Passenger Drones Market Size, Share, Trends, Industry Analysis Report: By Component, Capacity, End User (Personal and Commercial), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 122

- Format: PDF

- Report ID: PM1613

- Base Year: 2024

- Historical Data: 2020-2023

Passenger Drones Market Overview

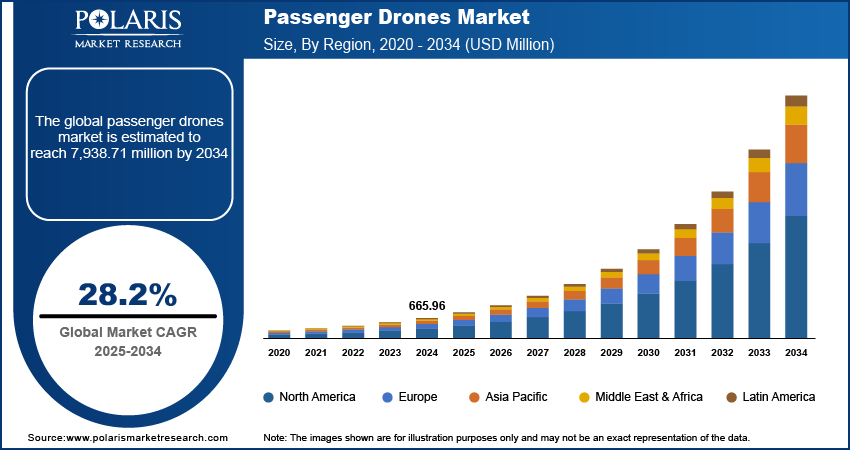

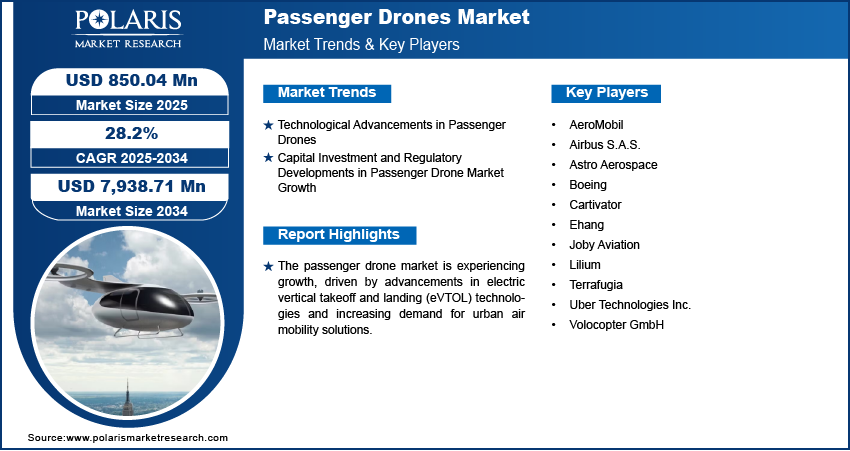

The global passenger drones market size was valued at USD 665.96 million in 2024. The market is projected to grow from USD 850.04 million in 2025 to USD 7,938.71 million by 2034, exhibiting a CAGR of 28.2% during the forecast period.

Passenger drones, also known as autonomous aerial vehicles (AAVs), are electric aircraft specifically designed to transport people rather than cargo or for surveillance purposes. The aerial taxis aim to revolutionize urban transportation by providing a more efficient and environmentally friendly solution to bypass traffic congestion. Equipped with Vertical Takeoff and Landing (VTOL) capabilities, they can operate either autonomously or via remote control, offering a flexible and sustainable alternative for city mobility. Government initiatives and investments in smart city projects are playing a pivotal role in driving the development of aerial taxis. Policies promoting green energy, urban air mobility infrastructure, and advanced air traffic management systems are fostering passenger drone adoption. Governments in regions such as North America, Europe, and Asia Pacific are collaborating with private companies and regulatory bodies to establish frameworks for safety, airspace integration, and public acceptance of passenger drones. This regulatory support is crucial for speeding up large-scale deployment and commercialization efforts, which in turn boosts the passenger drones market demand.

For instance, in October 2023, EHang received the world's first airworthiness certificate for an autonomous aerial vehicle (AAV) from the Civil Aviation Administration of China (CAAC). As a result, passenger drones are balanced to significantly transform urban transportation by reducing road traffic and promoting eco-friendly travel options.

