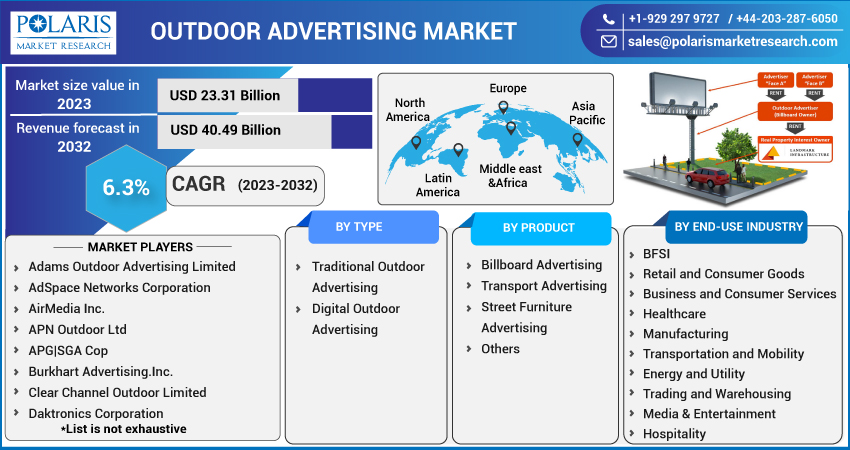

Outdoor Advertising Market Size, Share, & Industry Analysis Report

: By Type (Traditional Outdoor Advertising and Digital Outdoor Advertising), By Product, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: pdf

- Report ID: PM3022

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

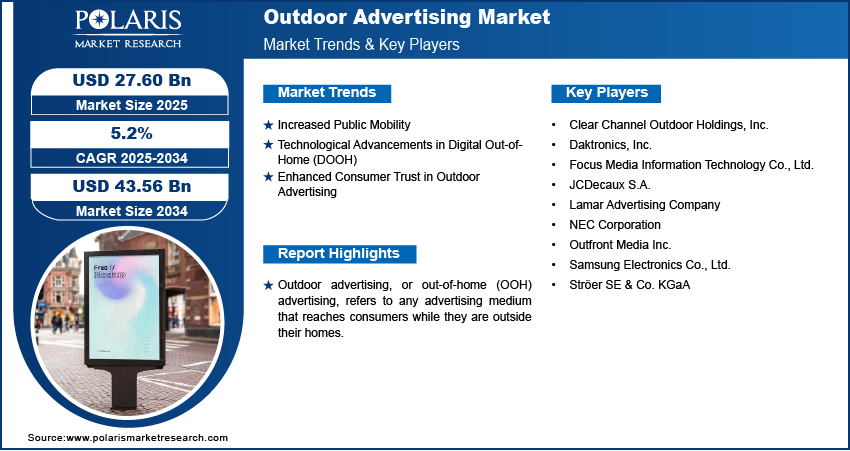

The outdoor advertising market size was valued at USD 26.30 billion in 2024, growing at a CAGR of 5.2% during 2025–2034. The market is driven by rising public mobility, increasing consumer trust, and technological advancements in dynamic digital out-of-home displays.

Key Insights

- Traditional outdoor advertising holds the largest market share because of its established infrastructure and consistent visibility in high-traffic locations.

- Billboard advertising leads in product share, as billboards are placed in prominent urban and roadside locations with high public visibility.

- Retail & consumer goods lead in end use, as businesses in this sector rely on outdoor advertising for broad brand visibility and promotion.

- North America leads the regional market due to mature infrastructure, strong advertiser presence, and high spending on outdoor advertising.

- Asia Pacific is the fastest-growing region, fueled by urban expansion, rising incomes, and rapid adoption of digital advertising technologies.

Industry Dynamics

- Increasing public mobility, driven by higher air travel and vehicle usage, expands exposure to outdoor ads along transit routes and in public spaces.

- Advances in digital out-of-home technology enable real-time content updates and interactivity, boosting advertiser engagement and campaign flexibility.

- Growing public trust in non-intrusive outdoor ads enhances brand credibility and makes OOH mediums a preferred choice for marketing strategies.

