Ophthalmic Spectacle Lenses and Equipment Market Size, Share, Trends, Industry Analysis Report: By Product (Ophthalmic Spectacle Lenses and Ophthalmic Spectacle Equipment) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 220

- Format: PDF

- Report ID: PM5550

- Base Year: 2024

- Historical Data: 2020-2023

Ophthalmic Spectacle Lenses and Equipment Market Overview

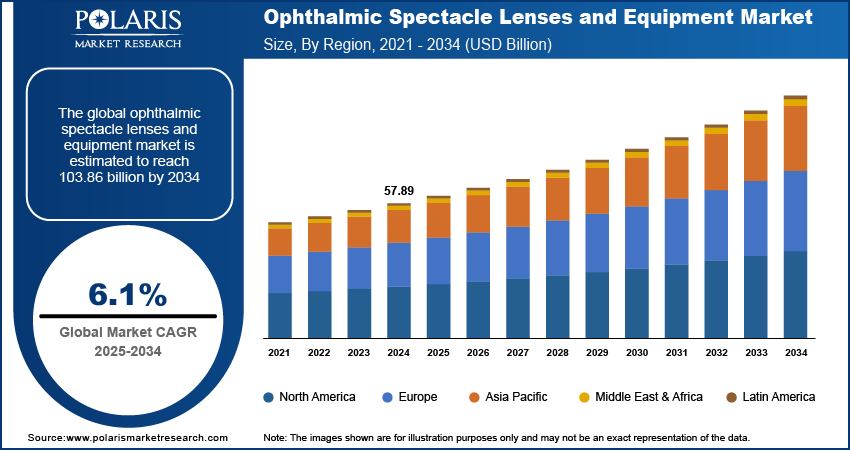

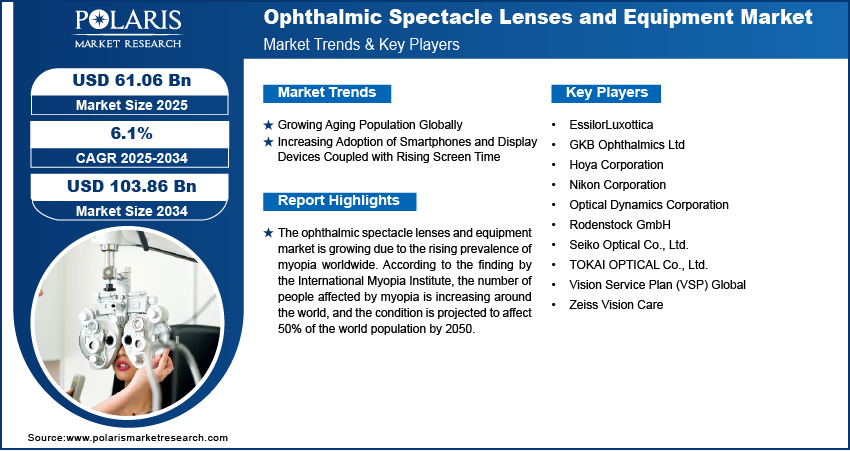

The global ophthalmic spectacle lenses and equipment market size was valued at USD 57.89 billion in 2024. The market is projected to grow from USD 61.06 billion in 2025 to USD 103.86 billion by 2034, exhibiting a CAGR of 6.1% during 2025–2034.

Ophthalmic spectacle lenses are essential components in vision correction. They are designed to address various refractive errors and enhance visual clarity. The lenses are categorized based on their optical properties and the specific vision needs they address. A few primary types of ophthalmic lenses include single-vision, multifocal, light protection, and progressive lenses. Single-vision lenses offer visual correction for just one distance, be it for near vision, distance vision, a specific distance, or general vision. They are classified into prismatic lenses, astigmatic, aspherical, and spherical lenses. Progressive lens offers the right dioptric power for every distance, allowing smooth vision at any distance. This design caters to individuals with presbyopia, allowing for comfortable viewing at all distances far, intermediate, and near without the abrupt changes associated with bifocal or trifocal lenses. Additionally, different types of light protection lenses are available in the market to accommodate individual requirements.

