Over the Top Market Size, Share, Trends, Industry Analysis Report: By Type (Video Streaming, Music Streaming, Gaming Platforms, and Communication Services), Device Type, Revenue Model, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM3124

- Base Year: 2024

- Historical Data: 2020-2023

Over the Top Market Overview

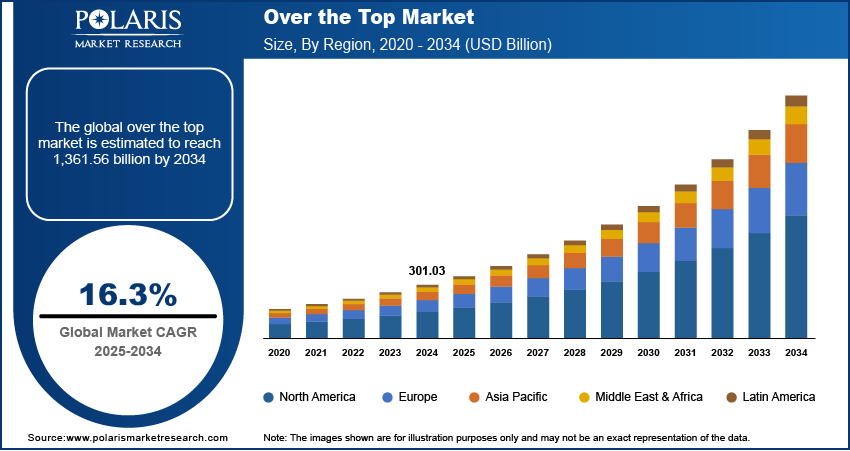

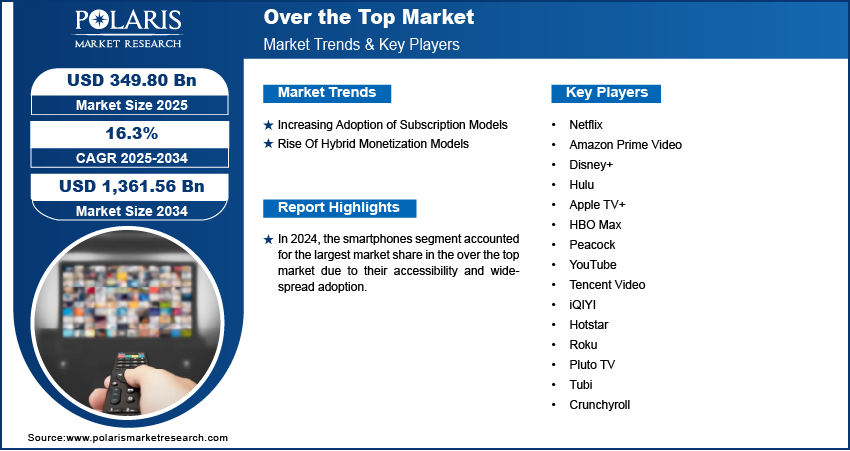

The global over the top market size was valued at USD 301.03 billion in 2024. The market is expected to grow from USD 349.80 billion in 2025 to USD 1,361.56 billion by 2034, exhibiting a CAGR of 16.3% from 2025 to 2034.

The over the top (OTT) market involves the delivery of video, audio, and other digital media content directly to consumers via the Internet, bypassing traditional cable, satellite, and broadcast platforms.

Increasing internet penetration, the proliferation of smart devices, and changing consumer preferences toward on-demand content consumption are a few of the key factors driving the over the top market expansion. The growing adoption of subscription-based models, such as Netflix, Disney+, and Amazon Prime, which offer diverse content libraries catering to various demographics, is fueling market growth. The expanding availability of free and ad-supported streaming platforms, which attract cost-conscious users globally, is also propelling the demand for OTT.

To Understand More About this Research: Request a Free Sample Report

The rollout of 5G networks has revolutionized the OTT market by providing faster and more stable internet connectivity, enabling seamless high-definition streaming, and reducing buffering issues. The growing number of OTT platforms supported by advertisements has made premium content accessible to a broader audience, contributing significantly to market expansion.

Over the Top Market Dynamics

Increasing Adoption of Subscription Models

Several leading OTT companies offer tailored content packages to meet diverse consumer needs. The subscription video on demand (SVOD) model, for instance, utilized by players such as Netflix and Hulu, provides users with ad-free access to an extensive range of content for a fixed monthly fee. This shift toward SVOD is driven by the growing demand for convenience, flexibility, and diverse content across genres, languages, and regions. Furthermore, subscription services have leveraged exclusive original programming to gain a competitive edge, attracting millions of subscribers globally. For instance, Netflix’s investment in region specific content, such as "Squid Game" from South Korea, has demonstrated the power of local programming in driving global subscriptions. Additionally, flexible payment options and mobile-friendly subscription plans have expanded the reach of OTT services, particularly in emerging markets. Thus, the rising adoption of subscription-based OTT platforms is driving the over the top market growth.

