Ostomy/Stoma Care Market Size, Share, Trends, Industry Analysis Report: By Surgery Type (Colostomy, Ileostomy, and Urostomy), Product, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM1098

- Base Year: 2024

- Historical Data: 2020-2023

Ostomy/Stoma Care Market Overview

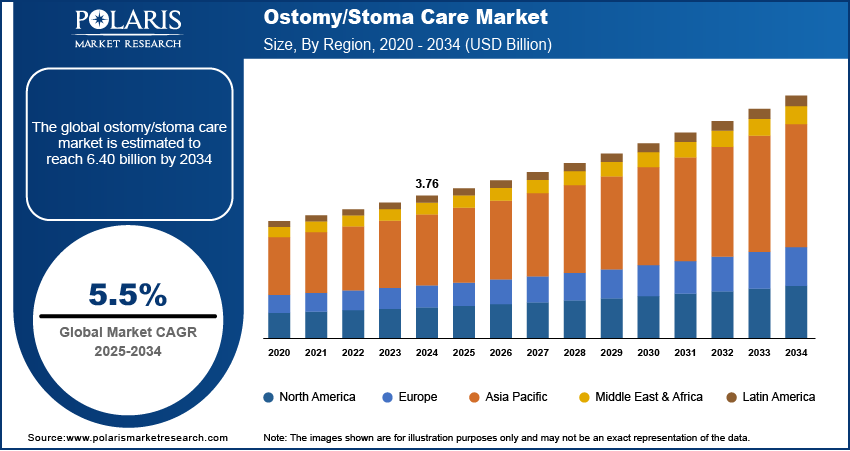

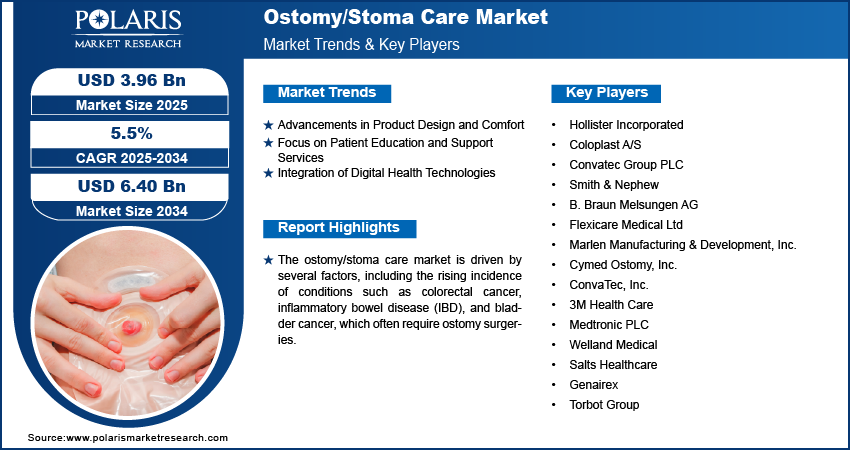

The global ostomy/stoma care market size was valued at USD 3.62 billion in 2024. The market is projected to grow from USD 3.77 billion in 2025 to USD 6.40 billion by 2034, exhibiting a CAGR of 5.5% from 2025 to 2034.

The ostomy/stoma care market involves products and services designed to support individuals who have undergone ostomy surgery, such as colostomies, ileostomies, and urostomies. This market includes ostomy bags, skin care products, adhesives, and accessories, as well as related services for patient education and support.

The aging population, rising incidences of gastrointestinal diseases, and advancements in ostomy care products that enhance comfort and quality of life are a few of the key factors driving the ostomy/stoma care market growth. Trends shaping the market include the development of more discreet and user-friendly ostomy products, increased focus on personalized care, and the adoption of digital health technologies for monitoring and support.

To Understand More About this Research: Request a Free Sample Report

Ostomy/Stoma Care Market Dynamics

Advancements in Product Design and Comfort

The market for ostomy/stoma care has seen significant advancements in product design, particularly focusing on enhancing user comfort and convenience. Innovations have led to the development of more discreet, skin-friendly, and easier-to-use ostomy bags and accessories. For instance, a 2020 survey by the US Ostomy Association found that 73% of ostomy patients reported feeling more confident with modern, discreet products compared to traditional ones. Manufacturers are increasingly using soft materials, breathable fabrics, and odor-controlling technologies in ostomy/stoma care products. Also, they are focusing on designing smaller, more discreet bags that are less noticeable under clothing. These advancements aim to address common challenges such as skin irritation and leakage, providing patients with a better quality of life. Thus, improvements in product design and comfort are driving the ostomy/stoma care market expansion.

