Palletizer Market Size, Share, Trends, Industry Analysis Report: By Technology (Conventional Palletizers, Robotic Palletizers), By Product Type, By End-Use Industry, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 118

- Format: PDF

- Report ID: PM5047

- Base Year: 2023

- Historical Data: 2019-2022

Palletizer Market Overview

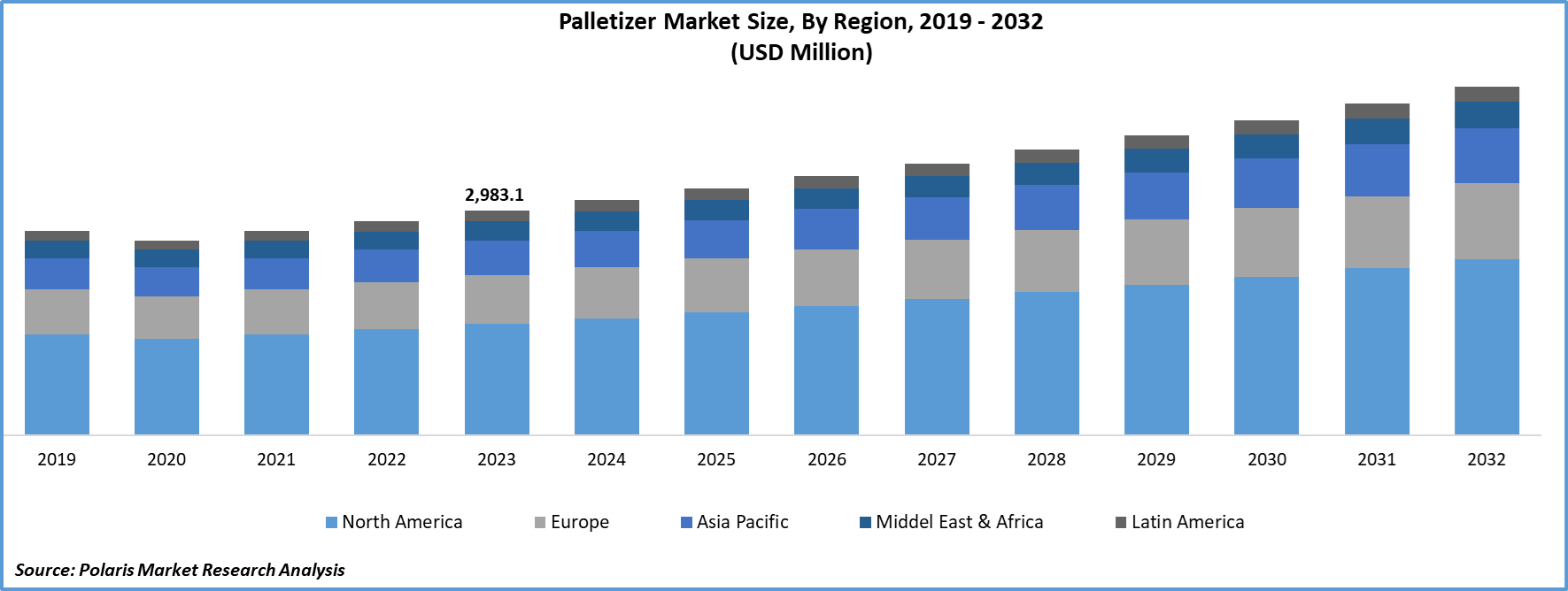

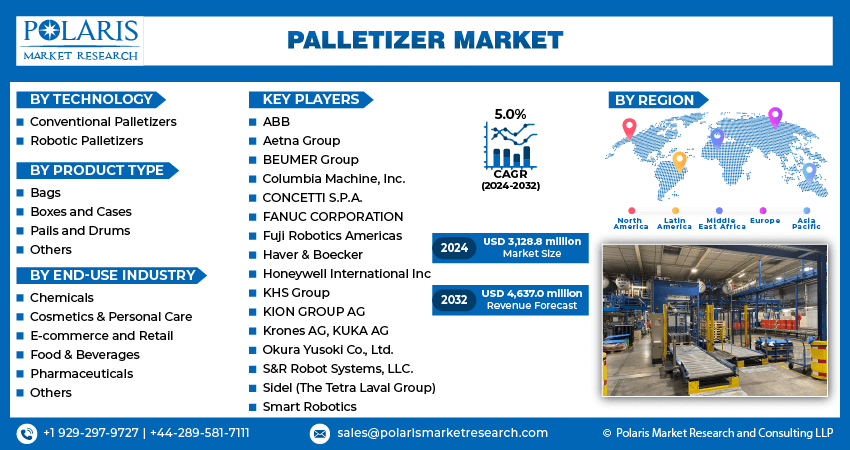

Global palletizer market size was valued at USD 2,983.1 million in 2023. The market is projected to grow from USD 3,128.8 million in 2024 to USD 4,637.0 million by 2032, exhibiting a CAGR of 5.0% during the forecast period.

A palletizer is a type of automated material handling equipment designed to arrange and position multiple individual products into a consolidated load, offering a more efficient and cost-effective solution for handling, storing, and shipping purposes. The growth of the palletizer market is driven by the expansion of the food and beverage processing industry across the globe. The food and beverage sector are experiencing increased demand for efficiency and scalability due to rising consumer preferences.

For instance, according to the IBEF, India's food processing market expanded to a size of USD 307.2 billion in 2022 and is projected to reach USD 470 billion by 2028, showcasing a CAGR of 9.5%. This growth in the food and beverage processing sector has created the need for automated solutions such as palletizers. Thus, increased demand for palletizers to streamline the packaging process quickly and accurately in modern food and beverage facilities is driving the growth of the palletizer market.

To Understand More About this Research: Request a Free Sample Report

The growth of the e-commerce sector is also propelling the palletizer market. It is experiencing a significant rise due to the expanding online retail sales. For instance, the Census Bureau of the Department of Commerce reported that the estimated U.S. retail e-commerce sales for the first quarter of 2024 reached USD 289.2 billion, reflecting a 2.1% growth compared to the fourth quarter of 2023. Also, the growth of retail e-commerce sales has generated the demand for more efficient and scalable logistics solutions, such as palletizers, as it plays a crucial role in automating the process of stacking and organizing goods onto pallets. Thus, this efficiency of palletizers in the e-commerce industry is driving the sales of palletizers, thereby driving market growth.

Palletizer Market Drivers and Trends

Launch of Technologically Advanced Palletizers

