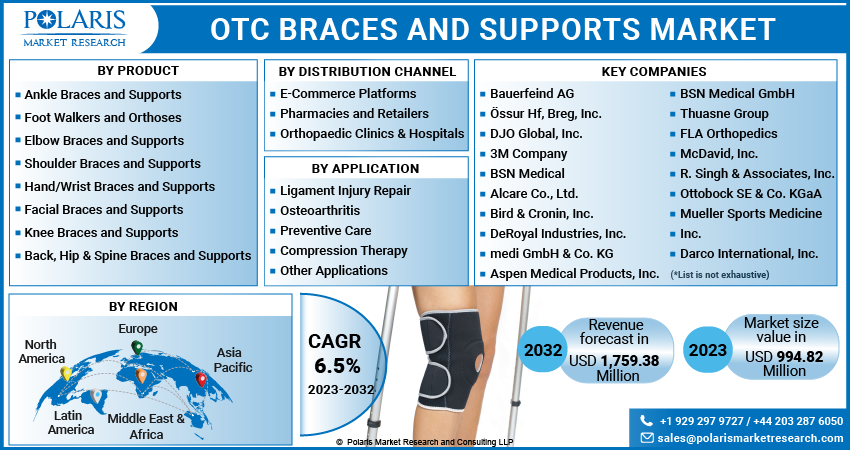

Global OTC Braces and Supports Market Share, Size, Trends, Analysis, Industry Report By Product, By Application, By Distribution channel (E-Commerce Platforms, Pharmacies and Retailers, Orthopedic Clinics & Hospitals), By Region and Forecast, 2023 – 2032

- Published Date:May-2023

- Pages: 114

- Format: PDF

- Report ID: PM3215

- Base Year: 2022

- Historical Data: 2019-21

Report Outlook

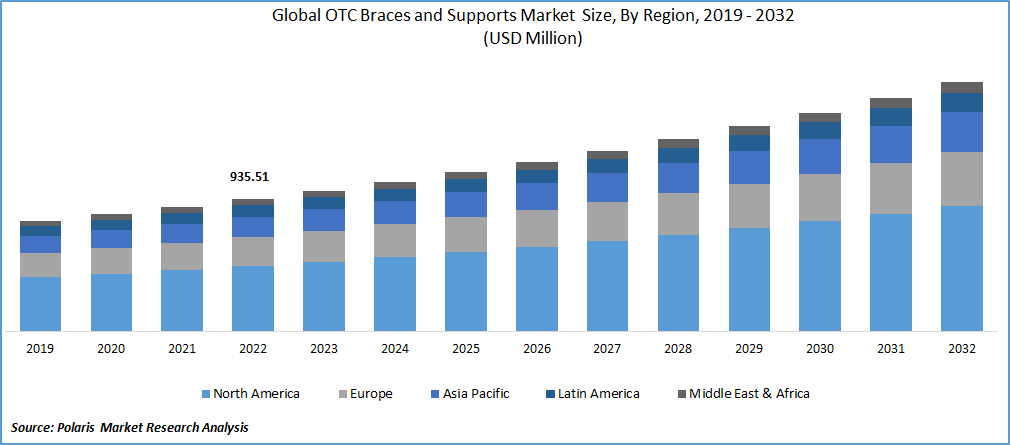

The Global otc braces and supports market was valued at USD 935.51 million in 2022 and is expected to grow at a CAGR of 6.5% during the forecast period.The global market for over-the-counter (OTC) braces and supports is rapidly growing, driven by several factors, including the rising incidence of musculoskeletal disorders, the aging population, and the increasing demand for non-invasive and drug-free pain management solutions. OTC braces and supports are devices designed to provide support, compression, and stabilization to different body parts, including the back, knee, ankle, wrist, and elbow. These devices are typically sold directly to consumers without needing a prescription or medical consultation, and they are widely available in drugstores, supermarkets, and online marketplaces. The growth driver in the OTC braces and supports market is the rising incidence of musculoskeletal disorders, such as arthritis, osteoporosis, and back pain.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the otc braces and supports market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

Know more about this report: Request for sample pages

These conditions are becoming increasingly common, particularly in older adults, and they often require ongoing management and treatment. OTC braces and supports can provide an effective and affordable solution for managing pain and improving mobility in these patients. The aging population is another factor driving growth in this market. As people age, they become more prone to developing musculoskeletal disorders and other conditions that require support and pain management.

