Paper and Paperboard Packaging Market Share, Size, Trends, Industry Analysis Report: By Grade, Type, Application (Food, Beverage, Healthcare, Personal & Homecare, And Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 117

- Format: PDF

- Report ID: PM1535

- Base Year: 2023

- Historical Data: 2019-2022

Paper and Paperboard Packaging Market Overview

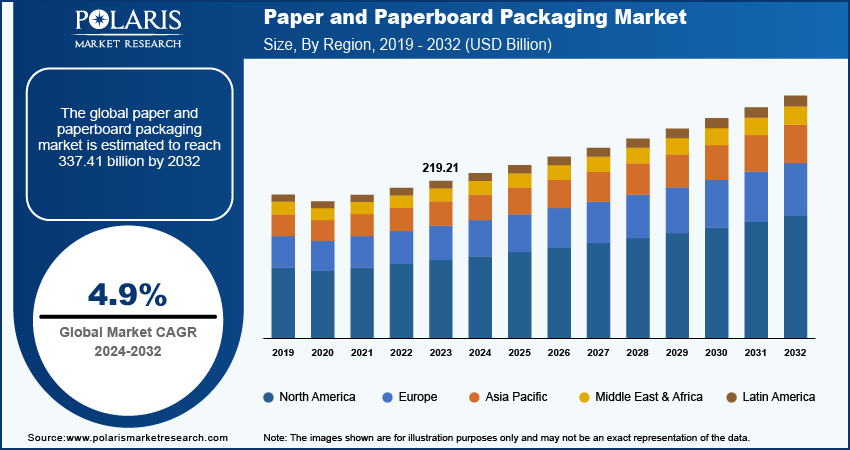

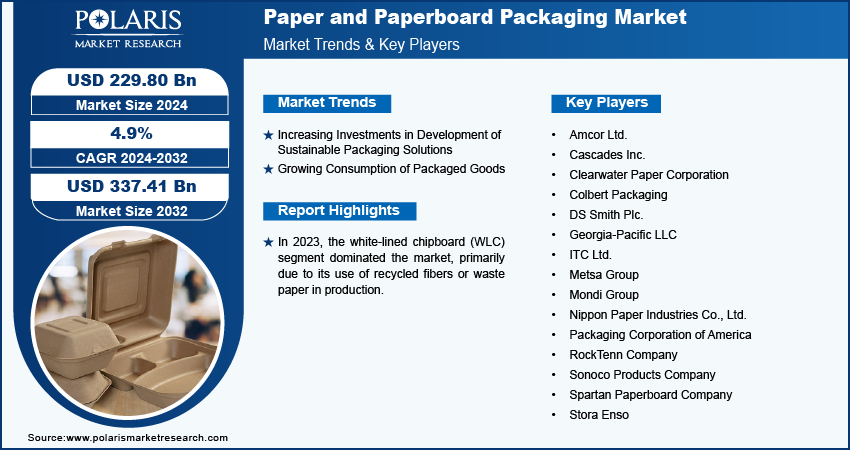

The global paper and paperboard packaging market size was valued at USD 219.21 billion in 2023. The market is projected to grow from USD 229.80 billion in 2024 to USD 337.41 billion by 2032, exhibiting a CAGR of 4.9% during 2024–2032.

The paper and paperboard packaging market is experiencing robust growth owing to an increasing number of consumers showing concerns about non-biodegradable product packaging, mainly for food and beverages, with rising sustainability norms in the market. The increasingly stringent regulations by governments to improve waste recycling activities are encouraging firms to adopt sustainable packaging solutions to limit future recycling and maintenance costs. Additionally, factors such as being lightweight and increasing advancements in the paper and paperboard packaging technologies such as die-cutting, and folding techniques, among others will facilitate significant market growth opportunities in the coming years.

To Understand More About this Research: Request a Free Sample Report

The food and beverage sector are a major contributor to the paper and paperboard packaging market size. The increasing consumption of packaged goods is tremendously driving the demand for compatible packaging solutions. The projected market growth during the forecast period will be driven by the increasing adoption of sustainable product packaging and the commitment of numerous companies to provide eco-friendly and safe paper and paperboard packaging solutions. Additionally, rising collaborative frameworks to innovate highly functional packaging solutions with recyclability are expected to showcase tremendous growth potential in the next few years. For instance, in October 2023, UPM Specialty Papers, in partnership with Lantmannen Unibake & Adara, developed novel fiber-based packaging for frozen baked goods packaging.