The ophthalmic spectacle lenses and equipment market demand is driven by the rising prevalence of vision disorders and the growing aging population. Increased demand for advanced vision correction solutions, technological advancements in lens manufacturing, and the expanding awareness of eye health further propel market growth, addressing the global need for improved eye care.

Ophthalmic Spectacle Lenses and Equipment Market Dynamics

Increasing Adoption of Smartphones and Display Devices Coupled with Rising Screen Time

The increasing use of smartphones and display devices, along with rising screen time, leads to digital eye strain or computer vision syndrome (CVS). To manage such conditions, there is a rising demand for innovative ophthalmic solutions, including corrective lenses such as blue-light-blocking lenses and anti-reflective coatings. Younger demographics, heavily reliant on smartphones, experience surging myopia cases, thus requiring high-index lenses, progressive lenses, and myopia control solutions. To address this, manufacturers incorporate peripheral defocus technology in lens designs to slow myopia progression and maintain central vision clarity, thus boosting the ophthalmic spectacle lenses and equipment market growth.

The global rise in remote work and online education accelerates screen time, creating a surge in demand for ophthalmic solutions. Individuals, including children and adults, increasingly seek lenses and equipment to mitigate screen-related vision issues. The World Economic Forum predicts a 25% rise in remote jobs by 2030, potentially expanding the ophthalmic spectacle lenses and equipment market demand in the future.

Wearable display devices, including VR headsets and AR glasses, contribute to eye strain due to intense visual focus. This trend drives the market for custom ophthalmic lenses tailored to wearable device users. The GSMA’s 2023 report noted that over 54% of the global population owns a smartphone. The increasing adoption of smartphones and display devices, coupled with rising screen time, rises, boosts the ophthalmic spectacle lenses and equipment market development.

Growing Aging Population Globally

The growing aging population globally is driving the ophthalmic spectacle lenses and equipment market growth. According to the United Nations, the number of people aged 65 and above is expected to more than double, from 761 million in 2021 to 1.6 billion by 2050. Aging leads to vision challenges such as presbyopia and age-related macular degeneration (AMD), creating substantial demand for corrective lenses and advanced diagnostic tools.

Older adults require bifocal or progressive lenses to address the loss of focus on nearby objects. This need encourages lens manufacturers to develop innovative solutions using lightweight materials, advanced optical technologies, and improved aesthetics. Additionally, the aging population faces higher rates of cataracts and degenerative eye conditions, driving demand for diagnostic equipment such as optical coherence tomography (OCT) scanners, fundus cameras, and phoropters.

Technological advancements support the ophthalmic spectacle lenses and equipment market expansion. Digitally enhanced lenses and AI-driven diagnostic tools provide superior accuracy and convenience, increasingly adopted by older individuals. In September 2023, Essilor launched the Varilux XR Series, the first progressive lens powered by artificial intelligence (AI). This innovative lens is designed to adapt to presbyopia, a common vision issue in aging individuals, offering enhanced visual comfort and precision for elders with near and far vision challenges. Furthermore, in March 2023, Hoya Vision Care introduced its advanced progressive lens technology, MySelf, targeting presbyopia among older consumers. Thus, the growing aging population globally is fueling the ophthalmic spectacle lenses and equipment market demand.

