Paracetamol IV Market Size, Share, Trends, Industry Analysis Report: By Indication (Pain and Pyrexia), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM5289

- Base Year: 2024

- Historical Data: 2020-2023

Paracetamol IV Market Overview

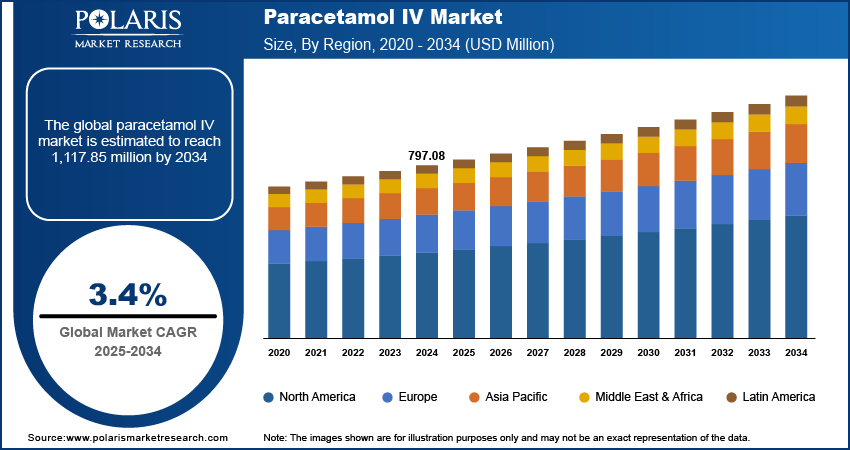

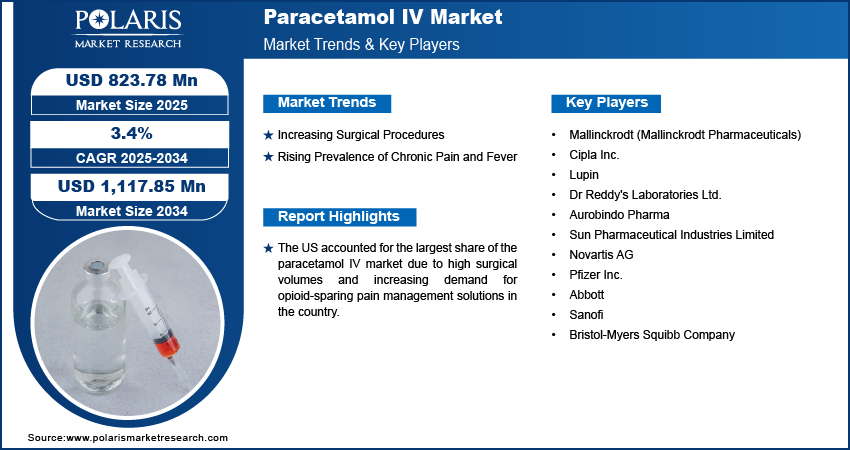

The paracetamol IV market size was valued at USD 797.08 million in 2024. The market is projected to grow from USD 823.78 million in 2025 to USD 1,117.85 million by 2034, exhibiting a CAGR of 3.4% during 2025–2034.

Paracetamol IV (Intravenous Paracetamol) is a formulation of paracetamol, also known as acetaminophen, that is administered directly into the bloodstream via an intravenous (IV) injection or infusion. Paracetamol is used to treat moderate pain and fever for those who require rapid pain relief, such as after surgery or in certain medical conditions. With the growing concerns around opioid abuse and addiction, there is a shift toward safer alternatives for pain management. Paracetamol IV provides a non-opioid solution for managing moderate pain and fever, making it an attractive option for healthcare providers seeking to avoid the risks associated with opioid use, which is fueling the paracetamol IV market demand. Furthermore, owing to the advancements in medical treatments and an increase in hospital-based care, more hospitals and healthcare centers are adopting intravenous therapies for various conditions, thereby contributing to the paracetamol IV market expansion.

Paracetamol IV works faster than oral medications, making it ideal for situations where quick pain relief is needed, such as in emergency rooms, intensive care units (ICUs), and after surgeries. Moreover, in pediatric and geriatric care, where oral medication compliance is challenging, paracetamol IV offers a reliable and easy alternative for pain and fever management, which is fueling the paracetamol IV market growth.