- Expanding DOOH deployment in emerging urban centers creates prime conditions for integrating dynamic digital campaigns into city infrastructure.

- High installation and maintenance costs of digital advertising infrastructure can discourage smaller businesses from adopting advanced DOOH solutions.

Market Statistics

2024 Market Size: USD 26.30 billion

2034 Projected Market Size: USD 43.56 billion

CAGR (2025–2034): 5.2%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Outdoor advertising, also known as out-of-home (OOH) advertising, encompasses any form of marketing that reaches consumers when they are outside their homes. This includes billboards, posters, transit advertising (ads on buses, trains, and taxis), street furniture advertising (ads on benches, bus stops, and kiosks), and digital signage. Unlike online advertising, which targets specific audiences, outdoor ads are seen by a broad and diverse group of people, increasing brand visibility and recognition. The effectiveness of outdoor advertising lies in its ability to reach a large audience with high-frequency messaging, making it a strategic way for businesses to enhance their marketing efforts.

The use of innovative digital out-of-home (DOOH) technology, such as digital billboards and interactive displays, allows for real-time content updates and more engaging campaigns. Consumers also tend to trust outdoor advertising more than digital ads, enhancing a brand's credibility. Furthermore, compared to digital video advertising, outdoor advertising offers broad reach with a stable investment, providing a compelling return on investment for businesses.

Market Dynamics

Increased Public Mobility

As more individuals commute, travel, and engage in outdoor activities, their exposure to outdoor advertising increases substantially. According to data from the Bureau of Transportation Statistics (BTS), in November 2023, the number of passenger enplanements on domestic flights in the US reached 77.1 million, indicating a strong recovery in air travel post-pandemic. Similarly, the Federal Highway Administration (FHWA) reported in 2023 that vehicle miles traveled in the US witnessed a notable increase compared to previous years, reflecting a sustained trend of higher on-road mobility. This heightened public movement ensures that outdoor advertisements reach a larger and more diverse audience, enhancing their effectiveness and making outdoor advertising a valuable component of marketing strategies. Therefore, increasing public mobility boosts the outdoor advertising market growth.

Technological Advancements in Digital Out-of-Home (DOOH) Advertising

Digital out-of-home (DOOH) advertising involves the use of digital displays to show dynamic and interactive content, offering greater flexibility and engagement compared to traditional static billboards. Research published in the Journal of Medical Internet Research in 2021 highlighted the increasing use of digital signage in public health messaging, demonstrating the versatility and impact of digital displays in reaching target audiences in real-time. The ability to update content remotely, display targeted advertisements based on time and location, and incorporate interactive elements enhances the effectiveness of outdoor campaigns. This technological evolution attracts more advertisers seeking dynamic and measurable advertising solutions. Thus, technological advancements in DOOH advertising drive the outdoor advertising market development.

Enhanced Consumer Trust in Outdoor Advertising

Outdoor advertising is often perceived as less intrusive and more credible than online advertising, where fatigue and concerns about data privacy are rising. A study published in the Public Health Nutrition journal in 2022, while focused on food marketing, noted the consistent exposure and recall of messages displayed in outdoor environments, suggesting a level of passive trust and acceptance by the public. Moreover, 31% of consumers say they trust OOH advertising, and 49% believe OOH is more trustworthy than social media, positioning OOH as a reliable space for brands to engage with audiences authentically. This trust stems from the non-intrusive nature of outdoor ads, which are a part of the physical environment rather than actively seeking personal data. The perception of outdoor advertising as a reliable and less invasive medium encourages businesses to allocate more of their advertising budgets to OOH. Hence, enhanced consumer trust in outdoor advertising compared to some digital formats propels the outdoor advertising market expansion.

Segment Insights

Market Assessment – By Type

The outdoor advertising market, by type, is segmented into traditional outdoor advertising and digital outdoor advertising. The traditional outdoor advertising segment holds the largest market share, due to the long-established presence and widespread infrastructure of traditional formats such as billboards, posters, and transit advertisements. These static forms of advertising benefit from their extensive reach and continuous visibility in high-traffic areas, making them a staple in many advertising campaigns.

