Packaging Printing Inks Market Size, Share, Trends, Industry Analysis Report: By Product (Gravure, Lithographic, Flexographic, Digital Printing, and Others), Resin, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 116

- Format: PDF

- Report ID: PM1494

- Base Year: 2024

- Historical Data: 2020-2023

Packaging Printing Inks Market Overview

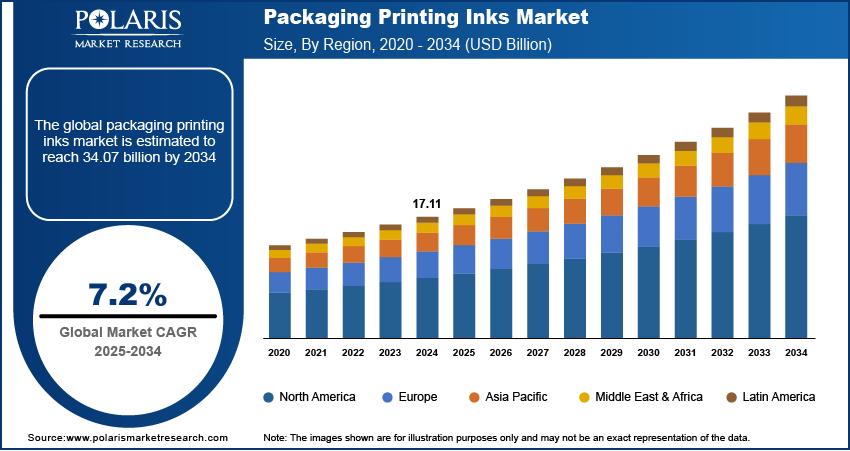

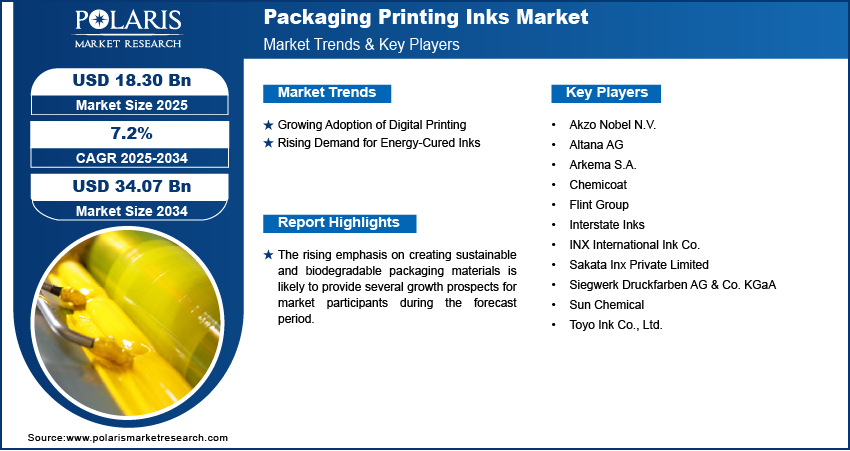

The global packaging printing inks market was valued at USD 17.11 billion in 2024. The market is projected to grow from USD 18.30 billion in 2025 to USD 34.07 billion by 2034. It is projected to exhibit a CAGR of 7.2% from 2025 to 2034.

Packaging printing inks are specialized inks designed for printing graphics, logos, text, and various designs on packaging substrates such as cardboard, plastic, glass, and metal. These inks offer outstanding adhesion, durability, and vivid color, guaranteeing the packaging is visually attractive and resilient to damage during handling and shipping. Printing inks for packaging need to comply with stringent safety regulations, ensuring they do not contaminate the contents or endanger consumers.

Growing urbanization, rising investments in construction & housing, booming cosmetics & healthcare sectors, and the development of retail chains are some of the key factors driving the packaging printing inks market growth. The rising demand for flexible packaging, driven by the growing food & beverage industry, is also fueling market expansion.

To Understand More About this Research: Request a Free Sample Report

Rising emphasis on the development of eco-friendly, high-quality inks that comply with regulatory requirements is one of the key market trends anticipated to fuel market growth in the coming years. The increasing consumer demand for appealing and sustainable packaging is expected to provide several packaging printing inks market opportunities during the forecast period.