The key market players are introducing innovative and technologically advanced palletizers to address the evolving market needs and enhance operational efficiency. Newer models of palletizers incorporate advanced technologies such as robotics, artificial intelligence, and sophisticated sensor systems that improve performance in terms of speed, accuracy, and flexibility. For instance, in March 2024, Liberty Robotics, a company from Michigan, introduced primary robotic palletizing and depalletizing solutions, VPick and VPack, which leverage advanced 3D volumetric vision guidance systems for robot applications. The VPick and VPack systems integrate AI-powered vision capabilities to optimize warehouse operations, improving both efficiency and dependability. Such technological advancements enable palletizers to handle a wider range of product types and sizes, adapt to various packaging formats, and integrate with other automated systems in the production line. Thus, the continuous introduction of advanced palletizers propels market growth by creating a favorable competitive environment across industries.

Industry 4.0 Initiatives

Industry 4.0 initiatives are fueling the growth of the palletizer market by integrating advanced technologies such as the Industrial Internet of Things (IIoT) into material handling and supply chain operations. IIoT enables palletizers to collect and share data in real-time, facilitating predictive maintenance and enhancing operational efficiency. This connectivity is allowing for autonomous decision-making, improving output, worker safety, and overall productivity. Moreover, IIoT sensors monitor palletizer performance, detecting potential issues before technical problems, thereby reducing downtime and maintenance costs. As a result, companies are increasingly adopting palletizers to optimize warehouse operations, streamline logistics, and enhance competitiveness, thus driving the growth of the palletizer market.

Palletizer Market Segment Insights

Palletizer Market Breakdown by Technology Insights

The global palletizer market segmentation, based on technology, includes conventional palletizers and robotic palletizers. The conventional palletizers segment accounted for the largest revenue share in the palletizer market due to its established presence and widespread use in various industries, including food and beverage and pharmaceuticals. Conventional palletizers are known for reliability, performance, and cost-effectiveness, especially in high-productivity settings. These palletizers are able to handle diverse product types and packaging formats, making them a preferred choice for many businesses. Furthermore, a conventional palletizer builds cases at a rate of up to 150 per minute, allowing products to form into layers at higher speeds than robotic palletizers. Thus, the extensive deployment and the need to improve output have contributed to the dominance of conventional palletizers in the global market in 2023.

