Organ-On-Chip Market Share, Size, Trends, Industry Analysis Report, By Organ Type (Heart, Lung, Liver, Intestine, and Kidney); By Application; By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4648

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

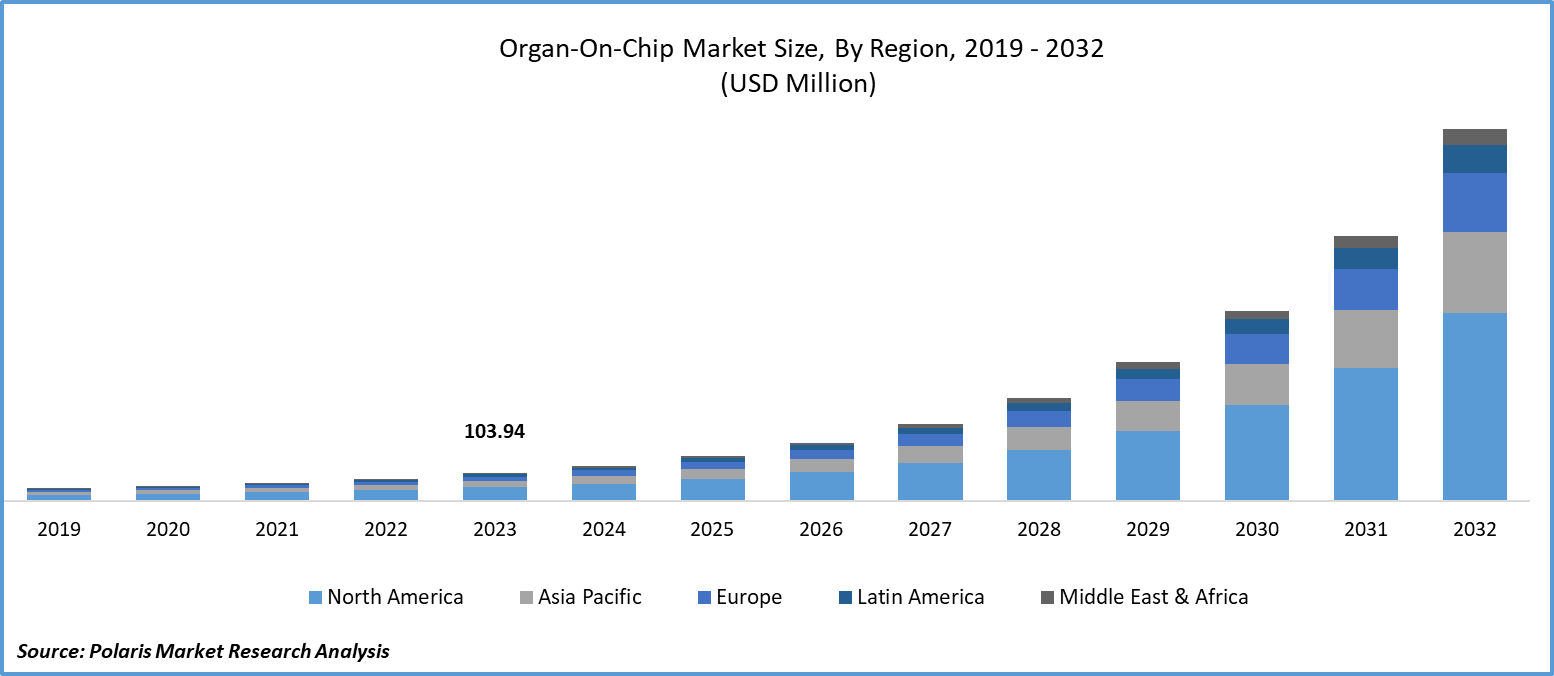

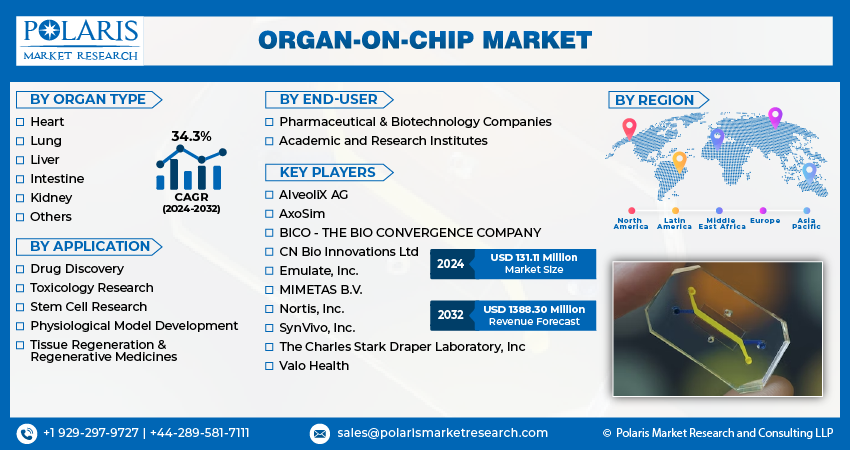

Global organ-on-chip market size was valued at USD 103.94 million in 2023. The market is anticipated to grow from USD 131.11 million in 2024 to USD 1388.30 million by 2032, exhibiting the CAGR of 34.3% during the forecast period

