Over-The-Top Devices and Services Market Size, Share, Trends, Industry Analysis Report: By Content (VOIP, Video, and Text and Image), Devices, Services, Revenue Model, Deployment Model, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 118

- Format: PDF

- Report ID: PM1420

- Base Year: 2024

- Historical Data: 2020-2023

Over-The-Top Devices and Services Market Overview

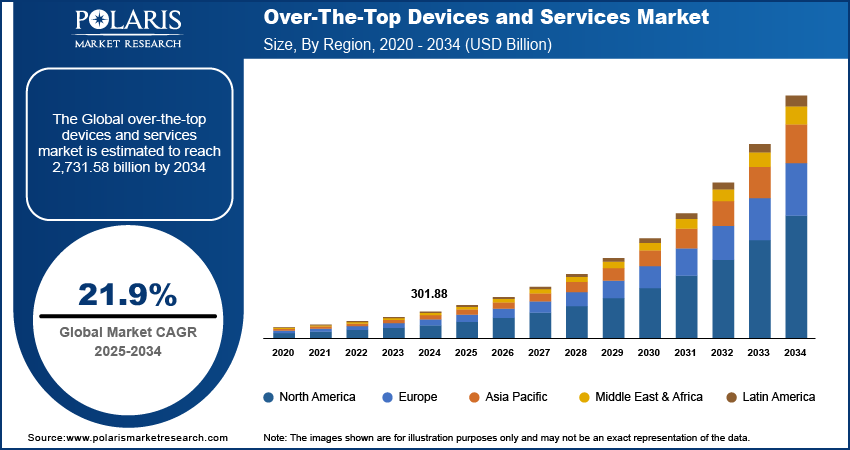

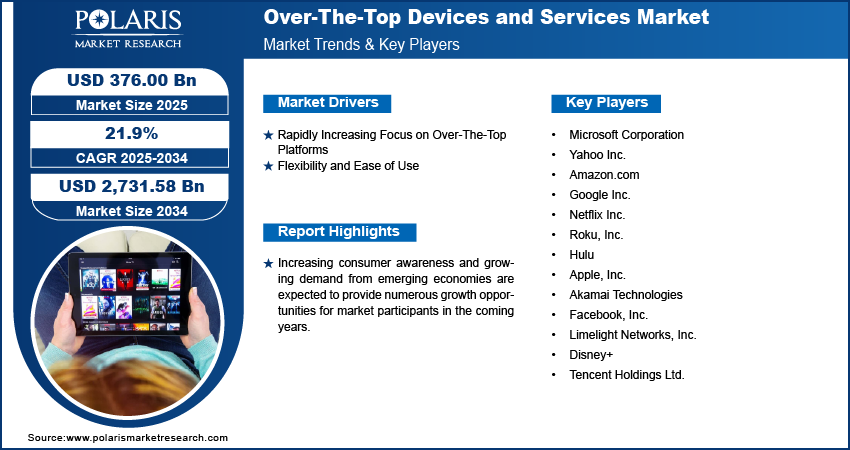

The global over-the-top devices and services market size was valued at USD 301.88 billion in 2024. The market is projected to grow from USD 376.00 billion in 2025 to USD 2,731.58 billion by 2034. It is projected to exhibit a CAGR of 21.9% from 2025 to 2034.

Over-the-top (OTT) platforms deliver content, services, and applications through the internet. OTT services provide film and TV content without requiring users to subscribe to traditional cable or satellite pay-TV services. The over-the-top (OTT) devices and services market operates through three different revenue models—subscription-based services, free and ad-supported services, and transactional services that allow users to pay for individual pieces of content.

To Understand More About this Research: Request a Free Sample Report

The rising adoption of device-based computing and increasing penetration of broadband infrastructure are driving the OTT devices and services market growth. The availability of affordable OTT devices and services encourages consumers to adopt them for a personalized experience. The expansion of the media and entertainment industry, especially in Asia Pacific, further supports the market growth. Additionally, rising disposable incomes and improving living standards boost the over-the-top devices and services market demand.

Rising focus on technological advancements, increasing purchasing power of consumers, and growing demand for online content are among the key trends anticipated to drive the over-the-top devices and services market expansion. Increasing consumer awareness and growing demand for emerging economies are expected to provide numerous growth opportunities for market participants in the coming years.

