-known for its commitment to improving patient and caregiver safety through its ergonomic and user-friendly products.

List of Key Companies in Patient Handling Equipment Market

- Hill-Rom Holdings, Inc.

- Arjo AB

- Invacare Corporation

- Stryker Corporation

- Etac AB

- Guldmann Inc.

- Medline Industries, Inc.

- Drive DeVilbiss Healthcare

- Joerns Healthcare LLC

- Handicare Group AB

- Prism Medical Ltd.

- Mangar Health Ltd.

- Stiegelmeyer GmbH & Co. KG

- DJO Global, Inc.

- Sunrise Medical (US) LLC

Patient Handling Equipment Market Developments

- November 2024: Stryker launched a new series of transport stretchers designed to reduce the physical strain on healthcare workers while enhancing patient comfort during transfers.

- In October 2024, Hill-Rom announced a partnership with a major healthcare provider to develop next-generation smart hospital beds equipped with advanced monitoring features. The goal is to improve patient outcomes and streamline hospital operations.

Patient Handling Equipment Market Segmentation

By Application Outlook (Revenue-USD Billion, 2020–2034)

- Bariatric Care

- Acute Care

- Long-Term Care

- Rehabilitation

- Others

By Type Outlook (Revenue-USD Billion, 2020–2034)

- Patient Lifts

- Medical Lifting Slings

- Wheelchairs

- Transport Chairs

- Stretchers

- Medical Beds

- Bathroom & Toilet Assist Devices

By End Use Outlook (Revenue-USD Billion, 2020–2034)

- Hospitals

- Homecare

- Elderly Care

- Other Healthcare

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

-

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Patient Handling Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.95 billion |

|

Market Size Value in 2025 |

USD 20.13 billion |

|

Revenue Forecast by 2034 |

USD 35.21 billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

By Application By Type By End Use |

|

Regional Scope |

North America Europe Asia Pacific Latin America Middle East & Africa |

|

Competitive Landscape |

Patient Handling Equipment Market Share Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The patient handling equipment market has been segmented into detailed segments of application, type, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth strategy for the patient handling equipment market involves a focus on innovation, strategic partnerships, and expanding distribution networks. Companies are investing in research and development to create advanced, ergonomically designed products that enhance patient safety and caregiver efficiency. Marketing strategies include collaborating with healthcare providers to offer tailored solutions and participating in industry trade shows to showcase new technologies. Additionally, businesses are leveraging digital marketing and e-commerce platforms to reach a broader audience, particularly in emerging markets where healthcare infrastructure is rapidly expanding.

FAQ's

The patient handling equipment market size was valued at USD 18.95 billion in 2024 and is projected to grow to USD 35.21 billion by 2034.

The market is projected to register a CAGR of 6.4% during the forecast period, 2025-2034.

North America had the largest share of the market.

Key players in the patient handling equipment market include Bayer AG; Pfizer Inc.; Merck & Co., Inc.; Johnson & Johnson; AbbVie Inc.; GlaxoSmithKline plc; Mylan N.V.; Teva Pharmaceutical Industries Ltd.; Novartis AG; HRA Pharma; Mithra Pharmaceuticals; Celgene Corporation; Allergan plc; Procter & Gamble Co.; and Reddy's Laboratories Ltd.

The Bariatric care segment accounted for the larger share of the market in 2024.

The Patient lifts segment accounted for the larger share of the market in 2024.

Patient handling equipment refers to devices and tools designed to assist healthcare providers in safely moving, transferring, and repositioning patients. These include patient lifts, wheelchairs, stretchers, transport chairs, medical beds, and bathroom and toilet assist devices. The primary purpose of this equipment is to ensure patient safety, enhance mobility, and reduce the risk of injuries for both patients and healthcare workers during handling. Patient Handling Equipment is widely used in hospitals, long-term care facilities, homecare settings, and other healthcare environments.

A few key trends in the market are described below: Technological Advancements: Development of automated and smart patient handling devices with integrated monitoring systems. Rising Demand for Home Healthcare: Increased adoption of patient handling equipment for in-home care, driven by an aging population and preference for personalized care. Focus on Ergonomics and Safety: Growing emphasis on ergonomic designs to reduce healthcare worker injuries and improve patient safety. Regulatory Compliance: Implementation of strict regulations and guidelines promoting the use of mechanical lifting equipment in healthcare settings

A new company entering the patient handling equipment market could focus on developing innovative, technology-driven solutions such as smart patient lifts and automated transfer systems to enhance safety and efficiency. Emphasizing ergonomic designs that reduce caregiver strain and improve patient comfort would also be key. Additionally, targeting emerging markets with affordable, high-quality products could offer significant growth opportunities. Building strong partnerships with healthcare providers for tailored solutions and investing in digital marketing and e-commerce platforms to expand reach would further help the company stay ahead of the competition. Prioritizing compliance with healthcare regulations and sustainability practices could also differentiate the company in the market.

Companies manufacturing, distributing, or purchasing Patient Handling Equipment and related products, and other consulting firms must buy the report.