OTC braces and supports can provide a simple and convenient way to manage these conditions, allowing older adults to maintain their independence and quality of life. The growth of the OTC braces and supports market is the increasing demand for non-invasive and drug-free pain management solutions. Many people prefer to avoid prescription drugs and invasive procedures, and OTC braces and supports provide a safe and effective alternative for managing pain and other symptoms. The OTC braces and supports market is expected to grow in the coming years, driven by factors such as the rising incidence of musculoskeletal disorders, the aging population, and the increasing demand for non-invasive and drug-free pain management solutions. With ongoing innovation and technological advancements, OTC braces and supports will likely become an increasingly important part of the healthcare landscape, providing patients with effective and affordable solutions for managing pain and improving mobility.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

The global OTC braces and supports market is expected to experience significant growth in the coming years due to several factors. The rising incidence of musculoskeletal disorders such as osteoporosis, arthritis, and back pain. These conditions are becoming increasingly common as the global population ages, and lifestyle factors such as sedentary behavior and poor diet take their toll. The demand for non-invasive and drug-free pain management solutions is increasing, driving growth in the OTC braces and supports market.

The prevalence of musculoskeletal disorders such as arthritis, osteoporosis, and back pain is increasing globally. This is mainly due to the aging population, sedentary lifestyle, and unhealthy dietary habits. As a result, the demand for non-invasive and drug-free pain management solutions is increasing, which is driving the growth of the OTC braces and support market.

The global population is aging rapidly, and older adults are more prone to developing musculoskeletal disorders and other conditions that require support and pain management. OTC braces and supports provide a simple and convenient way to manage these conditions, allowing older adults to maintain their independence and quality of life.

Increasing demand for non-invasive and drug-free pain management solutions: Many people prefer to avoid prescription drugs and invasive procedures, and OTC braces and supports provide a safe and effective alternative for managing pain and other symptoms. The demand for non-invasive and drug-free pain management solutions is increasing, which is driving the growth of the OTC braces and support market.

OTC braces and supports manufacturers invest heavily in research and development to develop new and improved products that provide better comfort, durability, and effectiveness. Technological advancements in materials and design are driving the market's growth by providing better products that can meet the needs of consumers.

OTC braces and supports are widely available in drugstores, supermarkets, and online marketplaces, and they are usually affordable for most people. This makes them accessible to a wide range of consumers, driving the market's growth.

Report Segmentation

The market is primarily segmented based on product, application, distribution channel, and region.

|

By Product |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Knee Braces and Supports segment is expected to witness the fastest growth in 2022

In the global OTC braces and supports, knee braces, and supports segment is expected to witness the fastest growth in the OTC braces and supports market. This is due to several factors, including knee injuries, osteoarthritis, and patellar tendonitis. Knee injuries are common in athletes, active individuals, and older adults who may experience wear and tear on their knee joints. Additionally, the knee joint is one of the largest and most complex joints in the body, and it is essential for mobility and daily activities. As a result, there is a high demand for effective and comfortable knee braces and supports that can help manage pain, provide stability, and promote healing. Advancements in knee brace technology are also driving growth in this segment. For instance, manufacturers are developing knee braces and support that use innovative materials and designs to provide better comfort, adjustability, and support. These products can be customized to fit patients' needs, improving their effectiveness and satisfaction. The growth of the knee braces and supports segment is the increasing use of braces and supports in post-surgical and post-injury rehabilitation. After knee surgery or injury, patients may require additional support and protection as they heal and regain strength. Braces and supports can provide this support, helping to prevent further damage and promoting faster recovery.

