OTA Testing Market Size, Share, Trends, Industry Analysis Report: By Offering (Solution and Service), Technology, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5254

- Base Year: 2024

- Historical Data: 2020-2023

OTA Testing Market Overview

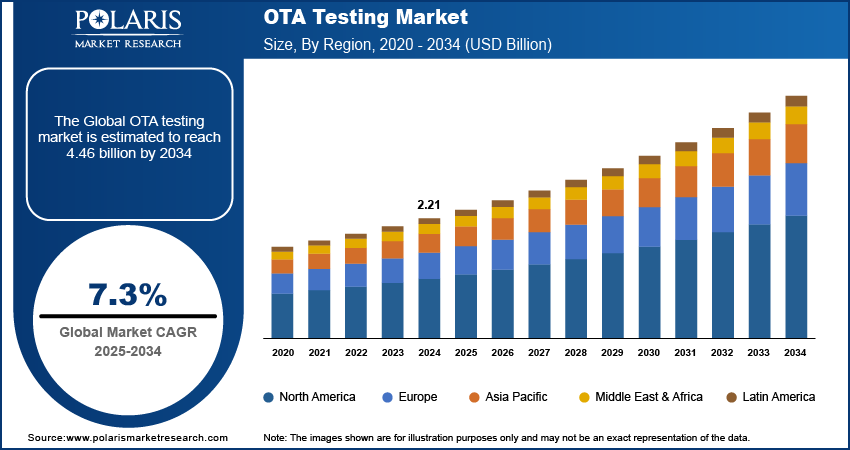

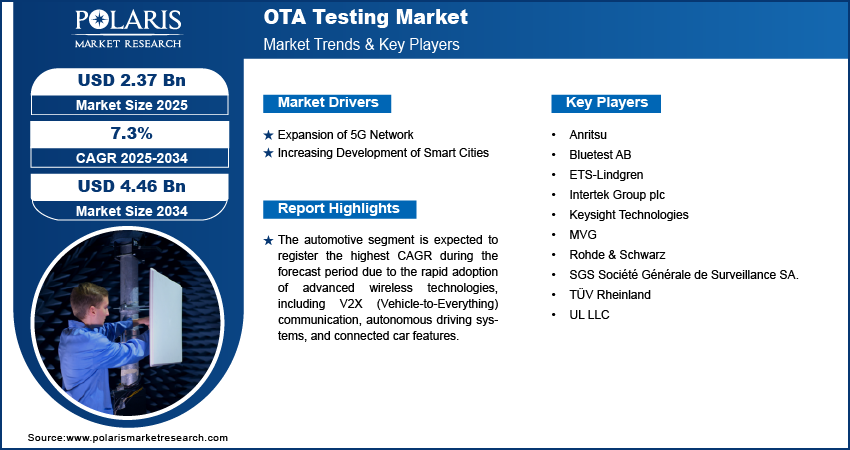

The global OTA testing market size was valued at USD 2.21 billion in 2024. The market is projected to grow from USD 2.37 billion in 2025 to USD 4.46 billion by 2034, exhibiting a CAGR of 7.3% during 2025–2034.

OTA (Over-the-Air) testing method is used to assess the performance of wireless devices by evaluating their ability to transmit and receive signals in practical conditions.

The testing is crucial for devices that rely on wireless communication, such as smartphones, tablets, IoT devices, wearables, and automotive electronics. The increasing adoption of Internet of Things (IoT) devices, including smart home automation systems, industrial sensors, and connected healthcare devices, drives the need for OTA testing to ensure reliable connectivity and compliance with various communication protocols such as Wi-Fi, Bluetooth, and Zigbee. Additionally, the rising focus on personal health and fitness, along with advancements in technology, is increasing the adoption of wearable devices such as smartwatches, fitness trackers, and health monitoring devices. Wearable devices rely heavily on wireless connectivity, making OTA testing crucial to assess their signal performance and battery efficiency under different conditions. Thus, the increasing adoption of wearable devices is fueling the OTA testing market.

To Understand More About this Research: Request a Free Sample Report

The advancement of telemedicine and remote patient monitoring devices has led medical systems to increasingly depend on wireless technologies to communicate health data, which significantly drives the OTA testing market growth. Moreover, the adoption of cloud technology in testing processes allows for more flexible, scalable, and cost-effective OTA testing, driving market growth as companies seek to optimize their testing capabilities.

