Paper Bags Market Size, Share, Trends, Industry Analysis Report: By Type (Brown Paper Bags, White Paper Bags, Laminated Paper Bags, and Recycled Paper Bags), End User, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM5396

- Base Year: 2024

- Historical Data: 2020-2023

Paper Bags Market Overview

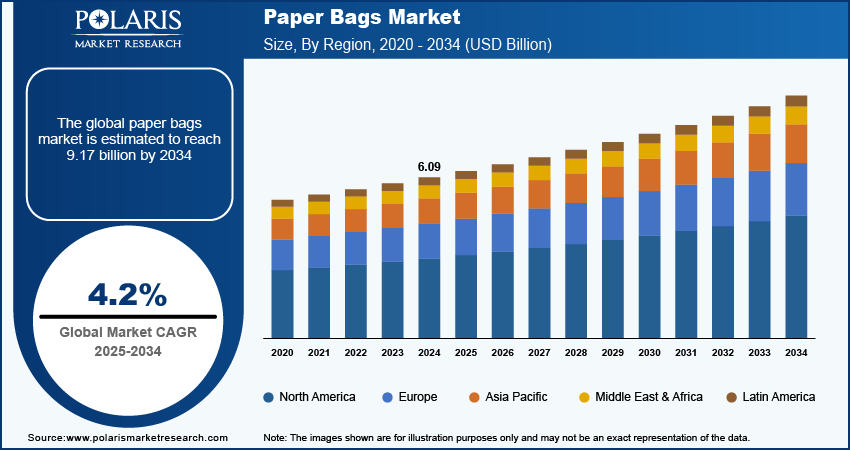

The paper bags market size was valued at USD 6.09 billion in 2024. The market is projected to grow from USD 6.33 billion in 2025 to USD 9.17 billion by 2034, exhibiting a CAGR of 4.2% during 2025–2034.

The paper bags market refers to the global industry involved in the production and distribution of paper-based bags used across various sectors such as retail, food & beverage, and industrial packaging. Key drivers for the market include increasing environmental concerns over plastic waste, stringent government regulations promoting sustainable packaging, and growing consumer preference for eco-friendly products. Additionally, advancements in manufacturing processes to enhance paper bag durability and customization are boosting market growth. Notable paper bags market trends include the rising adoption of biodegradable materials, demand for premium and recyclable packaging, and increasing use of paper bags by food delivery services and e-commerce platforms.

To Understand More About this Research: Request a Free Sample Report

Paper Bags Market Dynamics

Growing Environmental Concerns and Government Regulations

The increasing awareness about environmental degradation caused by plastic waste is propelling the focus on eco-friendly options such as paper bags. Plastic pollution accounts for approximately 11 million metric tons of waste entering oceans each year, according to the United Nations Environment Programme (UNEP). To address this issue, governments worldwide have implemented strict regulations and bans on single-use plastics, thereby encouraging the adoption of paper-based alternatives. For instance, the European Union’s Directive (EU) 2019/904 mandates member states to significantly reduce plastic packaging use, fueling demand for paper bags. Similarly, India’s ban on single-use plastic items, effective from July 2022, has accelerated the transition to sustainable packaging materials such as paper.

Rising Consumer Demand for Sustainable Packaging

Consumer preferences are shifting toward sustainable and eco-friendly products, driven by heightened awareness of environmental issues. Paper bags, being biodegradable, recyclable, and reusable, align with this growing demand. Retailers and brands across sectors such as food & beverage, apparel, and grocery are increasingly adopting paper bags to appeal to eco-conscious customers and enhance their sustainability credentials. For instance, major brands such as McDonald’s and H&M have replaced plastic bags with paper-based alternatives to meet consumer expectations and improve brand perception. Thus, increasing consumer demand for sustainable packaging is driving the paper bags market development.

Growth in E-Commerce and Food Delivery Services

The rapid expansion of e-commerce and food delivery sectors has been a crucial factor driving the demand for paper bags. As businesses prioritize sustainable packaging to meet environmental goals and regulatory requirements, paper bags have emerged as a preferred choice for delivery and takeaway packaging. The global e-commerce sector grew by 10% in 2022, according to the United Nations Conference on Trade and Development (UNCTAD), with increasing demand for eco-friendly packaging materials to support logistics and delivery. Additionally, food delivery companies such as Zomato and Uber Eats have adopted paper bags for packaging to align with sustainability initiatives and enhance brand image. This trend has significantly contributed to the paper bags market growth.