Ophthalmic Spectacle Lenses and Equipment Market Segment Insights

Ophthalmic Spectacle Lenses and Equipment Market Outlook by Product Insights

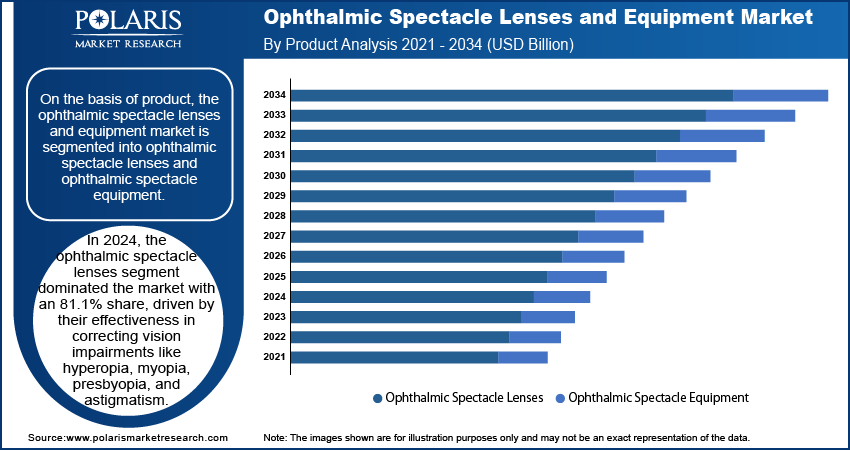

On the basis of product, the ophthalmic spectacle lenses and equipment market is bifurcated into ophthalmic spectacle lenses and ophthalmic spectacle equipment. The market for the ophthalmic spectacle lenses segment is further divided into lens types, lens materials, and usage. Additionally, the market for the ophthalmic spectacle equipment segment is subsegmented into lens fabrication equipment, lens coating equipment, optical measurement equipment, and others.

In 2024, the ophthalmic spectacle lenses segment dominated the ophthalmic spectacle lenses and equipment market share, accounting for 81.1% of the market revenue. This dominance is attributed to the rising prevalence of vision impairments across the world. According to the World Health Organization (WHO), at least 2.2 billion people are affected by vision impairment, with 1 billion cases being preventable or unaddressed. This highlights the urgent need for corrective solutions, particularly in underserved regions where access to surgical treatments or advanced eye care is limited. An aging global population further contributes to the demand for lenses as vision loss disproportionately affects people over the age of 50. The growing prevalence of vision impairment is directly driving the demand for ophthalmic spectacle lenses. Common conditions such as refractive errors, cataracts, and presbyopia are becoming more widespread due to factors such as lifestyle changes, aging, and prolonged use of digital devices. To manage these conditions, ophthalmic lenses are cost-effective solutions. Also, they are essential in preventing further productivity losses, which amount to an estimated US$411 billion annually.

Ophthalmic Spectacle Lenses and Equipment Market Regional Insights

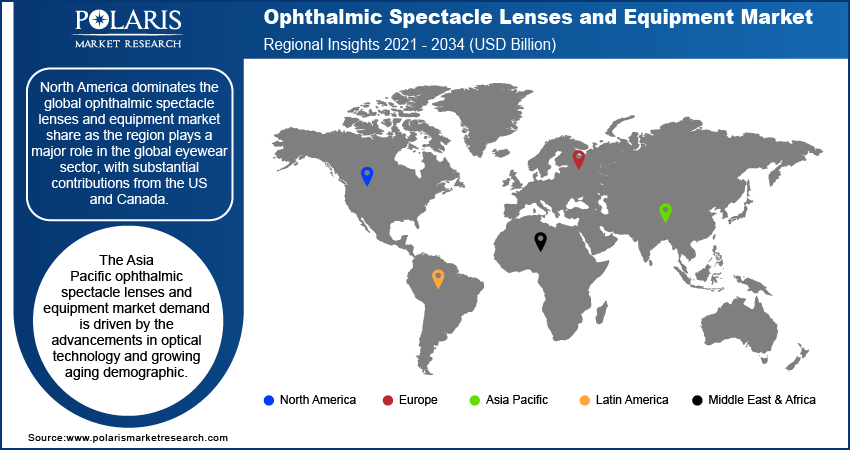

By region, the study provides ophthalmic spectacle lenses and equipment market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. The North America ophthalmic spectacle lenses and equipment market size was valued at USD 22.23 billion in 2024 and is estimated to register a CAGR of 5.4% during the forecast period. The growing demand for advanced vision correction solutions and increasing awareness of eye health significantly drive the market growth in this region.

