Otoscope Market Size, Share, Trends, Industry Analysis Report: By Type (Pocket Otoscope, Full-sized Otoscope, and Video Otoscope), Modality, Portability, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 118

- Format: PDF

- Report ID: PM3301

- Base Year: 2024

- Historical Data: 2020-2023

Otoscope Market Overview

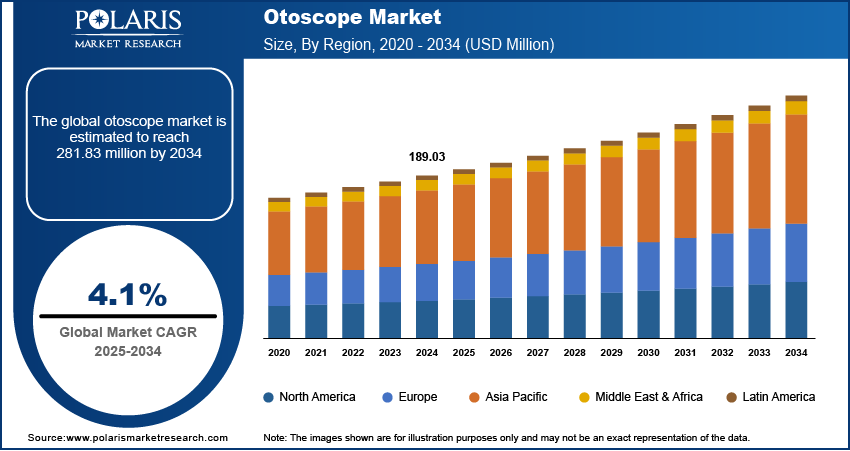

The otoscope market size was valued at USD 189.03 million in 2024. The market is projected to grow from USD 196.30 million in 2025 to USD 281.83 million by 2034, exhibiting a CAGR of 4.1% during 2025–2034.

The otoscope market refers to the global industry involved in the manufacturing, distribution, and sale of otoscopes, which are medical devices used for examining the ear canal and tympanic membrane. The increasing prevalence of ear infections and hearing disorders, rising adoption of digital otoscopes with advanced imaging capabilities, and expanding healthcare infrastructure, particularly in emerging economies are driving market growth. Additionally, the growing demand for point-of-care diagnostics and telemedicine solutions is supporting otoscope market expansion. Technological advancements, including the integration of artificial intelligence for automated diagnostics, further contribute to otoscope market growth.

To Understand More About this Research: Request a Free Sample Report

Otoscope Market Dynamics

Increasing Prevalence of Hearing Disorders

The otoscope market demand is significantly influenced by the rising incidence of hearing impairments. According to the National Institute on Deafness and Other Communication Disorders, approximately 15% of American adults, equating to 37.5 million individuals, report some degree of hearing difficulty. This prevalence escalates with age; about 25% of adults aged 65 and above experience some hearing challenges. This growing demographic necessitates regular auditory assessments, thereby amplifying the demand for otoscopic devices in clinical settings.

Advancements in Digital Otoscope Technology

Technological innovations have transformed otoscopic examinations through the development of digital otoscopes. These devices offer enhanced imaging capabilities, facilitating more accurate diagnoses of ear conditions. For instance, researchers at Johns Hopkins Medicine have developed a smart otoscope that employs artificial intelligence to diagnose ear infections with sensitivity and specificity comparable to that of a fellowship-trained otolaryngologist. Such advancements improve diagnostic precision and expand the applications of otoscopes in telemedicine and remote consultations, thereby driving otoscope market growth.

Expansion of Telemedicine and Remote Diagnostics

The expansion of telemedicine and remote diagnostics has markedly influenced the otoscope market trends. The COVID-19 pandemic accelerated the adoption of remote healthcare services, highlighting the necessity for reliable diagnostic tools that can be used in nonclinical settings. Digital otoscopes compatible with smartphones enable healthcare providers to remotely assess patients' ear health, facilitating timely interventions. Studies have demonstrated that, with appropriate training, parents can effectively use smartphone-enabled otoscopes to capture diagnostic-quality images of their children's tympanic membranes, which can then be evaluated by physicians remotely. This capability enhances patient access to care and reduces the need for in-person visits, thereby propelling the demand for portable otoscopic devices.