Paper Bags Market Segment Insights

Paper Bags Market Assessment – Type-Based Insights

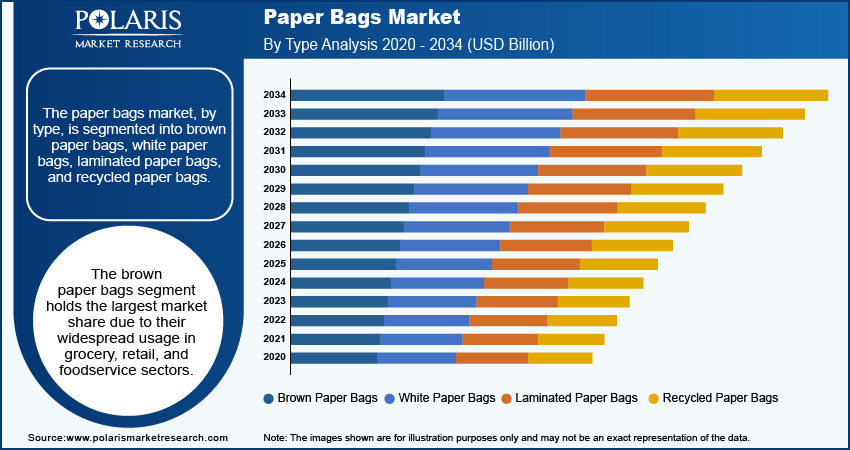

The paper bags market, by type, is segmented into brown paper bags, white paper bags, laminated paper bags, and recycled paper bags. The brown paper bags segment holds the largest market share due to their widespread usage in grocery, retail, and foodservice sectors. Their cost-effectiveness, durability, and eco-friendly nature make them a preferred choice among manufacturers and consumers. Furthermore, stringent regulations against single-use plastics have driven their adoption, especially in emerging economies. The segment’s growth is also supported by the increasing demand for sustainable packaging solutions in both developed and developing regions.

The recycled paper bags segment is registering the highest growth rate in the paper bags market, fueled by rising environmental concerns and a growing emphasis on circular economy practices. These bags align with global sustainability goals, as they utilize post-consumer waste and reduce the reliance on virgin paper materials. With governments and industries promoting recycling initiatives, demand for recycled paper bags is surging across industries, particularly in retail and e-commerce. In addition, advancements in recycling technologies and increasing investments in infrastructure are enhancing the quality and production efficiency of recycled paper bags, further propelling their growth.

Paper Bags Market Outlook – End User-Based Insights

The paper bags market, by end user, is segmented into shopping bags, grocery bags, food bags, merchandise bags, and gift bags. The grocery bags segment accounts for the largest market share, driven by their extensive use in retail and food distribution channels. The demand for these bags is supported by the ban on plastic bags in several countries and growing consumer awareness regarding environmentally sustainable packaging. Grocery bags are widely adopted by supermarkets, hypermarkets, and local stores, particularly in regions where regulations mandate the use of biodegradable materials. Their strength and cost-effectiveness further contribute to their dominant position in the market.

The food bags segment is registering the highest growth rate, primarily due to the increasing demand from the food & beverage industry and the rising popularity of food delivery services. These bags are preferred for packaging bakery products, snacks, and takeout meals, as they meet hygiene standards while being eco-friendly. The growth is further supported by the shift in consumer preference toward sustainable food packaging and the rising adoption of paper bags by quick-service restaurants (QSRs) and cafes. Additionally, technological advancements in paper bag manufacturing, such as grease-resistant coatings, are enhancing the functionality of food bags, driving their adoption in the foodservice sector.

Paper Bags Market Evaluation – Distribution Channel-Based Insights

The paper bags market, by distribution channel, is segmented into online retail, supermarkets/hypermarkets, convenience stores, and specialty stores. The supermarkets and hypermarkets segment holds the largest market share due to their extensive presence and the high volume of sales of paper bags for groceries and retail items. These outlets frequently adopt paper bags as part of their sustainability initiatives and compliance with regulatory requirements banning plastic bags. Their ability to cater to large customer bases and provide paper bags as an alternative to plastic has significantly contributed to the segment's dominance.