Organ-On-Chip Market Overview

The demand for organs-on-chip, especially those based on the kidneys and lungs, is expected to increase, leading to an expansion in the market growth. This technology is beneficial as it can help fulfill the demand for organ transplantation by engineering functioning organs in laboratories, which can address the scarcity of donor organs. However, the high cost of organ chip devices and the early stage of organ-on-chip technology research could impede market development. Despite this, market growth is expected to continue due to rising healthcare spending in developing nations and an increase in chronic diseases, the need for organ transplantation, and animal testing for drug development.

To Understand More About this Research: Request a Free Sample Report

- For instance, in September 2023, LifeNet Health and CN Bio Innovations Ltd entered into a partnership to provide verified human cells for the Organ-on-a-Chip devices of CN Bio.

Moreover, the worldwide organ-on-chip market is anticipated to grow due to the increase in demand for these devices in the healthcare sector. Applications of organ-on-chip devices in the healthcare sector include genetic & metabolic activity analysis, in vitro biochemical analysis, and real-time imaging of living cells in functional tissue. Organ-on-chip usage has increased as a result of developments in cell biology, microfabrication, and microfluidics, which has fueled the expansion of the organ-on-chip market.

The COVID-19 pandemic led to the implementation of strict lockdowns and social distancing measures, which had a negative impact on the development of the organ-on-chip market. The reduced consumer confidence, partial corporate shutdowns, and economic uncertainties affected the demand for organ-on-chip technology. Additionally, the supply chain faced challenges, and logistics operations were delayed during the pandemic. However, with the relaxation of regulations, the organ-on-chip business is expected to gain momentum in the post-pandemic scenario.

Organ-On-Chip Market Dynamics

Market Drivers

Rising demand of substitute to reduce animal drug experimentation

Organ-on-chip technology is being developed as a potential alternative to animal testing for drugs. Often, drugs fail in the later stages of preclinical trials because of differences in how animals and humans process drugs. This high rate of failure and ethical concerns about using animals for testing has led to the development of organ-on-chip technology, which aims to reduce the reliance on animals and improve the effectiveness of drug toxicity testing. In Europe, the use of animals for testing cosmetic drugs has been banned since 2013. In 2023, the US FDA passed the Modernization Act 2.0, which aims to reduce animal testing for drugs and promote the use of alternative methods such as organ-on-chip technology.

Integration of technologies such as microfluidics and tissue engineering

The rise in interest in organ-on-chip is due to a combination of microfluidics with tissue engineering. These technologies provide practical solutions to long-standing problems in pharmaceutical discovery and tailored disease therapy. Research on drug development is aided by technology. Furthermore, the organ-on-chip market opportunity is positively impacted by investments, rising consumer spending, fast urbanization, and changes in lifestyle.

Market Restraints

Organ-on-a-chip applications are restricted to preclinical studies

The application of organ-on-chip (OOC) technology to the clinical stage of drug development is hampered by a number of issues, including ethical concerns about the use of certain cell types, such as induced pluripotent stem cells (iPSCs), limited access to renewable cell sources that affect model reliability, and difficulties in accurately representing the complexity of human organs during biological scaling. The model's scalability and efficiency are hampered by the limited throughput of current OOC technology, which prevents it from being fully integrated into clinical research. High Throughput OOC (HT-OOC) technology, which implements automation and parallelization in OOC systems to overcome these limitations, presents a promising way to advance drug development past preclinical stages by enabling extensive testing of large compound libraries to find relevant drugs for disease pathogenesis.

Report Segmentation

The market is primarily segmented based on organ type, application, end-user, and region.

|

By Organ Type |

By Application |

By End-User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Organ-On-Chip Market Segmental Analysis

By Organ Type Analysis

- The liver segment commands a substantial market share due to several reasons, notably the high failure rates of potential drug candidates attributed to human-hepatocytic drug toxicity, a complication often overlooked in animal studies or traditional 2D cell cultures. Liver models effectively mimic human liver functions, providing advanced opportunities for optimizing drug delivery and refining drug development methodologies.

By Application Analysis

- The drug discovery segment accounted for the largest market share in 2023 and is likely to retain its position throughout the market forecast period. There is a significant demand for in vitro tissue models that replicate human organ functions to aid in drug development. The challenges in drug discovery, such as high costs and low success rates in clinical trials, highlight the need for more reliable preclinical in vitro models. As a result, companies are investing in advancing organ-on-a-chip technology.

