Outdoor Power Equipment Market Size, Share, Trends, Industry Analysis Report

: By Product (Lawn Mowers, Chainsaws, Trimmers & Edgers, Blowers, and Snow Throwers), Power Source, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM1755

- Base Year: 2024

- Historical Data: 2020-2023

Outdoor Power Equipment Market Overview

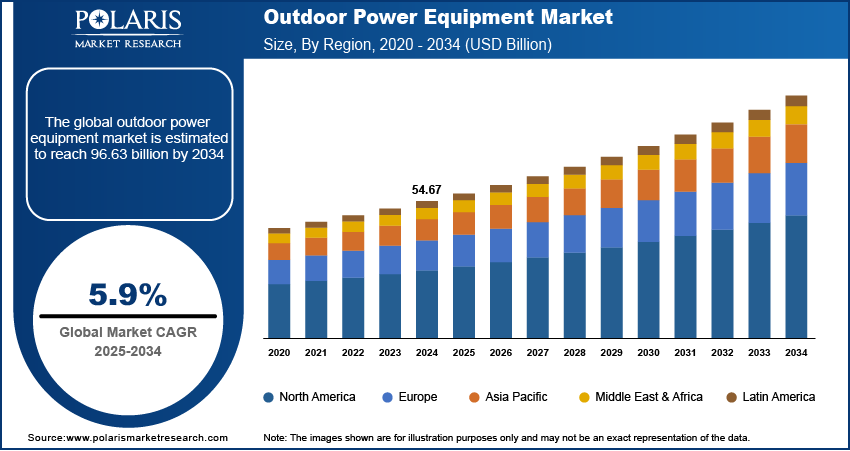

The global outdoor power equipment market size was valued at USD 54.67 billion in 2024. The market is projected to grow from USD 57.78 billion in 2025 to USD 96.63 billion by 2034, exhibiting a CAGR of 5.9% during 2025–2034.

The global outdoor power equipment (OPE) includes tools and machines powered by gas, electricity, or batteries designed for outdoor activities such as gardening, forestry, and construction. The tools include lawn mowers, chainsaws, blowers, trimmers, and snowblowers, catering to residential and commercial sectors. The outdoor power equipment market demand is driven by advancements in cordless and battery-powered technologies and rising disposable incomes. Additionally, increased awareness of eco-friendly solutions has propelled the adoption of electric and hybrid equipment.

The increasing infrastructure development across the world is propelling the global outdoor power equipment (OPW) market growth. According to a report published by the Ministry of Information & Broadcasting of India, since 2014, there has been a 500% increase in the road transport and highway budget allocation in India. Large-scale construction projects and the expansion of public spaces such as parks, highways, and recreational areas necessitate the use of powerful and efficient equipment such as lawnmowers, trimmers, blowers, and chainsaws, which boost the outdoor power equipment market revenue. Municipalities and governments usually invest in OPE to maintain public spaces and ensure compliance with environmental standards.

To Understand More About this Research: Request a Free Sample Report

Outdoor Power Equipment Market Driver Analysis

Growing Urbanization Worldwide

The outdoor power equipment market demand is driven by a surge in urbanization worldwide. As per the data published by the United Nations, 55% of the world's population lives in urban areas, and is expected to increase to 68% by 2050. Urban areas require well-maintained residential and commercial spaces to enhance aesthetic appeal and functionality. This drives homeowners and property managers to invest in efficient outdoor power tools such as lawnmowers, trimmers, and leaf blowers for upkeep. Additionally, the rise of compact urban gardens and green initiatives creates a need for specialized power equipment to maintain these spaces effectively. Therefore, the demand for outdoor power equipment increases with the growing urbanization.

Rising Technological Advancements in OPE

Manufacturers of outdoor power equipment are incorporating features such as battery-powered systems, smart controls, and lightweight material designs that appeal to consumers. Enhanced performance, reduced noise levels, and longer runtimes attract professionals and homeowners seeking reliable equipment for various outdoor tasks. Advancement in technology further drives innovation in automated solutions, such as robotic lawn mowers, to offer convenience and precision, which is encouraging potential consumers to invest in these advanced outdoor power equipment. Hence, the rising technological advancements in OPE are propelling the outdoor power equipment market expansion.