The rising use of passenger drones in the healthcare sector is notably boosting the passenger drones market growth, especially for medical emergencies and evacuations from isolated areas. For instance, in September 2022, Aimour Drones launched an autonomous drone designed to deliver essential medical supplies and transport healthcare personnel, assuring timely medical assistance when it is most needed.

Passenger Drones Market Dynamics

Technological Advancements in Passenger Drones

Technological advancements are crucial in making passenger drones more practical, safe, and cost-effective. The integration of AI and machine learning in autonomous systems allows drones to navigate complex urban environments with higher levels of autonomy. Additionally, the adoption of advanced lightweight materials, such as carbon fiber-reinforced polymers, has reduced the weight of drones, thereby improving flight efficiency and lowering manufacturing costs. Furthermore, technological advancement helps address challenges in the passenger drones market, such as safety, range, and cost, making drones increasingly suitable for widespread urban deployment. The passenger drones market revenue is expected to experience further growth and accelerated adoption driven by the advancements as technology continues to grow. For instance, the EHang 216 operates at Level 4 autonomy, allowing it to carry out most functions independently, with minimal human input. Additionally, advancements in electric propulsion systems have led to greater efficiency, as modern electric motors deliver higher power-to-weight ratios and cut emissions by up to 50% compared to traditional helicopters. Moreover, battery technology has made significant changes, with current lithium-ion batteries reaching energy densities of about 300 Wh/kg, allowing flight ranges of 35-40 kilometers, as demonstrated by the EHang 216.

Capital Investment and Regulatory Developments in Passenger Drone Market Growth

The passenger drones market size is expanding rapidly through investment and regulatory developments, which are driving technological progress and speeding up commercial deployment. Private investments, with startups such as Joby Aviation securing over $800 million, while major corporations such as Hyundai, Boeing, and Airbus are committing millions to urban air mobility projects. Additionally, government funding plays a crucial role, with programs such as the EU's SESAR and NASA’s Advanced Air Mobility (AAM) initiative providing substantial support for research and development. For instance, the FAA’s BEYOND program, EASA’s special condition VTOL guidelines, and EHang's milestone operational flight permit from the CAAC in 2023 demonstrate the advancements. Thus, clear regulations promote a stable investment environment, , and transform passenger drones market expansion from experimental technology into mainstream transportation solutions.

Passenger Drones Market Segment Analysis

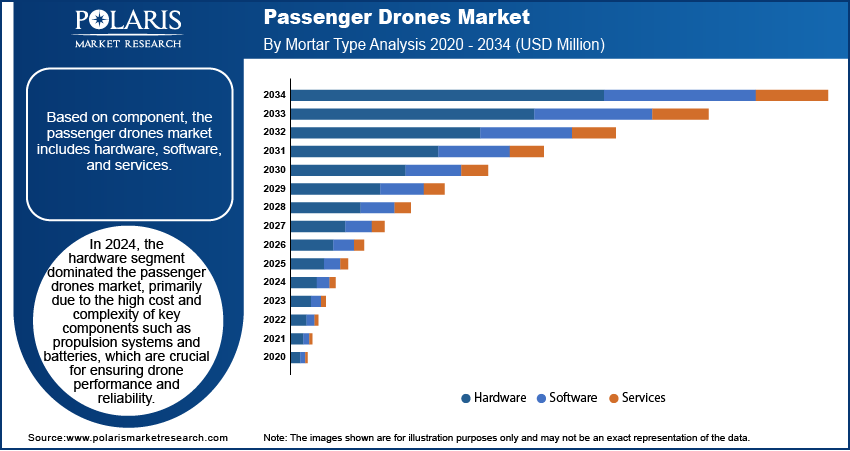

Passenger Drones Market Evaluation by Component Outlook

The passenger drones market evaluation, based on component, includes hardware, software, and services. In 2024, the hardware segment dominated the passenger drones market expansion, primarily due to the high cost and complexity of key components such as propulsion systems and batteries, which are crucial for ensuring drone performance and reliability. Additionally, the continuous development of new materials and technologies within the hardware sector is driving significant investment and innovation. Furthermore, while software and services are gaining importance, the substantial investment required for hardware and its direct impact on drone functionality continue to solidify its leading position in the market. Thus, the hardware segment remains the most dominant in shaping the industry's growth.

The software segment is also expected to grow rapidly in the coming years due to the shift toward autonomous systems, AI, and flight management software for safer and more efficient navigation. Software is becoming essential for urban air mobility operations and improving user experience. Additionally, the rise of software-driven innovations, along with growing demand for drone fleet management services, is expected to drive the software segment's growth, surpassing hardware in the near future.