Paper and Paperboard Packaging

Increasing Investments in Development of Sustainable Packaging Solutions

The increasing investments in R&D activities to design highly-performing packaging solutions is facilitating efficient application of paper and paperboard packaging for the goods. In November 10 2022, Sappi North America announced a $418 million project to convert Paper Machine No. 2 at its Somerset Mill in Maine to produce solid bleached sulfate (SBS) board, increasing capacity to meet growing demand for sustainable packaging. The investment aligns with Sappi's Thrive25 strategy and targets rising market needs for environmentally friendly packaging solutions, with the project expected to be operational by early 2025.

Additionally, the growing measures to fuel production capacity by the organizations are projected to promote accessibility to paper and paperboard packaging solutions to the end users, which would propel market expansion during the forecast period. In 2024, Clearwater Paper Corporation completed the acquisition of an Augusta-based bleached paperboard manufacturing plant from Graphic Packaging.

Growing Consumption of Packaged Goods

The paper and paperboard packaging market is experiencing notable growth, fueled by increasing urbanization and rising disposable incomes, which drive the demand for processed and packaged foods, thereby boosting the need for paper-based packaging solutions. The expansion of online shopping has also improved accessibility to consumer goods and food products, further driving the demand for paperboard packaging. Additionally, manufacturers are increasingly focusing on providing sustainable packaging options to meet consumer expectations, which is expected to accelerate market growth further. In February 2024, DS Smith PLC developed a sustainable packaging solution for gas boilers for Bosch Home Comfort Group by replacing plastic foam packaging. This initiative is expected to reduce DS Smith’s CO2 emissions by over 75%.

Paper and Paperboard Packaging

Paper & Paperboard Packaging Market Breakdown – by Grade Insights

The global paper and paperboard packaging market segmentation, based on grade, includes solid bleached sulfate (SBS), coated unbleached kraft paperboard (CUK), folding boxboard (FBB), white lined chipboard (WLC), glassine & greaseproof paper, label paper, and others.

In 2023, the white-lined chipboard (WLC) segment dominated the market, primarily due to its use of recycled fibers or waste paper in production. The front surface of WLC typically undergoes multiple coatings for a smooth finish, while the reverse side is coated once. The growing demand for frozen and chilled foods, along with cosmetics, is driving the segment's growth. Additionally, increased retail activities are boosting the need for paper and paperboard packaging, particularly in shipping boxes, as WLC offers durability and protection, making it a preferred choice for traders.

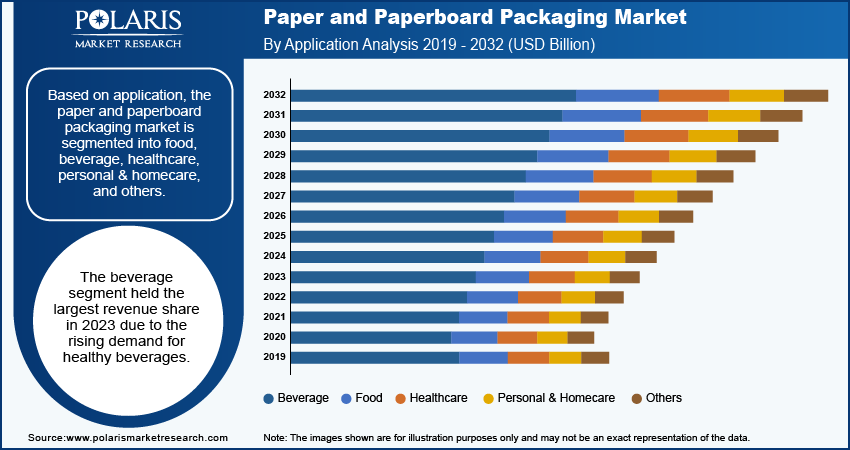

Paper and Paperboard Packaging Market Breakdown – by Application Insights

The global paper and paperboard packaging market, based on application, is segmented into food, beverage, healthcare, personal & homecare, and others.

The beverage segment held the largest revenue share in 2023 due to the rising demand for healthy beverages. The expanding application of paperboard packaging to liquids through polymer coating and the capacity to safeguard flavors, nutritional content, and product freshness propel the growth of the segment. Additionally, the availability of carton recycling facilities will promote their adoption in beverage packaging over the long run. For instance, in June 2023, Stora Enso & Tetra Pak introduced a new beverage carton recycling plant in Poland, Europe.

Paper and Paperboard Packaging Market – Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

In 2023, North America dominated the paper and paperboard packaging market, owing to rising awareness about the potential disadvantages of plastic packaging and the higher demand for packaged foods. As per the Paper and Paperboard Packaging Environmental Council (PPEC) 2022 recycled survey, the average recycled material in domestically produced paper packing is more than 80% in Canada.

The Asia Pacific paper and paperboard packaging market is expected to grow at the highest CAGR from 2024 to 2032 due to the presence of larger populous nations, driving the demand for necessary products, and the rising need for sustainable consumption.