Focus on Patient Education and Support Services

As ostomy care requires ongoing management and adaptation, many healthcare providers are focusing on patient education programs to ensure proper care and reduce complications. These programs include training on ostomy bag application, skin care, and lifestyle management. Additionally, telehealth services and digital platforms are increasingly being used to connect patients with healthcare professionals for remote consultations, follow-ups, and advice. For instance, according to a 2021 report by the National Institute of Health, approximately 30% of ostomy patients utilized virtual care platforms for education and support. The rise of telehealth and digital platforms for patient support helps enhance patient outcomes, improve product adherence, and reduce healthcare costs. Thus, the growing emphasis on providing comprehensive support and education services for ostomy patients is propelling the ostomy/stoma care market development.

Integration of Digital Health Technologies

Companies are developing innovative solutions like smart ostomy products that monitor factors such as bag fullness, leakage, and pressure. These devices can send real-time data to healthcare providers, enabling proactive care and reducing the risk of complications. The use of mobile apps to track patient symptoms, product usage, and skin condition is also on the rise. For instance, a study conducted by Digital Health Journal in 2022 showed that 45% of ostomy patients found digital health tools useful in managing their condition and preventing complications. The integration of technology not only improves patient outcomes but also offers convenience for both patients and caregivers. As a result, the integration of digital health technologies into ostomy care is a notable trend anticipated to drive the ostomy/stoma care market demand in the coming years.

Ostomy/Stoma Care Market Segment Insights

Ostomy/Stoma Care Market Evaluation – Surgery Type-Based Insights

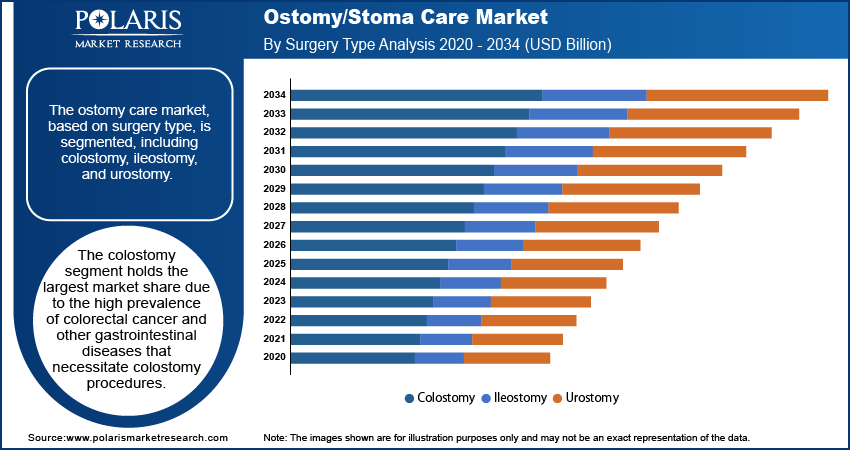

The ostomy/stoma care market, based on surgery type, is segmented into including colostomy, ileostomy, and urostomy. The colostomy segment holds the largest market share due to the high prevalence of colorectal cancer and other gastrointestinal diseases that necessitate colostomy procedures. This segment benefits from a large patient base, particularly in aging populations, where conditions such as colorectal cancer and inflammatory bowel diseases are more common. The growing awareness of colostomy care and improvements in ostomy products for this group have further supported its dominance.

The ileostomy and urostomy segments are also witnessing notable growth, with the ileostomy segment experiencing the highest growth rate. The rise in the number of patients diagnosed with Crohn's disease and ulcerative colitis is a primary driver of this growth. Advancements in ileostomy product designs that offer enhanced comfort and ease of use are contributing to increased adoption. The urostomy segment, while smaller in comparison, is expanding due to a rise in bladder cancer and spinal cord injuries, which increase the demand for urostomy procedures. Both segments benefit from innovations in medical devices, particularly those focused on improving patient outcomes and convenience.