Passenger Drones Market Assessment by Capacity Outlook

The passenger drones market assessment based on capacity, with segments of more than 100 kg and less than 100 kg. The segment more than 100 kg is expected to witness the fastest growth due to the growing demand for practical urban air mobility solutions and commercial applications that require higher payload capacities and longer flight ranges. The larger drones’ versatility and broader applications make them the focal point for major investments and technological advancements, positioning this segment as the leading force in passenger drones.

On the other hand, drones with a capacity of less than 100 kg are smaller and lighter. They are usually designed to carry 1-2 passengers or light cargo. These drones are commonly utilized for short-distance urban commuting or specialized tasks such as aerial tours. For example, the Flytrex Drone is used for lightweight deliveries, and the SkyDrive SD-03 supports a capacity of around 100 kg.

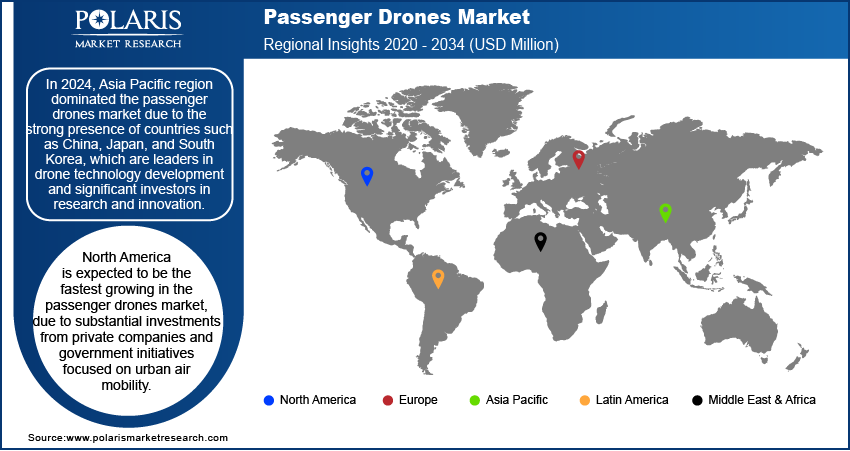

Passenger Drones Market Regional Insights

By region, the study provides the passenger drones market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each with distinct characteristics and growth potential. In 2024, Asia Pacific dominated the passenger drones market revenue due to the strong presence of countries such as China, Japan, and South Korea, which are leaders in drone technology development and significant investors in research and innovation. The region’s rapid urbanization and dense population created a growing need for advanced transportation solutions to alleviate traffic congestion. Additionally, government support for urban air mobility through favorable policies and pilot programs further accelerated the adoption of passenger drones. These combined factors established Asia Pacific as the dominant force in the market. For instance, in April 2023, SkyDrive Inc., a manufacturer of electric vertical takeoff and landing (eVTOL) aircraft based in Japan, revealed that the company is now open for pre-orders for its SD-05 eVTOL aircraft intended for personal use. Notably, Mr. Kotaro Chiba, a licensed pilot and the first owner of a HondaJet in Japan has become the first private customer of the SkyDrive SD-05.

North America is expected to witness the fastest passenger drones market growth, driven by substantial investments from private companies and government initiatives focused on urban air mobility. Key players such as Joby Aviation, Archer Aviation, and Uber Elevate are driving innovation in the market. In addition, supportive regulatory frameworks, such as the FAA's BEYOND program, are facilitating the commercial operations of passenger drones. , North America is positioning itself as a crucial player in the evolving passenger drones landscape as cities aim to reduce congestion and improve transportation options.

Passenger Drones Market- Key Players & Competitive Analysis

The competitive landscape of the passenger drones industry is characterized by a mix of global leaders and emerging players aiming for market dominance through innovation and strategic expansion. Major companies, including Ehang, Volocopter GmbH, Joby Aviation, and Boeing, leverage their extensive research and development capabilities and established distribution networks to deliver advanced aerial taxi solutions that meet urban transportation needs. These industry leaders emphasize product innovation, focusing on efficiency, safety, and eco-friendliness to address challenges such as traffic congestion and environmental sustainability. Additionally, regional players such as AeroMobil and Lilium are carving out places by introducing unique designs and tailored solutions for specific markets. Competitive strategies within this sector include partnerships, mergers and acquisitions, and targeted product launches aimed at broadening market presence and improving service offerings in key regions. Major player includes Ehang; Volocopter GmbH; AeroMobil; Joby Aviation; Uber Technologies Inc.; Boeing; Airbus S.A.S.; Astro Aerospace; Cartivator; Lilium; and Terrafugia, among others.

