Organic Pigments Market Size, Share, Trends, Industry Analysis Report – By Source (Synthetic and Natural), Type, Application, and Region; Segment Forecast, 2024 – 2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM5108

- Base Year: 2023

- Historical Data: 2019-2022

Organic Pigments Market Outlook

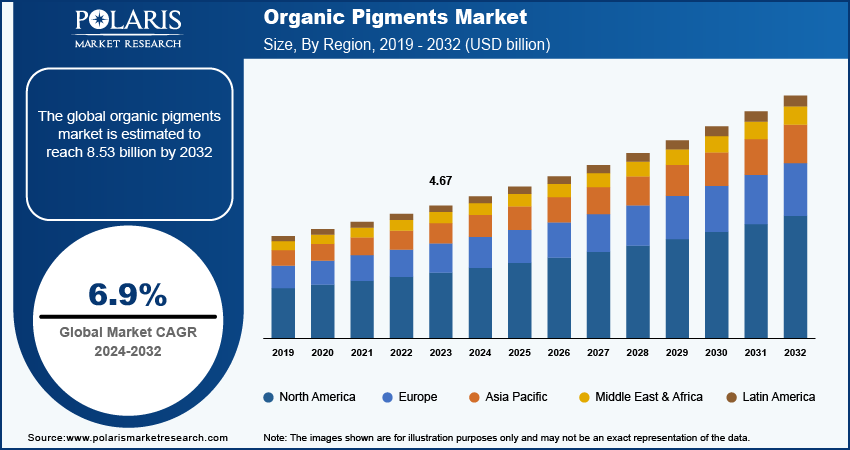

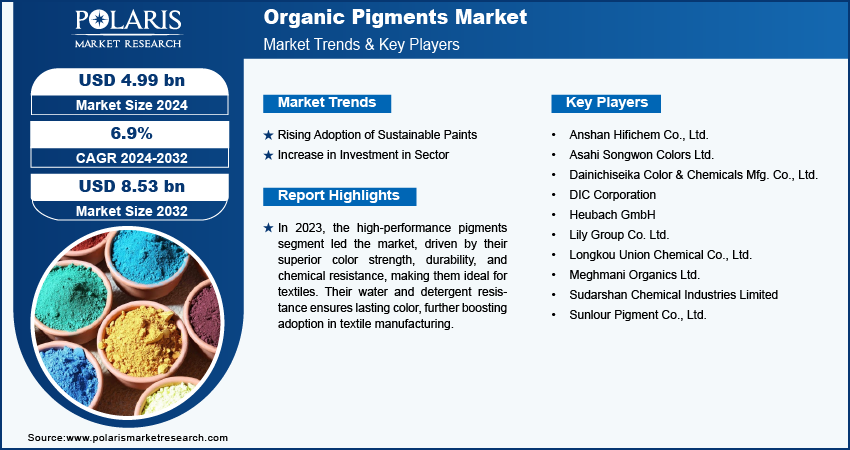

The organic pigments market size was valued at USD 4.67 billion in 2023. The market is anticipated to grow from USD 4.99 billion in 2024 to USD 8.53 billion by 2032, exhibiting a CAGR of 6.9% during 2024–2032.

Organic Pigments Market Overview

The increasing use of plastic in decoration, rising demand for attractive textiles, and notable surge in paper production and packaging are driving the growth of the organic pigment market. Organic pigments offer superior solubility and environmental compatibility compared to inorganic pigments. Additionally, major companies' expansion initiatives to reach a broader consumer base are expected to further accelerate market growth in the coming years. In March 2023, BTC Europe signed a distribution agreement with Sudarshan Chemical Industries Ltd., a Pune-based pigments producer, to expand organic, inorganic, and effect pigments in Europe.

To Understand More About this Research: Request a Free Sample Report

The increasing use of organic pigments in the food & beverage industry, driven by a stronger emphasis on improving food appearance, is expected to significantly increase demand for organic pigments in the coming years. The rising literacy and awareness about the health risks associated with toxic chemicals are contributing to the growing preference for organic pigments. As consumers and industries prioritize safer, more natural alternatives, the organic pigments market is poised for substantial growth during the forecast period.

Growth Drivers

Rising Adoption of Sustainable Paints

The increasing adoption of sustainable paints by households, businesses, and government organizations to address environmental pollution is creating favorable conditions for the organic pigment market. Additionally, the growing number of companies committed to reducing emissions and limiting carbon footprints in their manufacturing processes drives the market growth.