Over-The-Top Devices and Services Market Dynamics

Rapidly Increasing Availability of Over-The-Top Platforms

The growing media & entertainment industry is attracting regional and global players. These new players are emerging from various traditional media services, such as broadcasters, network providers, right holders, and connectivity providers. They are using digital solutions over traditional media channels to deliver content. Also, they are providing subscription-based content streaming services to their users. For instance, providers such as Disney and NBCUniversal have introduced dedicated platforms featuring original content and live streaming. Similarly, right providers such as HBO are making content exclusive to their platforms. Thus, the rapidly increasing availability of OTT platforms drives the over-the-top (OTT) devices and services market development.

Flexibility and Ease of Use

The flexibility and ease of use offered by OTT devices and services act as a major contributor to the OTT devices and services market revenue. Viewership dynamics have transformed the way consumers seek and consume video content. In recent years, there has been a major shift from traditional TV viewership to online and OTT content consumption. OTT services allow users to choose content based on their preferred genre. Also, viewers can enjoy watching their favorite shows and other content anywhere, anytime. This, in turn, contributes to a highly seamless customer experience.

Over-The-Top Devices and Services Market Segment Insights

Over-The-Top Devices and Services Market Outlook by Revenue Model

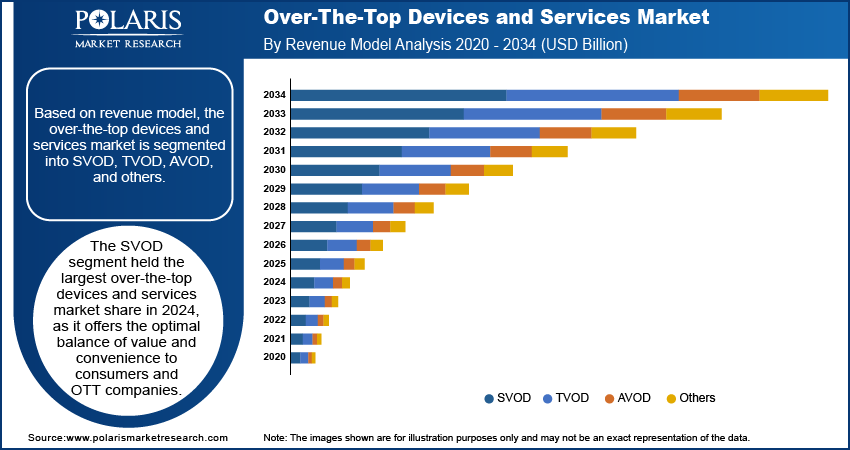

The over-the-top devices and services market segmentation, based on revenue model, includes SVOD, TVOD, AVOD, and others. The SVOD segment held the largest over-the-top devices and services market share of 58.1% in 2024. The SVOD model requires users to pay a subscription fee to access content. It is often considered convenient as users can access a large library of content on an internet-connected device. This optimal balance of value and convenience offered by the SVOD model to the company and the customer primarily drives the segment growth.

Over-The-Top Devices and Services Market Evaluation by Devices

The over-the-top devices and services market segmentation, based on devices, includes mobile devices, laptops and desktops, set top box, and gaming consoles. The mobile devices segment accounted for a significant market share of 33% in 2024. Continuous innovations in mobile devices such as smartphones have led to the creation of advanced apps that facilitate seamless access to music, videos, and live content. Also, the significant surge in mobile viewership worldwide has prompted OTT providers to prioritize mobile features and introduce flexible subscription plans to cater to the varying viewer needs.