Airbus is a designer, manufacturer, and service provider of aeronautics, space, and others, with a comprehensive range of passenger airliners. The company also provides tankers, combat, transport, and mission aircraft in Europe. Further, Airbus offers civil and military rotorcraft solutions worldwide for helicopters. As of 2023, Airbus employs over 130,000 people across multiple locations in Europe, the Americas, and Asia and operates in the fields of commercial and military aircraft, helicopters, satellites, and defense systems. The company's product portfolio includes aircraft, such as the A320neo family of single-aisle aircraft, the A350 XWB wide-body aircraft, and the A330neo long-haul aircraft. The company is investing in new areas such as electric and hybrid-electric propulsion systems, autonomous systems, and urban air mobility.

The Boeing Company, founded in 1916, is an American multinational corporation headquartered in Arlington, Virginia. It is one of the largest aerospace manufacturers worldwide, operating in the design, production, and sale of a wide range of aerospace products, including commercial airplanes, military aircraft, rotorcraft, rockets, satellites, and missiles. Boeing operates through three main divisions, which include Boeing Commercial Airplanes (BCA), Boeing Defense, Space & Security (BDS), and Boeing Global Services (BGS). The BCA division focuses on the production of commercial jetliners, with key models including the 737, 767, 777, and 787 families. This division has delivered over 10,000 aircraft globally. BDS is responsible for military aircraft and space systems, offering products such as the KC-46 aerial refueling aircraft and the AH-64 Apache helicopter. This division serves both military and commercial sectors with a diverse portfolio that incorporates advanced technologies. BGS provides aftermarket support services for both commercial and defense customers. This division plays a critical role in maintaining and upgrading various aircraft types. Boeing's operations span more than 150 countries, supported by a global supplier network that facilitates economic engagement and operational capabilities.

Key Companies in Passenger Drones Market

- AeroMobil

- Airbus S.A.S.

- Astro Aerospace

- Boeing

- Cartivator

- Ehang

- Joby Aviation

- Lilium

- Terrafugia

- Uber Technologies Inc.

- Volocopter GmbH

Passenger Drones Market Developments

June 2024: EHang announced its pilotless electric vertical takeoff and landing aircraft completed its first autonomous air taxi flight in Mecca, Saudi Arabia. The autonomous flight, conducted with rigorous safety measures, underscores EHang's commitment to safety and innovation. The partnership with Front End Limited Company ("Front End"), a Saudi-based enterprise specializing in advanced solutions for various industries, also the transformative potential of pilotless eVTOL aircraft for the region's transportation system.

September 2023: Aurora Flight Sciences, a subsidiary of Boeing, finalized the acquisition of Uber's aerial ride-sharing division, Uber Elevate. This acquisition aims to combine Uber's ride-sharing technology with Boeing's proficiency in autonomous flight and UAM, bolstering Boeing's capabilities in creating a scalable Passenger Drones ecosystem.

September 2023: Cartivator's SkyDrive Testing, the company behind the SkyDrive eVTOL project, reported significant progress in its development and testing phases. The company is gearing up for regulatory certification and is focusing on forming partnerships to support its commercial launch.

Passenger Drones Market Segmentation

By Component Outlook (Revenue, USD Million, 2020–2034)

- Hardware

- Software

- Services

By Capacity Outlook (Revenue, USD Million, 2020–2034)

- Less than 100 kg

- More than 100 kg

By End User Outlook (Revenue, USD Million, 2020–2034)

- Personal

- Commercial

Passenger Drones Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Vietnam

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Passenger Drones Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 665.96 million |

|

Market Size Value in 2025 |

USD 850.04 million |

|

Revenue Forecast in 2034 |

USD 7,938.71 million |

|

CAGR |

28.2% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global passenger drones market size was valued at USD 665.96 million in 2024 and is projected to grow to USD 7,938.71 million by 2034.

The global market is projected to register a CAGR of 28.2% during the forecast period, 2025-2034.

In 2024, Asia Pacific had the largest share of the global market.

The key players in the market are Ehang; Volocopter GmbH; AeroMobil; Joby Aviation; Uber Technologies Inc.; Boeing; Airbus S.A.S.; Astro Aerospace; Cartivator; Lilium; and Terrafugia

The more than 100 kg segment is expected to witness the fastest growth in the market.

The commercial segment dominated the passenger drones market in 2024.