Palletizer Market Breakdown by End-Use Industry Insights

The global palletizer market segmentation, based on the end-use industry, includes chemicals, cosmetics & personal care, e-commerce and retail, food & beverages, pharmaceuticals, and others. The pharmaceutical segment of the palletizer market is expected to grow significantly due to the expanding pharmaceutical industry that encompasses the research, development, manufacturing, and distribution of drugs and medications. Palletizers are crucial in automating the palletizing of packaged pharmaceutical products, such as drugs, vials, bottles, blister packs, and cartons, for efficient storage, transportation, and distribution. The industry's strict regulations and quality standards are demanding precise handling and adherence to safety protocols. Therefore, palletizing systems are effectively ensuring safety by reducing the risk of contamination and human error. This increased demand for the adoption of palletizers in drug manufacturing and packaging is expected to drive the significant growth of the pharmaceutical segment in the palletizer market across the globe.

Palletizer Market, Segmental Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database, and Analyst Review

Palletizer Regional Insights

By region, the study provides the palletizer market insights into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The North America palletizer market held the largest revenue share due to the business presence of numerous manufacturers and industry leaders, such as ABB; Honeywell International Inc.; KUKA AG; and FANUC CORPORATION in the region. The region boasts a well-established industrial infrastructure, advanced technological capabilities, and significant investment in automation and manufacturing processes. Moreover, North American companies benefit from a mature supply chain and access to innovative technologies that enhance the ability to offer a wide range of palletizing solutions. Thus, the concentration of key market players and the region's growing emphasis on innovation and operational efficiency have contributed to North America's dominant position in the global palletizer market.

Palletizer Market Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

The Asia Pacific palletizer market is anticipated to grow significantly due to the rapid expansion of the manufacturing sector in the region. The countries in the region are experiencing substantial growth in the manufacturing of products due to increased investment and export to global markets. For instance, according to IBEF, in the fiscal year 2023, India achieved annual manufacturing exports of USD 447.46 billion, marking a 6.03% growth compared to FY22, which stood at USD 422 billion. Such growth of the manufacturing sector of countries assists the Asia Pacific region in developing as a global manufacturing hub. The growing manufacturing sector has created a demand for efficient and scalable automation solutions, such as palletizers. Thus, this burgeoning manufacturing sector drives the need for advanced palletizing systems to streamline workflows, enhance productivity, and meet stringent quality standards, thereby driving the growth of the Asia Pacific palletizer market.

China's palletizer market is also anticipated to grow substantially due to the expansion of the chemical industry within the country. For instance, according to the Information Technology & Innovation Foundation, China accounted for 44% of global chemical production and 46% of capital investment in 2022. This data represents the dominance of China's chemical industry across the global market. Hence, there is a growing need for efficient and reliable packaging solutions, including palletizers for automating the palletizing process of various chemical products. Such growing demand for automatic packaging solutions from the expanding chemical sector is expected to drive the palletizer market in China.

Palletizer Market – Key Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the palletizer market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market conditions, the palletizer industry must offer cost-effective solutions.

The global and regional manufacturers in the palletizer market compete by offering a diverse range of palletizing solutions, including robotic, mechanical, and hybrid systems tailored to various industry needs. Leading companies focus on technological advancements such as automation, artificial intelligence, and integrated systems to enhance efficiency and adaptability. Major companies dominate the market by leveraging extensive experience, technological advancements, and broad distribution networks. Major players in the palletizer industry include ABB; Aetna Group; BEUMER Group; Columbia Machine, Inc.; CONCETTI S.P.A.; FANUC CORPORATION; Fuji Robotics Americas; Haver & Boecker; Honeywell International Inc; KHS Group; KION GROUP AG; Krones AG; KUKA AG; Okura Yusoki Co., Ltd.; S&R Robot Systems, LLC.; Sidel (The Tetra Laval Group; and Smart Robotics.