Rise Of Hybrid Monetization Models

The rise of hybrid monetization models that combine subscription and ad-supported revenue streams, such as platforms like Hulu and Peacock, is driving the over the top market development. This model benefits users by providing cost-effective options, while enabling providers to maximize their revenue streams. For instance, Hulu’s ad-supported tier allows advertisers to target specific audiences based on viewing habits, while premium subscribers enjoy an ad-free experience. The adoption of hybrid models is also fueled by increased competition among OTT platforms, which necessitates innovative strategies to attract and retain users.

Over the Top Market Segment Insights

Over the Top Market Assessment by Type Outlook

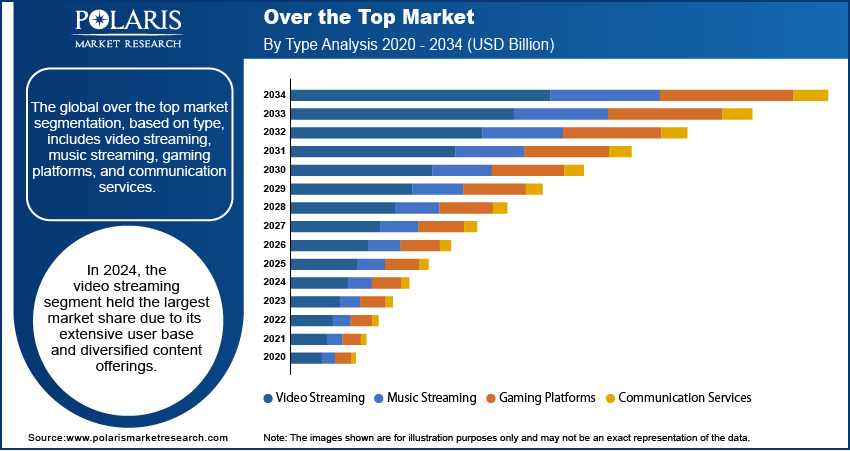

The global over the top market segmentation, based on type, includes video streaming, music streaming, gaming platforms, and communication services. In 2024, the video streaming segment held the largest market share due to its extensive user base and diversified content offerings. Platforms like Netflix, Amazon Prime, and Disney+ have capitalized on the rising demand for on-demand video content. In addition, increasing investments in original programming, including series, movies, and documentaries, have contributed to the video streaming segment’s growth. Furthermore, a focus on regional content has expanded the appeal of video streaming in non-English-speaking markets. For instance, Amazon Prime’s strategy of producing regional-language content in India has significantly boosted its subscriber base. The ability to stream high-definition and 4K content, enabled by advancements in internet technology and device compatibility, has further fueled the segmental growth.

Over the Top Market Evaluation by Device Type Outlook

The global over the top market segmentation, based on device type, includes smartphones, smart TVs, laptops/tablets, and gaming consoles. In 2024, the smartphones segment accounted for the largest market share due to its accessibility and widespread adoption. The proliferation of affordable smartphones and data plans, particularly in developing economies, has made OTT services accessible to a larger audience. Additionally, platforms have optimized their apps for mobile viewing, offering features like offline downloads and mobile-only subscription plans, catering to on-the-go users and contributing to the segment’s dominance in the global market.

Over the Top Market Regional Analysis

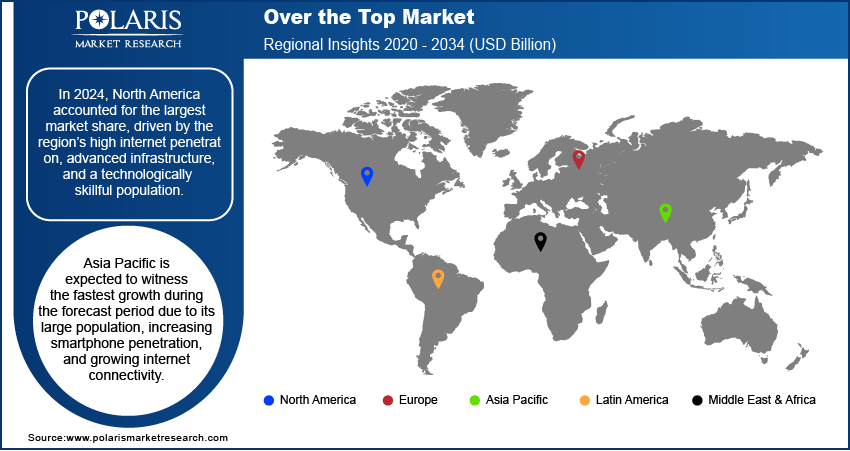

By region, the study provides over the top market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the region's high internet penetration, advanced infrastructure, and a technologically skillful population. The presence of major OTT players such as Netflix, Hulu, and Disney+ further propels the region's dominant position. The region also benefits from higher disposable income levels, which support the adoption of multiple subscriptions per household. For instance, 98 percent of Americans have subscriptions to at least one OTT platform. The integration of artificial intelligence (AI) and machine learning to personalize content has further enhanced user satisfaction, driving regional market growth.