To Understand More About this Research: Request a Free Sample Report

Paracetamol IV Market Trend Analysis

Increasing Surgical Procedures

The rise in the number of surgeries, both elective and emergency, has significantly increased the demand for effective post-operative pain management. According to the American Society of Plastic Surgery, there was a notable increase in the volume of cosmetic surgeries performed, with 1.49 million procedures in 2022 and 1.57 million in 2023. This represents a 5% year-over-year growth in the cosmetic surgery sector. Paracetamol IV is often preferred in hospital settings for rapid pain relief and to reduce fever, especially when oral medications cannot be used or are ineffective. The increasing number of surgeries, particularly in the cosmetic surgery sector, is driving the demand for effective post-operative pain management, positioning the Paracetamol IV market for significant growth.

Rising Prevalence of Chronic Pain and Fever

The growing incidence of chronic pain conditions, such as arthritis, and fever-related illnesses, contributes to the increasing use of paracetamol IV for long-term and acute pain relief. Also, an aging population is more susceptible to conditions requiring frequent pain management, which boosts demand for IV paracetamol. In 2022, the Centers for Disease Control and Prevention (CDC) reported that 18.9% of adults aged 18 and above were diagnosed with arthritis, with women (21.5%) experiencing higher rates than men (16.1%). The prevalence of arthritis is higher in an aging population. The condition affects 3.6% of individuals aged 18–34, whereas 53.9% of adults aged 75 and above are suffering from the disease.

Paracetamol IV Market Segment Insights

Paracetamol IV Market Assessment by Indication Insights

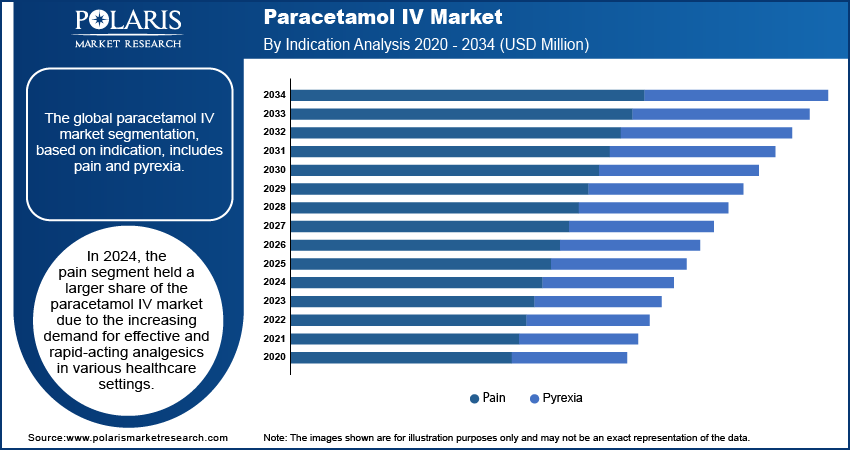

The global paracetamol IV market segmentation, based on indication, includes pain and pyrexia. In 2024, the pain segment held a larger share of the paracetamol IV market revenue due to the increasing demand for effective and rapid-acting analgesics in various healthcare settings. In May 2022, West China Hospital demonstrated that intravenous paracetamol effectively reduced postoperative opioid consumption and pain scores after lumbar disc surgery without increasing adverse effects. This highlights paracetamol’s role as a safer and an effective component of multimodal analgesia. Paracetamol IV is widely used in hospitals and surgical centers for postoperative pain management, providing a non-opioid alternative that helps reduce the need for opioid analgesics, which carry a higher risk of addiction and adverse effects. Paracetamol’s quick onset of action and ability to provide reliable pain relief also make it a preferred option in emergency departments, where patients often require immediate treatment.

Paracetamol IV Market Evaluation by End Use Insights

The global paracetamol IV market segmentation, based on end use, includes hospitals, clinics, and others. The clinics segment is expected to witness the highest CAGR during the forecast period due to the growing adoption of outpatient and day surgery procedures, where rapid and effective pain management is crucial. Clinics, particularly those specializing in minor surgical interventions, orthopedic treatments, and post-procedure care, are increasingly incorporating intravenous paracetamol into their multimodal analgesia protocols. Paracetamol IV has proven efficacy in reducing opioid use and managing pain with a favorable safety profile. Additionally, the increasing preference for outpatient care, where patients are discharged on the same day, boosts demand for fast-acting and reliable pain relief options such as paracetamol IV.