Outdoor Power Equipment Market Segment Analysis

Outdoor Power Equipment Market Evaluation by Product

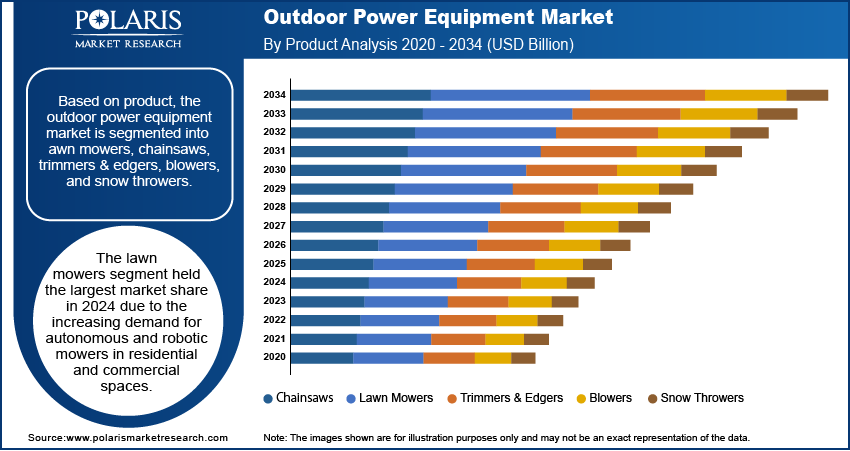

Based on product, the outdoor power equipment market is categorized into lawn mowers, chainsaws, trimmers & edgers, blowers, and snow throwers. The lawn mowers segment held the largest market share in 2024 due to the increasing demand for autonomous and robotic mowers in residential and commercial spaces. Consumers and businesses are moving toward these solutions as they offer convenience, efficiency, and compatibility with smart systems.

Outdoor Power Equipment Market Insight by Application

In terms of application, the outdoor power equipment market is divided into residential, commercial, and public & municipal. The residential segment accounts for the largest market share in 2024 due to homeowners' continuous investments in maintaining their gardens and outdoor spaces, particularly during the pandemic-induced home improvement activities.

Outdoor Power Equipment Market Regional Insights

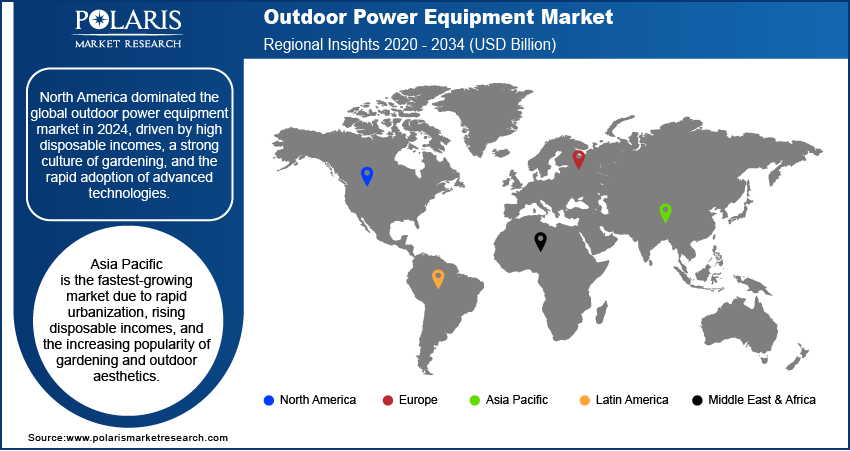

By region, the report provides the outdoor power equipment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024, driven by high disposable incomes, a strong culture of gardening, and the rapid adoption of advanced technologies. The US is a major contributor to this dominance, with consumers increasingly opting for eco-friendly, smart, and cordless equipment. The country's established infrastructure and preference for premium outdoor tools further fueled the outdoor power equipment market expansion in the region.

