Ophthalmic Packaging Market Share, Size, Trends, Industry Analysis Report, By Dose (Single dose, Multi-dose), By Type (OTC, Prescription), By Material (Glass, Plastic, Others), By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 119

- Format: PDF

- Report ID: PM2148

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

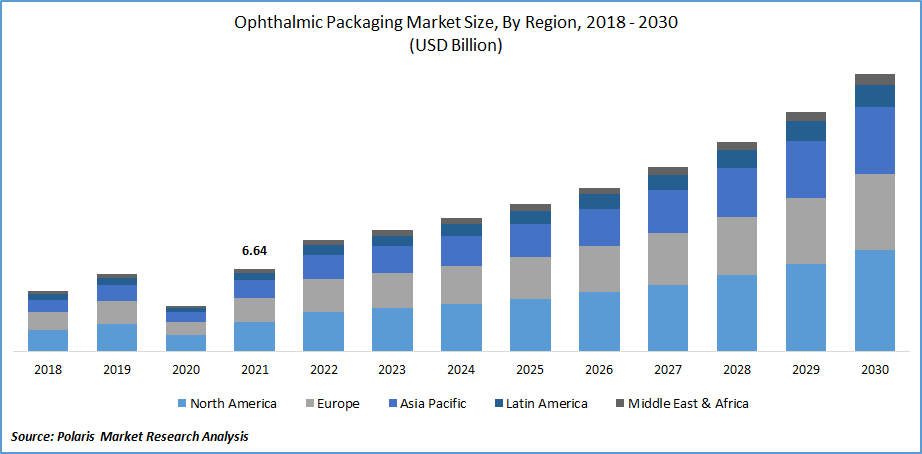

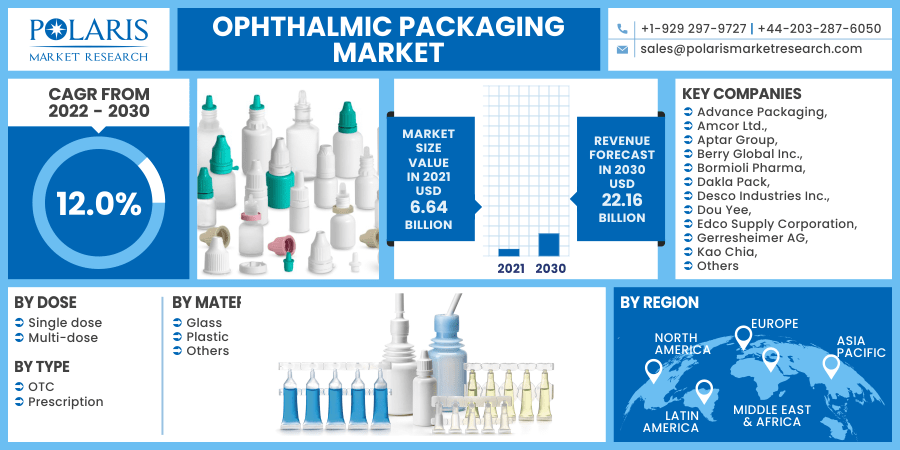

The global ophthalmic packaging market was valued at USD 6.64 billion in 2021 and is expected to grow at a CAGR of 12.0% during the forecast period.

The demand for ophthalmic packing is rising owing to the increasing incidences of eye problems such as dry eye and conjunctivitis, as well as growing regulatory guidelines for recycling wrapping materials are attributed to the market growth across the globe.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

In addition, increasing awareness regarding eye care, the growing population, and rapid technological developments are some further prominent factors that positively impact the ophthalmic packaging market growth in the upcoming years. The outbreak of COVID-19 has affected every sector of the global economy, including the ophthalmic packaging market. The industry demand is impeded during this pandemic, leading to the downfall in the ophthalmic packing growth rate due to the fewer number of visits in hospitals.

The execution of strict lockdowns and social distancing rules across various regions shows a shortage of essential goods & manpower, as well as disruption in logistics and supply chain, which obstructs the production of goods. However, the market witnessed significant growth in the upcoming years due to the gradual opening of the lockdown and resumption of the clinics and hospital visits, which, in turn, may bring an upsurge in the global ophthalmic packaging market in the future scenario.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The growing incidences of ophthalmic conditions are one of the significant driving factors that accelerate the ophthalmic packaging market growth worldwide. Several eye issues such as conjunctivitis, cataract, eye dryness, red-eye syndrome, and age-related muscular degeneration majorly occur among the population. As a result, these conditions demand eye care and several other treatments, which, in turn, positively influence the ophthalmic packing demand.

For instance, as per the USA General Population Cross-sectional Study, approximately 16 to 49 million Americans suffered from dry eye disease, accounting for around 5% to 15% of the total regional population. Furthermore, the growing geriatric population globally is majorly suffering from age-related ocular diseases, which further contributes to the demand for ophthalmic products. Accordingly, rising reimbursement policies regarding ocular surgeries comprise cataract & eye implants, and growing responsiveness for the ocular disorders treatment options also propels the product demand.