China held the largest share of the Asia Pacific paper & paperboard packaging market in 2023, driven by rising urbanization and growing environmental consciousness. On the other hand, the Japan paper and paperboard packaging market is expected to continue its sustained growth during the forecast period.

Paper and Paperboard Packaging Market – Key Players and Competitive Insights

Leading market players are often enhancing their investments in R&D to widen their product lines, thereby driving the expansion of the global market. Companies in the market are also adopting numerous strategic activities to enhance their global footprint through vital market developments, including new product innovations, collaborations, partnerships, mergers, and acquisitions. Companies obtain more revenue via cost-effective packaging, which assists them in surviving in the competitive paper and paperboard packaging industry.

Amcor Ltd.; Cascades; Clearwater Paper Corporation; Colbert Packaging; DS Smith; Georgia-Pacific LLC; ITC Ltd.; Metsa Group; Mondi Group; Nippon Paper Industries; Packaging Corporation of America; RockTenn Company; Sonoco Products Company; Spartan Paperboard Company; and Stora Enso are among the major players in the paper and paperboard packaging market.

Guyenne papier, a French company recognized as a living heritage company, has developed sunibarrier, a new range of eco-friendly barrier papers after over four years of research. These papers offer a sustainable alternative to plastic packaging, featuring water, grease, and vapor resistance, heat-sealability, and over 95% recyclability. Unlike traditional options, sunibarrier is free of harmful resins, chlorine derivatives, and plastic films.

Mill Rock Packaging Partners, created by Mill Rock Packaging Capital, invests across sectors including technology, specialty manufacturing, packaging, and logistics, serving customers in the US. In February 2023, the company expanded its operations by acquiring All Packaging Company, a paper packaging firm catering to various consumer markets. This acquisition significantly boosts Mill Rock Packaging's scale, adding three converting facilities in the Western US and improving its product and service offerings. The combined platform now provides a comprehensive range of design, engineering, production, and fulfillment solutions for both new and existing customers.

Key Companies in Paper and Paperboard Packaging Market

- Amcor Ltd.

- Cascades Inc.

- Clearwater Paper Corporation

- Colbert Packaging

- DS Smith Plc.

- Georgia-Pacific LLC

- ITC Ltd.

- Metsa Group

- Mondi Group

- Nippon Paper Industries Co., Ltd.

- Packaging Corporation of America

- RockTenn Company

- Sonoco Products Company

- Spartan Paperboard Company

- Stora Enso

Paper and Paperboard Packaging

In June 2024: Green Bay Packaging acquired SMC Packaging, a provider of packaging materials, corrugated boxes, equipment, and displays, to improve its product offering.

In September 2023: Greif Inc. acquired a 51% stake in ColePak LLC, a packaging paperboard manufacturing organization, to expand its brand presence in North America.

In July 2023: Pringles Crisps developed a new 90% recyclable paper fiber tube in collaboration with the Fost Plus (LDC), Kellogg’s Belgian Engineering, and R&D teams. This new technology tends to produce more than a billion sealed Pringles annually with an investment of USD 109 million.

Paper and Paperboard Packaging Market Segmentation

By Grade Outlook (Revenue, USD Billion, 2019-2032)

- Solid Bleached Sulfate (SBS)

- Coated Unbleached Kraft Paperboard (CUK)

- Folding Boxboard (FBB)

- White Lined Chipboard (WLC)

- Glassine & Greaseproof Paper

- Label Paper

- Others

By Type Outlook (Revenue, USD Billion, 2019-2032)

- Corrugated Box

- Boxboard

- Flexible Paper

By Application Outlook (Revenue, USD Billion, 2019-2032)

- Food

- Beverage

- Healthcare

- Personal & Homecare

- Others

By Regional Outlook (Revenue, USD Billion, 2019-2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Paper and Paperboard Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 219.21 Billion |

|

Market Size Value in 2024 |

USD 229.80 Billion |

|

Revenue Forecast by 2032 |

USD 337.41 Billion |

|

CAGR |

4.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global paper and paperboard packaging market size was valued at USD 219.21 billion in 2023 and is projected to grow to USD 337.41 billion by 2032.

The global market is projected to register a CAGR of 4.9% during the forecast period.

In 2023, North America accounted for the largest share of the global market.

Amcor Ltd.; Cascades Inc.; Clearwater Paper Corporation; Colbert Packaging; DS Smith Plc.; Georgia-Pacific LLC; ITC Ltd.; Metsa Group; Mondi Group; Nippon Paper Industries Co., Ltd.; Packaging Corporation of America; RockTenn Company; Sonoco Products Company; Spartan Paperboard Company; and Stora Enso are a few key players in the market.

The white-lined chipboard (WLC) segment dominated the market in 2023.

The beverage segment held the largest market share in 2023.