Over-The-Top Video Market Size, Share, Trends, Industry Analysis Report: Information By Devices (Mobile Devices, Laptop, Desktops, Set-Top Box, and Gaming Consoles), Revenue Model, Deployment Model, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 120

- Format: PDF

- Report ID: PM1452

- Base Year: 2024

- Historical Data: 2020-2023

Over-The-Top Video Market Overview

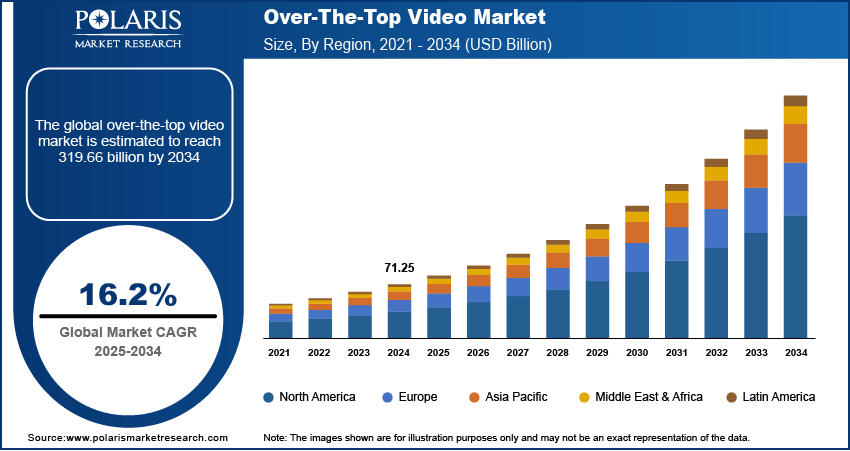

Global over-the-top video market size was valued at USD 71.25 billion in 2024. The market is projected to grow from USD 82.70 billion in 2025 to USD 319.66 billion by 2034, exhibiting a compound annual growth rate of 16.2% during the forecast period.

Over-the-top (OTT) video refers to distributing visual media using the internet, rather than traditional cable or satellite pay-tv subscriptions. These services deliver video content directly to users, providing more affordability and efficiency in distribution. OTT platforms give consumers access to a wide variety of entertainment and infotainment media, such as videos and films, often offering the option to download content for offline viewing. The over-the-top video market growth is driven by several key factors such as continuous implementation of faster broadband services, customized content, and strategic collaborations.

The continuous improvement of faster broadband services has been crucial in improving connectivity and user experience across digital platforms. This ongoing implementation allows for faster data transmission, supports high-definition streaming, and enables seamless access to online content, driving technological progress and user satisfaction. Additionally, the over-the-top video market demand expanded during the COVID-19 pandemic due to the preference for uninterrupted entertainment during government-mandated lockdowns.

To Understand More About this Research: Request a Free Sample Report

The provision of personalized content has significantly enhanced the appeal of the OTT video market, leading to substantial revenue growth. Content producers are actively introducing diverse genres of new content to cater viewers’ varied demands. Collaborations between content producers and OTT platforms are becoming more frequent, resulting in exclusive and innovative content offerings. This strategic partnership approach not only enriches the content library but also enhances viewer engagement and satisfaction, thereby fostering a dynamic and competitive OTT marketplace.

Over-The-Top Video Market Dynamics

Rapidly Increasing OTT Platforms

The expanding online media and entertainment industry is attracting new local and international players. These new players are appearing from various traditional media services, such as broadcasters, network providers, rights holders, electronic device providers, connectivity providers, and many more. By offering subscription-based content streaming services, the new providers are bypassing the traditional cable and pay-TV options. Specialized streaming platforms for original content and live streaming are being introduced by providers such as NBCUniversal Media, LLC. Disney+, HBO, and other rights holder providers are also keeping their original content for their platforms. These growing new platform launches are anticipated to drive the over-the-top video market share.

Flexibility and Ease-of-Use

Viewership dynamics have altered the way customers watch videos and consume television content. Streaming services have brought home entertainment to consumers, allowing them to enjoy the content according to their comfort level, freedom, flexibility, and genre preference. Viewers are further provided with a lot of choices, with titles from multiple genres within the huge library to choose from at any given time. Owing to this flexibility and ease of use, viewers can have a seamless experience, driving the over-the-top video market growth.