The digital outdoor advertising segment is experiencing the highest growth rate. This rapid expansion is fueled by technological advancements that allow for dynamic content, enhanced audience engagement, and greater flexibility in advertising campaigns. Digital billboards, interactive displays, and digital transit screens offer advertisers the ability to update messages in real-time, target specific demographics at certain times, and even incorporate interactive elements.

Market Evaluation – By Product

The outdoor advertising market, by product, is segmented into billboard advertising, transport advertising, street furniture advertising, and others. The billboard advertising segment holds the largest share, primarily due to the extensive deployment of billboards in high-visibility locations along major roadways and in urban centers. Billboards offer a large format for impactful messaging and benefit from high exposure rates to a wide range of audiences, making them a foundational element in many outdoor advertising strategies.

The transport advertising segment is exhibiting the highest growth rate, driven by increasing urbanization and the rising use of public transportation. Advertisements displayed on buses, trains, subways, and in transit stations reach a large and often captive audience of commuters. Furthermore, the integration of digital technologies into transit advertising, such as digital screens in stations and on vehicles, enhances engagement and allows for dynamic content delivery.

Market Assessment – By End Use

The outdoor advertising market, by end use, is segmented into BFSI, retail & consumer goods, business & consumer services, healthcare, manufacturing, transportation & mobility, energy & utility, trading & warehousing, media & entertainment, and hospitality. The retail & consumer goods segment accounts for the largest share. This dominance is driven by the continuous need for businesses in this sector to maintain high visibility and brand awareness among a broad consumer base. Outdoor advertising provides an effective platform for reaching a large audience with promotional messages, new product launches, and brand-building campaigns, making it a crucial component of their overall marketing strategies.

The transportation & mobility segment is experiencing the highest growth rate, primarily due to the growing emphasis on reaching commuters and travelers in transit hubs and along transportation corridors. The integration of digital out-of-home (DOOH) advertising in airports, train stations, and on public transport vehicles offers dynamic and location-based advertising opportunities that are highly effective in engaging this mobile audience. This increasing focus on transit advertising, coupled with technological advancements, is driving the rapid growth of the transportation & mobility segment.