Over-The-Top Devices and Services Market Regional Analysis

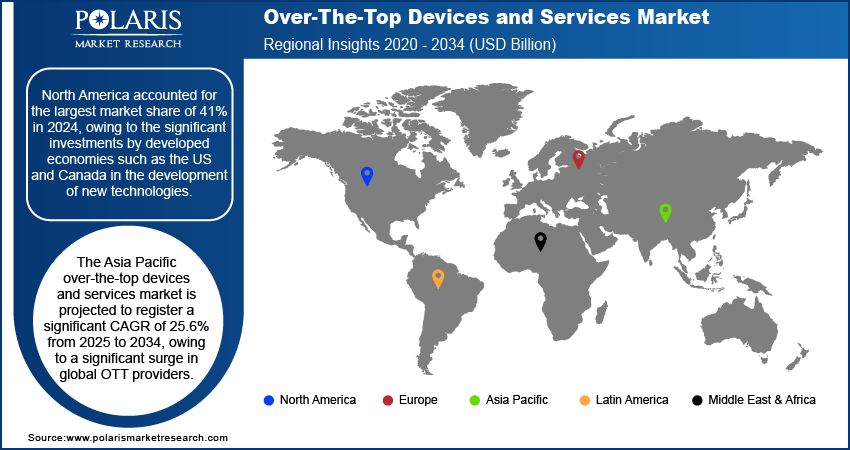

The market report offers OTT devices and services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest market share of 41% in 2024. The regional market growth is primarily fueled by significant investments made by developed economies such as the US and Canada in the development of new technologies. Also, a high level of internet and smartphone penetration is anticipated to have a positive impact on the market growth in the region.

The Asia Pacific OTT devices and services market is projected to register a significant CAGR of 25.6% from 2025 to 2034. The region has witnessed a significant surge in global OTT providers, aiming to take advantage of the growing popularity of subscription OTT among consumers. The implementation of mobile-based subscription models to cater to the rising mobile video viewership is also anticipated to create lucrative growth opportunities for the Asia Pacific market during the forecast period.

Over-The-Top Devices and Services Market – Key Players and Competitive Insights

The over-the-top devices and services market is characterized by intense competition. It has the presence of several leading companies and emerging players. The key market players are making significant investments in R&D to improve their OTT offerings. Also, they are undertaking several strategic initiatives, such as mergers and acquisitions, partnerships, and collaborations, to expand their global reach.

In recent years, the over-the-top devices and services market has witnessed several technological and innovation breakthroughs. The study includes a competitive analysis report covering all the major market players such as Microsoft Corporation; Yahoo Inc.; Amazon.com; Google Inc.; Netflix Inc.; Roku, Inc.; Hulu; Apple, Inc.; Akamai Technologies; Facebook, Inc.; Limelight Networks, Inc.; Disney+; and Tencent Holdings Ltd.

List of Key Companies in Over-The-Top Devices and Services Market

- Microsoft Corporation

- Yahoo Inc.

- Amazon.com

- Google Inc.

- Netflix Inc.

- Roku, Inc.

- Hulu

- Apple, Inc.

- Akamai Technologies

- Facebook, Inc.

- Limelight Networks, Inc.

- Disney+

- Tencent Holdings Ltd.

Over-The-Top Devices and Services Industry Developments

February 2024: Amazon Prime Video introduced the Explicit Streaming Language of Preference feature to enable personalization of the homepage for preferred languages. With the new feature, Prime Video’s Indian customers have the option to choose up to five languages from languages.

September 2023: Disney+ announced its expansion into ten new countries, including New Zealand, Australia, and South Korea. Disney+ stated that its services will be available in 60+ countries with the expansion.

Over-The-Top Devices and Services Market Segmentation

By Content Outlook

- VOIP

- Video

- Text and Image

By Devices Outlook

- Mobile Devices

- Laptops and Desktops

- Set Top Box

- Gaming Consoles

By Services Outlook

- Consulting

- Managed Services

- Installation and Maintenance

- Training and Support

By Revenue Model Outlook

- SVOD

- TVOD

- AVOD

- Others

By Deployment Model Outlook

- On-Premise

- Cloud-Based

By End Users Outlook

- BFSI

- Healthcare

- Media and Entertainment

- IT and Telecom

- Retail

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Over-The-Top Devices and Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 301.88 billion |

|

Market Size Value in 2025 |

USD 376.00 billion |

|

Revenue Forecast by 2034 |

USD 2,731.58 billion |

|

CAGR |

21.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 301.88 billion in 2024 and is projected to grow to USD 2,731.58 billion by 2034.

The market is projected to register a CAGR of 21.9% from 2025 to 2034.

North America accounted for the largest market share in 2024.

Microsoft Corporation; Yahoo Inc.; Amazon.com; Google Inc.; Netflix Inc.; Roku, Inc.; Hulu; Apple, Inc.; Akamai Technologies; Facebook, Inc.; Limelight Networks, Inc.; Disney+; and Tencent Holdings Ltd are a few key players in the market.

The SVOD segment accounted for the largest market share in 2024.

The mobile devices segment dominated the market share in 2024.