Over-The-Top Video Market Segment Insights

Over-The-Top Video Market Assessment by Devices

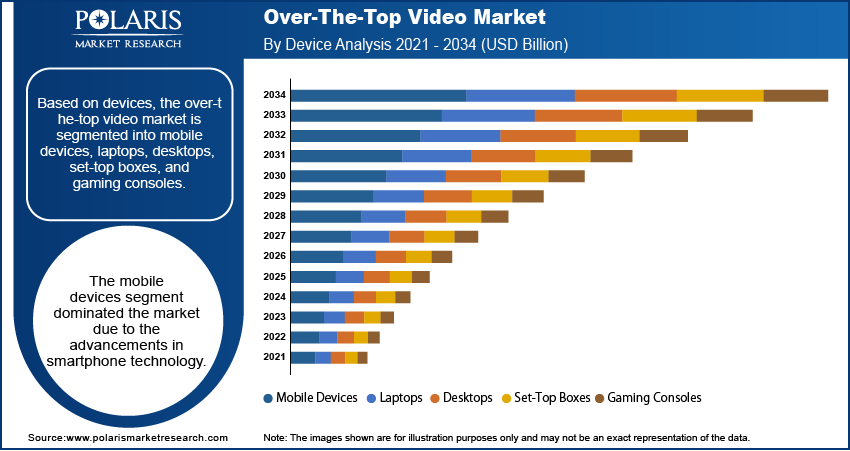

The over-the-top video market segmentation, based on devices, includes mobile devices, laptops, desktops, set-top boxes, and gaming consoles. In 2024, the mobile devices segment dominated the market. The advancements in smartphone technology, such as user-friendly interfaces, high-speed internet connectivity, and improved video streaming capabilities, have significantly improved the mobile viewing experience. In addition, the easy access to various apps, along with the rise of live video streaming and music platforms, has led to a significant increase in mobile video consumption. This trend is further supported by the growing affordability of smartphones and the availability of data plans with high-speed internet, making video streaming accessible to a wider audience. Netflix's focus on mobile features, including the introduction of mobile-only subscription tiers, has significantly contributed to the growth of the mobile device segment within the OTT video market. Additionally, the continuous enhancement of in-app experiences by OTT providers has led to increased subscriptions, further fueling market expansion.

Over-The-Top Video Market Evaluation by Revenue

The over-the-top video market segmentation, based on revenue, includes subscription video on demand (SVOD), transactional video on demand (TVOD), advertising video on demand (AVOD), and others. Advertising video on demand (AVOD) segment is expected to hold the largest over-the-top video market share during the forecast period. The model's appeal lies in its ability to offer a vast content library without subscription fees, attracting a large consumer base seeking free entertainment. Advertisers also benefit from this model, reaching a wide audience through targeted commercials. The combination of accessibility, affordability, and personalized advertising enhances user engagement. Furthermore, the increasing internet penetration has contributed to the expansion of the AVOD market.

Subscription video on demand (SVOD) segment is also expected to witness the fastest growth. This growth is due to its balanced value proposition for customers and companies. In March 2023, Forbes Home reported that approximately 78% of US households have at least one active subscription to streaming services. The COVID-19 pandemic led to a surge in subscriptions to SVOD platforms such as Amazon Prime Video, Netflix, and Disney+. This increase in subscribers strengthened the SVOD business model, which is characterized by a fixed pricing structure, and significantly expanded the customer base.

Over-The-Top Video Market Regional Insights

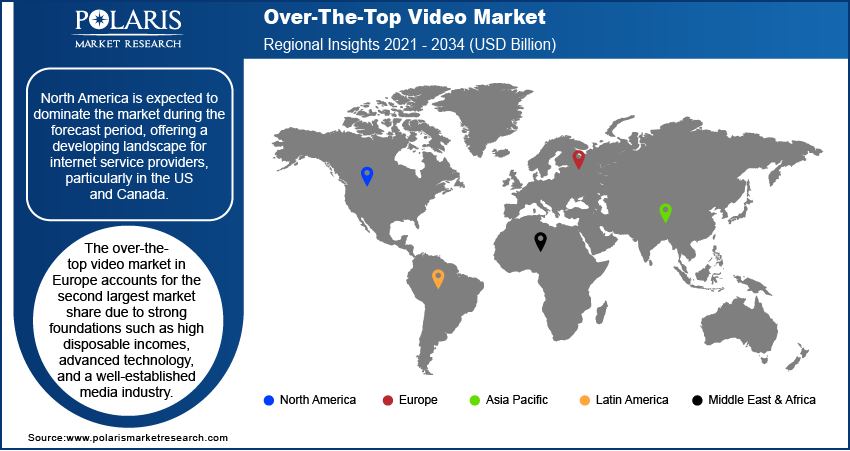

By region, the study provides over-the-top video market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is expected to dominate the market during the forecast period, offering a developing landscape for internet service providers, particularly in the US and Canada. Moreover, widespread internet and smartphone penetration create a vast market for these services. The region's high disposable income enables consumers to prioritize quality service, presenting opportunities for providers to offer premium packages and charge premium prices. The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the market during the forecast period.