Packaging Printing Inks Market Dynamics

Growing Adoption of Digital Printing

Digital printing is gaining popularity in the packaging industry, fueled by increasing demand for personalized, high-quality products. Digital textile printing is widely used for custom packaging solutions, enabling on-demand designs and smaller production runs. This method is particularly beneficial for short-run packaging, labels, and promotional materials, offering greater flexibility and faster turnaround times compared to traditional printing methods. Additionally, digital printing reduces waste and setup times, leading to lower costs and environmental benefits. Thus, the growing adoption of digital printing, particularly by textiles and ceramic tiles manufacturers, is fueling the packaging.

Rising Demand for Energy-Cured Inks

Energy-cured inks, including UV-cured inks, latex (resin), solvent-UV hybrid inks, and solid inks, are becoming increasingly popular because of their excellent properties, such as low volatile organic compounds (VOC) and diverse applications. These inks provide advantages such as enhanced adhesion, faster drying time, greater efficiency, superior performance, ecological benefits, and decreased energy expenses. Although the initial setup costs of packaging printing solutions are higher, businesses are embracing new technologies to reduce these expenses, making energy-curing inks an attractive option for modern printing solutions. Thus, the rising demand for energy-curing inks in packaging and printing is boosting the packaging printing inks market development.

Packaging Printing Inks Market Segment Insights

Packaging Printing Ink Market Outlook Based on Product

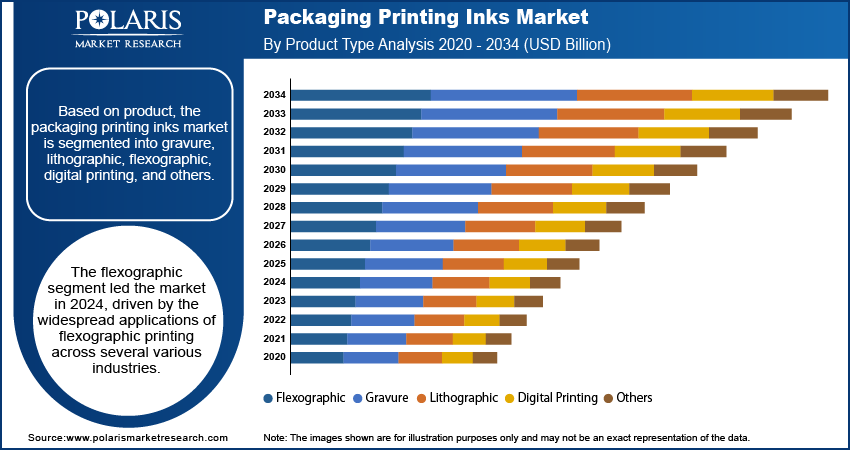

The packaging printing inks market, by product, is segmented into gravure, lithographic, flexographic, digital printing, and others. The flexographic segment held the largest market share in 2024 and is expected to maintain its dominance during the projection period. Flexographic printing, known for its efficiency, adaptability, and affordability, is widely used in industries such as food and beverages, pharmaceuticals, and consumer products. The widespread applications of flexographic printing drive the need for flexographic inks, thereby fueling the segment’s dominance in the global market.

Packaging Printing Ink Market Evaluation Based on End Use

The packaging printing inks market, by end use, is segmented into food & beverage, cosmetics, pharmaceuticals, industrial, and others. The food & beverage segment accounted for the largest packaging ink market share in 2024, driven by the growing demand for food and beverages due to the rising global population. Flexible packaging, including pouches and bags, is becoming popular in the food & beverage industry due to its lightweight nature, ease of use, and extended shelf life. This shift is driving the demand for inks that provide strong adhesion to flexible materials and maintain high print quality over time.

