Orthopedic Devices Market Share, Size, Trends, Industry Analysis Report

By Product (Accessories And Surgical Devices); By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 181

- Format: PDF

- Report ID: PM3263

- Base Year: 2023

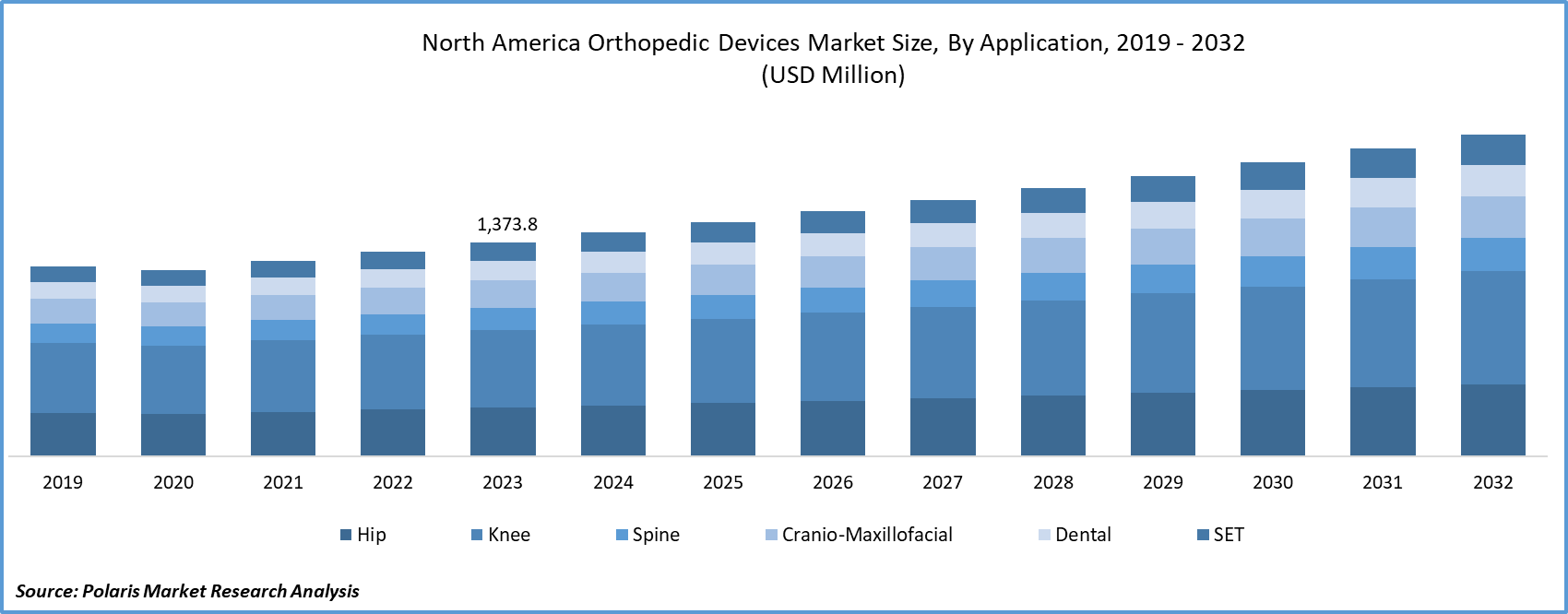

- Historical Data: 2019-2022

Report Outlook

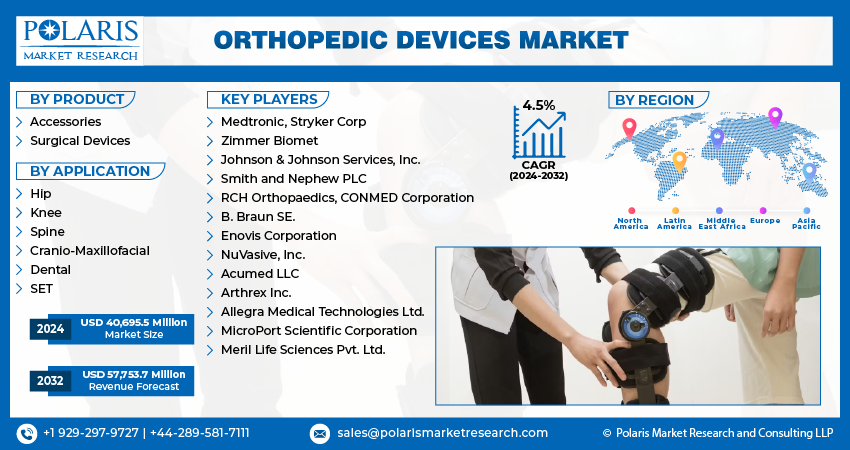

The orthopedic devices market size was valued at USD 38,970.0 million in 2023. The market is anticipated to grow from USD 40,695.5 million in 2024 to USD 57,753.7 million by 2032, exhibiting a CAGR of 4.5% during the forecast period.