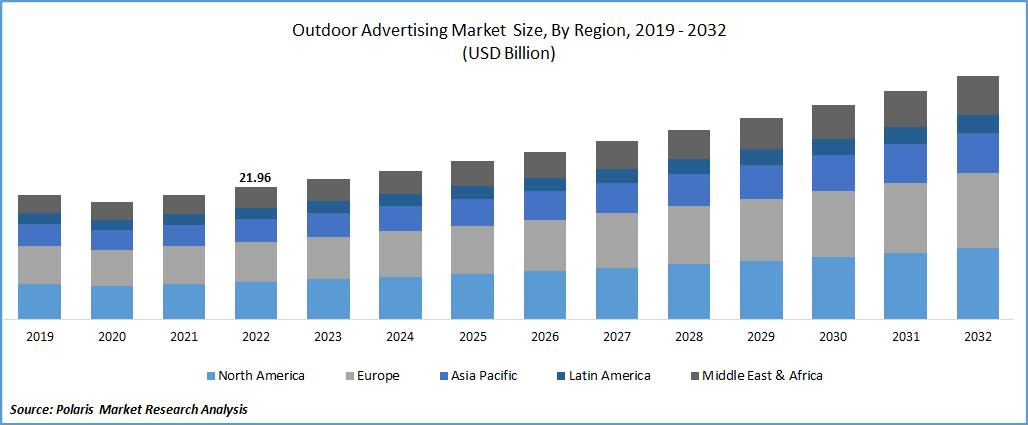

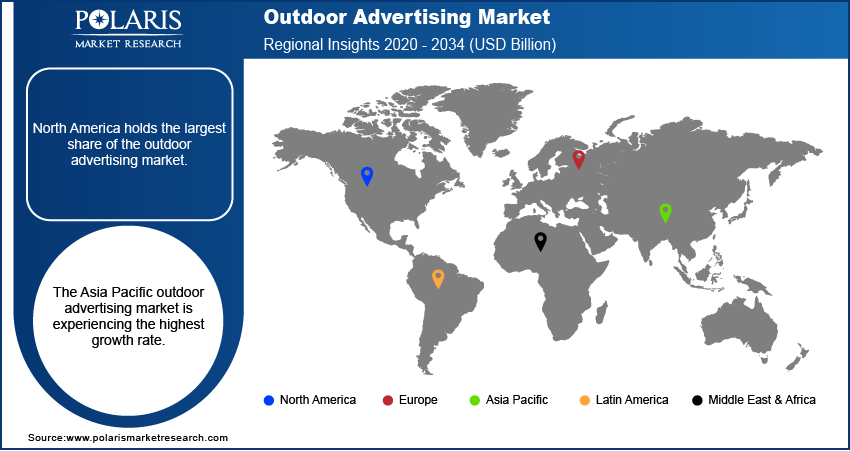

Regional Analysis

The outdoor advertising industry demonstrates varied penetration and growth across different geographical regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region's dynamics are influenced by factors such as economic development, urbanization rates, technological adoption, and the presence of key industry players. While established regions benefit from mature infrastructure and consistent advertising spending, emerging markets present significant growth opportunities driven by increasing consumerism and infrastructure development. The adoption of digital out-of-home (DOOH) technologies, along with podcast advertising and evolving advertising regulations play a crucial role in shaping the regional market landscapes.

North America holds the largest share of the market, due to the region's well-established advertising infrastructure, high levels of advertising expenditure, and the early adoption of various outdoor advertising formats. The presence of major global advertisers and sophisticated advertising agencies in North America contributes to the sustained demand for diverse outdoor advertising options, ranging from traditional billboards to advanced digital displays. The mature nature of the North American market and the consistent investment in out-of-home advertising maintain its leading position in terms of market share.

The Asia Pacific market is experiencing the highest growth rate, fueled by rapid urbanization, increasing disposable incomes, and a growing consumer base in countries such as China and India. The region is also witnessing significant investments in infrastructure development, including transportation and smart city projects, which create more opportunities for outdoor advertising deployment. Furthermore, the swift adoption of digital out-of-home (DOOH) technologies across the region is enhancing the effectiveness and appeal of outdoor advertising, making it a high-growth regional market.

Key Players and Competitive Insights

A few of the major players actively operating in the outdoor advertising industry include Clear Channel Outdoor Holdings, Inc. (Clear Channel Outdoor); Outfront Media Inc.; JCDecaux S.A.; Lamar Advertising Company; Ströer SE & Co. KGaA; oOh!media Limited; Focus Media Information Technology Co., Ltd.; Daktronics, Inc.; Samsung Electronics Co., Ltd. (for digital signage solutions); and NEC Corporation (for digital signage solutions). These companies offer a wide range of outdoor advertising solutions, including traditional billboards, digital out-of-home displays, transit advertising, and street furniture advertising, catering to diverse advertising needs across various geographies.

The competitive landscape of the market is characterized by a mix of large, multinational corporations and smaller, regional players. Competition is driven by factors such as the extent of advertising inventory, technological innovation in digital out-of-home (DOOH) offerings, geographic reach, and the ability to provide comprehensive advertising solutions. Key competitive strategies include expanding digital networks, offering data-driven targeting capabilities, and providing integrated advertising campaigns across multiple outdoor formats. Market insights suggest a growing emphasis on programmatic DOOH buying and the use of audience measurement technologies to enhance the effectiveness and accountability of outdoor advertising.

Clear Channel Outdoor Holdings, Inc. is headquartered in New York, USA. Their offerings encompass a broad spectrum of outdoor advertising formats, including billboards (both static and digital), street furniture, and transit advertising across North America and Europe. They provide advertisers with extensive reach and innovative digital solutions, making them a significant player in connecting brands with audiences in out-of-home environments.

JCDecaux S.A. is based in Plaisir, France. The company's offerings include a diverse range of outdoor advertising solutions such as city furniture (bus shelters, kiosks, and public benches), transport advertising (airports, metros, buses, and trams), and billboards. With a global presence, JCDecaux provides advertisers with strategically located advertising spaces in urban areas and transportation hubs, playing a key role in urban communication and brand visibility.