Otoscope Market Segment Insights

Otoscope Market Assessment by Type Outlook

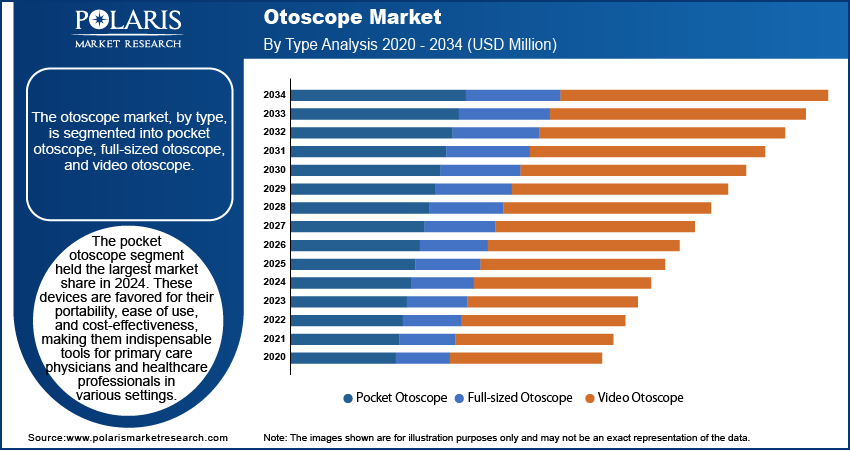

The otoscope market, by type, is segmented into pocket otoscope, full-sized otoscope, and video otoscope.

The pocket otoscope segment holds the largest market share in 2024. These devices are favored for their portability, ease of use, and cost-effectiveness, making them indispensable tools for primary care physicians and healthcare professionals in various settings. The widespread availability and affordability of pocket otoscopes contribute to their dominance in the market, catering to routine examinations and initial assessments of ear health. Their continued prevalence underscores the importance of accessible diagnostic instruments in everyday medical practice.

The video otoscope segment is experiencing the highest growth within the otoscope market. This surge is driven by the increasing adoption of telemedicine and the demand for advanced diagnostic tools that facilitate remote consultations. Video otoscopes, equipped with high-resolution imaging and the capability to transmit visuals in real-time, are becoming essential in modern healthcare practices. Their integration with digital platforms allows for enhanced patient monitoring and more accurate diagnoses, aligning with the evolving landscape of patient care.

Otoscope Market Evaluation by Modality Outlook

The otoscope market, by modality, is segmented into wired digital and wireless. In 2024, the wired digital segment held a larger otoscope market share. This dominance is attributed to the reliability and consistent performance of wired devices, which are essential in clinical settings where uninterrupted power supply and data transfer are critical. Wired digital otoscopes provide high-resolution imaging capabilities, enabling healthcare professionals to conduct accurate and detailed examinations of the ear canal and tympanic membrane. Their cost-effectiveness and ease of integration into existing medical infrastructure further enhance their widespread adoption in hospitals and clinics.

The wireless segment is experiencing a higher growth rate within the market. The increasing demand for telemedicine and remote patient monitoring solutions has propelled the adoption of wireless otoscopes, which offer enhanced mobility and convenience. These devices facilitate real-time transmission of high-quality images and videos, enabling healthcare providers to perform remote diagnostics and consultations effectively. Technological advancements, such as improved battery life and wireless connectivity, have further augmented the functionality and appeal of wireless otoscopes, making them a valuable tool in modern healthcare practices.

Otoscope Market Assessment by Portability Outlook

The otoscope market, by portability, is segmented into wall-mounted and portable. In 2024, the portable otoscope segment holds a larger share of the otoscope market revenue. This dominance is attributed to the device's compact design, which offers flexibility for use across various healthcare settings, including hospitals, clinics, and home healthcare environments. Portable otoscopes are favored for their ease of use and the convenience they provide to healthcare professionals during patient examinations. Their widespread availability and adaptability contribute significantly to their leading position in the market.

The portable otoscope segment is expected to experience a higher growth rate during the forecast period. This growth is driven by the increasing adoption of home healthcare services, where portable medical devices are essential for providing patient care outside traditional clinical settings. The user-friendly and compact nature of portable otoscopes makes them ideal for point-of-care diagnostics, enabling timely and efficient patient assessments. Additionally, the rise in emergency and ambulatory care services has further propelled the demand for portable otoscopes, as they facilitate prompt and accurate examinations in diverse medical situations.