Industry Trend

The knee orthopedic equipment category maintained significant market shares in 2023, a trend projected to persist from 2024 to 2032, driven by the rising number of knee surgeries. Despite its dominance, obstacles such as elevated costs and prolonged follow-up periods hinder segment growth. Additionally, stringent regulatory requirements are impeding the approval of class III medical devices.

The Sports Medical, Extremities & Trauma (SET) sector is anticipated to exhibit the fastest CAGR between 2024 and 2032. Increased occurrences of sports and auto accident injuries, coupled with growing public awareness of available treatments, are expected to drive the orthopedic devices market in foot and ankle applications.

To Understand More About this Research: Request A Free Sample

The market is categorized into surgical devices and accessories based on products. Between 2024 and 2032, the accessories market is poised for the highest CAGR, encompassing products like braces, arthroscopy devices, and various consumables. This section also includes items such as fasteners, plaster supplies, and sutures. Subcategories of the surgical instrument market comprise drill guides, special clamps, guide tubes, screwdrivers, and distracters.

The landscape for the newly launched orthopedic devices market is shaped by factors such as technological innovation, market demand, regulatory compliance, competition, and healthcare trends. Companies aim to address unmet clinical needs, improve patient outcomes, and gain market share by introducing innovative orthopedic devices such as implants, prosthetics, and surgical instruments. Key players invest in R&D, clinical trials, and marketing to establish a competitive edge and capitalize on opportunities arising from demographic shifts, advancements in medical technology, and evolving treatment paradigms in orthopedic care.

For instance, in July 2023, Stryker has launched the Ortho Q Guidance system, a cutting-edge solution for developed surgery planning and recommendation in knee and hip procedures. This system provides surgeons with easy control from the sterile field.

During the initial phases of the pandemic, many healthcare facilities postponed elective surgeries, including orthopedic procedures, to prioritize resources for COVID-19 patients. This led to a decline in the number of orthopedic surgeries and subsequently impacted the demand for orthopedic devices.

Key Takeaway

- Europe dominated the largest market and contributed to more than 40% of the share in 2023.

- The Asia Pacific market is expected to be the fastest-growing CAGR during the forecast period.

- By product, the surgical device segment accounted for the largest market share in 2023.

- By application category, the SET segment is projected to grow at a fastest CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Orthopedic Devices Market?

Growing Aging Population have been Projected to Spur Market Demand

The aging population is a key driver of the orthopedic devices market due to the increased prevalence of musculoskeletal conditions among elderly individuals. As people age, the likelihood of experiencing orthopedic issues such as osteoarthritis, fractures, and degenerative joint diseases rises. These conditions often necessitate the use of orthopedic devices such as joint implants, braces, and support systems. The growing aging demographic globally creates a substantial and sustained demand for orthopedic interventions, driving market growth. Orthopedic devices aid in restoring mobility, alleviating pain, and improving overall quality of life for the elderly population, making them crucial in addressing the healthcare needs of this demographic. This trend is expected to persist as populations continue to age, contributing to the ongoing expansion of the orthopedic devices market.

Which Factor is Restraining the Demand for Orthopedic Devices?

High Cost of Orthopedic Devices

The high cost of orthopedic devices poses a significant challenge to the orthopedic devices market for several reasons. Firstly, the elevated expense of developing, manufacturing, and marketing these devices contributes to increased healthcare costs, limiting accessibility for patients and straining healthcare budgets. This cost challenge is particularly crucial as healthcare systems globally strive for cost-effectiveness and affordability.

Secondly, the financial burden extends to patients who may face high out-of-pocket expenses for orthopedic treatments, impacting their willingness and ability to undergo certain procedures. Moreover, limited reimbursement policies in some regions exacerbate the financial challenges for patients and healthcare providers, potentially leading to disparities in access to advanced orthopedic interventions.

The high cost also affects market dynamics, leading to pricing pressures and reduced profit margins for manufacturers. This, in turn, can hinder investment in research and development, slowing down innovation in the orthopedic devices sector. Addressing the challenge of high costs requires a multifaceted approach, including efforts to streamline manufacturing processes, negotiate pricing with healthcare systems, and explore innovative financing models to enhance accessibility and sustainability in the orthopedic devices market.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

Based on product analysis, the market is segmented into accessories and surgical devices. The surgical device segment held the largest market in 2023. Surgical devices are pivotal components of the orthopedic devices market, encompassing a diverse range of instruments and tools used in orthopedic surgeries. These devices include power tools, drills, saws, reamers, and precision instruments designed for tasks like bone cutting, shaping, and fixation. Surgical devices play a crucial role in procedures such as joint replacement surgeries, fracture repair, and spinal interventions. Advancements in surgical device technology contribute to the efficiency, precision, and safety of orthopedic procedures, enabling minimally invasive techniques and reducing recovery times. The integration of robotic-assisted surgical systems further enhances the capabilities of orthopedic surgical devices.