The online retail segment is experiencing the highest growth rate, driven by the rapid expansion of e-commerce platforms and increased consumer preference for home delivery services. Online retailers increasingly use paper bags for packaging and shipping to align with sustainability goals and address environmental concerns. The rise of eco-conscious consumers has further fueled this trend, as brands prioritize sustainable packaging to enhance customer trust and brand value. Additionally, the convenience of online shopping and the growing penetration of digital platforms in emerging markets are further boosting demand for paper bags within this distribution channel.

Paper Bags Market Regional Insights

By region, the study provides paper bags market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe holds the largest market share, driven by stringent government regulations aimed at reducing plastic usage and promoting sustainable alternatives. Policies such as the European Union’s ban on single-use plastics and initiatives under the Circular Economy Action Plan have significantly increased the demand for paper bags across various sectors. Furthermore, heightened consumer awareness regarding environmental sustainability and the strong presence of eco-friendly packaging manufacturers in the region contribute to its dominance. The adoption of paper bags is particularly high in the retail, grocery, and foodservice industries in countries such as Germany, France, and the UK. Additionally, the presence of well-established manufacturers and advancements in eco-friendly bag production technologies drive the paper bags market expansion in this region.

Asia Pacific is one of the fastest-growing regions in the global paper bags market, fueled by rising environmental concerns and government initiatives to reduce plastic waste. Countries such as China, India, and Japan are key contributors, driven by the rapid expansion of the retail and foodservice industries. Increasing urbanization and consumer demand for sustainable packaging solutions have further boosted the adoption of paper bags. Moreover, the growing e-commerce sector in the region is creating additional demand for biodegradable packaging materials, supported by the availability of cost-effective raw materials and large-scale manufacturing capabilities.

Paper Bags Market – Key Players and Competitive Insights

The paper bags market features several prominent companies actively contributing to its growth and innovation. Notable players include Amcor plc, Champion Packaging & Distribution Inc., Coveris, Genpak LLC, Global-Pak Inc., Huhtamaki Oyj, Inteplast Group, International Paper Company, Klabin S.A., Mondi plc, Novolex Holdings LLC, Oji Holdings Corporation, Parksons Packaging Ltd., Rawlings Group, Smurfit Kappa Group plc, Sonoco Products Company, and Visy Industries Pty Ltd.

These companies are actively engaged in the market, offering a diverse range of paper bag products to meet varying consumer and industrial needs. For instance, Smurfit Kappa Group plc and Mondi plc focus on innovative designs and environmentally friendly materials, aligning with global sustainability trends. Novolex Holdings LLC and Sonoco Products Company emphasize the development of recyclable and compostable paper bags, addressing the increasing consumer preference for eco-friendly products.

In the competitive landscape, companies differentiate themselves through product innovation, sustainability initiatives, and strategic expansions. For example, Mondi plc has introduced recyclable paper bags with enhanced durability, catering to the retail and food sectors. Smurfit Kappa Group plc has expanded its operations in emerging markets, capitalizing on the rising demand for paper-based packaging. Additionally, collaborations and partnerships among these key players contribute to technological advancements and the development of high-quality paper bags, strengthening their positions in the global market.

International Paper Company is a global producer of renewable fiber-based packaging and pulp products, operating in North America, Europe, Latin America, Russia, Asia, North Africa, and the Middle East. The company focuses on manufacturing paper bags, corrugated packaging, and cellulose fibers, serving various industries, including food & beverage, industrial, and consumer goods.

International Paper Company provide comprehensive packaging solutions, including paper bags, to cater to the growing demand for sustainable packaging.

List of Key Companies in Paper Bags Market

- Amcor plc

- Champion Packaging & Distribution Inc.

- Coveris

- Genpak LLC

- Global-Pak Inc.

- Huhtamaki Oyj

- Inteplast Group

- International Paper Company

- Klabin S.A.

- Mondi plc

- Novolex Holdings LLC

- Oji Holdings Corporation

- Parksons Packaging Ltd.