Increasing Investments in end–use industry

The rise in funding is driving innovation and expansion, leading to the development of new and improved organic pigments with superior performance characteristics. This financial boost supports research and development efforts aimed at creating more vibrant, durable, and environmentally friendly pigments. Additionally, increased investments in production facilities and technologies enable manufacturers to meet the rising demand across various industries, including automotive, textiles, and packaging. As rising investments are enabling advancements and scaling operations, the organic pigment market is growing rapidly.

Restraining Factors

Lack of Resources

The production of organic pigments involves intricate processes, resulting in limited supply and higher costs for end products. This complexity is reducing the production and consumption of organic pigments, as chemical pigments offer advantages such as greater durability under extreme weather conditions, easier color dispersion, and lower costs. Consequently, the higher expense and production challenges associated with organic pigments are driving preference toward more cost-effective and versatile chemical alternatives.

Organic Pigments Market Report Segmentation

The organic pigments market is primarily segmented on the basis of source, type, application, and region.

By Source Analysis

Natural Segment to Witness Higher Growth Rate in Organic Pigments Market During Forecast Period

The natural segment is projected to register a higher CAGR during the forecast period due to the abundant availability of natural raw materials. Manufacturers are increasingly focusing on research to derive vibrant colors directly from these natural sources, aiming to offer highly natural organic pigments to consumers. Additionally, the rising use of bio-based compounds, such as ethanol, is enhancing extraction efficiency and simplifying production processes. These advancements in natural pigment production are driving the growth of the segment.

By Type Analysis

High-Performance Pigments Segment Accounted for Largest Market Share in Organic Pigments Market

The high-performance pigments segment held the largest market revenue share in 2023 and is likely to retain its market position during the forecast period. This dominance is attributed to their exceptional color strength, durability, and resistance to chemicals and impacts, which make them highly suitable for the textile industry. Their ability to withstand water and detergents is particularly important for textiles, ensuring long-lasting color and performance in clothing. These attributes drive the widespread adoption of high-performance pigments in textile manufacturing.

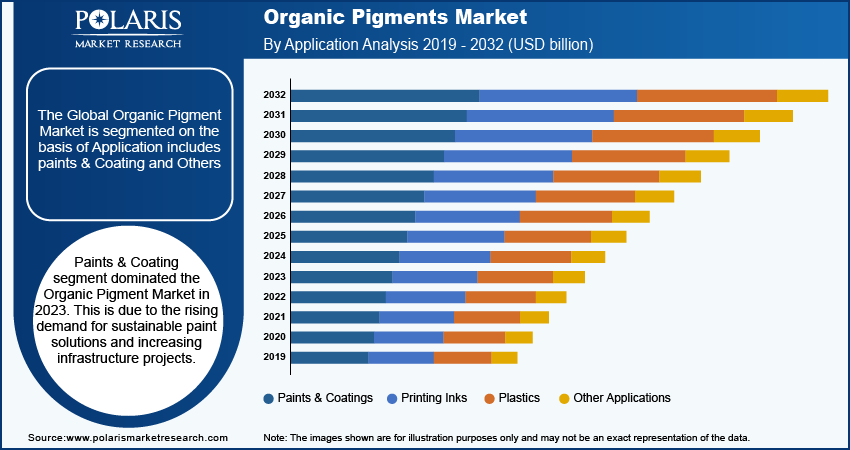

By Application Analysis

Paints & Coatings Segment Held Significant Market Revenue Share in Organic Pigments Market

The paints & coatings segment held a significant market share in revenue in 2023, driven by the surge in new building construction fueled by population growth and urbanization. The demand for organic pigments in this sector is heightened by their vibrant colors and water-resistance properties, which are crucial for new builds and renovation projects. Increasing focus on aesthetics, coupled with rising home renovation and decoration activities, further boosts the need for organic pigments. Additionally, growing awareness of the benefits of organic pigments over conventional options is expected to support the growth of this segment.