The Asia Pacific over the top market is expected to witness the fastest growth during the forecast period, driven by the region’s large population, increasing smartphone penetration, and growing internet connectivity. For instance, as reported by the National Informatics Centre in November 2022, broadband subscriptions have increased from 60 million to a substantial 810 million in India, indicating a significant expansion in internet infrastructure and accessibility. Similarly, the number of smartphone users has increased dramatically from 150 million to 750 million in India, showcasing the rapid adoption of mobile technology and the growing reliance on mobile internet services. Furthermore, countries such as India, China, and Southeast Asia have emerged as key growth drivers due to their expanding middle class and rising demand for affordable entertainment options. Regional platforms like Hotstar and iQIYI have capitalized on local content preferences, making them formidable competitors to global players.

Over the Top Market – Key Players and Competitive Insights

The competitive landscape of the over the top market is characterized by their extensive content libraries, technological innovation, and strategic regional expansions. Netflix leads with its diverse global content and investment in original programming, while Amazon Prime leverages its ecosystem of services for subscriber retention. Disney+ has rapidly gained market share with its exclusive franchises like Marvel and Star Wars. Platforms like Hulu and HBO Max excel in hybrid monetization models, attracting diverse user bases. Regional players such as Hotstar and Tencent Video have secured leadership in local markets through culturally relevant content. Collectively, these companies have established a competitive edge by addressing varying consumer demands and adopting advanced analytics for content personalization.

Netflix, headquartered in California, US, was founded in 1997. The company’s product portfolio includes a vast range of original series, films, documentaries, and licensed content across multiple genres and languages. Its services focus on subscription-based video streaming, offering ad-free content globally. Netflix’s dominance stems from its significant investments in original programming, such as "Stranger Things" and "The Crown," and its ability to provide diverse regional markets with localized content. In May 2024, Netflix launched an ad-supported tier to attract cost-conscious users and expand its market share further. The company's advanced AI-driven recommendation algorithms have enhanced user engagement.

Amazon Prime Video, launched in 2006, operates under Amazon.com and is headquartered in Washington, US. The platform provides on-demand video streaming services, including original content like "The Boys" and "Fleabag," and an extensive library of films and series. Additionally, Prime Video integrates with Amazon Prime membership, adding value through bundled services like free shipping to its standalone offerings. The company’s recent development includes expanding its regional content library, particularly in India and Latin America, to capture emerging markets. Amazon's adoption of advanced streaming technologies and partnerships with local creators has solidified its position in the global OTT market.

List of Key Companies in Over the Top Market

- Amazon Prime Video

- Apple TV+

- Crunchyroll

- Disney+

- HBO Max

- Hotstar

- Hulu

- iQIYI

- Netflix

- Peacock

- Pluto TV

- Roku

- Tencent Video

- Tubi

- YouTube

Over the Top Industry Developments

In January 2025, Astro launched Free Ad-supported Streaming Television (FAST) channels on both Over-the-Top (OTT) and Direct-to-Home (DTH) platforms, leveraging AWS Elemental Media Tailor for active ad insertion and enhanced viewer engagement.

In May 2024, Netflix launched a new slate of unscripted series, solidifying its global unscripted content sector. The expansion of the Netflix Reality Universe features both new and returning shows, as well as interactive formats based on popular franchises, aimed at boosting viewer engagement.

In November 2023, Winter Television Critics Association press tour, Apple TV+ presented a preview of its upcoming original content and returning series, scheduled for global release in spring and summer 2024, emphasizing its strategy to broaden audience appeal and maintain engagement.

Over the Top Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Video Streaming

- Music Streaming

- Gaming Platforms

- Communication Services

By Device Type Outlook (Revenue – USD Billion, 2020–2034)

- Smartphones

- Smart TVs

- Laptops/Tablets

- Gaming Consoles

By Revenue Model Outlook (Revenue – USD Billion, 2020–2034)

- Subscription-Based (SVOD)

- Advertising-Based (AVOD)

- Transaction-Based (TVOD)

- Freemium

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Media and Entertainment

- Education and E-Learning

- Fitness and Wellness

- Online Shopping

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Over the Top Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 301.03 billion |

|

Market Size Value in 2025 |

USD 349.80 billion |

|

Revenue Forecast by 2034 |

USD 1,361.56 billion |

|

CAGR |

16.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global over the top market size was valued at USD 301.03 billion in 2024 and is projected to grow to USD 1,361.56 billion by 2034.

• The global market is projected to grow at a CAGR of 16.3% during the forecast period.

• In 2024, North America accounted for the largest market share due to the region's high internet penetration, advanced infrastructure, and a technologically skillful population.

• Some of the key players in the market are Netflix, Amazon Prime Video, Disney+, Hulu, Apple TV+, HBO Max, Peacock, YouTube, Tencent Video, iQIYI, Hotstar, Roku, Pluto TV, Tubi, and Crunchyroll.

• In 2024, the video streaming segment held the largest market share due to its extensive user base and diversified content offerings.

• In 2024, the smartphones segment accounted for the largest market share due to their accessibility and widespread adoption.