Online Trading Platform Market Share, Size, Trends, Industry Analysis Report, By Type (Commissions, Transaction Fees); By Application (Institutional Investors, Retail Investors); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM2323

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

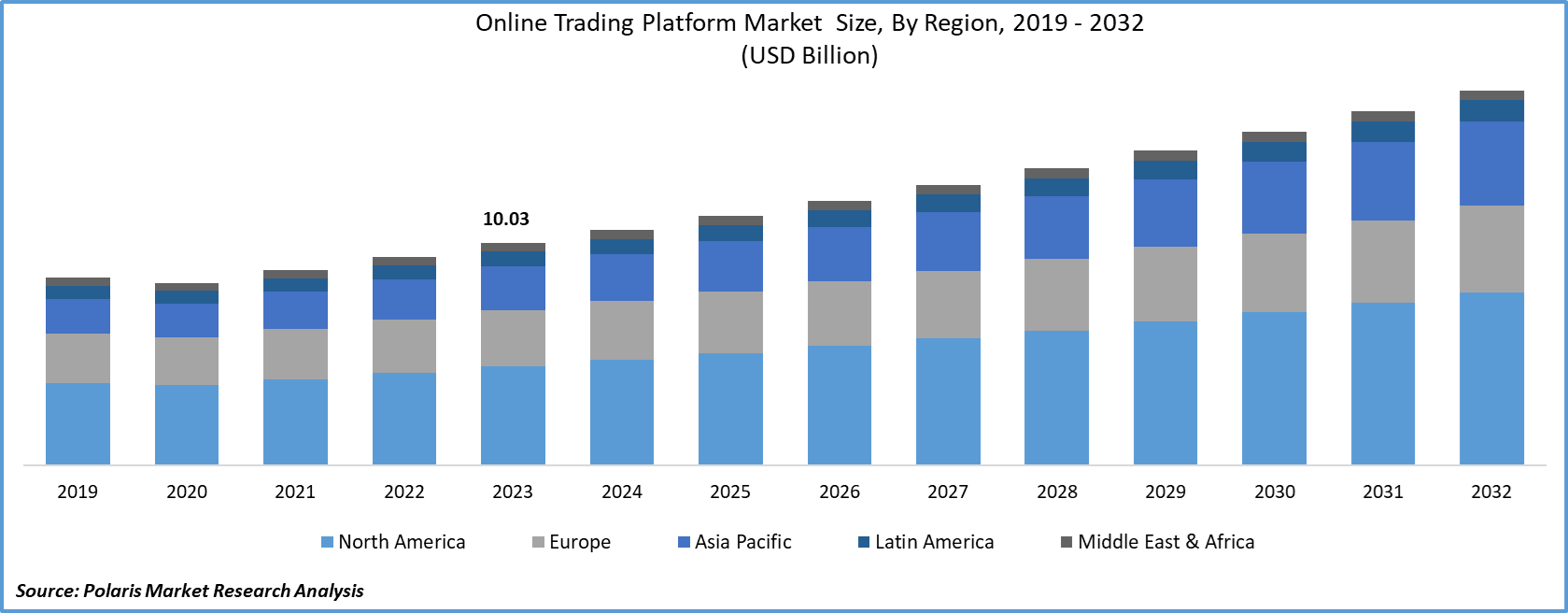

The global online trading platform market size was valued at USD 10.03 billion in 2023. The market is anticipated to grow from USD 10.62 billion in 2024 to USD 16.92 billion by 2032, exhibiting the CAGR of 6.0% during the forecast period.

An online trading platform is a software that is utilized to place orders for financial commodities over the internet. These platforms enable the user to monitor live market prices and help the user buy, sell, and hold the commodities.

Know more about this report: request for sample pages

Online platforms include services including online trading in stocks (shares), bonds, international currencies, and other financial commodities. The growing technology advancements coupled with the introduction of new trading software in the industry are anticipated to drive the growth of the online trading platform market. For instance, in January 2021, Binomo launched its online platform that has real-time forecasting & analysis. The platform consists of over 900,000 brokers from 130 countries. Moreover, in January 2021, Deutsche Bank partnered with Sharekhan Ltd. in order to develop & introduce DB TradePro, an online trading platform.

This trading software offers services including competitive brokerage rates, effective research, online banking service, and interactive account options, among others. Additionally, the increasing trend of the integration of Chatbots in online trading platforms is anticipated to drive the growth of the segment. For instance, in June 2020, Reliance Ltd. introduced AI chatbot in order to assist its shareholders in the industry. Chatbots enable users to stay up to date with the market trends, help with prediction, and further automate routine trading tasks.