OTA Testing Market Driver Analysis

Expansion of 5G Network

The rapid global deployment of 5G networks has led to a surge in the need for OTA testing. In August 2024, Nokia and TIM partnered to expand the 5G network across 15 Brazilian states from January 2025 due to the increasing 5G access and enabling digital transformation for businesses. The implementation of 5G technology necessitates thorough testing of devices to guarantee compliance with enhanced performance criteria for increased data rates and minimal latency. The incorporation of intricate frequency bands, massive Multiple-Input Multiple-Output (MIMO), and beamforming techniques in 5G technology makes OTA testing crucial for validating device performance, which is expected to fuel the OTA testing market growth in the coming years.

Increasing Development of Smart Cities

The development of smart city infrastructure relies heavily on interconnected devices and networks to manage essential services such as traffic control, public surveillance, energy distribution, and environmental monitoring. In June 2023, San Antonio's Office of Innovation launched the Smart Cities Roadmap and Smarter Together Initiative, outlining a community-driven vision for using technology to enhance public services and residents' quality of life. Infrastructure in smart cities requires seamless communication between thousands of sensors, communication modules, and other wireless technologies. OTA testing is essential for ensuring the reliability and efficiency of these devices. Therefore, the growing focus on the development of smart cities would fuel the OTA testing market growth during the forecast period.

OTA Testing Market Segment Analysis

OTA Testing Market Assessment by Offering

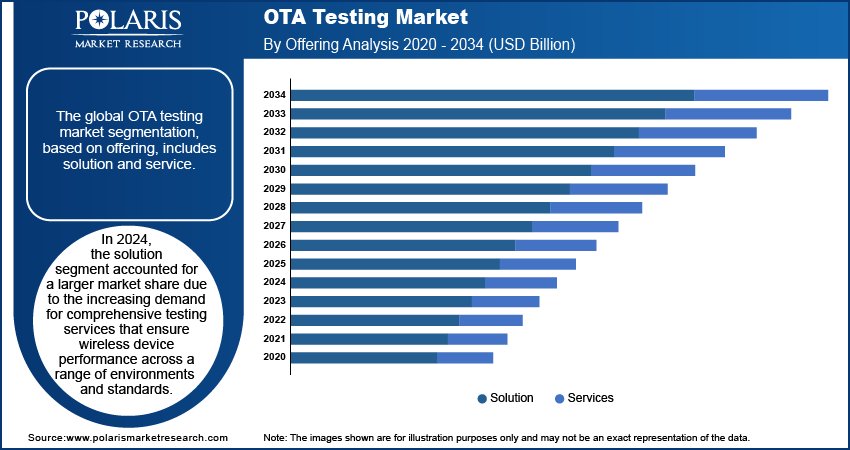

The global Over-the-Air testing market segmentation, based on offering, includes solution and service. In 2024, the solution segment accounted for a larger market share due to the increasing demand for comprehensive testing services that ensure the performance of wireless devices across a range of environments and standards. Furthermore, various companies formed strategic partnerships to launch innovative OTA testing solutions, aiming to address the growing complexity of wireless technologies. These collaborations combine expertise in testing methodologies, wireless communication, and device manufacturing to create comprehensive solutions for industries such as telecommunications, automotive, and IoT. In January 2023, Airbiquity and Elektrobit launched a joint, pre-integrated OTA solution, integrating Elektrobit's in-vehicle OTA update software with Airbiquity's multi-ECU OTA software management platform.

OTA Testing Market Evaluation by End Use

The global OTA testing market segmentation, based on end use, includes aerospace & defense, automotive, consumer electronics, healthcare, IT & telecommunications, and others. The automotive segment is expected to record the highest CAGR during the forecast period due to the rapid adoption of advanced wireless technologies, including V2X (Vehicle-to-Everything) communication, autonomous driving systems, and connected car features. Vehicles are increasingly becoming smart, autonomous entities; therefore, the need for precise OTA testing of wireless modules, sensors, and communication systems is increasing. Furthermore, the launch of new OTA testing products is playing a pivotal role in meeting the evolving demands of industries such as automotive, telecommunications, and IoT. Companies are continuously innovating and introducing advanced testing solutions that cater to emerging wireless technologies such as 5G, Wi-Fi 6, and V2X communications. For instance, in August 2024, HARMAN launched OTA 12.0, focusing on enhancing the security and robustness of OTA update workflows for E/E vehicle architectures and critical business requirements.

