Oxygen-Free Copper Market Share, Size, Trends, Industry Analysis Report – By Grade (Cu-OF and Cu-OFE), Product, Application, and Region; Segment Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5103

- Base Year: 2023

- Historical Data: 2019-2022

Oxygen-Free Copper Market Outlook

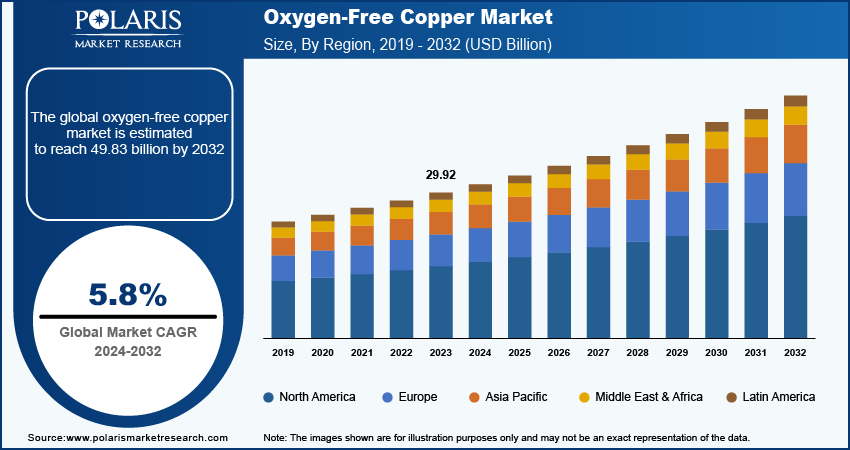

The oxygen-free copper market size was valued at USD 29.92 billion in 2023.

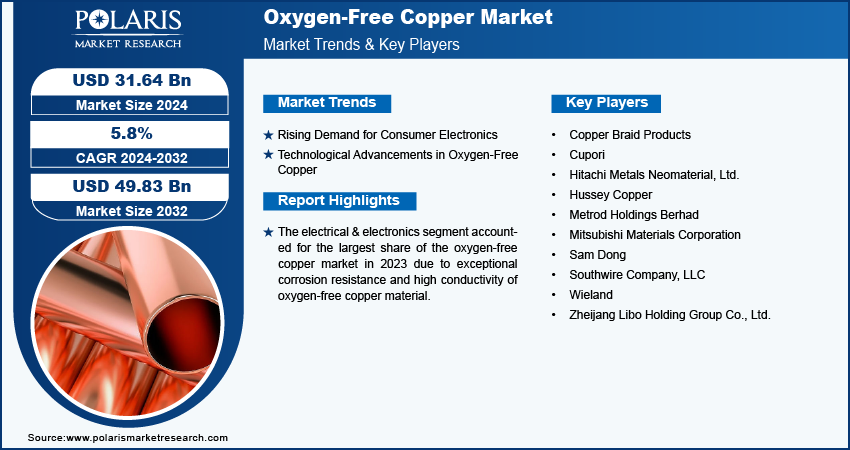

The market is anticipated to grow from USD 31.64 billion in 2024 to USD 49.83 billion by 2032, exhibiting a CAGR of 5.8% during 2024–2032.

Oxygen-Free Copper Market Overview

The expansion in manufacturing capacity of end-use industries is fueling the oxygen-free copper market growth. As electronics, automotive, renewable energy, and other sectors scale up production, the demand for high-conductivity materials such as oxygen-free copper intensifies. This copper variant, known for its superior electrical and thermal conductivity, is crucial for high-performance applications in these industries. With advancements in technology and increased investments in manufacturing infrastructure, companies are ramping up their production of oxygen-free copper to meet rising market needs. As a result, the oxygen-free copper market is growing across the world.

To Understand More About this Research: Request a Free Sample Report

The expansion of the automotive industry is significantly driving the growth of the oxygen-free copper market. As automotive manufacturers increasingly adopt advanced technologies, the demand for high-performance materials such as oxygen-free copper rises. This copper variant is prized for its superior conductivity and resistance to corrosion, making it ideal for use in electric vehicles (EVs), hybrid vehicles, and sophisticated in-car electronics. The shift toward electrification and improved vehicle performance necessitates the use of high-quality materials for power transmission and electronic components, which is accelerating the adoption of oxygen-free copper.

Growth Drivers

Rising Demand for Consumer Electronics

The increasing demand for consumer electronics is significantly boosting the market for oxygen-free copper. Oxygen-free copper is known for its exceptional corrosion resistance and superior electrical conductivity. It is increasingly favored for enhancing the reliability and performance of electronic devices. This high-performance material is becoming a preferred choice among manufacturers seeking to meet the growing consumer demand for advanced, durable electronics. Consequently, many industry players are transitioning to oxygen-free copper to leverage its benefits. Thus, rising demand for consumer electronics fuels the oxygen-free copper market growth.