The market in Asia Pacific is expected to grow at a rapid pace during the forecast period due to rapid urbanization, rising disposable incomes, and the increasing popularity of gardening and outdoor aesthetics. As per the data published by the Asia Development Bank, more than 55% of the population of Asia will be urban by 2023. China accounted for a major share in the regional growth, driven by government initiatives promoting green spaces and public parks. The country’s large middle-class population and growing preference for affordable and innovative solutions have further accelerated the demand for outdoor power equipment. These factors position Asia Pacific as a key region for market expansion.

Outdoor Power Equipment Market – Key Players and Competitive Analysis Report

Major market players are investing heavily in research and development to expand their offerings, which will contribute to the rising outdoor power equipment market revenue. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

Husqvarna Group, established in 1689, is a global manufacturer of outdoor power equipment known for its innovative solutions in forestry, gardening, and landscaping services. Originally founded as a weapons factory in Huskvarna, Sweden, the company has undergone significant transformations over the centuries, diversifying its product range to include sewing machines, motorcycles, and outdoor power tools. The company operates under a commitment to sustainability and user-centered design, making it a preferred choice for those who shape green spaces and urban environments. The outdoor power equipment segment of Husqvarna Group encompasses a broad range of products for various users, from homeowners to professional landscapers. The product lineup of the company includes chainsaws, trimmers, blowers, robotic lawnmowers, garden tractors, and zero-turn mowers.

Stanley Black & Decker, Inc., a prominent American manufacturer headquartered in New Britain, Connecticut, has emerged as a global company in the OPE sector. Formed from the merger of The Stanley Works and Black & Decker in 2010, the company has built a diverse portfolio that includes a wide range of tools, accessories, and outdoor equipment under well-known brands such as DeWALT, Black & Decker, Craftsman, and Cub Cadet. Stanley Black & Decker is committed to innovation and quality, serving professional tradespeople and DIY enthusiasts alike with a workforce of ∼50,000 employees and operations in over 60 countries.

Key Companies in Outdoor Power Equipment Market

- Ariens Company

- Briggs & Stratton, LLC

- Deere & Company

- Ego Power+

- Honda Motor Co., Ltd.

- Husqvarna Group

- Kubota Corporation

- Makita Corporation

- MTD Products Inc.

- Robert Bosch GmbH

- Stanley Black & Decker, Inc.

- STIHL Holding AG & Co. KG

- Techtronic Industries Co., Ltd.

- The Toro Company

- Yanmar Holdings Co., Ltd.

Outdoor Power Equipment Market Developments

September 2024: ECHO Incorporated, a manufacturer of high-performance outdoor power equipment for commercial and homeowner use, announced nine new products to their portfolio during their annual media event, Power-On-Athon 2024.

July 2023: Kress Commercial, a company that makes professional outdoor power equipment (OPE) and power tools for commercial landscaping and turf care, launched a line of powerful 60v outdoor power equipment with independent dealerships across North America.

January 2023: Caterpillar partnered with Positec Tool Corporation to produce a new line of Cat 60-volt outdoor power equipment. The new Cat OPE line is being made available through Lowes, Tractor Supply, Amazon, and other retailers.

Outdoor Power Equipment Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Lawn Mowers

- Chainsaws

- Trimmers & Edgers

- Blowers

- Snow Throwers

By Power Source Outlook (Revenue, USD Billion, 2020–2034)

- Gasoline-Powered

- Electric-Powered

- Battery-Powered

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Public & Municipal

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Outdoor Power Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 54.67 billion |

|

Market Forecast Value in 2025 |

USD 57.78 billion |

|

Revenue Forecast by 2034 |

USD 96.63 billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global outdoor power equipment market size was valued at USD 54.67 billion in 2024 and is projected to grow to USD 96.63 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are Deere & Company; Honda Motor Co., Ltd.; Husqvarna Group; STIHL Holding AG & Co. KG; Kubota Corporation; MTD Products Inc.; The Toro Company; Briggs & Stratton, LLC; Ariens Company; Robert Bosch GmbH; Makita Corporation; Stanley Black & Decker, Inc.; Techtronic Industries Co., Ltd.; Ego Power+; and Yanmar Holdings Co., Ltd.

The lawn mowers segment dominated the outdoor power equipment (OPE) market in 2024.