Otoscope Market Assessment by End User Outlook

The otoscope market, by end user, is segmented into hospitals, ENT clinics, and others. The hospital segment accounted for the largest market share in 2024. This prominence is attributed to the extensive use of otoscopes in hospital settings for diagnosing and treating ear-related conditions. Hospitals are primary centers for medical care, equipped with advanced diagnostic tools and staffed by specialists capable of managing complex ear disorders. The availability of comprehensive healthcare services and the capacity to handle a high volume of patients contribute to the substantial demand for otoscopes in these institutions. Additionally, the integration of otoscopic examinations into routine check-ups and emergency care further solidifies the hospital segment's leading position in the market.

The ENT clinics segment is experiencing the highest growth within the otoscope market. This surge is driven by the increasing prevalence of ear, nose, and throat disorders, prompting patients to seek specialized care. ENT clinics offer focused expertise and personalized treatment plans, attracting a growing patient base. The rise in healthcare awareness and the availability of advanced otoscopic technologies in these clinics enhance diagnostic accuracy and patient outcomes. Moreover, the convenience and accessibility of ENT clinics make them a preferred choice for patients, contributing to the accelerated growth of this segment.

Otoscope Market Regional Insights

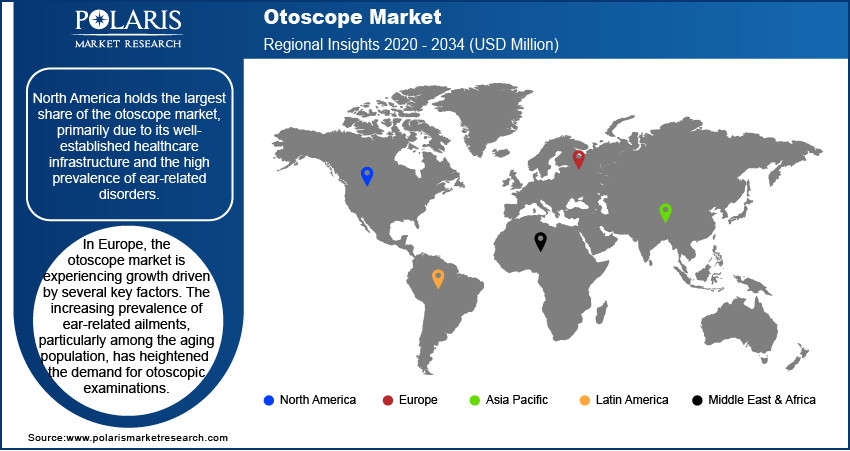

By region, the study provides otoscope market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America held the largest otoscope market share, primarily due to its well-established healthcare infrastructure and the high prevalence of ear-related disorders. The region benefits from the presence of major hospital chains and advanced ambulatory facilities, which facilitate the widespread adoption of otoscopic devices. Additionally, a significant portion of the population experiences hearing issues, necessitating regular auditory assessments and driving demand for otoscopes. The local presence of key industry players further enhances market accessibility and innovation. Moreover, supportive government regulations and reimbursement policies encourage the use of advanced diagnostic tools, contributing to the market's dominance in this region.

In Europe, the otoscope market is experiencing growth driven by several key factors. The increasing prevalence of ear-related ailments, particularly among the aging population, has heightened the demand for otoscopic examinations. Technological advancements, such as the development of LED and video otoscopes, have enhanced diagnostic capabilities, further propelling market expansion. Notably, countries such as the UK are contributing significantly to this growth, attributed to their advanced healthcare infrastructure and a rising number of otolaryngologists. The adoption of pocket-sized otoscopes is also on the rise, offering portability and convenience for healthcare professionals across various settings.

The Asia Pacific otoscope market is poised for substantial growth. This expansion is largely attributed to the increasing prevalence of ear infections and related disorders, coupled with a growing awareness of ear health. Improving healthcare infrastructure and rising healthcare expenditures in countries such as China, Japan, and India are facilitating greater access to advanced diagnostic tools, including otoscopes. The integration of telemedicine and the demand for portable, user-friendly devices are further influencing market dynamics, making otoscopic examinations more accessible in urban and rural healthcare settings.