Organic Pigments Market Regional Insights

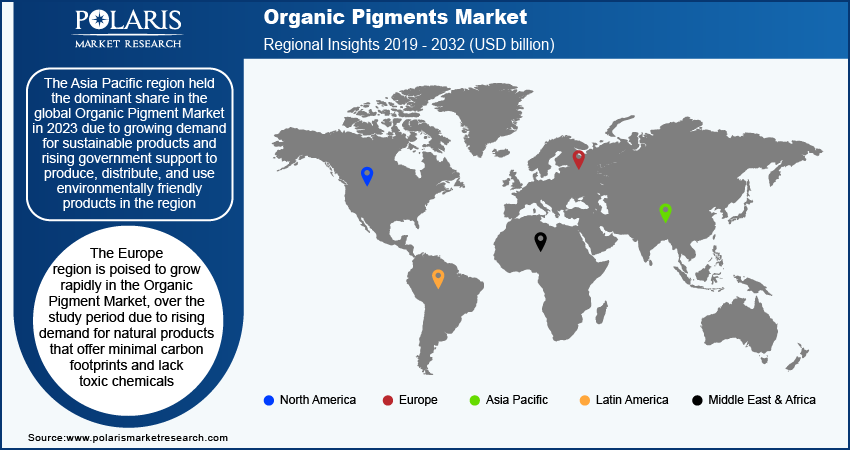

Asia Pacific Registered Largest Share of Global Organic Pigments Market in 2023

Asia Pacific held the dominant share in 2023 due to growing demand for sustainable products and rising government support to produce, distribute, and use environmentally friendly products in the region. Additionally, the growing merger and acquisition activities and collaborations between major players are expected to boost advancements in the organic pigments market during the forecast period. For instance, in April 2024, Heubach Group joined forces with Evonik Coating Additives to foster the development of environmentally friendly ink and other printing solutions in China.

Europe is expected to record the highest CAGR during the forecast period due to rising demand for natural products that offer minimal carbon footprints and lack toxic chemicals. Stringent government regulations on the food industry and increasing efforts to cut global greenhouse gas emissions boost demand for organic pigments. These factors contribute to Europe's strong push toward sustainability and environmental responsibility, fostering the growth of the organic pigments market in the region.

Key Market Players and Competitive Insights

Strategic Expansion Activities to Fuel Competition

The organic pigments market is fragmented. The rising emergence of new entrants in organic pigment production and increasing demand for natural pigments are anticipated to drive innovation in the market. The growing merger and acquisition by the major players is expected to boost market expansion in the long run. For instance, in September 2023, Genpharmasec Ltd, a trader of organic and inorganic pigments and dyes, announced its strategy to purchase a 70% stake in Derren Healthcare in the next year in a phased manner.

Major Players Operating in Organic Pigments Market

- Anshan Hifichem Co., Ltd.

- Asahi Songwon Colors Ltd.

- Dainichiseika Color & Chemicals Mfg. Co., Ltd.

- DIC Corporation

- Heubach GmbH

- Lily Group Co. Ltd.

- Longkou Union Chemical Co., Ltd.

- Meghmani Organics Ltd.

- Sudarshan Chemical Industries Limited

- Sunlour Pigment Co., Ltd.

Recent Developments in Industry

- In May 2023, ChromaScape completed the acquisition of the colorants and dye business of Kemira. Its product portfolio includes pigments, dyes, and special colorants, which can be utilized in packaging and paper applications.

- In March 2023, The Heubach Group launched its new Ultrazur product line, featuring Ultramarine Blue pigments in four shades. Produced at their new Dahej facility, the pigments were noted for their exceptional quality, environmental performance, and versatility.

Organic Pigment Market Segmentation

By Source Outlook (USD million, 2019–2032)

- Synthetic

- Natural

By Type Outlook (USD million, 2019–2032)

- Azo Pigments

- Phthalocyanine Pigments

- High Performance Pigments (HPPs)

- Other Types

By Application Outlook (USD million, 2019–2032)

- Printing Inks

- Paints & Coatings

- Plastics

- Other Applications

By Regional Outlook (USD million, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Coverage

The organic pigments market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, it covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, source, type, application, and futuristic opportunities.

Organic Pigments Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.99 billion |

|

Revenue Forecast by 2032 |

USD 8.53 billion |

|

CAGR |

6.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The organic pigment market size was valued at USD 4.67 billion in 2023 and is projected to grow to USD 8.53 billion by 2032

The global market is projected to register a CAGR of 6.9% during the forecast period.

Asia Pacific accounted for the largest share of the global market in 2023.

A few key players in the market are Anshan Hifichem Co., Ltd.; Asahi Songwon Colors Ltd.; Dainichiseika Color & Chemicals Mfg. Co., Ltd.; DIC Corporation; Heubach GmbH; Lily Group Co. Ltd.; Longkou Union Chemical Co., Ltd.; Meghmani Organics Ltd.; Sudarshan Chemical Industries Limited; and Sunlour Pigment Co., Ltd.

The natural segment is anticipated to experience substantial growth with a significant CAGR in the global market during the forecast period. This growth is attributed to the easy availability of raw materials and cost effectiveness.

The paints & coating segment accounted for the largest revenue share of the market in 2023 due to the rising demand for sustainable paint solutions and increasing infrastructure projects.