Packaging Printing Inks Market Regional Analysis

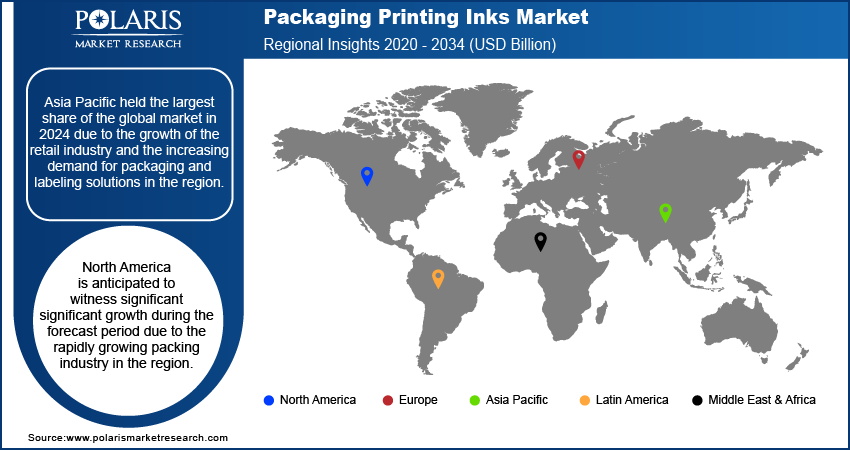

By region, the report offers packaging printing inks market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific had the largest share of the global market in 2024. The growth of the retail industry and the increasing demand for packaging and labeling solutions are key factors driving the regional market demand. In particular, developing nations like China and India are seeing a rising need for packaging inks.

The North America packaging printing inks market is expected to witness significant growth during the forecast period due to the rapidly growing packing industry in the region. In addition, the rapid adoption of digital printing over conventional printing and the evolution of the fashion industry contributes to the regional market demand.

Packaging Printing Inks Market – Key Players and Competitive Insights

The leading players in the market are emphasizing research and development initiatives to improve their product offerings. Market key players are also undertaking various strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to expand their global reach. To expand and survive in a more competitive and rising market environment, market participants must offer innovative solutions.

Manufacturing locally is one of the key business strategies used by manufacturers to benefit clients and increase the market sector. In recent years, the market has witnessed several technological and innovation breakthroughs. The packaging printing ink market report offers a market assessment of all the key players, including Akzo Nobel N.V.; Altana AG; INX International Ink Co.; Siegwerk Druckfarben AG & Co. KGaA; Sakata Inx Private Limited; Flint Group; Chemicoat; Arkema S.A.; Toyo Ink Co., Ltd.; Interstate Inks; and Sun Chemical.

List of Key Companies in Packaging Printing Inks Market

- Akzo Nobel N.V.

- Altana AG

- Arkema S.A.

- Chemicoat

- Flint Group

- Interstate Inks

- INX International Ink Co.

- Sakata Inx Private Limited

- Siegwerk Druckfarben AG & Co. KGaA

- Sun Chemical

- Toyo Ink Co., Ltd.

Packaging Printing Ink Industry Developments

May 2024: Flint Group, a leader in printing and packaging inks, announced the expansion of its TerraCode line with TerraCode Bio. This new addition offers eco-friendly, bio-based extenders and coatings designed for the corrugated industry.

February 2024: Flint Group launched Novasens P670 PRIME, an advanced low-odor, low-migration (LOLM) ink series for sheetfed offset packaging printers worldwide. Designed to enhance productivity and minimize waste, the new series aids sustainability goals while ensuring print quality and adhering to regulatory standards.

Packaging Printing Inks Market Segmentation

By Product Outlook

- Gravure

- Lithographic

- Flexographic

- Digital Printing

- Others

By Resin Outlook

- Modified Rosin

- Modified Cellulose

- Acrylic

- Polyurethane

- Others

By Application Outlook

- Packaging & Labels

- Corrugated Cardboards

- Commercial Printing/Publishing

- Others

By End Use Outlook

- Food & Beverage

- Cosmetics

- Pharmaceuticals

- Industrial

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Packaging Printing Inks Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.11 billion |

|

Market Size Value in 2025 |

USD 18.30 billion |

|

Revenue Forecast by 2034 |

USD 34.07 billion |

|

CAGR |

7.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Packaging Printing Inks Industry Trends Analysis (2024) Company profiles/industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The packaging printing ink market size was valued at USD 17.11 billion in 2024 and is projected to grow to USD 34.07 billion by 2034.

The packaging printing ink market is projected to register a CAGR of 7.2% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024

• Akzo Nobel N.V.; Altana AG; INX International Ink Co.; Siegwerk Druckfarben AG & Co. KGaA; Sakata Inx Private Limited; Flint Group; Chemical; Arkema S.A.; Toyo Ink Co., Ltd.; Interstate Inks; and Sun Chemical are a few key players in the market.

The food & beverages segment accounted for the largest market share in 2024.

• The flexographic segment dominated the market for packaging printing inks in 2024.