Technological Advancements in Oxygen-Free Copper

Technological advancements in oxygen-free copper to enhance the material's properties and applications propel the oxygen-free copper market growth. Innovations in production techniques and refining processes have led to improved purity and conductivity of oxygen-free copper, making it increasingly valuable in high-performance electronics and other demanding applications. These advancements enable better performance, reliability, and efficiency in products such as high-speed data cables, connectors, and electronic components. As technology continues to evolve, the increased capabilities of oxygen-free copper are meeting the rising demands of modern industries, thereby fueling its adoption.

Restraining Factors

High Initial Investments

Oxygen-free copper is ∼20% more expensive than traditional copper, primarily due to the rigorous quality control measures and specialized production processes necessary to maintain its purity. These enhanced production requirements ensure the superior conductivity and performance of the material, but they also contribute to its elevated price. This cost disparity poses a challenge for widespread adoption, as manufacturers and consumers weigh the benefits against the financial implications. Thus, the higher expenses remain a significant barrier to broader oxygen-free copper market expansion.

Report Segmentation

The oxygen-free copper market is primarily segmented on the basis of grade, product, application, and region.

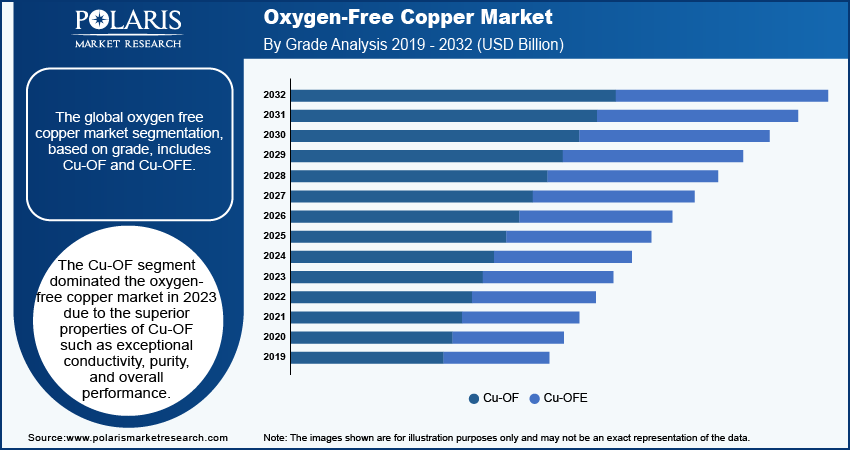

By Grade Analysis

Cu-OF Segment Held Larger Market Share of Oxygen-Free Copper Market in 2023

The Cu-OF segment dominated the oxygen-free copper market in 2023 due to the superior properties of Cu-OF such as exceptional conductivity, purity, and overall performance. Owing to its properties, Cu-OF is an ideal choice for a range of industries such as telecommunications, electronics, and power generation. Its excellent resistance to corrosion further enhances its appeal, ensuring durability and longevity in applications that demand high conductivity. The combination of these attributes positions Cu-OF as a preferred material among other grades.

By Product Analysis

Wires Segment Accounted for Largest Oxygen-Free Copper Market Share in 2023

The wires segment dominated the oxygen-free copper market in 2023 owing to its advantageous properties and rising demand. Oxygen-free copper’s superior conductivity and resistance to corrosion make it exceptionally well-suited for high-performance wiring applications. Its ability to ensure stable and efficient signal transmission is crucial for industries such as telecommunications, electronics, and power generation. The increasing demand for reliable and high-quality wiring solutions has propelled the wires segment.

By Application Analysis

Electrical & Electronics Segment Held Significant Market Revenue Share in 2023

The electrical & electronics segment accounted for the largest share of the oxygen-free copper market in 2023 due to exceptional corrosion resistance and high conductivity of oxygen-free copper material. These properties make oxygen-free copper particularly valuable in applications such as power transmission lines and high-end audio cables, where signal efficiency and integrity are essential. These benefits are leading to the increase in demand for oxygen-free copper in the electrical & electronics industry.