The COVID-19 pandemic had a huge negative impact on the global economy. As the virus spread, a large number of businesses were shut down, out of which most were small businesses, but large businesses were impacted too. These effects of the COVID-19 outbreak are leading nations as well as the global economy towards recession. Due to this, the reduced consumer and institutional spending are anticipated to hinder the growth of the online trading platform market. WTO (World Trade Organization) predicts a fall in foreign trade between 13 to 32 % amid the pandemic.

The increasing health problems, reducing income, and the reduction in resources explain the possible outcomes. Most of the trade data may not show the negative impact of the pandemic yet; however, some predicted the scale of recession as per the previous crises. Furthermore, based on the pre-pandemic growth forecast, United Nations ESCAP (Economic & Social Commission for the Asia Pacific) projects that Asia Pacific will lose over USD 2.2 trillion in trade.

Additionally, the S&P 500 index fell by 20% in three weeks and then dropped another 30% in 30 days. Similarly, from February 20th to 9th March, the US Treasury note yield dropped from 1.52% to 0.54%. In conclusion, the virus outbreak negatively impacted trade and reduced foreign investment globally.

Industry Dynamics

Growth Drivers

Major players are adopting AI for their online-based trading services in the form of Robo-advisors. The online software that are enabled with this technology help the users to analyze a large number of data pointers. Furthermore, AI-enabled online platforms enable analysts to precisely study the trade market and efficiently reduce the associated risks, providing higher returns.

For instance, Tracxn Technologies (Epoque Plus), the company, offers a completely automated AI trading platform that comprises three engines powered by AI. The first is a strategy engine that helps analyze potential trades, the second engine to perform operational actions, and the last engine that utilizes machine learning to improve its performance.

Moreover, Kavout Corporation, based in the U.S., offers an AI-based trade platform. This utilizes big data, predictive analytics, and machine learning along with the company’s quantitative analysis model. The platform enables traders to identify potential short-term losers & winners in the online trading platform market.

Report Segmentation

The market is primarily segmented on the basis of cryptocurrency type, end-use, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Application

The Institutional Investor segment is recorded to hold the larger shares in 2021 and is expected to lead the industry in the forecasting years. Institutional investors are individual or organization that trades in large volumes and qualify for preferential treatment along with lower fees. Thus, the trade of large volumes is anticipated to drive the growth of the segment. Additionally, institutional investors invest other people’s money on their behalf.

The Retail Investors segment is projected to have the highest growth rate in the forecasting years. Retail investors are non-professional investors or individuals that buy & sell through brokerage firms or personal accounts. Retail investors generally invest for themselves. Additionally, the increasing prevalence of online trading software is anticipated to drive the growth of the segment.

Geographic Overview

North America is accounted with the highest shares in 2021 and is likely to dominate the market over the upcoming scenario. The huge share can be attributed to the presence of key industry players such as ETNA, Artezio LLC, TD Ameritrade Holding Corporation, and Chetu Inc., among others.

Furthermore, the increasing developments made by these companies are anticipated to offer huge growth opportunities. For instance, in March 2020, EffectiveSoft Ltd, a US-based company, expanded its development center and business units across Eastern Europe & Canada. This geographic expansion is estimated to strengthen the company’s market position.

Moreover, Asia Pacific is anticipated to grow with a progressive CAGR during the forecast period. BFSI in emerging nations is increasing their investments in order to adopt customized trading services. A large number of providers of online trading platforms in the Asia Pacific is anticipated to drive the growth of the industry.

Furthermore, the increasing urbanization coupled with the growing per capita income of the population in emerging nations is estimated to boost the growth of the market. Emerging nations such as China, India, and Japan, among others, are positively influencing the market development across the APAC region.

Competitive Insight

Some of the major players operating in the global market include AAX, Ally Invest, Charles SCHWAB, ErisX, E-TRADE, Fidelity, Huobi Group, Interactive Brokers, MarketAxess, Merril Edge, Plus500, and TD Ameritrade.

Online Trading Platform Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.62 billion |

|

Revenue forecast in 2032 |

USD 16.92 billion |

|

CAGR |

6.0% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AAX, Ally Invest, Charles SCHWAB, ErisX, E-TRADE, Fidelity, Huobi Group, Interactive Brokers, MarketAxess, Merril Edge, Plus500, and TD Ameritrade. |