Ostomy/Stoma Care Market Assessment – Product-Based Insights

The ostomy/stoma care market, by product, is segmented into ostomy bags and ostomy accessories. The ostomy bags segment holds the largest market share due to its essential role in the daily management of ostomy patients. As the most widely used product, ostomy bags are crucial for collecting bodily waste after surgery, and their demand is driven by the high number of ostomy surgeries performed globally. The segment continues to grow due to advancements in bag design, such as the development of smaller, more discreet, and odor-controlling products that improve patient comfort and quality of life.

The ostomy accessories segment is experiencing the highest growth rate, driven by increasing demand for complementary products that enhance the performance of ostomy bags. Accessories such as skin care products, adhesives, and pouches are essential in managing skin irritation, leaks, and other complications, leading to a growing preference for integrated care solutions. This segment benefits from innovations aimed at improving patient outcomes, such as skin-friendly adhesives and products designed to prevent leaks or maintain the seal between the bag and the skin. As the focus on patient comfort and convenience increases, the ostomy accessories market is expected to expand rapidly.

Ostomy/Stoma Care Market Outlook – End Users-Based Insights

The ostomy/stoma care market, based on end users, is segmented into hospitals & specialty clinics, homecare settings, and ambulatory surgery centers. The hospitals & specialty clinics segment holds the largest market share, primarily due to the central role these facilities play in the initial care and management of ostomy patients. These institutions provide critical pre- and post-surgical care, including education on ostomy management, making them essential for the ongoing treatment of patients following ostomy surgery. The demand for ostomy care products in this segment remains strong, driven by the high volume of surgeries performed in hospital settings and the availability of specialized care.

The homecare settings segment is experiencing the fastest growth, reflecting a shift towards more personalized, patient-centered care outside of institutional settings. As patients increasingly manage their condition at home, the need for homecare products, such as ostomy bags and accessories, has surged. This growth is supported by the rising adoption of telehealth services and remote patient monitoring, which help patients manage their ostomy care independently. The ambulatory surgery centers segment, while smaller in comparison, is also expanding due to the growing preference for outpatient procedures, offering cost-effective alternatives to inpatient hospital care. These centers are becoming more involved in providing immediate post-surgical care, contributing to the rising demand for ostomy products.

Ostomy/Stoma Care Market Regional Analysis

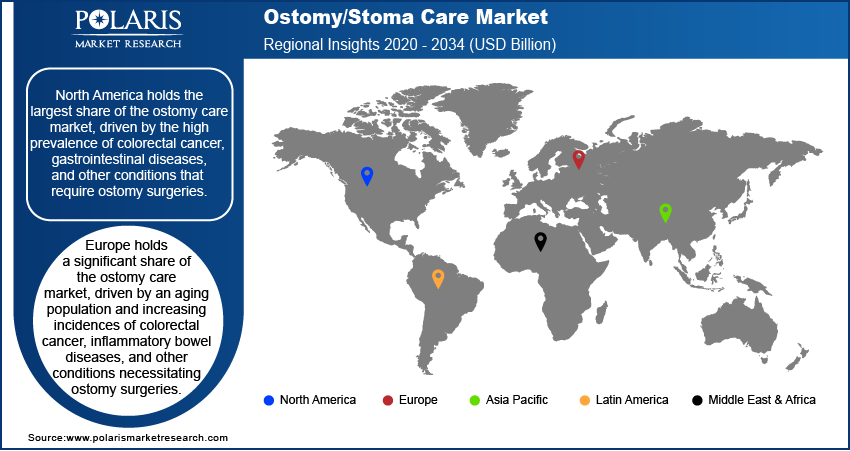

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the ostomy/stoma care market, driven by the high prevalence of colorectal cancer, gastrointestinal diseases, and other conditions that require ostomy surgeries. The region benefits from advanced healthcare infrastructure, high patient awareness, and access to a wide range of innovative ostomy care products. The presence of major market players in the US and Canada, coupled with a robust healthcare system that emphasizes patient education and support, further contributes to the regional market dominance. Europe follows closely, with increasing adoption of advanced ostomy care products and a growing aging population. Meanwhile, Asia Pacific, Latin America, and the Middle East & Africa are experiencing steady growth due to rising healthcare access, improved awareness, and a growing patient base in these regions.