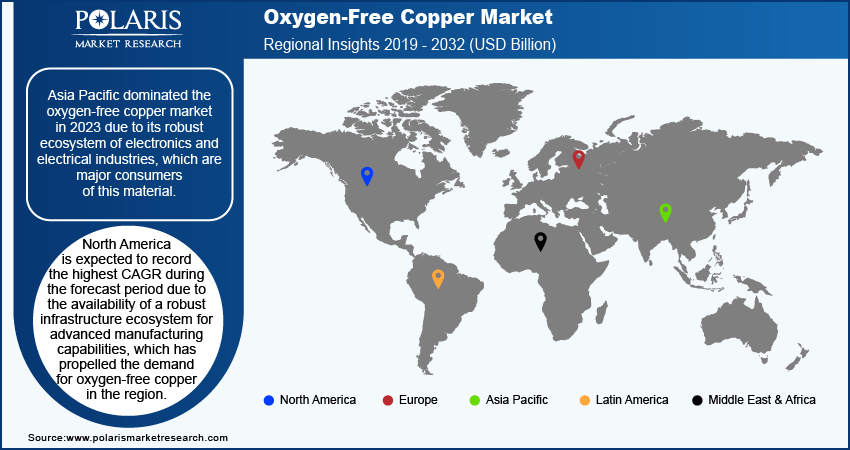

Regional Insights

Asia Pacific Held Largest Share of Global Oxygen-Free Copper Market in 2023

Asia Pacific dominated the oxygen-free copper market in 2023 due to its robust ecosystem of electronics and electrical industries, which are major consumers of this material. Oxygen-free copper is essential in applications such as power transmission, high-end audio equipment, and telecommunications, all of which are prominent in this region. Additionally, significant investments in infrastructure development by countries such as Japan and China have fueled market growth. These investments are enhancing the region’s capacity for advanced technology and electrical systems, boosting the demand for high-performance materials such as oxygen-free coppers across the region.

North America is expected to record the highest CAGR during the forecast period due to the availability of a robust infrastructure ecosystem for advanced manufacturing capabilities, which has propelled the demand for oxygen-free copper in the region. Additionally, increasing merger and acquisition strategies by major players in the region are anticipated to expand the oxygen-free copper market reach during the forecast period.

Key Market Players and Competitive Insights

Strategic Initiatives by Market Players to Drive Competition

The oxygen-free copper market is consolidated. The growing technological advancements in oxygen-free copper production positively impact the global market. Ongoing activities of market players such as expansions, partnerships, and mergers & acquisitions fuel competition in the market. For instance, in December 2023, PT. Smelting ("PTS"), a subsidiary of Mitsubishi Materials, expanded its processing capacity of the copper concentrate at its Gresik Smelter & Refinery in the Gresik District, Indonesia.

Major Players Operating in Global Oxygen-Free Copper Market

- Copper Braid Products

- Cupori

- Hitachi Metals Neomaterial, Ltd.

- Hussey Copper

- Metrod Holdings Berhad

- Mitsubishi Materials Corporation

- Sam Dong

- Southwire Company, LLC

- Wieland

- Zheijang Libo Holding Group Co., Ltd.

Recent Developments in Industry

- In October 2023, SK Nexilis Co., a global copper foil maker, launched commercial production at its first overseas facility in Kota Kinabalu, Malaysia. The plant, featuring the world's largest copper foil production lines, was inaugurated for diverse rechargeable battery applications.

- In February 2024, Incus GmbH, based in Vienna, Austria, announced the production of 99.9% pure copper material after a year of research and development. This new material, created using advanced lithography-based metal manufacturing techniques, achieved 92% of the conductivity of conventionally produced copper.

Oxygen-Free Copper Market Segmentation

By Grade Outlook (USD billion, 2019–2032)

- Cu-OF

- Cu-OFE

By Product Outlook (USD billion, 2019–2032)

- Wires

- Strips

- Busbars & Rods

- Other Products

By Application Outlook (USD billion, 2019–2032)

- Electrical & Electronics

- Automotive

- Other Applications

By Regional Outlook (USD billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Coverage

The oxygen-free copper market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, it covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, grade, product, application, and their futuristic growth opportunities.

Oxygen-Free Copper Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 31.64 billion |

|

Revenue Forecast by 2032 |

USD 49.83 billion |

|

CAGR |

5.8% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The oxygen-free copper market size was valued at USD 29.92 billion in 2023 and is projected to grow to USD 49.83 billion by 2032.

The global market is projected to register a CAGR of 5.8% during 2024–2032.

Asia Pacific accounted for the largest share of the global market in 2023.

A few key players in the market are Copper Braid Products; Cupori; Hitachi Metals Neomaterial, Ltd.; Hussey Copper; Metrod Holdings Berhad; Mitsubishi Materials Corporation; Sam Dong; Southwire Company, LLC; Wieland; and Zheijang Libo Holding Group Co., Ltd.

The Cu-OF segment is anticipated to experience substantial growth with a significant CAGR in the global market during the forecast period. This growth is attributed to the exceptional conductivity, purity, and overall performance of Cu-OF

The electrical & electronics segment accounted for the largest revenue share of the market in 2023 due to an increase in demand for durable and advanced consumer electronics.