The Pharmacies and Retailers segment accounted for the largest market share in 2022

In global OTC braces and supports pharmacies and retailers segment accounted for the largest market share in the OTC braces and supports market. Pharmacies and retailers are the most accessible and convenient distribution channels for OTC braces and supports. Consumers can easily purchase braces and support from their local drugstores or supermarkets or order them online from major retailers such as Amazon or Walmart. Pharmacies and retailers also offer a wide range of OTC braces and support products, including knee braces, ankle supports, wrist supports, back braces, and others. It allows consumers to easily find the products they need to manage their condition or injury. Inaccessibility and convenience, pharmacies and retailers offer competitive pricing and promotions on OTC braces and support products. This is due to the large volume of products sold through these channels, which allows them to negotiate better prices from manufacturers and pass on the savings to consumers. Pharmacies and retailers are often staffed by healthcare professionals who can provide guidance and advice on selecting and using OTC braces and supports. This can be particularly helpful for consumers who may need to become more familiar with these products or need additional assistance choosing the right product.

The demand in North America is expected to witness significant growth over forecasted period

The demand for Global OTC braces and supports is expected to witness significant growth in North America in the coming years. This is due to several factors, including an aging population, an increase in the prevalence of musculoskeletal conditions, and the growing trend toward self-care and non-invasive treatment options. The baby boomer generation continues to age. There is a higher prevalence of musculoskeletal conditions such as arthritis, osteoporosis, and back pain. This has resulted in a higher demand for OTC braces and supports to manage these conditions and injury prevention and rehabilitation. The trend towards self-care and non-invasive treatment options drives growth in the OTC braces and supports market. Many consumers seek alternatives to prescription drugs and invasive procedures for managing pain and other symptoms. OTC braces and supports provide a safe and effective non-invasive treatment option for many conditions, making them an attractive choice for consumers. The availability of OTC braces and support products through various channels, including pharmacies, retailers, and online platforms, makes them more accessible to consumers than ever before. This increased accessibility, combined with competitive pricing and promotions, has helped to drive demand for OTC braces and supports in North America.

Competitive Insight

Some of the major players operating in the global market include Bauerfeind AG, Össur Hf, Breg, Inc., DJO Global, Inc., 3M Company, BSN Medical, Alcare Co., Ltd., Bird & Cronin, Inc., DeRoyal Industries, Inc., medi GmbH & Co. KG, Aspen Medical Products, Inc., BSN Medical GmbH, Thuasne Group.

Recent Developments

In November 2019, DJO Global announced the acquisition of LiteCure, a US-based manufacturer of therapeutic laser devices. The acquisition expanded DJO Global's portfolio of products for pain management and rehabilitation, including OTC braces and supports.

In May 2020, Mueller Sports Medicine, a US-based manufacturer of sports medicine products, acquired the Shock Doctor and McDavid brands from United Sports Brands. The acquisition included a portfolio of OTC braces and supports for the ankle, knee, elbow, and back.

In October 2020, Össur, an Icelandic manufacturer of prosthetics and braces, acquired the OTC bracing business of Medi, a German medical device company.

OTC Braces and Supports Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 994.82 million |

|

Revenue forecast in 2032 |

USD 1,759.38 million |

|

CAGR |

6.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Bauerfeind AG, Össur Hf, Breg, Inc., DJO Global, Inc., 3M Company, BSN Medical, Alcare Co., Ltd., Bird & Cronin, Inc., DeRoyal Industries, Inc., medi GmbH & Co. KG, Aspen Medical Products, Inc., BSN Medical GmbH, Thuasne Group, FLA Orthopedics, McDavid, Inc., R. Singh & Associates, Inc., Ottobock SE & Co. KGaA Lohmann & Rauscher International GmbH & Co. KG, Mueller Sports Medicine, Inc. Darco International, Inc. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the otc braces and supports market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

FAQ's

The gobal otc braces and supports market size is expected to reach USD 1,759.38 million by 2032

Key players in the otc braces and supports market are Bauerfeind AG, Össur Hf, Breg, Inc., DJO Global, Inc., 3M Company, BSN Medical, Alcare Co., Ltd., Bird & Cronin

North America contribute notably towards the global otc braces and supports market

The Global otc braces and supports market expected to grow at a CAGR of 6.5% during the forecast period

The otc braces and supports market report covering key segments are product, application, distribution channel, and region