Europe holds a significant share of the ostomy/stoma care market, driven by an aging population and increasing incidences of colorectal cancer, inflammatory bowel diseases, and other conditions necessitating ostomy surgeries. The region benefits from advanced healthcare infrastructure, high awareness about ostomy care, and widespread access to modern ostomy products. Key markets within Europe include Germany, France, and the UK, where healthcare systems are well-established, and patients have access to a broad range of ostomy care products. Additionally, Europe is seeing growth in homecare solutions and digital health technologies, which are improving patient outcomes and driving the demand for ostomy products. The growing focus on personalized care and patient education is also contributing to the market growth in this region.

Asia Pacific is experiencing rapid growth in the ostomy/stoma care market, driven by increasing healthcare access, a growing elderly population, and a rise in the incidence of conditions requiring ostomy surgeries, such as colorectal cancer and Crohn’s disease. Countries like Japan, China, and India are expected to lead the market due to their large patient bases and improving healthcare infrastructure. In particular, China and India are witnessing rising awareness and adoption of ostomy care products, fueled by both urbanization and the increasing prevalence of lifestyle-related diseases. While the market is still developing in many parts of the region, the demand for advanced ostomy products, including skin-friendly bags and accessories, is increasing. The rise in homecare services and government support for healthcare improvements are also expected to drive the regional market expansion.

Ostomy/Stoma Care Market – Key Players and Competitive Insights

Key players in the ostomy/stoma care market include well-established companies such as Hollister Incorporated, Coloplast A/S, Convatec Group PLC, and Smith & Nephew. Other notable companies include B. Braun Melsungen AG; Flexicare Medical Ltd; Marlen Manufacturing & Development, Inc.; and Cymed Ostomy, Inc. Additionally, ConvaTec, Inc.; 3M Health Care; Medtronic PLC; and Welland Medical are actively involved in providing a wide range of ostomy care products. The market also sees participation from smaller companies like Salts Healthcare, Genairex, and Torbot Group, all contributing to the development of innovative products in ostomy care. Many of these companies operate globally, offering products that cater to the needs of patients undergoing colostomy, ileostomy, and urostomy procedures.

The competitive landscape of the ostomy/stoma care market is shaped by the continuous introduction of new and advanced products, such as discreet, skin-friendly, and odor-controlling ostomy bags. Companies are focusing on improving patient comfort and convenience, which has led to innovation in product design and materials. A significant portion of competition arises from the adoption of digital health technologies, which allow for better monitoring and management of ostomy care, thereby enhancing patient outcomes. Several players are also engaging in strategic collaborations and partnerships with healthcare providers to expand their market reach and offer more personalized care solutions.

Companies are increasingly emphasizing patient education and support services, which is an important part of the competitive strategy. Many key players are expanding their offerings beyond just products by providing comprehensive support through online platforms, mobile applications, and homecare services. This shift towards a more integrated approach to patient care is expected to drive growth and differentiation in the market. Companies that invest in improving the overall patient experience, whether through advanced product features or enhanced customer support, are well-positioned to gain a competitive edge in the evolving market.

Hollister Incorporated is a privately held company that focuses on providing healthcare products for ostomy care, continence care, and wound care. It is known for its wide range of ostomy bags, accessories, and skin care products. The company has a strong global presence and aims to improve the quality of life for people living with stomas through its innovative product designs and patient support services.

Coloplast A/S is a Danish company that develops products in the areas of ostomy, continence, wound care, and urology. The company’s ostomy care products are widely used across the globe, and it has a reputation for developing solutions that improve the daily lives of patients. Coloplast focuses on providing high-quality, reliable products for people living with ostomies.

List of Key Companies in Ostomy/Stoma Care Market

- Hollister Incorporated

- Coloplast A/S

- Convatec Group PLC

- Smith & Nephew

- B. Braun Melsungen AG

- Flexicare Medical Ltd

- Marlen Manufacturing & Development, Inc.

- Cymed Ostomy, Inc.

- ConvaTec, Inc.