List of Key Companies

- Clear Channel Outdoor Holdings, Inc. (Clear Channel Outdoor)

- Daktronics, Inc.

- Focus Media Information Technology Co., Ltd.

- JCDecaux S.A.

- Lamar Advertising Company

- NEC Corporation

- Outfront Media Inc.

- Samsung Electronics Co., Ltd.

- Ströer SE & Co. KGaA

Outdoor Advertising Industry Developments

- January 2025: T-Mobile completed its acquisition of Vistar Media, a leading provider of programmatic technology for out-of-home (OOH) advertising. This acquisition signifies the increasing convergence of the telecommunications and advertising technology sectors, with a focus on enhancing digital out-of-home (DOOH) capabilities through real-time advertising and audience targeting.

- April 2024: oOh!media announced the rollout of a new digital advertising network across Woolworths Group's retail ecosystem. This expansion includes the installation of digital screens in high-traffic areas within Woolworths supermarkets and other retail locations.

Outdoor Advertising Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Traditional Outdoor Advertising

- Digital Outdoor Advertising

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Billboard Advertising

- Transport Advertising

- Street Furniture Advertising

- Others

By End-use Outlook (Revenue – USD Billion, 2020–2034)

- BFSI

- Retail & Consumer Goods

- Business & Consumer Services

- Healthcare

- Manufacturing

- Transportation & Mobility

- Energy & Utility

- Trading & Warehousing

- Media & Entertainment

- Hospitality

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Outdoor Advertising Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 26.30 billion |

|

Market Size Value in 2025 |

USD 27.60 billion |

|

Revenue Forecast by 2034 |

USD 43.56 billion |

|

CAGR |

5.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The outdoor advertising market has been segmented into detailed segments of type, product, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: Growth of the market is increasingly driven by the expansion of digital out-of-home (DOOH) networks and the integration of programmatic advertising technologies. Marketing strategies are evolving to leverage the dynamic capabilities of DOOH, offering advertisers greater flexibility in content scheduling and audience targeting. A key focus is on demonstrating the effectiveness of outdoor advertising through enhanced measurement and attribution models, proving its value alongside digital channels.

FAQ's

The outdoor advertising market size was valued at USD 26.30 billion in 2024 and is projected to grow to USD 43.56 billion by 2034.

The market is projected to register a CAGR of 5.2% during the forecast period.

North America held the largest share of the market in 2024.

A few of the major players actively operating in the market include Clear Channel Outdoor Holdings, Inc. (Clear Channel Outdoor); Outfront Media Inc.; JCDecaux S.A.; Lamar Advertising Company; Ströer SE & Co. KGaA; oOh!media Limited; Focus Media Information Technology Co., Ltd.; Daktronics, Inc.; Samsung Electronics Co., Ltd. (for digital signage solutions); and NEC Corporation (for digital signage solutions).

The traditional outdoor advertising segment accounted for a larger share of the market in 2024.

Following are a few of the market trends: ? Expansion of Digital Out-of-Home (DOOH): The increasing deployment of digital screens is a significant trend, offering dynamic content, flexibility in scheduling, and enhanced engagement opportunities. ? Programmatic DOOH Buying: The adoption of programmatic platforms is streamlining the buying and selling of DOOH inventory, enabling more efficient and targeted campaigns. ? Data Integration and Audience Targeting: Leveraging data analytics to understand audience movement and demographics is allowing for more precise targeting of outdoor advertising.

Outdoor advertising, often referred to as out-of-home (OOH) advertising, encompasses any form of advertising that reaches consumers when they are outside of their homes. This includes various formats such as billboards, posters, transit advertising (on buses, trains, and taxis), street furniture (bus shelters and kiosks), and digital signage. The primary goal of outdoor advertising is to capture the attention of people in public spaces, thereby increasing brand awareness, conveying specific messages, and influencing consumer behavior. It serves as a broad reach medium, capable of targeting a wide and diverse audience with consistent and high-frequency exposure.