Otoscope Market – Key Players and Competitive Insights

The competitive landscape of the otoscope market is characterized by technological advancements, increasing product differentiation, and strategic market expansion. Companies are focusing on developing digital and wireless otoscopes that offer enhanced imaging quality, real-time connectivity, and integration with telemedicine platforms. The demand for portable and high-resolution otoscopes is driving innovation, with manufacturers investing in advanced optical systems, LED illumination, and AI-assisted diagnostics. Competition is further intensified by the growing adoption of otoscopes in primary care, ENT clinics, and home healthcare settings, pushing companies to enhance product affordability and user-friendliness. Regulatory approvals and compliance with safety standards are key factors influencing market positioning, as players seek to gain a competitive edge. Strategic partnerships, and mergers and acquisitions are enabling market expansion, particularly in emerging economies. Moreover, as healthcare professionals prioritize precision diagnostics and patient convenience, competition in the otoscope market remains dynamic, with a strong emphasis on product innovation and technological integration.

Welch Allyn, a subsidiary of Baxter International Inc., is a prominent manufacturer of medical diagnostic devices, including otoscopes. The company is recognized for its innovative products that enhance patient care and diagnostic accuracy. In October 2023, Baxter introduced digital image capture capabilities for the Welch Allyn PanOptic Plus Ophthalmoscope through the iExaminer Pro System, enabling clinicians to capture and share eye images efficiently.

HEINE Optotechnik GmbH & Co. KG is a German company specializing in the production of high-quality medical instruments, such as otoscopes and ophthalmoscopes. Known for their precision and durability, HEINE's products are widely used in clinical settings. The company's commitment to continuous research and development has solidified its reputation in the medical community.

List of Key Companies in Otoscope Market

- 3M

- American Diagnostic Corporation

- CellScope, Inc.

- Dino-Lite

- Heine Optotechnik GmbH & Co. KG

- Inventis SRL

- Luxamed GmbH & Co. KG

- Medline Industries, LP

- Olympus Corporation

- Orlvision GmbH

- Portonics

- Spengler SA

- SyncVision Technology Corporation

- Welch Allyn, Inc. (a subsidiary of Baxter International Inc.)

- Zinnanti Surgical Design

Otoscope Industry Developments

- In February 2025, JEDMED Corporation, a global leader in advanced otoscopic solutions, and Otologic Technologies, a developer of an artificial intelligence (AI)-driven diagnostic for ear diseases, announced partnership to deliver the world’s first AI-enabled digital otoscope.

- In January 2023, Portronics launched its latest upgraded otoscope, XLife. It offers a powerful wireless streaming capability, providing a 360° Full HD view of the external acoustic meatus (ear canal) on smartphone. Equipped with a safe silicone scoop tip, it helps in effectively cleaning the daily buildup of earwax.

Otoscope Market Segmentation

By Type Outlook (Revenue – USD Million, 2020–2034)

- Pocket Otoscope

- Full-sized Otoscope

- Video Otoscope

By Modality Outlook (Revenue – USD Million, 2020–2034)

- Wired Digital

- Wireless

By Portability Outlook (Revenue – USD Million, 2020–2034)

- Wall-Mounted

- Portable

By End User Outlook (Revenue – USD Million, 2020–2034)

- Hospitals

- ENT Clinics

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Otoscope Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 189.03 million |

|

Market Size Value in 2025 |

USD 196.30 million |

|

Revenue Forecast by 2034 |

USD 281.83 million |

|

CAGR |

4.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The otoscope market size was valued at USD 189.03 million in 2024 and is projected to grow to USD 281.83 million by 2034.

The market is projected to register a CAGR of 4.1% during the forecast period.

North America held the largest share of the market in 2024.

A few notable key players include 3M; American Diagnostic Corporation; CellScope, Inc.; Dino-Lite; Heine Optotechnik GmbH & Co. KG; Inventis SRL; Luxamed GmbH & Co. KG; Medline Industries, LP; Olympus Corporation; Orlvision GmbH; Portonics; Spengler SA; SyncVision Technology Corporation; Welch Allyn, Inc. (a subsidiary of Baxter International Inc.); and Zinnanti Surgical Design.

The video otoscopes segment accounted for the largest share of the market in 2024.

The wireless otoscopes segment accounted for a larger share of the market in 2024.

An otoscope is a medical device used by healthcare professionals to examine the ear canal and eardrum. It consists of a light source, a magnifying lens, and a speculum that allows for a clear view inside the ear. Otoscopes are commonly used to diagnose ear infections, blockages, and other auditory conditions. They are available in various types, including pocket otoscopes, full-sized otoscopes, and video otoscopes, with some models featuring digital capabilities for enhanced visualization and telemedicine applications.

A few key trends in the market are described below: