Organic Chocolate Spreads Market Size, Share, Trends, Industry Analysis Report: By Product, Distribution Channel, Market Nature (Certified Organic and Non-Certified Organic), Sweetening Agent, Packaging, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5535

- Base Year: 2024

- Historical Data: 2020-2023

Organic Chocolate Spreads Market Overview

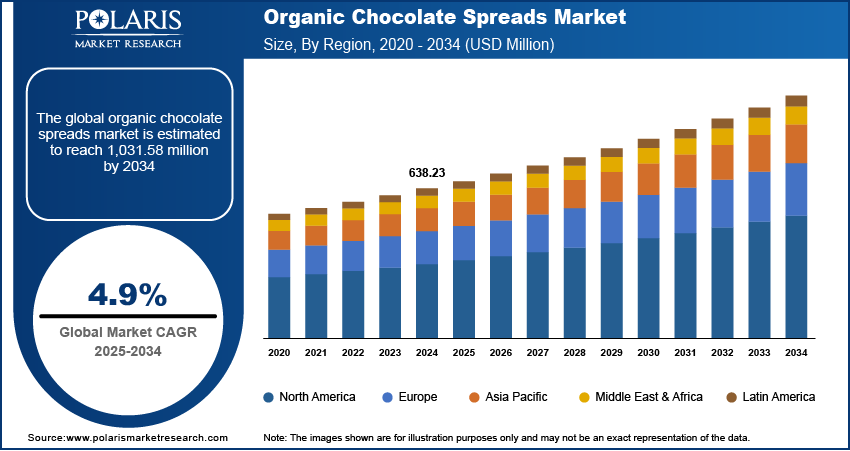

The global organic chocolate spreads market was valued at USD 638.23 million in 2024. It is expected to grow from USD 668.94 million in 2025 to USD 1,031.58 million by 2034, at a CAGR of 4.9% during the forecast period.

Organic chocolate spread is a confectionery product made from organic cocoa, sugar, and other natural ingredients, free from synthetic additives and pesticides. The organic chocolate spreads market growth is driven by increasing consumer awareness of health and sustainability. Consumers are actively seeking healthier alternatives to conventional spreads with a shift toward organic and clean-label ingredients. For instance, in a February 2022 report, the Ministry of Agriculture & Farmers Welfare highlighted that the Indian government promotes organic food through schemes such as PKVY and MOVCDNER, providing financial aid for inputs, training, certification, and marketing. Initiatives such as large-area certification and online platforms such as Jaivikkheti, supported by RKVY, MIDH, and ICAR programs, reflect the growing emphasis on organic products. This rising demand is further fueled by concerns over artificial ingredients, leading to higher adoption of organic chocolate spreads. The expanding availability of these products in mainstream retail channels has also contributed to their market penetration, making them more accessible to health-conscious buyers.

To Understand More About this Research: Request a Free Sample Report

Another driver shaping the organic chocolate spreads market is the increased influence of Western food habits and urbanization. Dietary preferences are evolving as urbanization accelerates, with consumers increasingly adopting global food trends, such as premium organic spreads. For instance, a June 2023 NIH report reveals 65% adult obesity in the US, with over 280,000 obesity-related deaths annually, highlighting the urgent need for healthier dietary choices. This growing awareness of health risks has further fueled the demand for organic and clean-label products such as organic chocolate spreads. Exposure to Western lifestyles, particularly in developing economies, has led to greater acceptance of organic and gourmet food products. Additionally, the growth of e-commerce and modern retail formats has further facilitated the accessibility of organic chocolate spreads, reinforcing their demand among urban populations. This shift in consumer behavior, combined with the broader trend of health-conscious consumption, continues to drive market expansion.

