Oilfield Integrity Management Market Share, Size, Trends, Industry Analysis Report, By Management Type (Planning, Predictive Maintenance & Inspection, Data Management, Corrosion Management, and Monitoring System); By Component; By Application; By Region; Segment Forecast, 2023- 2032

- Published Date:Mar-2023

- Pages: 118

- Format: PDF

- Report ID: PM3095

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

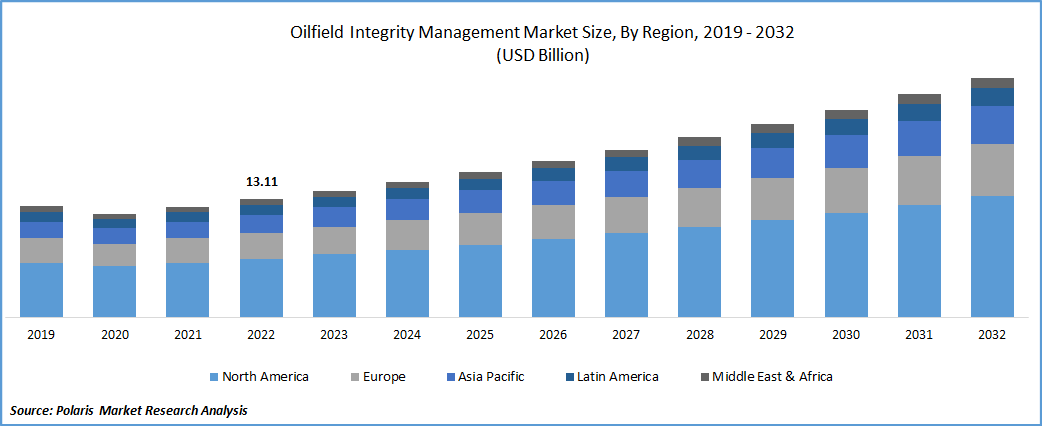

The global oilfield integrity management market was valued at USD 13.11 billion in 2022 and is expected to grow at a CAGR of 7.34% during the forecast period. Oilfields are constantly at risk from corrosion and scale. A wide range of factors can also impact the lifespan and quality of assets. One needs to practice effective management, employ the right chemicals, and ensure proper asset utilization to reduce losses and prevent or minimize naturally occurring phenomena. A variety of compounds from Thermax can support Integrity. The assets will be managed in good condition during the desired life of the help with proper selection and exploitation.

Know more about this report: Request for sample pages

In managing oilfield integrity on a national and international scale, markets only concerned with the supply and trade of energy are managed. Electricity and alternative energy markets can be called "energy markets." When a government creates an energy policy that encourages the expansion of the energy sector in a cutthroat manner, energy development often follows. This will help to maintain consistent production over time and provide the projected ROI.

The oil and gas companies, as well as governments across the globe, are focusing on investments for the development of oil and gas fields is a major factor driving the demand for oilfield integrity management software and solutions. For instance, in December 2022, The expenditure total for MENA's five-year oil investment portfolio was $879 billion, which represents a 9% increase over the investment forecast for 2021–2025. To expand the nation's oil and natural gas output in the upcoming years, national oil corporations in the region have invested in the oil and gas sector.

The ongoing COVID-19 pandemic outbreak has had a substantial global impact on the oil industry. Due to the current situation and the worldwide halt of operations, numerous oil businesses across the globe have closed their manufacturing facilities and services. Due to the shutdown of transportation, industrial, and commercial operations and a halt in planned exploration efforts, Covid-19's spread poses a danger to the market. Firms from various locations have also put major oil projects on hold.

Also significantly influenced by the COVID-19 pandemic are crude oil pricing, well drilling, production activities, and the oil supply chain. Due to the limited financial support available to continue operations, various industries, including automotive, aviation, electricity, manufacturing, and transportation, are suffering a detrimental impact on their business during the worldwide pandemic.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The oil and gas industry is heavily involved in updating its outdated business models with more intelligent operations to attract more players to the oilfield integrity management market. In addition, the oil plants' deteriorating construction and design are driving up overhead expenses. Process automation and digital transformation thus aid in overcoming these difficulties and benefiting the business. They also help lower downtime, centralize operations management, and boost output. Due to these causes, firms and organizations involved in refining actively invest in oilfield integrity management services. This is likely to help the market grow in the next years.