- 3M Health Care

- Medtronic PLC

- Welland Medical

- Salts Healthcare

- Genairex

- Torbot Group

Ostomy/Stoma Care Industry Developments

- In September 2023, Coloplast introduced a new version of its ostomy bag. According to Coloplast, the new bag features a streamlined design for better comfort and ease of use and focuses on reducing the risk of skin irritation.

- In August 2023, Hollister announced the launch of a new line of ostomy bags with improved odor control and skin protection features. The company stated that the new product line aims to improve user comfort and confidence.

Ostomy/Stoma Care Market Segmentation

By Surgery Type Outlook

- Colostomy

- Ileostomy

- Urostomy

By Product Outlook

- Ostomy Bags

- Ostomy Accessories

By End Users Outlook

- Hospitals & Speciality Clinics

- Homecare Settings

- Ambulatory Surgery Centers

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ostomy/Stoma Care Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.76 billion |

|

Market Size Value in 2025 |

USD 3.96 billion |

|

Revenue Forecast by 2034 |

USD 6.40 billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The ostomy/stoma care market has been segmented into detailed segments of surgery type, product, and end users. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the ostomy/stoma care market primarily focuses on product innovation, enhancing patient comfort, and expanding accessibility. Companies are investing in research and development to create advanced, discreet, and user-friendly ostomy products that address common issues such as leakage and skin irritation. Additionally, partnerships with healthcare providers and the integration of digital health technologies are key strategies to improve patient support and monitoring. Companies also emphasize patient education through various channels, including online platforms, to improve adherence and foster brand loyalty. Expanding in emerging markets and offering personalized care solutions are also important components of growth strategies in this sector.

FAQ's

? The ostomy/stoma care market size was valued at USD 3.76 billion in 2024 and is projected to grow to USD 6.40 billion by 2034.

? The market is projected to register a CAGR of 5.5% from 2025 to 2034.

? North America had the largest share of the market in 2024.

? Key players in the ostomy/stoma care market include well-established companies such as Hollister Incorporated, Coloplast A/S, Convatec Group PLC, and Smith & Nephew. Other notable companies include B. Braun Melsungen AG; Flexicare Medical Ltd; Marlen Manufacturing & Development, Inc.; and Cymed Ostomy, Inc. Additionally, ConvaTec, Inc.; 3M Health Care; Medtronic PLC; and Welland Medical are actively involved in providing a wide range of ostomy care products.

? The colostomy segment accounted for the largest share of the market in 2024.

? The ostomy bags segment accounted for the largest share of the market in 2024.

? Ostomy/stoma care refers to the management and treatment of individuals who have undergone ostomy surgery, a procedure where a part of the digestive or urinary system is diverted to an opening (stoma) on the abdominal wall. This surgery is typically performed to treat conditions such as colorectal cancer, inflammatory bowel disease (IBD), or bladder cancer. Ostomy care involves using specialized products like ostomy bags, pouches, and skin care accessories to manage the collection of bodily waste, prevent skin irritation, and maintain overall hygiene and comfort. The goal of ostomy care is to help patients live normal, active lives by providing effective solutions that address the physical and emotional challenges associated with the procedure.

? A few key trends in the ostomy/stoma care market are described below: Advancements in Product Design: Development of more discreet, comfortable, and skin-friendly ostomy bags and accessories, with features like odor control and breathable materials. Personalized Care Solutions: Growing emphasis on tailored products and services to meet individual patient needs, enhancing comfort and ease of use. Digital Health Integration: Increasing use of digital technologies, such as mobile apps and smart ostomy products, to monitor patient conditions and improve outcomes. Patient Education and Support: A rise in online platforms and telehealth services aimed at educating patients and providing ongoing support for managing ostomy care at home.

? For a new company entering the ostomy/stoma care market, focusing on product innovation and patient comfort would be essential to stay ahead of the competition. Developing ostomy bags and accessories with improved skin protection, odor control, and more discreet designs would appeal to a growing demand for convenience and enhanced quality of life. Additionally, offering personalized care solutions and integrating digital health technologies, such as smart monitoring tools or mobile apps, can provide added value. Building strong partnerships with healthcare providers and offering patient education and support services will also differentiate the brand and foster customer loyalty in a competitive market.

? Companies manufacturing, distributing, or purchasing products related to ostomy/stoma care and other consulting firms must buy the report.