For instance, in March 2022, The Charles Stark Draper Laboratory, Inc., a provider of organ-on-a-chip and bioprocessing systems, declared a plan of action to improve its organ-on-a-chip technology in order to comply with the growing focus on precise and advanced therapeutics in drug development. Their plan includes developing new human organ models, advanced data collection and analysis tools for various stages of drug discovery and development, including drug toxicity assessment, efficacy testing in disease conditions, and evaluating therapeutic interventions.

- The toxicology research segment is expected to grow at the fastest CAGR over coming years. Despite the availability of antifungal medications, invasive fungal infections continue to be a major worldwide health issue, with a mortality rate surpassing 1.6 million deaths per year. Because the existing medicines are not precisely targeted, there is significant systemic damage. In September 2023, the Wyss Institute team unveiled Fungicidal endovascular Controlled-release Iron-binding Lectin Liposomes (FeCILL), which are intended to concentrate medications in the fungus cell wall by targeting it. Platforms for organs on a chip may be useful for toxicity testing and other research into such treatments.

By End-User Analysis

- Based on end-user analysis, the market has been segmented on the basis of pharmaceutical and biotechnology companies & academic and research institutes. The pharmaceutical and biotechnology companies segment held a significant market revenue share in 2023. The increase in demand can be credited to significant investments in research and development, a shift towards personalized medicine, the introduction of new products, and the requirement for advanced drug testing methods. For instance, in March 2023, Tokyo-based Telephone Corporation and Nippon Telegraph achieved a milestone by developing an on-chip actuator capable of mimicking organ movements. This advancement utilizes NTT's unique shape-morphing technique within the chip, allowing a hydrogel film that responds to light stimulation to change into a thin-film tube resembling the structure of organs.

- The academic and research institutes segment is expected to grow rapidly, with the highest CAGR from 2024 to 2032, making it the fastest-growing segment in the organ-on-a-chip industry. This growth is driven by its role as a center for innovation and research. In March 2022, a team of researchers from the University of Toronto's Faculty of Applied Science & Engineering used the organ-on-a-chip platform to discover a potential catalyst for the industry, the QHREDGS molecule. This novel anti-inflammatory peptide does not directly target the virus but instead addresses a critical complication of COVID-19 infections by preventing cytokine storms. The molecule's ability to mitigate cytokine storms is a promising development in combating severe outcomes of COVID-19 and related illnesses, underscoring the important role of organ-on-a-chip technology in drug discovery and understanding complex physiological responses.

Organ-On-Chip Market Regional Insights

The North America region dominated the global market with the largest market share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. Key market players, government initiatives, and the increasing prevalence of chronic diseases drive the region's growth. For instance, in response to COVID-19, the FDA partnered with NIAID to advance organs-on-chips and MPS models, aiming to develop and assess Medical Countermeasures. Similarly, the Wyss Institute collaborated with the UK Health Security Agency to enhance in vitro models for studying viral infections using organs-on-chips. In 2023, the FDA granted an award to further develop organ chips for radiation countermeasure research, including evaluating radiation countermeasure efficacy and screening experimental compounds for Medical Countermeasures.

The Europe region is expected to be the fastest growing region with a significant CAGR during the projected period. The growth in the region is primarily fueled by the increasing incidence of chronic diseases, advancements in technology, government initiatives, and the growing research and development efforts of non-profit organizations. In September 2023, the European organ-on-chip Society reported that scientists at Tampere University's Centre of Excellence in Body-on-Chip Research (Finland) published a review detailing the construction of microphysiological systems to mimic cardiac functions. The review highlights the center's focus on modeling brain strokes, hypoxia in cardiac ischemia, and conditions related to obesity. Their main activities include developing monitoring technologies for controlling oxygen levels, designing chip platforms, and improving hydrogel development.

Competitive Landscape

The organ-on-chip market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AlveoliX AG

- AxoSim

- BICO - THE BIO CONVERGENCE COMPANY

- CN Bio Innovations Ltd

- Emulate, Inc.

- MIMETAS B.V.

- Nortis, Inc.

- SynVivo, Inc.

- The Charles Stark Draper Laboratory, Inc

- Valo Health

Recent Developments

- In June 2023, PMI and TissUse GmbH signed a cooperation agreement to use the Multi-Organ-Chip (MOC) platform from TissUse and PMI's InHALES technology.

Report Coverage

The organ-on-chip market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, organ type, application, end-users, and their futuristic growth opportunities.

Organ-On-Chip Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 131.11 million |

|

Revenue forecast in 2032 |

USD 1388.30 million |

|

CAGR |

34.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Organ Type, By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Gain profound insights into the 2024 Organ-on-Chip Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

FAQ's

The Organ-On-Chip Market report covering key segments are organ type, application, end-user, and region.

The global organ-on-chip market size is expected to reach USD 1388.30 million by 2032

Organ-On-Chip Market exhibiting the CAGR of 34.3% during the forecast period

North America is leading the global market

key driving factors in Organ-On-Chip Market are Rising demand of substitute to reduce animal drug experimentation