Paracetamol IV Market Regional Outlook

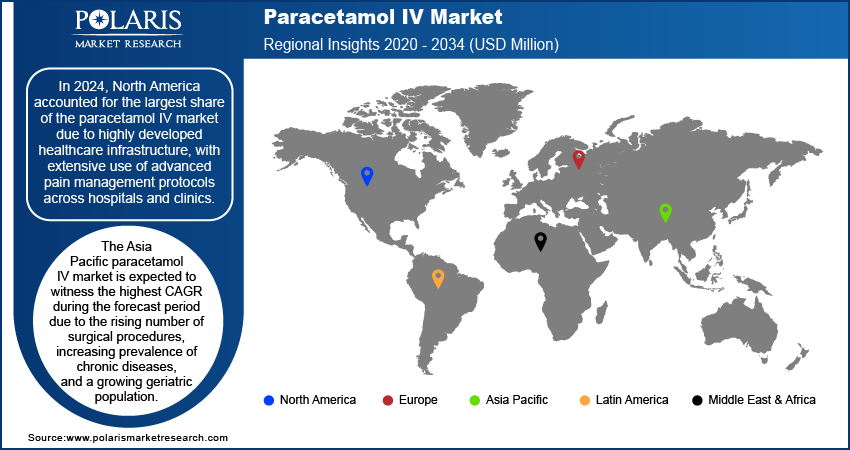

By region, the study provides paracetamol IV market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the paracetamol IV market due to the highly developed healthcare infrastructure, with extensive use of advanced pain management protocols across hospitals and clinics. Furthermore, the rising incidence of trauma and injury in the region is significantly driving the demand for IV paracetamol. In 2022, the Insurance Institute for Highway Safety (IIHS) reported 42,514 motor vehicle collision fatalities in the US, with a mortality rate of 12.8 deaths per 100,000 people and an incidence rate of 1.33 fatalities per 100 million vehicle miles traveled. In emergency and trauma care settings, paracetamol IV is increasingly utilized for rapid pain relief following acute injuries, particularly when oral administration is not feasible due to the intensity of pain or the patient's compromised condition.

The US accounted for the largest share of the paracetamol IV market due to high surgical volumes and increasing demand for opioid-sparing pain management solutions. Additionally, the growing use of multimodal analgesia protocols, along with advancements in emergency and critical care settings, has boosted the demand for IV paracetamol in the US.

The Asia Pacific paracetamol IV market is expected to witness the highest CAGR during the forecast period due to the rising number of surgical procedures, increasing prevalence of chronic diseases, and a growing geriatric population. The region is experiencing an uptick in surgeries, particularly in orthopedic and abdominal procedures. Thus, the demand for effective pain management options such as paracetamol IV is rising in the region. Additionally, the growing burden of chronic diseases, such as cancer and arthritis, coupled with the challenges faced by the geriatric population in managing pain, is further driving the adoption of IV paracetamol. According to the World Economic Forum, Asia accounts for 45% of global breast cancer cases and 58% of cervical cancer deaths, with both expected to rise by 21% and 19%, respectively, by 2030.

The India paracetamol IV market is expected to witness the highest CAGR during the forecast period. India is a manufacturing hub for pharmaceutical products, which contributes to the availability and cost-effectiveness of IV paracetamol. This factor boosts its adoption in domestic and export markets.

Paracetamol IV Market – Key Players and Competitive Insights

The competitive landscape of the paracetamol IV market is shaped by a blend of major pharmaceutical companies, generics manufacturers, and specialized biotech firms. Leading players, such as Pfizer, GlaxoSmithKline, and Johnson & Johnson, dominate the market with their established portfolios in pain management. Major companies leverage their global reach, substantial research and development capabilities, and robust manufacturing infrastructures. Generic manufacturers are gaining traction by offering cost-effective alternatives to branded paracetamol IV products. Competition also stems from product differentiation, with companies focusing on factors such as the speed of onset, duration of action, and compatibility with other medications to meet specific patient needs. Regulatory approvals play a key role in determining market entry, as compliance with health agencies such as the FDA and EMA is essential for product availability. Furthermore, firms with strong distribution networks and partnerships within healthcare systems, especially in regions such as North America, Europe, and Asia Pacific, are well-positioned to capture the largest market share and expand their reach in this growing market. A few key major players are Mallinckrodt (Mallinckrodt Pharmaceuticals), Cipla Inc., Lupin, Dr Reddy's Laboratories Ltd., Aurobindo Pharma, Sun Pharmaceutical Industries Limited, Novartis AG, Pfizer Inc., Abbott, Sanofi, and Bristol-Myers Squibb Company.