ABB Ltd. is a global manufacturer and seller of automation, robotics, electrification, and motion products. The company operates in various segments to serve a diverse range of industries. In the electrification segment, ABB provides a wide array of products, including renewable power solutions, electric vehicle charging infrastructure, distribution automation products, modular substation packages, and intelligent home and building solutions. Robotics & discrete automation focuses on industrial robots, autonomous mobile robotics, software, and digital services. The motion segment specializes in designing, manufacturing, and selling drives, generators, motors, and traction converters to drive the low-carbon future for industries, infrastructure, cities, and transportation. Process automation develops and sells control technologies, manufacturing execution systems, advanced process control software, marine propulsion systems, instrumentation, and turbochargers and provides services such as preventive maintenance, remote monitoring, emission monitoring, and cybersecurity. In February 2023, ABB launched a SWIFTI CRB 1300 industrial collaborative robot, which offers an increased load-handling capacity of up to 11kg. The model is equipped with advanced features such as palletizing and pick-and-place capabilities and is expected to serve as a solution that addresses the convergence of industrial and collaborative robotics.

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers in the product of four areas, including building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). Honeywell Aerospace provides aircraft engines, avionics, flight management systems, and services to airlines, airports, manufacturers, space programs, and militaries. The company operates for various industries such as aerospace and travel, commercial real estate, energy, healthcare, life sciences, logistics & warehouse, retail, and utilities. In September 2021, Honeywell launched a new robotic technology aimed at automating the manual unloading process of pallets in warehouses and distribution centers. The innovation was designed to mitigate the operational risks associated with potential injuries and labor shortages.

List of Key Companies in Palletizer Market

- ABB

- Aetna Group

- BEUMER Group

- Columbia Machine, Inc.

- CONCETTI S.P.A.

- FANUC CORPORATION

- Fuji Robotics Americas

- Haver & Boecker

- Honeywell International Inc

- KHS Group

- KION GROUP AG

- Krones AG

- KUKA AG

- Okura Yusoki Co., Ltd.

- S&R Robot Systems, LLC.

- Sidel (The Tetra Laval Group)

- Smart Robotics

Palletizer Industry Developments

December 2023: Smart Robotics launched the Smart Mixed Case Palletizer. The industrial robot pick and place station is designed to enhance warehouse delivery speed by automating the palletizing of mixed SKUs, thereby eliminating the manual palletizing bottleneck.

March 2023: OMRON introduced a new palletizing solution designed for collaborative robots, addressing the growing demand for enhanced production flexibility and reduced programming time. The solution is PLC-based and built on OMRON's NX1 series modular machine controller, featuring a specialized Palletizing Function Block.

January 2024: Doosan Robotics Inc. introduced two new products, the Dart-Suite software and the Otto Matic palletizing system, designed to enhance the versatility and user-friendliness of its collaborative robot line.

Palletizer Market Segmentation

Palletizer – Technology Outlook

- Conventional Palletizers

- High-Level Palletizers

- Low-Level Palletizers

- Robotic Palletizers

- Cobot Palletizers

- Traditional Robot Palletizers

Palletizer – Product Type Outlook

- Bags

- Boxes and Cases

- Pails and Drums

- Others

Palletizer – End-Use Industry Outlook

- Chemicals

- Cosmetics & Personal Care

- E-commerce and Retail

- Food & Beverages

- Pharmaceuticals

- Others

Palletizer – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Palletizer Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 2,983.1 million |

|

Market Size Value in 2024 |

USD 3,128.8 million |

|

Revenue Forecast in 2032 |

USD 4,637.0 million |

|

CAGR |

5.0% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

· By Technology · By Product Type · By End-Use Industry |

|

Regional Scope |

· North America · Europe · Asia Pacific · Latin America · Middle East & Africa |

|

Competitive Landscape |

· Palletizer Market Share Analysis (2023) · Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

· PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global palletizer market size was valued at USD 2,983.1 million in 2023 and is projected to grow to USD 4,637.0 million by 2032.

The global market is projected to grow at a CAGR of 5.0% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are ABB; Aetna Group; BEUMER Group; Columbia Machine, Inc.; CONCETTI S.P.A.; FANUC CORPORATION; Fuji Robotics Americas; Haver & Boecker; Honeywell International Inc; KHS Group; KION GROUP AG; Krones AG; KUKA AG; Okura Yusoki Co., Ltd.; S&R Robot Systems, LLC.; Sidel (The Tetra Laval Group); and Smart Robotics.

The conventional segment held the largest share in the palletizer market in 2023

The pharmaceuticals category had the highest CAGR in the global market.