Report Segmentation

The market is primarily segmented on the basis of dose, type, material, and region.

|

By Dose |

By Type |

By Material |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Dose

The multi-dose segment is the leading segment in terms of revenue generation in the year 2021 and is expected to dominate the market in forecast years. The rising adoption of multi-dose containers in the OTC market is a major driving factor for product growth. Besides, these containers are environmentally friendly and highly patient compliant, and more convenient for the patients to use.

Moreover, the usage of preservatives leads to the maintenance of product quality and minimizes the chances of microbial contamination. Generally, these packaging for the ophthalmic products includes cap, dispensing tip or nozzle, bottles, and tamper-evident features, thus these factors of multi-dose may gain huge traction across the industry, which, in turn, boost the product growth.

The Single-dose segment is estimated to show substantial growth in the forecasting period. Factors such as increasing drug efficacy, stability, formulation, treatment duration, and single-dose are intended for the one-time use of ophthalmic products that contribute to the product demand. In addition, it does not include any preservatives; thereby, it may decrease the chances of allergic reactions to the patients. Moreover, the increasing demand for single-dose packaging in eye-based surgeries and growing healthcare manufacturing facilities are catalytic factors for the segment growth.

Insight by Type

The prescription segment is accounted for the largest revenue generator by holding the highest revenue shares in the global industry due to the large-scale adoption of first-line treatment. Increasing advancements in drug delivery mechanisms, rising incidences of ocular illness, and the growing geriatric population across the globe contribute to the segment demand. For instance, as per the study issued by the National Center for Biotechnology Information, the occurrence of eye diseases is likely to reach 61.4 million people across the globe in 2019.

Moreover, the growing number of eye healthcare hospitals and clinics and rising incidences of glaucoma or severe conjunctivitis may further support the industry's growth globally. Therefore, these various advantages offered by the segment mainly contribute to segment growth.

The OTC (over-the-counter) segment is expected to show the highest CAGR in the near future due to frequent product launches, rising responsiveness regarding self-medication and preventive care, along the increasing number of pharmacies. Also, growing incidences of common eye problems such as red-eye syndrome, dry eyes, and conjunctivitis are the further factors that contribute to the segment demand.

Furthermore, the rising number of product consents by the regulatory for several ophthalmic conditions also creates the lucrative growth of the segment in the near future. For instance, Aptar Pharma obtained EU consent for its multi-dose ophthalmic prescription drug Saflutan/Taflotan, which was adopted to reduce elevated Intraocular Pressure (IOP) in February 2019.

Geographic Overview

Geographically, North America is the largest revenue contributor in 2021 and is expected to dominate the global market in the forecast period. The growing export of ophthalmic products, increasing incidences of ocular disorders, and execution of strict regulatory policies in parametrical packing are the factors that accelerate the market demand.

Besides, North America is one of the major consumers of plastics because of the high demand from the packing industry for applications such as the ability to obtain the desired shape, easy molding, and resistance to climate and water. Furthermore, growing investment in healthcare R&D activities and the growing geriatric population also boost the segment demand. Hence, these factors create a productive demand for ophthalmic packaging in North America.

Moreover, the Asia Pacific is projected to grow at the highest CAGR across the globe in the upcoming years. The factors such as the growing trend of social security and safety by providing better healthcare services and increasing expenditure by the leading players for ophthalmic packaging development fuel the demand of the market.

In addition, growing requirements for quick and reliable packaging solutions that fulfill the regulatory standards of packaging, offer high quality and product protection and enhance patient comfort also support segment growth. Accordingly, these factors are fostering market growth across the Asia Pacific.

Competitive Insight

Some of the major market players operating in the global market include Advance Packaging, Amcor Ltd., Aptar Group, Berry Global Inc., Bormioli Pharma, Dakla Pack, Desco Industries Inc., Dou Yee, Edco Supply Corporation, Gerresheimer AG, Kao Chia, Miller packaging, MK Master, Nolato AB, Pall Corporation, Polyplus Packaging, Schott AG, Tekni-plex Inc., West Pharmaceutical Services Inc., and WG Pro-Manufacturing Inc.

Ophthalmic Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 6.64 billion |

|

Revenue forecast in 2030 |

USD 22.16 billion |

|

CAGR |

12.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Dose, By Type, By Material, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Advance Packaging, Amcor Ltd., Aptar Group, Berry Global Inc., Bormioli Pharma, Dakla Pack, Desco Industries Inc., Dou Yee, Edco Supply Corporation, Gerresheimer AG, Kao Chia, Miller packaging, MK Master, Nolato AB, Pall Corporation, Polyplus Packaging, Schott |