North American manufacturers are leveraging innovative technologies, incorporating advanced lens materials such as high-index lenses and photochromic lenses, along with automated manufacturing equipment for improved precision and efficiency. These advancements cater to the rising demand for customized eyewear. The increasing use of digital devices has also raised awareness about digital eye strain, boosting the adoption of blue light-blocking lenses. The region's focus on innovation continues to support the ophthalmic spectacle lenses and equipment market expansion, as manufacturers meet the growing demand for advanced vision correction solutions.

Government health initiatives play a critical role in promoting the North America ophthalmic spectacle lenses and equipment market growth. Agencies such as the National Institutes of Health (NIH) and the CDC emphasize the importance of regular eye exams by encouraging consumers to prioritize eye health and adopt high-quality eyewear solutions. Thus, technological advancements and rising consumer awareness boost the ophthalmic spectacle lenses and equipment market expansion, addressing the diverse vision needs of North America’s population.

The North American ophthalmic spectacle lenses and equipment market plays a major role in the global eyewear sector, with substantial contributions from the US and Canada. The growing demand for advanced vision correction solutions, paired with a heightened awareness of eye health, drives market expansion in the region. One of the primary factors influencing the market is the high prevalence of refractive errors, with the Centers for Disease Control and Prevention (CDC) report in May 2024 estimating that 11 million Americans aged 12 years and above could see better if they used corrective lenses or eye surgery. Additionally, the aging population in North America is a substantial factor driving the increasing demand for ophthalmic lenses. The US Census Bureau's report from May 2024 stated that approximately 12 million individuals aged 40 and above in the US experience some form of vision impairment, with 1 million classified as blind. This demographic trend is compounded by the rising prevalence of refractive errors such as myopia, hyperopia, and astigmatism.

The Asia Pacific ophthalmic spectacle lenses and equipment market is expected to register a significant CAGR from 2025 to 2034 The expanding consumer base drives the market demand. Further, factors such as rapid urbanization and lifestyle changes have led to a higher incidence of myopia and other refractive errors, particularly among younger populations. According to a report published by the National Library of Medicine, the prevalence of myopia will reach 65% by 2050 in Asia. Thus, the rising prevalence of eye conditions is contributing to market expansion in the region.

Ophthalmic Spectacle Lenses and Equipment Market – Key Players & Competitive Insights

Major market players are investing heavily in research and development to expand their product lines, which will help the ophthalmic spectacle lenses and equipment market to grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the market players must offer cost-effective lenses and equipment. A few major players in the ophthalmic spectacle lenses and equipment market are EssilorLuxottica; Hoya Corporation; Zeiss Vision Care; Nikon Corporation; Seiko Optical Co., Ltd.; Vision Service Plan (VSP) Global; Rodenstock GmbH; TOKAI OPTICAL Co., Ltd.; Optical Dynamics Corporation; and GKB Ophthalmics Ltd.

EssilorLuxottica is a technology company engaged manufacturing, design, and distribution of ophthalmic lenses, frames, and sunglasses. The company has a global presence in North America, EMEA, Asia Pacific, and Latin America. Moreover, it operates under two major business segments, including professional solutions and direct-to-consumer. Further, the professional solutions category is bifurcated into eyecare and eyewear segments. EssilorLuxottica’s eyecare segment is engaged in the development and manufacturing of a wide range of ophthalmic lenses and optical equipment, focusing on innovative solutions to correct and protect vision. The company’s lens technologies include brands such as Crizal, Varilux, Transitions, and Eyezen, catering to diverse visual needs and enhancing the quality of vision for consumers. The company’s eyewear segment consists comprehensive portfolio of proprietary and licensed eyewear brands that have diverse market reach due to a wide range of product offerings from brands such as Ray-Ban, Oakley, Persol, Oliver Peoples, and Vogue Eyewear. Additionally, EssilorLuxottica holds exclusive licensing agreements to design, manufacture, and distribute eyewear for luxury fashion brands, including Armani, Burberry, Chanel, Prada, Versace, and others.