The over-the-top video market in Europe accounts for the second largest market share due to the combination of factors. These include strong foundations such as high disposable incomes, advanced technology, and a well-established media industry. This has led to an increased demand for premium content and prompting OTT services. Germany is expected to be the fastest growing country in Europe. This growth is attributed to localized content and affordable subscriptions, which cater to a population seeking convenient entertainment options.

The over-the-top video market in Asia Pacific is expected to register the highest CAGR during the forecast period. China and India are actively acquiring new subscribers. Additionally, the region's increasing mobile video viewership is leading providers to adopt subscription models. This emphasis on affordability and smartphone accessibility is attracting new users, expanding the market growth.

Over-The-Top Video Market Key Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. In recent years, the over-the-top video industry has offered some technological advancements. Major players in the market include Microsoft Corporation; Yahoo Inc.; Amazon.com; Google Inc.; Netflix Inc.; Roku, Inc.; Hulu; Apple, Inc.; Akamai Technologies; Meta, Inc; Limelight Networks, Inc.; and Tencent Holdings Ltd.

Netflix is a leading streaming entertainment service that offers a wide range of original and licensed content, including shows, movies, documentaries, and international productions. It caters to a global audience and excels at localizing its offerings with affordable subscription plans. The company is committed to providing high-quality, exclusive programming and user-friendly features such as voice search and AI recommendations.

Yahoo has transformed into a global platform connecting millions of users. Their offerings include media (Yahoo Sports, Finance), technology (Yahoo Mail), and business solutions. Recently, they acquired Artifact, an AI-powered news app, to personalize news discovery for users. This showcases Yahoo's commitment to innovation and technology.

Key Companies in Over-The-Top Video Market

- Akamai Technologies

- Amazon.com

- Apple, Inc.

- Google Inc.

- Hulu

- Limelight Networks, Inc.

- Meta, Inc

- Microsoft Corporation

- Netflix Inc.

- Roku, Inc.

- Tencent Holdings Ltd.

- Yahoo Inc.

Over-The-Top Video Market Developments

May 2024: Netflix's ad chief, Amy Reinhard, announced an in-house ad tech platform launch by year-end 2025. This empowers advertisers with innovative buying methods, deeper insights, and effective impact measurement. It reflects Netflix's commitment to elevate its ad-supported tier and offer superior value to advertisers.

June 2022: Amazon Prime Video partnered with AMC Networks to expand its content library in India. This collaboration provides Indian viewers with ad-free access to AMC+ and Acorn TV (AMC's streaming service) through subscription options on Prime Video Channels.

April 2021: Apple partnered with SK Telecom, South Korea's top carrier, to offer Apple TV+ streaming to their customers, aiming to expand its reach through an established platform.

Over-The-Top Video Market Segmentation

By Devices Outlook

- Mobile Devices

- Laptops

- Desktops

- Set-Top Boxes

- Gaming Consoles

By Revenue Model Outlook

- Subscription Video on Demand (SVOD)

- Transactional Video on Demand (TVOD)

- Advertising Video on Demand (AVOD)

- Others

By Deployment Model Outlook

- On-Premise

- Cloud-Based

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Over-The-Top Video Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 71.25 billion |

|

Market Size Value in 2025 |

USD 82.70 billion |

|

Revenue Forecast in 2032 |

USD 319.66 billion |

|

CAGR |

16.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

FAQ's

• The global over-the-top video market size was valued at USD 71.25 billion in 2024 and is expected to reach to USD 319.66 billion by 2034.

• The global market is projected to register at a CAGR of 16.2% during the forecast period, 2025–2034.

• North America had the largest share of the global market.

• The key players in the market are Microsoft Corporation; Yahoo Inc.; Amazon.com; Google Inc.; Netflix Inc.; Roku, Inc.; Hulu; Apple, Inc.; Akamai Technologies; Meta, Inc; Limelight Networks, Inc.; and Tencent Holdings Ltd.

• The mobile devices dominated the market in 2024.

• The AVOD had the largest share in the global market.