Furthermore, the rising exploration and production activities, as well as the government investment for this, are driving market growth. Global demand for oilfield integrity management services has increased due to exploration efforts in reserves and oilfields. Oil field producers and autonomous exploration organizations are expected to invest in oil and gas discoveries and exploration activities due to the predicted rise in oil prices in the upcoming years. In December 2022, By 2025, India anticipated spending $58 billion, or around Rs 4.76 lakh crore, on oil and natural gas exploration and extraction as it works to cut the number of restricted no-go zones inside the EEZ by 99%. Thus, the market is growing rapidly.

Report Segmentation

The Oilfield Integrity Management market is primarily segmented based on management type, component, application, and region.

|

By Management Type |

By Component |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The onshore segment is expected to hold the significant revenue share in 2022

The onshore segment held the largest revenue share in 2022. With greater oil and gas production potential in areas like the Middle East, North America, Africa, and Asia Pacific, onshore wells are widely used worldwide. Additionally, compared to offshore applications, onshore oilfield activities are less expensive.

The demand in North America is expected to witness significant growth in 2022

North America is expected to dominate the market due to the presence of major players and their focus on investing in creating advanced solutions for the oil & gas industry. Oilfield integrity management services are being purchased by North American enterprises involved in refining to boost production and cut expenses. Due to the rising investment in onshore and offshore exploration and production activities to increase crude oil production to meet future energy demand, Asia Pacific is anticipated to hold the second-largest market share for oilfield integrity management.

The Middle East and Africa will have the highest growth rate worldwide during the anticipated period. This is due to the existence of significant oil and gas-producing nations, including Kuwait, Iraq, Iran, Saudi Arabia, and the United Arab Emirates, which contain some of the world's greatest petroleum reserves. The majority of the production from these nations is exported to China and India, two Asian neighbors with large energy needs. Additionally, the region's market is expanding due to increased drilling activities and the demand for inspection and monitoring systems to maximize production from older fields.

Competitive Insight

Some of the major players operating in the global Oilfield Integrity Management market include Aker Solutions, Bureau Veritas, Baker Hughes Company, Emerson Electric Company, Halliburton Limited, IBM Inc., John Wood Group PLC, National Oilwell Varc, Oceaneering International Group, Oracle Corporation, Schlumberger Limited, Saipem limited Company, Siemens Limited, SGS SA Corporation, and Weatherford Group

Recent Developments

- In February 2022, Halliburton introduced the SPIDRIve Self-Powered Intelligent Data Retriever, a novel well-testing and fracture interaction monitoring device that collects good real-time data devoid of human intervention to save costs and enhance fracture comprehension for greater recovery.

Oilfield Integrity Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 14.05 billion |

|

Revenue forecast in 2032 |

USD 26.57 billion |

|

CAGR |

7.34% from 2023- 2032 |

|

Base year |

2022 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023- 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Management Type, By Component, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Aker Solutions, Bureau Veritas, Baker Hughes Company, Emerson Electric Company, Halliburton Limited, IBM Inc., John Wood Group PLC, National Oilwell Varc, Oceaneering International Group, Oracle Corporation, Schlumberger Limited, Saipem limited Company, Siemens Limited, SGS SA Corporation, and Weatherford Group |

FAQ's

The global Oilfield Integrity Management Market size is expected to reach USD 26.57 billion by 2032.

Key players in the oilfield integrity management market are Aker Solutions, Bureau Veritas, Baker Hughes Company, Emerson Electric Company, Halliburton Limited, IBM Inc., John Wood Group PLC.

North America contribute notably towards the global oilfield integrity management market.

The global oilfield integrity management market expected to grow at a CAGR of 7.3% during the forecast period.

The oilfield integrity management market report covering key segments are management type, component, application, and region.