OTA Testing Market Regional Insights

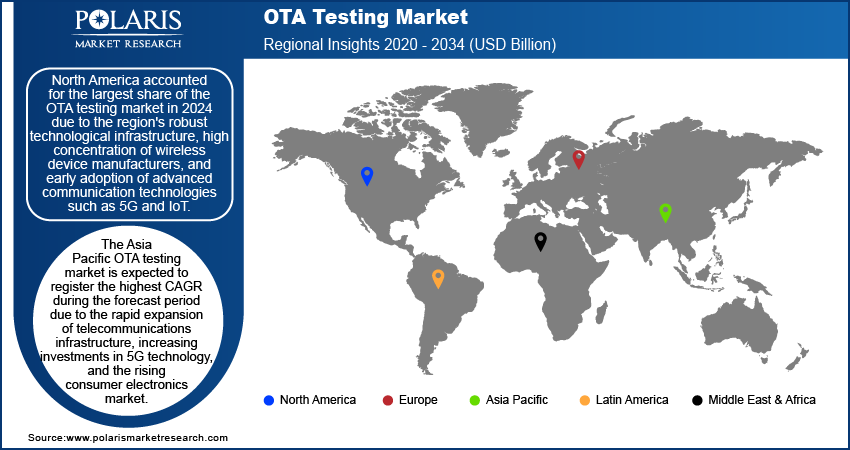

By region, the study provides Over-the-Air testing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the OTA testing market in 2024 due to the region's robust technological infrastructure, high concentration of wireless device manufacturers, and early adoption of advanced communication technologies such as 5G and IoT. North America has a strong presence of leading technology companies and research institutions. Thus, there is a strong emphasis on innovation and quality assurance in wireless communications. Furthermore, the US-based companies formed strategic partnerships with other industry leaders to enhance their offerings in the OTA testing market.

In June 2024, ETS-Lindgren, a US-based company known for its expertise in OTA performance testing, partnered with Anritsu, a global player in telecommunications testing technology, to provide test support for devices utilizing the Narrow Band NTN (NB-NTN) protocol. These collaborations aim to leverage complementary strengths in technology and expertise, allowing companies to develop advanced testing solutions tailored to the growing demand for wireless communication devices.

The US held the largest share of the OTA testing market in North America in 2024 due to the growing adoption of smart technologies across sectors such as automotive, healthcare, and consumer electronics that have contributed to the demand for OTA testing solutions.

The Asia Pacific OTA testing market is expected to record the highest CAGR during the forecast period due to the rapid expansion of telecommunications infrastructure, rising investments in 5G technology, and the increasing consumer electronics market. Countries such as China, India, and Japan accelerated the deployment of advanced wireless networks; thus, the demand for comprehensive OTA testing solutions is becoming critical to ensure device performance and compliance with regulatory standards. Additionally, the proliferation of IoT devices across various sectors, including automotive, healthcare, and smart cities, drives the need for rigorous testing to validate the connectivity and reliability of these technologies. The rising consumer demand for high-quality, reliable wireless devices fuels the market growth, encouraging manufacturers to invest in OTA testing to enhance product quality and user experience.

The China OTA testing market is expected to record the highest CAGR during the forecast period due to the push toward 5G deployment and infrastructure development, creating a significant need for OTA testing to ensure that devices meet the stringent performance and safety standards associated with this advanced technology.

OTA Testing Market – Key Players and Competitive Analysis Report

The competitive landscape of the OTA testing market is characterized by a diverse range of players, including specialized testing laboratories, telecommunications companies, and technology firms offering comprehensive testing solutions for wireless devices. Key players such as Keysight Technologies, Anritsu Corporation, Rohde & Schwarz, National Instruments, and SGS are prominent in providing advanced testing solutions for technologies such as 5G, IoT, and V2X communications. The continuous technological advancements drive companies to enhance their testing solutions to adapt to the fast-paced evolution of wireless technologies. Strategic partnerships between testing firms and device manufacturers or telecommunications companies have become common, enabling the development of tailored testing solutions that meet industry needs. Additionally, the necessity for compliance with stringent regulatory standards fuels the demand for high-quality OTA testing services, offering companies opportunities to differentiate themselves based on their capabilities. However, the market faces challenges such as the complexity of new wireless technologies and competitive pricing pressures, necessitating continuous investments in advanced testing equipment and methodologies. A few major market players are Anritsu, Bluetest AB, ETS-Lindgren, Intertek Group plc, Keysight Technologies, MVG, Rohde & Schwarz, SGS Société Générale de Surveillance SA., TÜV Rheinland, and UL LLC.