Abbott is a global healthcare company that discovers, develops, manufactures, and sells a wide range of healthcare products worldwide. The company operates in four segments such as established pharmaceutical products, diagnostic products, nutritional products, and medical devices. Its established pharmaceutical products segment offers generic pharmaceuticals for various medical conditions such as hypertension, pancreatic exocrine insufficiency, and pain management. The diagnostic products segment provides laboratory and transfusion medicine systems, point-of-care testing, molecular diagnostics, and informatics solutions for clinical laboratories. The company’s paracetamol IV is available in the name of Malidens Injection [paracetamol infusion I.P (1.0% w/v)].

Pfizer Inc. is a global biopharmaceutical company that discovers, develops, manufactures, markets, distributes, and sells a wide range of medicines and vaccines worldwide. The company operates in various therapeutic areas, including infectious diseases, cardiovascular metabolism, women's health, and COVID-19 prevention and treatment. Pfizer's product portfolio includes brands such as Prevnar, Enbrel, Eliquis, Xeljanz, and Ibrance. These brands address diverse medical needs, ranging from chronic, immune, and inflammatory diseases and oncology to rare genetic disorders.

Key Companies in Paracetamol IV Market

- Mallinckrodt (Mallinckrodt Pharmaceuticals)

- Cipla Inc.

- Lupin

- Dr Reddy's Laboratories Ltd.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Limited

- Novartis AG

- Pfizer Inc.

- Abbott

- Sanofi

- Bristol-Myers Squibb Company

Paracetamol IV Industry Developments

In February 2024, AFT Pharmaceuticals launched Maxigesic IV in the US through licensee Hikma Pharmaceuticals. This patented intravenous formulation, licensed in over 100 countries, combines 1,000 mg of acetaminophen (paracetamol) with 300 mg of ibuprofen for enhanced pain relief.

In February 2021, B. Braun Medical Inc. received FDA approval for the first acetaminophen injection with multiple dosing options. Produced in Irvine, California, it is offered in PAB IV bags with two concentrations: 500 mg in 50 mL and 1,000 mg in 100 mL.

In December 2020, Fresenius Kabi launched acetaminophen injection in freeflex bags in the US, enhancing its anesthesia and analgesia portfolio with this addition to its ready-to-use pharmaceutical offerings.

Paracetamol IV Market Segmentation

By Indication Outlook (Revenue, USD Million; 2020–2034)

- Pain

- Pyrexia

By Application Outlook (Revenue, USD Million; 2020–2034)

- Surgical

- Non-Surgical

By End Use Outlook (Revenue, USD Million; 2020–2034)

- Hospitals

- Clinics

- Others

By Regional Outlook (Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Paracetamol IV Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 797.08 million |

|

Market Size Value in 2025 |

USD 823.78 million |

|

Revenue Forecast by 2034 |

USD 1,117.85 million |

|

CAGR |

3.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 797.08 million in 2024 and is projected to grow to USD 1,117.85 million by 2034.

The global market is projected to register a CAGR of 3.4% during the forecast period.

In 2024, North America dominated the paracetamol IV market revenue share due to highly developed healthcare infrastructure, with extensive use of advanced pain management protocols across hospitals and clinics.

A few key players in the market are Mallinckrodt (Mallinckrodt Pharmaceuticals), Cipla Inc., Lupin, Dr Reddy's Laboratories Ltd., Aurobindo Pharma, Sun Pharmaceutical Industries Limited, Novartis AG, Pfizer Inc., Abbott, Sanofi, and Bristol-Myers Squibb Company.

In 2024, the pain segment held a larger share of the paracetamol IV market due to the increasing demand for effective and rapid-acting analgesics.

The clinics segment is expected to witness the highest CAGR during the forecast period due to the growing adoption of outpatient and day surgery procedures.