HOYA Vision Care is a technology-based company specializing in optical technology that provides innovative solutions for vision needs across all life stages. The company operates in 52 countries and has 50 production sites located across the globe. Moreover, HOYA Vision Care is a subsidiary of HOYA Corporation and held expertise in optical products. Its business segments encompass a diverse range of vision products, including progressive lenses, such as Hoyalux iD Myself, Hoyalux iD MyStyle, Hoyalux iD LifeStyle 3, Hoyalux Balansis, Daynamic, and Amplitude Plus, designed to provide clear vision at all distances. Additionally, HOYA offers single-vision lenses such as Nulux iDentity V+, Nulux, and Hilux, which deliver crystal-clear eyesight and maximum comfort. The company also addresses specific visual requirements with occupational lenses, photochromic lenses, sun solutions, and special lenses, ensuring comprehensive eye care solutions for various lifestyles and conditions. Additionally, HOYA's product portfolio also includes the MiYOSMART lens, a noninvasive solution designed to manage myopia progression in children.

List of Key Companies in Ophthalmic Spectacle Lenses and Equipment Market

- EssilorLuxottica

- GKB Ophthalmics Ltd

- Hoya Corporation

- Nikon Corporation

- Optical Dynamics Corporation

- Rodenstock GmbH

- Seiko Optical Co., Ltd.

- TOKAI OPTICAL Co., Ltd.

- Vision Service Plan (VSP) Global

- Zeiss Vision Care

Ophthalmic Spectacle Lenses and Equipment Industry Developments

August 2024: HOYA launched Sensity Fast marks, high-performing light-adaptive lenses, an addition to HOYA's Sensity family that allows faster transition times, offering unparalleled convenience and comfort for the wearer.

February 2024: ZEISS Vision Care acquired a comprehensive intellectual property portfolio from Mitsui Chemicals, focusing on electronic eyewear. This strategic move aims to advance the development of electro-active lenses and smart spectacle frames, positioning ZEISS at the forefront of technological innovation in the eyewear industry.

October 2023: EssilorLuxottica inaugurated an integrated largest manufacturing facility within the Group for ophthalmic lenses and frames in Rayong, Thailand. The plant supports the production of ophthalmic lenses, prescription frames, sunglasses, and the assembly of complete eyewear pairs.

Ophthalmic Spectacle Lenses and Equipment Market Segmentation

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Ophthalmic Spectacle Lenses

- By Lens Type

- Single-Vision Lens

- Multifocal Lenses

- Progressive Lenses

- Bifocal Lenses

- Trifocal Lenses

- Others

- By Lens Material

- Plastic

- Polycarbonate

- CR-39 Plastic

- Others

- Glass

- Plastic

- By Usage

- Prescription Spectacle Lenses

- Non-prescription Spectacle Lenses

- By Lens Type

- Ophthalmic Spectacle Equipment

- Lens Fabrication Equipment

- Lens Generators

- Edging Machines

- Others

- Lens Coating Equipment

- Anti-Reflective Coating Machines

- Hard Coating Equipment

- UV Coating Equipment

- Others

- Optical Measurement Equipment

- Refractors & Autorefractors

- Lensometer

- Others

- Others

- Lens Fabrication Equipment

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Austria

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Ophthalmic Spectacle Lenses and Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 57.89 Billion |

|

Market Size Value in 2025 |

USD 61.06 Billion |

|

Revenue Forecast by 2034 |

USD 103.86 Billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global ophthalmic spectacle lenses and equipment market size was valued at USD 57.89 billion in 2024 and is projected to grow to USD 103.86 billion by 2034.

The global market is expected to register a CAGR of 6.1% during the forecast period.

North America held the largest share of the global market in 2024

A few key players in the market are EssilorLuxottica; Hoya Corporation; Zeiss Vision Care; Nikon Corporation; Seiko Optical Co., Ltd.; Vision Service Plan (VSP) Global; Rodenstock GmbH; TOKAI OPTICAL Co., Ltd.; Optical Dynamics Corporation; and GKB Ophthalmics Ltd.

The ophthalmic spectacle lenses segment dominated the market in 2024.