Cummins, a global provider of power technologies, operates through diverse business segments, specializing in designing, manufacturing, distributing, and servicing a comprehensive array of power solutions. The company offers a wide range of products encompassing internal combustion engines and electric and hybrid integrated power solutions, along with components such as filtration systems, after treatment devices, turbochargers, fuel systems, control systems, air handling systems, and others. In September 2024, Cummins Inc. partnered with Bosch Global Software and KPIT to launch Eclipse CANought, an open-source project for commercial vehicle telematics. This is part of the broader Open Telematics initiative aiming to reduce costs for developing telematics applications in commercial vehicles.

Rohde & Schwarz is a technology group focused on enhancing safety and connectivity through its divisions in test & measurement, technology systems, and networks & cybersecurity. The company develops innovative solutions across several sectors, including aerospace & defense, automotive testing, broadcasting & media, critical infrastructure, electronics testing, networks & cybersecurity, research & education, satellite testing, security, and wireless communications testing. The company’s advanced products enable industrial, regulatory, and military clients to achieve technological and digital sovereignty. Rohde & Schwarz operates in more than 70 countries and has a strong sales and service network supported by its subsidiaries. The company's headquarters are in Munich, Germany, with regional hubs in Singapore and Columbia, Maryland, managing business operations in Asia and North America. In July 2024, EMITE and Rohde & Schwarz collaborated to enhance EMITE’s OTA measurement solutions by integrating the latest test capabilities of the R&S CMX500 multi-technology, multi-channel one-box signaling tester. This integration enables support for FR1, FR2, LTE, IEEE 802.11be, and 5G RedCap standards.

Key Companies in OTA Testing Market

- Anritsu

- Bluetest AB

- ETS-Lindgren

- Intertek Group plc

- Keysight Technologies

- MVG

- Rohde & Schwarz

- SGS Société Générale de Surveillance SA.

- TÜV Rheinland

- UL LLC

OTA Testing Market Developments

In June 2024, T-Systems and Aurora Labs partnered to provide car manufacturers with a differential software update capacity and an end-to-end Over-the-Air platform. This solution is designed to optimize Time-to-Market and total cost of ownership for Software Defined Vehicles (SDV), while also delivering continuous software updates to improve the driving experience for customers.

In November 2023, RanLOS, AeroGT Labs, TOYO Corporation, and Anritsu launched the first 5G OTA measurement system, combining RanLOS’ OTA test solution with Anritsu’s 5G Radio Communication Test Station MT8000A. This system is a significant advancement for 5G connected vehicles.

In March 2020, MVG launched STARWAVE, a 5G mmWave OTA testing solution featuring plane wave generators mounted on a rotating disk and an electromagnetically transparent mast to facilitate the support and rotation of the Device Under Test.

OTA Testing Market Segmentation

By Offering Outlook (Revenue – USD Billion, 2020–2034)

- Solution

- Services

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Cellular Networks

- Wi-Fi

- Bluetooth

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Aerospace & Defense

- Automotive

- Consumer Electronics

- Healthcare

- IT & Telecommunications

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

OTA Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.21 Billion |

|

Market Size Value in 2025 |

USD 2.37 Billion |

|

Revenue Forecast by 2034 |

USD 4.46 Billion |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global OTA testing market size was valued at USD 2.21 billion in 2024 and is projected to grow to USD 4.46 billion by 2034

The global market is projected to register a CAGR of 7.3% during the forecast period.

North America accounted for the largest share of the global market in 2024 due to the region's robust technological infrastructure

A few key players in the market are Anritsu, Bluetest AB, ETS-Lindgren, Intertek Group plc, Keysight Technologies, MVG, Rohde & Schwarz, SGS Société Générale de Surveillance SA., TÜV Rheinland, and UL LLC.

The solution segment dominated the market in 2024 due to the increasing demand for comprehensive testing services.

The automotive category is expected to register the highest CAGR during the forecast period due to the rapid adoption of advanced wireless technologies.