Organic Chocolate Spreads Market Driver Dynamics

Growing Adoption of Plant-Based Diets

Demand for plant-based products has surged, leading to the development of organic chocolate spreads made with alternative milk sources such as almonds, coconut, and oats, with rising health consciousness and ethical concerns surrounding animal-derived ingredients. A 2023 report by the GFI stated that the US plant-based food market grew from USD 3.9 billion to USD 8.1 billion in 2023, driven by products mimicking animal-based foods. Innovation and investment by companies have expanded options, increasing plant-based shares in the meat, dairy, and egg categories. This shift aligns with the broader trend of clean-label and minimally processed foods, further reinforcing consumer preference for organic options. Therefore, as plant-based diets become more mainstream, manufacturers are expanding their product portfolios to cater to this growing consumer base, thereby driving growth opportunities.

Technological Advancements and Product Innovation

Technological advancements and product innovation in product quality, texture, and shelf life play a crucial role in shaping the organic chocolate spreads market. Advances in food processing techniques have enabled manufacturers to develop spreads with improved consistency, reduced sugar content, and enhanced nutritional profiles without compromising taste. For instance, in June 2024, a Franklin & Marshall College graduate launched Broma, a plant-based, organic chocolate spread made with dark chocolate, almonds, and lentils, offering complete protein, fiber, and essential nutrients. Additionally, innovations in sustainable packaging and ingredient sourcing have strengthened the market appeal of organic chocolate spreads. Companies are also leveraging research and development to introduce functional ingredients, such as added protein or superfoods, catering to evolving consumer preferences. These advancements differentiate products in a competitive market and also contribute to the overall demand for organic chocolate spreads.

Organic Chocolate Spreads Market Segment Analysis

Organic Chocolate Spreads Market Assessment by Product

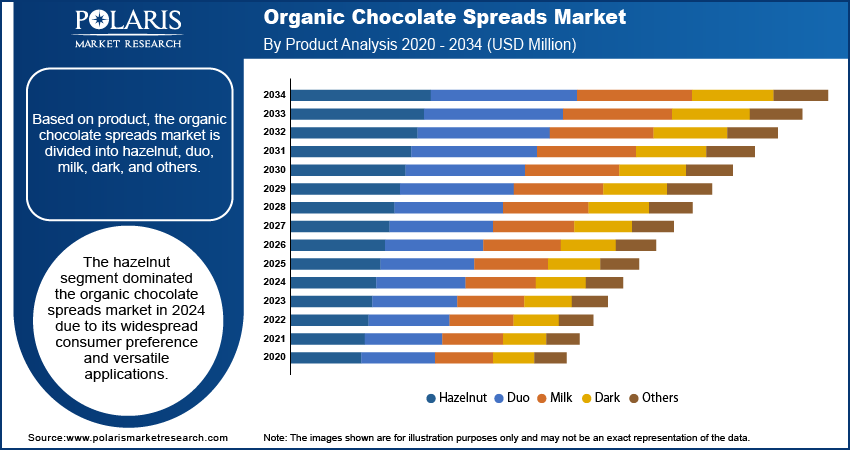

The global organic chocolate spreads market segmentation, based on product, includes hazelnut, duo, milk, dark, and others. The hazelnut segment dominated the organic chocolate spreads market in 2024 due to its widespread consumer preference and versatile applications. Hazelnut-based spreads offer a rich and creamy texture, enhancing their appeal among health-conscious consumers seeking organic alternatives to conventional chocolate spreads. The natural compatibility of hazelnuts with cocoa results in a distinctive flavor profile that is both indulgent and nutritious. Additionally, hazelnut-based spreads are often positioned as premium products, attracting consumers willing to pay a premium for organic and high-quality offerings. The strong association of hazelnuts with traditional chocolate spreads further reinforces their dominance, making them the preferred choice in the organic segment.