- Rawlings Group

- Smurfit Kappa Group plc

- Sonoco Products Company

- Visy Industries Pty Ltd

Paper Bags Industry Developments

- January 21, 2025: International Paper announced that it is set to receive European Union approval for its $7.1 billion acquisition of UK-based DS Smith, following agreements to divest certain assets to address competition concerns.

- October 29, 2024: Mondi has introduced IntegoBag, a sustainable alternative to free film paper bags used in the construction industry. It is designed to reduce plastic usage by up to 50% while maintaining the shelf life of building materials with protective barrier coatings.

Paper Bags Market Segmentation

By Type Outlook

- Brown Paper Bags

- White Paper Bags

- Laminated Paper Bags

- Recycled Paper Bags

By End User Outlook

- Shopping Bags

- Grocery Bags

- Food Bags

- Merchandise Bags

- Gift Bags

By Distribution Channel Outlook

- Online Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Paper Bags Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.09 billion |

|

Market Size Value in 2025 |

USD 6.33 billion |

|

Revenue Forecast by 2034 |

USD 9.17 billion |

|

CAGR |

4.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The paper bags market has been segmented into detailed segments of type, end user, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The paper bags market growth and marketing strategies focus on sustainability, innovation, and expanding market reach. Companies are increasingly investing in research and development to create stronger, more eco-friendly paper bags that cater to consumer preferences for sustainable packaging. Strategic partnerships with retailers and e-commerce platforms are key to gaining market share as demand for biodegradable and recyclable packaging rises. Additionally, companies are leveraging digital marketing to highlight their environmental efforts and enhance brand image. Expanding production capabilities in emerging markets is also a critical strategy to capitalize on growing environmental awareness and government regulations.

FAQ's

The paper bags market size was valued at USD 6.09 billion in 2024 and is projected to grow to USD 9.17 billion by 2034.

The market is projected to register a CAGR of 4.2% during 2025–2034.

North America had the largest share of the paper bags market revenue in 2024.

A few key players in the paper bags market include Paper Company, WestRock Company, Smurfit Kappa Group plc, Oji Holdings Corporation, Mondi plc, Sonoco Products Company, Visy Industries Pty Ltd, Novolex Holdings LLC, Genpak LLC, Ronpak Inc., Champion Packaging & Distribution Inc., Paperbag Limited, Packaging Pro Inc., Bagcraft Packaging LLC, and Global-Pak Inc.

The brown paper bags segment held the largest market share in 2024.

The grocery bags segment accounts for the largest market share in 2024.

Paper bags are packaging materials made from paper, commonly used for carrying goods. They are typically manufactured from recycled or virgin paper and come in various sizes and designs. Paper bags are popular alternatives to plastic bags due to their eco-friendly nature, as they are biodegradable, recyclable, and can be reused. They are commonly used in retail, grocery stores, foodservice, and other industries for packaging items such as groceries, clothing, and takeout food. Paper bags are a sustainable solution in response to increasing environmental concerns over plastic waste.

A few key trends in the market are described below: Sustainability Focus: Increasing demand for eco-friendly, recyclable, and biodegradable paper bags due to environmental concerns. Government Regulations: Implementation of stricter regulations and bans on single-use plastics, driving the adoption of paper bags. Rising Consumer Awareness: Growing consumer preference for sustainable packaging options in response to climate change and waste management issues. Innovative Designs: Development of stronger, more durable, and customizable paper bags for different industries, including retail and foodservice.

A new company entering the paper bags market should focus on innovation, sustainability, and differentiation to stay ahead of the competition. Prioritizing the development of strong, durable, and eco-friendly paper bags using recycled materials would cater to the growing demand for sustainable packaging. Additionally, investing in advanced manufacturing technologies to offer customized, cost-effective solutions for different industries such as foodservice, retail, and e-commerce would help build a unique market presence. Strong partnerships with online retailers and adherence to regulatory standards can further enhance competitiveness. Marketing efforts should highlight environmental impact and the company's commitment to sustainability, appealing to increasingly eco-conscious consumers

Companies manufacturing, distributing, or purchasing paper bags and related products, and other consulting firms must buy the report.