By Application Insights

Based on application analysis, the market has been segmented on the basis of hip, knee, spine, cranio-maxillofacial, dental, SET. The SET segment is anticipated to experience the highest Compound Annual Growth Rate (CAGR) during the forecast period orthopedic devices market. The Sports Medicine, Extremities, and Trauma applications form a critical segment within the orthopedic devices market, addressing injuries and conditions related to sports activities, extremities (such as hands and feet), and traumatic orthopedic events. Orthopedic devices in this category include implants, braces, and instrumentation used in the treatment of fractures, dislocations, and soft tissue injuries in areas like the shoulder, elbow, wrist, hip, knee, and ankle. Sports medicine devices are tailored for athletes, supporting injury prevention, treatment, and rehabilitation. The focus on minimally invasive techniques, advanced materials, and patient-specific solutions enhances outcomes in extremity and trauma-related orthopedic care.

Regional Insights

Europe

Europe region accounted for the largest market share in 2023. Europe plays a pivotal role in the orthopedic devices market, driven by a combination of advanced healthcare infrastructure, an aging population, and a strong emphasis on medical research and innovation. The region encompasses diverse markets, including the United Kingdom, Germany, France, and others, contributing to the overall growth. Increasing incidences of musculoskeletal disorders, coupled with rising awareness and acceptance of advanced orthopedic treatments, propel market expansion. European countries maintain stringent regulatory standards, ensuring product safety and efficacy. Additionally, a preference for minimally invasive procedures, coupled with a focus on personalized medicine, shapes the orthopedic landscape.

Asia Pacific

Asia Pacific is expected for the growth of fastest CAGR during the forecast period. The Asia Pacific region is a dynamic and rapidly growing market in the orthopedic devices sector. Rising healthcare awareness, increasing geriatric population, and expanding healthcare infrastructure contribute to the region's significance. Countries such as China, Japan, and India are key players, witnessing a surge in orthopedic procedures and device demand. The prevalence of musculoskeletal conditions, coupled with improving economic conditions, propels market growth. In Asia Pacific, there's a notable trend toward adopting advanced technologies like robotics and 3D printing in orthopedic surgeries. However, challenges include varying healthcare regulations and diverse market dynamics across countries..

Competitive Landscape

The orthopedic devices market is highly competitive and constantly evolving due to advancements in technology, changes in consumer preferences, and regulatory developments. To stay ahead, companies engage in mergers and acquisitions, strategic partnerships, and product innovations. Manufacturers are also investing in research and development to meet the growing demand for minimally invasive procedures and personalized orthopedic solutions. Additionally, with a focus on cost-effective healthcare solutions and patient-centric approaches, companies are expanding their distribution networks and geographic presence to tap into emerging markets, further intensifying the competition.

Some of the major players operating in the global market include:

- Medtronic, Stryker Corp

- Zimmer Biomet

- Johnson & Johnson Services, Inc.

- Smith and Nephew PLC

- RCH Orthopaedics, CONMED Corporation

- B. Braun SE.

- Enovis Corporation

- NuVasive, Inc.

- Acumed LLC

- Arthrex Inc.

- Allegra Medical Technologies Ltd.

- MicroPort Scientific Corporation

- Meril Life Sciences Pvt. Ltd.

Recent Developments

- In January 2024, Smith+Nephew, has finalized the acquisition of CartiHeal, for sports medicine technology designed for knee cartilage regeneration.

- In October 2023, Smith+Nephew has introduced the REGENETEN Bioinductive Implant in Japan, providing access to thousands of patients. With over 100,000 procedures conducted worldwide since its introduction in the US and Europe, REGENETEN has significantly influenced the approach surgeons take to rotator cuff repair.

- In August 2024, Medtronic plc has secured Conformite Europeenne (CE) Mark approval for its Inceptiv closed-loop rechargeable SCS (spinal cord stimulator). Distinguished as the first of its kind within Medtronic's SCS devices, Inceptiv introduces a closed-loop characteristic.

- In April 2023, Stryker partnered with Project C.U.R.E. to provide medical equipment to underserved regions. Project C.U.R.E., acknowledged as the major distributor globally of donated medical devices and supplies to communities with limited resources, positively influences the lives of patients, families, and children across more than 135 countries.

- In April 2023, Enovis Corporation acquired Novastep, which is a subsidiary of Amplitude Surgical SA. Novastep is a developer of clinically proven foot and ankle solutions, and its portfolio of CE-marked forefoot and midfoot implants, along with its robust OUS channel, is expected to bolster Enovis' global position in the market.

- In November 2022, Zimmer Biomet expands its Persona Knee System offerings as the FDA grants clearance for Persona OsseoTi Keel Tibia, enhancing options for cementless knee replacement.

Report Coverage

The orthopedic devices market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application and their futuristic growth opportunities.

Orthopedic Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 40,695.5 million |

|

Revenue forecast in 2032 |

USD 57,753.7 million |

|

CAGR |

4.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global orthopedic devices market size is expected to reach USD 57,753.7 million by 2032

Key players in the orthopedic devices market are Medtronic PLC; Stryker Corporation; Zimmer-Biomet Holdings, Inc.; DePuy Synthes; Smith and Nephew PLC; Aesculap Implant Systems, LLC.

North America contribute notably towards the global orthopedic devices market.

The orthopedic devices market anticipated to rise at a CAGR of 4.5%.

The orthopedic devices market report covering key segments are application, product type and region.