Organic Chocolate Spreads Market Evaluation by Distribution Channel

The global organic chocolate spreads market segmentation, based on distribution channel, includes supermarkets & hypermarkets, online, and others. The online segment is expected to witness the fastest organic chocolate spreads market growth during the forecast period due to increasing e-commerce penetration and shifting consumer shopping behavior. The convenience of online platforms allows consumers to access a wider variety of organic chocolate spreads, including niche and specialty brands that may not be available in physical stores. Additionally, the rise of direct-to-consumer (DTC) strategies by organic brands has strengthened online sales, offering consumers personalized recommendations and subscription-based purchasing options. Competitive pricing, discounts, and easy home delivery further enhance the appeal of online channels, making them a key driver of market expansion.

Organic Chocolate Spreads Market Regional Insights

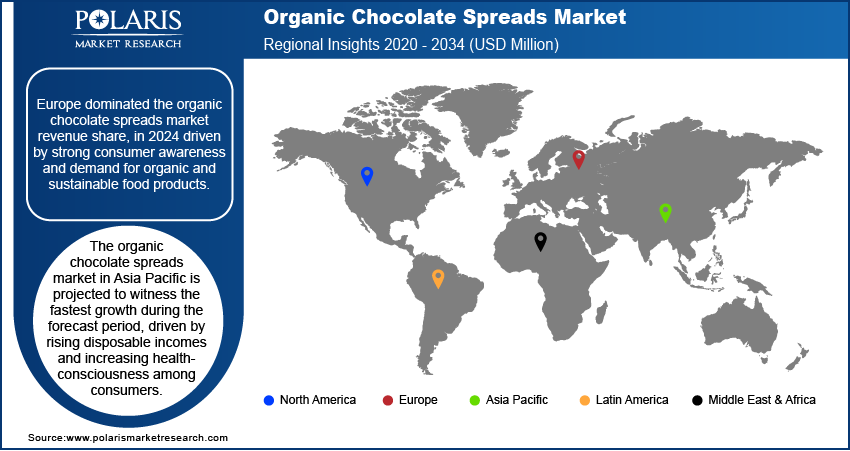

By region, the report provides the organic chocolate spreads market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the market revenue share in 2024, driven by strong consumer awareness and demand for organic and sustainable food products. The region has well-established regulations supporting organic certification, ensuring product authenticity, and fostering consumer trust. For instance, in January 2024, Ajinomoto utilized its Kokumi technology to enhance chocolate spreads, improving creaminess and flavor while reducing fat and sugar content. They introduced Savorboost K and Sweet Answer MB and invested in machinery to optimize production efficiency, reflecting the industry’s focus on innovation and quality. Additionally, European consumers exhibit a high preference for premium and clean-label food products, contributing to the widespread adoption of organic chocolate spreads. Countries such as Germany, France, and Italy have a deep-rooted culture of chocolate consumption, further fueling market demand. The presence of leading organic food manufacturers and extensive retail distribution networks has also played a crucial role in securing Europe’s market leadership.

The organic chocolate spreads market in Asia Pacific is projected to witness the fastest growth during the forecast period, driven by rising disposable incomes and increasing health-consciousness among consumers. The region is experiencing a shift in dietary preferences, with growing demand for organic and plant-based food products, particularly in urban centers. The expanding middle-class population, coupled with greater exposure to Western food trends, has accelerated the adoption of organic chocolate spreads. Additionally, the rapid expansion of e-commerce and modern retail infrastructure in countries such as China, India, and Japan has improved market accessibility. These factors collectively contribute to the strong growth of the market in Asia Pacific.

Organic Chocolate Spreads Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for organic chocolate spreads market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Organic chocolate spreads market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes.

Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with organic chocolate spreads market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the organic chocolate spread industry's growth is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, assuring sustained growth in a hypercompetitive global market. A few key major players are Artisana Organics, BIONA, Ferrero, Green & Black's, Justin's, Mason & Co., Nutiva, Pana Organic, Rigoni di Asiago, and The Organic Family Ltd. (Mr. Organic).

Artisana Organics is a company in the organic food industry specializing in the artisanal production of raw, vegan, and organic products. Founded in 2002 and headquartered in Oakland, California, Artisana Organics is renowned for its high-quality nut butter and seed butter, including organic raw cashew, coconut, pecan, and walnut butter. While primarily focused on nut butter, Artisana Organics also offers a hazelnut cacao spread, which serves as a healthier alternative to traditional chocolate hazelnut spreads such as Nutella. This spread combines hazelnuts with cacao, providing a rich and delicious taste without excessive sugar. Artisana Organics emphasizes sustainability and environmental responsibility, sourcing ingredients from trusted farmers worldwide. Their products are crafted in small batches to preserve natural flavors and nutrients, ensuring that every bite is both nutritious and delicious. Artisana Organics appeals to consumers seeking healthier and more environmentally friendly food options by offering organic and sustainably sourced ingredients, making their hazelnut cacao spread a notable choice in the organic chocolate spreads market.

Justin's is an American brand known for its natural and organic nut butter, peanut butter cups, and other snacks. Founded by Justin Gold in 2004, the company started by making unique nut butter flavors in a home kitchen in Boulder, Colorado. Justin's gained popularity for its innovative products, including organic peanut butter cups made with Rainforest Alliance Certified cocoa. They offer a Chocolate Hazelnut Butter that combines hazelnut butter with chocolate, providing a delicious and nutritious alternative to traditional chocolate spreads. This product is part of their commitment to using organic ingredients whenever possible and aligns with their mission to source ingredients mindfully. Justin's products are widely distributed across the US through retailers such as Whole Foods Market and Target. The company's dedication to sustainability and social responsibility, such as supporting organic farming practices, positions it well in the market for consumers seeking organic and natural food options.

Key Companies in Organic Chocolate Spreads Market

- Artisana Organics

- BIONA

- Ferrero

- Green & Black's

- Justin's

- Mason & Co.

- Nutiva

- Pana Organic

- Rigoni di Asiago

- The Organic Family Ltd. (Mr. Organic)

Organic Chocolate Spreads Market Development

September 2024: Ferrero launched Nutella Plant-Based, a vegan version of its iconic spread. Made with chickpeas, rice syrup, roasted hazelnuts, and cocoa, it retains the classic taste and texture while being certified vegan, catering to plant-based consumers.

Organic Chocolate Spreads Market Segmentation

By Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2020 - 2034)

- Hazelnut

- Duo

- Milk

- Dark

- Others

By Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2020 - 2034)

- Supermarkets & Hypermarkets

- Online

- Others

By Market Nature Outlook (Volume, Thousand Units; Revenue, USD Million, 2020 - 2034)

- Certified Organic

- Non-certified Organic

By Sweetening Agent Outlook (Volume, Thousand Units; Revenue, USD Million, 2020 - 2034)

- Cane Sugar

- Coconut Sugar

- Date Sugar

- Honey

By Packaging Outlook (Volume, Thousand Units; Revenue, USD Million, 2020 - 2034)

- Jar

- Tube

- Sachet

By Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Organic Chocolate Spreads Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 638.23 million |

|

Market Size Value in 2025 |

USD 668.94 million |

|

Revenue Forecast in 2034 |

USD 1,031.58 million |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Volume, Thousand Units; Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global organic chocolate spreads market size was valued at USD 638.23 million in 2024 and is projected to grow to USD 1,031.58 million by 2034.

The global market is projected to register a CAGR of 4.9% during the forecast period.

Europe dominated the organic chocolate spreads market revenue share in 2024.

Some of the key players in the market are Artisana Organics, BIONA, Ferrero, Green & Black's, Justin's, Mason & Co., Nutiva, Pana Organic, Rigoni di Asiago, and The Organic Family Ltd. (Mr. Organic).

The hazelnut segment dominated the organic chocolate spreads market in 2024 due to increasing e-commerce penetration and shifting consumer shopping behavior.

• The online segment is expected to witness the fastest organic chocolate spreads market growth during the forecast period due to increasing e-commerce penetration and shifting consumer shopping behavior.